by Calculated Risk on 1/28/2016 06:58:00 PM

Thursday, January 28, 2016

Friday: GDP, Chicago PMI

From the Atlanta Fed GDPNow:

The final GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2015 is 1.0 percent on January 28, up from 0.7 percent on January 20. The forecast for fourth-quarter real residential investment growth, currently 3.4 percent, increased more than 4 percentage points after last Friday's existing home sales report from the National Association of Realtors. The advance estimate for fourth-quarter GDP growth will be released Friday, January 29 by the U.S. Bureau of Economic AnalysisThe headline GDP number will not be great.

Friday:

• At 8:30 AM ET, Gross Domestic Product, 4th quarter 2015 (Advance estimate). The consensus is that real GDP increased 0.9% annualized in Q4.

• At 9:45 AM, Chicago Purchasing Managers Index for January. The consensus is for a reading of 45.5, up from 42.9 in December.

• At 10:00 AM, the University of Michigan's Consumer sentiment index (final for January). The consensus is for a reading of 93.0, down from the preliminary reading 93.3.

Freddie Mac: Mortgage Serious Delinquency rate declined in December, Lowest since September 2008

by Calculated Risk on 1/28/2016 03:56:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate declined in December to 1.32%, down from 1.36% in November. Freddie's rate is down from 1.88% in December 2014, and the rate in December was the lowest level since September 2008.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Note: Fannie Mae is expected to report early next week.

Although the rate is declining, the "normal" serious delinquency rate is under 1%.

The serious delinquency rate has fallen 0.56 percentage points over the last year, and at that rate of improvement, the serious delinquency rate will not be below 1% until the second half of 2016.

So even though delinquencies and distressed sales are declining, I expect an above normal level of Fannie and Freddie distressed sales through 2016 (mostly in judicial foreclosure states).

HVS: Q4 2015 Homeownership and Vacancy Rates

by Calculated Risk on 1/28/2016 01:40:00 PM

The Census Bureau released the Residential Vacancies and Homeownership report for Q4 2015.

This report is frequently mentioned by analysts and the media to track household formation, the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. The Census Bureau is investigating the differences between the HVS, ACS and decennial Census, and analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate, except as a guide to the trend.

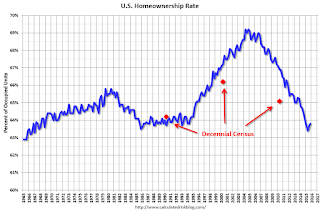

The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate increased to 63.8% in Q4, from 63.7% in Q3.

I'd put more weight on the decennial Census numbers - and given changing demographics, the homeownership rate is probably close to a bottom.

This has been mostly moving sideways for the last 2+ years.

Once again - this probably shows the general trend, but I wouldn't rely on the absolute numbers.

I think the Reis quarterly survey (large apartment owners only in selected cities) is a much better measure of the rental vacancy rate, but this does suggest the rental vacancy rate might have bottomed.

The quarterly HVS is the most timely survey on households, but there are many questions about the accuracy of this survey.

Kansas City Fed: Regional Manufacturing Activity Declined Further in January

by Calculated Risk on 1/28/2016 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Fell Again

The Federal Reserve Bank of Kansas City released the January Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity fell again in January.This was the last of the regional Fed surveys for January. Four our of five of the regional surveys indicated contraction in January, especially in the Dallas region (oil prices).

“We saw another moderate drop in regional factory activity in January, marking the eleventh straight month of slight to moderate declines,” said Wilkerson. “However, firms remained optimistic that conditions would improve slightly in coming months.”

...

The month-over-month composite index was -9 in January, unchanged from -9 in December but down from -1 in November.

...

The employment index was largely unchanged at -15. ...

Most future factory indexes were somewhat lower, but on net positive overall. The future composite index was basically unchanged at 5, while the shipments, employment, and new orders for exports indexes increased somewhat.

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through January), and five Fed surveys are averaged (blue, through January) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through December (right axis).

It seems likely the ISM index will be weak in January, and will probably show contraction again. The early consensus is the ISM index will decline to 47.9% from 48.2% in December (below 50 is contraction).

NAR: Pending Home Sales Index increased 0.1% in December, up 4.2% year-over-year

by Calculated Risk on 1/28/2016 10:02:00 AM

From the NAR: Pending Home Sales Tick Up in December

The Pending Home Sales Index, a forward-looking indicator based on contract signings, crawled 0.1 percent to 106.8 in December from a downwardly revised 106.7 in November and is now 4.2 percent above December 2014 (102.5). The index has increased year-over-year for 16 consecutive months.This was below expectations of a 0.8% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in January and February.

...

The PHSI in the Northeast increased 6.1 percent to 97.8 in December, and is now 15.3 percent above a year ago. In the Midwest the index decreased 1.1 percent to 103.6 in December, but is still 3.6 percent above December 2014.

Pending home sales in the South declined 0.5 percent to an index of 119.3 in December but are 1.0 percent higher than last December. The index in the West decreased 2.1 percent in December to 97.5, but remains 3.4 percent above a year ago.

emphasis added

Weekly Initial Unemployment Claims decrease to 278,000

by Calculated Risk on 1/28/2016 08:38:00 AM

The DOL reported:

In the week ending January 23, the advance figure for seasonally adjusted initial claims was 278,000, a decrease of 16,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 293,000 to 294,000. The 4-week moving average was 283,000, a decrease of 2,250 from the previous week's revised average. The previous week's average was revised up by 250 from 285,000 to 285,250.The previous week was revised up to 293,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 283,000.

This was close to the consensus forecast of 275,000. Although initial claims have increased recently, this is still a very low level and the 4-week average suggests few layoffs.

Wednesday, January 27, 2016

Thursday: Unemployment Claims, Durable Goods, Pending Home Sales and More

by Calculated Risk on 1/27/2016 06:21:00 PM

From former Minneapolis Fed President Narayana Kocherlakota: Monetary Policy is Not About Interest Rates

Both the inflation situation and (perhaps more arguably) the employment situation seem to call for more monetary stimulus, not less. But the FOMC is set on gradual normalization of interest rates. This framework seems grounded in a troubling aversion to both low interest rates and interest rate volatility.If Kocherlakota was on the FOMC, he would have dissented.

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for 285 thousand initial claims, down from 293 thousand the previous week.

• Also at 8:30 AM, Durable Goods Orders for December from the Census Bureau. The consensus is for a 0.2% increase in durable goods orders.

• At 10:00 AM, Pending Home Sales Index for December. The consensus is for a 0.8% increase in the index.

• Also at 10:00 AM, the Q4 Housing Vacancies and Homeownership from the Census Bureau.

• At 11:00 AM, the Kansas City Fed manufacturing survey for January.

FOMC Statement: No Change to Policy, Uncertain about rise in inflation

by Calculated Risk on 1/27/2016 02:03:00 PM

Information received since the Federal Open Market Committee met in December suggests that labor market conditions improved further even as economic growth slowed late last year. Household spending and business fixed investment have been increasing at moderate rates in recent months, and the housing sector has improved further; however, net exports have been soft and inventory investment slowed. A range of recent labor market indicators, including strong job gains, points to some additional decline in underutilization of labor resources. Inflation has continued to run below the Committee's 2 percent longer-run objective, partly reflecting declines in energy prices and in prices of non-energy imports. Market-based measures of inflation compensation declined further; survey-based measures of longer-term inflation expectations are little changed, on balance, in recent months.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee currently expects that, with gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace and labor market indicators will continue to strengthen. Inflation is expected to remain low in the near term, in part because of the further declines in energy prices, but to rise to 2 percent over the medium term as the transitory effects of declines in energy and import prices dissipate and the labor market strengthens further. The Committee is closely monitoring global economic and financial developments and is assessing their implications for the labor market and inflation, and for the balance of risks to the outlook.

Given the economic outlook, the Committee decided to maintain the target range for the federal funds rate at 1/4 to 1/2 percent. The stance of monetary policy remains accommodative, thereby supporting further improvement in labor market conditions and a return to 2 percent inflation.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. In light of the current shortfall of inflation from 2 percent, the Committee will carefully monitor actual and expected progress toward its inflation goal. The Committee expects that economic conditions will evolve in a manner that will warrant only gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run. However, the actual path of the federal funds rate will depend on the economic outlook as informed by incoming data.

The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction, and it anticipates doing so until normalization of the level of the federal funds rate is well under way. This policy, by keeping the Committee's holdings of longer-term securities at sizable levels, should help maintain accommodative financial conditions.

Voting for the FOMC monetary policy action were: Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Lael Brainard; James Bullard; Stanley Fischer; Esther L. George; Loretta J. Mester; Jerome H. Powell; Eric Rosengren; and Daniel K. Tarullo.

emphasis added

Comments on December New Home Sales

by Calculated Risk on 1/27/2016 11:59:00 AM

The new home sales report for December was above expectations, and sales for September, October and November were revised up. Sales were up 9.9% year-over-year in December (SA).

Earlier: New Home Sales increased to 544,000 Annual Rate in December.

The Census Bureau reported that new home sales in 2015 were 501,000. That is up 14.5% from 437,000 sales in 2014. That is a strong year-over-year gain for 2015.

Here is a table showing new home sales and the year-over-year changes since 2005:

| New Home Sales (000s) | ||||

|---|---|---|---|---|

| New Home Sales | Year-over-Year Change | |||

| 2005 | 1,283 | 6.7% | ||

| 2006 | 1,051 | -18.1% | ||

| 2007 | 776 | -26.2% | ||

| 2008 | 485 | -37.5% | ||

| 2009 | 375 | -22.7% | ||

| 2010 | 323 | -13.9% | ||

| 2011 | 306 | -5.3% | ||

| 2012 | 368 | 20.3% | ||

| 2013 | 429 | 16.6% | ||

| 2014 | 437 | 1.9% | ||

| 2015 | 501 | 14.5% | ||

Click on graph for larger image.

Click on graph for larger image.This graph shows new home sales for 2014 and 2015 by month (Seasonally Adjusted Annual Rate).

The year-over-year gains were stronger earlier in 2015.

The comparisons in early 2016 will be more difficult. And I expect lower growth this year.

Overall 2015 was a solid year for new home sales.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next few years.

The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through December 2015. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through December 2015. This graph starts in 1994, but the relationship has been fairly steady back to the '60s. Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

I expect existing home sales to move more sideways, and I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales increased to 544,000 Annual Rate in December

by Calculated Risk on 1/27/2016 10:14:00 AM

The Census Bureau reports New Home Sales in December were at a seasonally adjusted annual rate (SAAR) of 544 thousand.

The previous three months were revised up by a total of 28 thousand (SAAR).

"Sales of new single-family houses in December 2015 were at a seasonally adjusted annual rate of 544,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 10.8 percent above the revised November rate of 491,000 and is 9.9 percent above the December 2014 estimate of 495,000.

...

An estimated 501,000 new homes were sold in 2015. This is 14.5 percent above the 2014 figure of 437,000."

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales since the bottom, new home sales are still fairly low historically.

The second graph shows New Home Months of Supply.

The months of supply decreased in December to 5.2 months.

The months of supply decreased in December to 5.2 months. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

"The seasonally adjusted estimate of new houses for sale at the end of December was 237,000. This represents a supply of 5.2 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In December 2015 (red column), 38 thousand new homes were sold (NSA). Last year 35 thousand homes were sold in December.

The all time high for December was 87 thousand in 2005, and the all time low for December was 23 thousand in both 1966 and 2010.

This was above expectations of 500,000 sales SAAR in December, and prior months were revised up - a solid report. I'll have more later today.