by Calculated Risk on 1/28/2016 10:02:00 AM

Thursday, January 28, 2016

NAR: Pending Home Sales Index increased 0.1% in December, up 4.2% year-over-year

From the NAR: Pending Home Sales Tick Up in December

The Pending Home Sales Index, a forward-looking indicator based on contract signings, crawled 0.1 percent to 106.8 in December from a downwardly revised 106.7 in November and is now 4.2 percent above December 2014 (102.5). The index has increased year-over-year for 16 consecutive months.This was below expectations of a 0.8% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in January and February.

...

The PHSI in the Northeast increased 6.1 percent to 97.8 in December, and is now 15.3 percent above a year ago. In the Midwest the index decreased 1.1 percent to 103.6 in December, but is still 3.6 percent above December 2014.

Pending home sales in the South declined 0.5 percent to an index of 119.3 in December but are 1.0 percent higher than last December. The index in the West decreased 2.1 percent in December to 97.5, but remains 3.4 percent above a year ago.

emphasis added

Weekly Initial Unemployment Claims decrease to 278,000

by Calculated Risk on 1/28/2016 08:38:00 AM

The DOL reported:

In the week ending January 23, the advance figure for seasonally adjusted initial claims was 278,000, a decrease of 16,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 293,000 to 294,000. The 4-week moving average was 283,000, a decrease of 2,250 from the previous week's revised average. The previous week's average was revised up by 250 from 285,000 to 285,250.The previous week was revised up to 293,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 283,000.

This was close to the consensus forecast of 275,000. Although initial claims have increased recently, this is still a very low level and the 4-week average suggests few layoffs.

Wednesday, January 27, 2016

Thursday: Unemployment Claims, Durable Goods, Pending Home Sales and More

by Calculated Risk on 1/27/2016 06:21:00 PM

From former Minneapolis Fed President Narayana Kocherlakota: Monetary Policy is Not About Interest Rates

Both the inflation situation and (perhaps more arguably) the employment situation seem to call for more monetary stimulus, not less. But the FOMC is set on gradual normalization of interest rates. This framework seems grounded in a troubling aversion to both low interest rates and interest rate volatility.If Kocherlakota was on the FOMC, he would have dissented.

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for 285 thousand initial claims, down from 293 thousand the previous week.

• Also at 8:30 AM, Durable Goods Orders for December from the Census Bureau. The consensus is for a 0.2% increase in durable goods orders.

• At 10:00 AM, Pending Home Sales Index for December. The consensus is for a 0.8% increase in the index.

• Also at 10:00 AM, the Q4 Housing Vacancies and Homeownership from the Census Bureau.

• At 11:00 AM, the Kansas City Fed manufacturing survey for January.

FOMC Statement: No Change to Policy, Uncertain about rise in inflation

by Calculated Risk on 1/27/2016 02:03:00 PM

Information received since the Federal Open Market Committee met in December suggests that labor market conditions improved further even as economic growth slowed late last year. Household spending and business fixed investment have been increasing at moderate rates in recent months, and the housing sector has improved further; however, net exports have been soft and inventory investment slowed. A range of recent labor market indicators, including strong job gains, points to some additional decline in underutilization of labor resources. Inflation has continued to run below the Committee's 2 percent longer-run objective, partly reflecting declines in energy prices and in prices of non-energy imports. Market-based measures of inflation compensation declined further; survey-based measures of longer-term inflation expectations are little changed, on balance, in recent months.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee currently expects that, with gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace and labor market indicators will continue to strengthen. Inflation is expected to remain low in the near term, in part because of the further declines in energy prices, but to rise to 2 percent over the medium term as the transitory effects of declines in energy and import prices dissipate and the labor market strengthens further. The Committee is closely monitoring global economic and financial developments and is assessing their implications for the labor market and inflation, and for the balance of risks to the outlook.

Given the economic outlook, the Committee decided to maintain the target range for the federal funds rate at 1/4 to 1/2 percent. The stance of monetary policy remains accommodative, thereby supporting further improvement in labor market conditions and a return to 2 percent inflation.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. In light of the current shortfall of inflation from 2 percent, the Committee will carefully monitor actual and expected progress toward its inflation goal. The Committee expects that economic conditions will evolve in a manner that will warrant only gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run. However, the actual path of the federal funds rate will depend on the economic outlook as informed by incoming data.

The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction, and it anticipates doing so until normalization of the level of the federal funds rate is well under way. This policy, by keeping the Committee's holdings of longer-term securities at sizable levels, should help maintain accommodative financial conditions.

Voting for the FOMC monetary policy action were: Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Lael Brainard; James Bullard; Stanley Fischer; Esther L. George; Loretta J. Mester; Jerome H. Powell; Eric Rosengren; and Daniel K. Tarullo.

emphasis added

Comments on December New Home Sales

by Calculated Risk on 1/27/2016 11:59:00 AM

The new home sales report for December was above expectations, and sales for September, October and November were revised up. Sales were up 9.9% year-over-year in December (SA).

Earlier: New Home Sales increased to 544,000 Annual Rate in December.

The Census Bureau reported that new home sales in 2015 were 501,000. That is up 14.5% from 437,000 sales in 2014. That is a strong year-over-year gain for 2015.

Here is a table showing new home sales and the year-over-year changes since 2005:

| New Home Sales (000s) | ||||

|---|---|---|---|---|

| New Home Sales | Year-over-Year Change | |||

| 2005 | 1,283 | 6.7% | ||

| 2006 | 1,051 | -18.1% | ||

| 2007 | 776 | -26.2% | ||

| 2008 | 485 | -37.5% | ||

| 2009 | 375 | -22.7% | ||

| 2010 | 323 | -13.9% | ||

| 2011 | 306 | -5.3% | ||

| 2012 | 368 | 20.3% | ||

| 2013 | 429 | 16.6% | ||

| 2014 | 437 | 1.9% | ||

| 2015 | 501 | 14.5% | ||

Click on graph for larger image.

Click on graph for larger image.This graph shows new home sales for 2014 and 2015 by month (Seasonally Adjusted Annual Rate).

The year-over-year gains were stronger earlier in 2015.

The comparisons in early 2016 will be more difficult. And I expect lower growth this year.

Overall 2015 was a solid year for new home sales.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next few years.

The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through December 2015. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through December 2015. This graph starts in 1994, but the relationship has been fairly steady back to the '60s. Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

I expect existing home sales to move more sideways, and I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales increased to 544,000 Annual Rate in December

by Calculated Risk on 1/27/2016 10:14:00 AM

The Census Bureau reports New Home Sales in December were at a seasonally adjusted annual rate (SAAR) of 544 thousand.

The previous three months were revised up by a total of 28 thousand (SAAR).

"Sales of new single-family houses in December 2015 were at a seasonally adjusted annual rate of 544,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 10.8 percent above the revised November rate of 491,000 and is 9.9 percent above the December 2014 estimate of 495,000.

...

An estimated 501,000 new homes were sold in 2015. This is 14.5 percent above the 2014 figure of 437,000."

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales since the bottom, new home sales are still fairly low historically.

The second graph shows New Home Months of Supply.

The months of supply decreased in December to 5.2 months.

The months of supply decreased in December to 5.2 months. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

"The seasonally adjusted estimate of new houses for sale at the end of December was 237,000. This represents a supply of 5.2 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In December 2015 (red column), 38 thousand new homes were sold (NSA). Last year 35 thousand homes were sold in December.

The all time high for December was 87 thousand in 2005, and the all time low for December was 23 thousand in both 1966 and 2010.

This was above expectations of 500,000 sales SAAR in December, and prior months were revised up - a solid report. I'll have more later today.

MBA: Mortgage Applications Increased in Latest Weekly Survey, Purchase Applications up 22% YoY

by Calculated Risk on 1/27/2016 07:00:00 AM

From the MBA: Mortgage Applications Increase as Rates Continue to Drop in Latest MBA Weekly Survey

Mortgage applications increased 8.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 22, 2016. This week’s results include an adjustment to account for the Martin Luther King holiday.

...

The Refinance Index increased 11 percent from the previous week. The seasonally adjusted Purchase Index increased 5 percent from one week earlier. The unadjusted Purchase Index increased 0.4 percent compared with the previous week and was 22 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to its lowest level since October 2015, 4.02 percent, from 4.06 percent, with points decreasing to 0.40 from 0.41 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity was higher in 2015 than in 2014, but it was still the third lowest year since 2000.

Refinance activity will probably stay low in 2016.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 22% higher than a year ago.

Tuesday, January 26, 2016

Wednesday: FOMC Announcement, New Home Sales

by Calculated Risk on 1/26/2016 09:15:00 PM

From Tim Duy at Bloomberg: The Five Scenarios Now Facing the Federal Reserve

Bottom Line: If there was ever any doubt about the “about” of this week’s FOMC meeting, it has long since been eliminated. The Fed will hold policy steady and affirm the faith in its underlying forecast while acknowledging the global and financial risks. This will be interpreted dovishly, probably more so than the policymakers at the central bank would like. Given that I’m in the “no recession” camp, I am wary that the Fed falls into risk management mode now, but at the cost of a faster pace of hikes later. Of course, if you’re in the “recession now” camp, then the game is already over.Wednesday:

• 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• 10:00 AM, New Home Sales for December from the Census Bureau. The consensus is for a increase in sales to 500 thousand Seasonally Adjusted Annual Rate (SAAR) in December from 490 thousand in November.

• 2:00 PM, FOMC Meeting Announcement. The FOMC is expected to make no change to policy at this meeting.

Chemical Activity Barometer "Notches Slight Gain " in January

by Calculated Risk on 1/26/2016 03:49:00 PM

Here is an indicator that I'm following that appears to be a leading indicator for industrial production.

From the American Chemistry Council: Chemical Activity Barometer Notches Slight Gain As Signs of Slowing Growth Mount

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), ticked up slightly in January, rising 0.1 percent following a downward adjustment of 0.1 percent in December. All data is measured on a three-month moving average (3MMA). Accounting for adjustments, the CAB remains up 1.6 percent over this time last year, a marked deceleration of activity from one year ago when the barometer logged a 3.2 percent year-over-year gain from 2014. On an unadjusted basis the CAB fell 0.1 percent and 0.2 percent in December and January, respectively, raising concerns about the pace of future business activity through the second quarter of 2016. ...

...

Applying the CAB back to 1919, it has been shown to provide a lead of two to 14 months, with an average lead of eight months at cycle peaks as determined by the National Bureau of Economic Research. The median lead was also eight months. At business cycle troughs, the CAB leads by one to seven months, with an average lead of four months. The median lead was three months. The CAB is rebased to the average lead (in months) of an average 100 in the base year (the year 2012 was used) of a reference time series. The latter is the Federal Reserve’s Industrial Production Index.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

Real Prices and Price-to-Rent Ratio in November

by Calculated Risk on 1/26/2016 12:41:00 PM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 5.3% year-over-year in November

The year-over-year increase in prices is mostly moving sideways now around 5%. In November 2015, the index was up 5.3% YoY.

In the earlier post, I graphed nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $274,000 today adjusted for inflation (37%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

It has been almost ten years since the bubble peak. In the Case-Shiller release this morning, the National Index was reported as being 4.3% below the bubble peak. However, in real terms, the National index is still about 18% below the bubble peak.

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) is back to September 2005 levels, and the Case-Shiller Composite 20 Index (SA) is back to May 2005 levels, and the CoreLogic index (NSA) is back to June 2005.

Real House Prices

In real terms, the National index is back to November 2003 levels, the Composite 20 index is back to July 2003, and the CoreLogic index back to January 2004.

In real terms, house prices are back to 2003 levels.

Note: CPI less Shelter is down 0.8% year-over-year, so this has been pushing up real prices recently.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

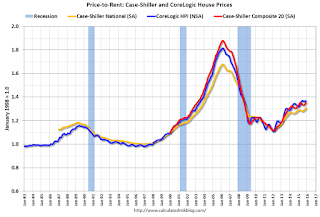

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to July 2003 levels, the Composite 20 index is back to March 2003 levels, and the CoreLogic index is back to August 2003.

In real terms, and as a price-to-rent ratio, prices are back to 2003 levels - and the price-to-rent ratio maybe moving a little sideways now.