by Calculated Risk on 2/01/2016 10:08:00 AM

Monday, February 01, 2016

ISM Manufacturing index increased to 48.2 in January

The ISM manufacturing index indicated contraction in January. The PMI was at 48.2% in January, up from 48.0% in December. The employment index was at 45.9%, down from 48.0% in December, and the new orders index was at 51.5%, up from 48.8%.

From the Institute for Supply Management: January 2016 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector contracted in January for the fourth consecutive month, while the overall economy grew for the 80th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee. "The January PMI® registered 48.2 percent, an increase of 0.2 percentage point from the seasonally adjusted December reading of 48 percent. The New Orders Index registered 51.5 percent, an increase of 2.7 percentage points from the seasonally adjusted reading of 48.8 percent in December. The Production Index registered 50.2 percent, 0.3 percentage point higher than the seasonally adjusted December reading of 49.9 percent. The Employment Index registered 45.9 percent, 2.1 percentage points below the seasonally adjusted December reading of 48 percent. Inventories of raw materials registered 43.5 percent, the same reading as in December. The Prices Index registered 33.5 percent, the same reading as in December, indicating lower raw materials prices for the 15th consecutive month. Comments from the panel indicate a mix ranging from strong to soft orders, as eight of our 18 industries report an increase in orders, and seven industries report a decrease in orders."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was close to expectations of 48.3%, and suggests manufacturing contracted in January.

Personal Income increased 0.3% in December, Spending decreased slightly

by Calculated Risk on 2/01/2016 08:35:00 AM

The BEA released the Personal Income and Outlays report for December:

Personal income increased $42.5 billion, or 0.3 percent, ... according to the Bureau of Economic Analysis.Personal consumption expenditures (PCE) decreased $0.7 billion, or less than 0.1 percent.On inflation: The PCE price index increased 0.6 percent year-over-year due to the sharp decline in oil prices. The core PCE price index (excluding food and energy) increased 1.4 percent year-over-year in December.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.1 percent in December, compared with an increase of 0.4 percent in November. ... The price index for PCE decreased 0.1 percent in December, in contrast to an increase of 0.1 percent in November. The PCE price index, excluding food and energy, increased less than 0.1 percent, compared to an increase of 0.2 percent.

The December PCE price index increased 0.6 percent from December a year ago. The December PCE price index, excluding food and energy, increased 1.4 percent from December a year ago.

Sunday, January 31, 2016

Monday: Personal Income and Outlays, ISM Mfg Survey, Construction Spending

by Calculated Risk on 1/31/2016 08:12:00 PM

Weekend:

• Schedule for Week of January 31, 2016

• January 2016: Unofficial Problem Bank list declines to 238 Institutions

Monday:

• At 8:30 AM ET, Personal Income and Outlays for December. The consensus is for a 0.3% increase in personal income, and for a 0.1% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• At 10:00 AM, ISM Manufacturing Index for January. The consensus is for the ISM to be at 48.3, up from 48.2 in December.

• Also at 10:00 AM, Construction Spending for December. The consensus is for a 0.6% increase in construction spending.

• At 1:00 PM, Discussion, Fed Vice Chairman Stanley Fischer, Recent Monetary Policy, Council on Foreign Relations Event: C. Peter McColough Series on International Economics, New York, N.Y.

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are down 7 and DOW futures are down 60 (fair value).

Oil prices were up over the last week with WTI futures at $33.29 per barrel and Brent at $35.56 per barrel. A year ago, WTI was at $45, and Brent was at $47 - so prices are down about 30% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $1.79 per gallon (down over $0.20 per gallon from a year ago).

Hotel Occupancy: Solid Start for 2016

by Calculated Risk on 1/31/2016 11:13:00 AM

Here is an update on hotel occupancy from HotelNewsNow.com: STR: US results for week ending 23 January

The U.S. hotel industry reported mixed results in the three key performance measurements during the week of 17-23 January 2016, according to data from STR, Inc.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average. Hotels are currently in the weakest part of the year; December and January.

In year-over-year measurements, the industry’s occupancy decreased 1.9% to 56.2%. Average daily rate for the week rose 2.5% to US$116.51, and revenue per available room increased 0.5% to US$65.51.

emphasis added

The red line is for 2016, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.

The red line is for 2016, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.2015 was the best year on record for hotels.

So far 2016 is tracking close to 2015. A solid start to the year.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Saturday, January 30, 2016

January 2016: Unofficial Problem Bank list declines to 238 Institutions

by Calculated Risk on 1/30/2016 08:08:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for January 2016.

Changes and comments from surferdude808:

Update on the Unofficial Problem Bank List for January 2016. During the month, the list dropped from 250 institutions to 238 after 12 removals. Assets dropped by $5.52 billion to an aggregate $69.5 billion. This is the largest monthly asset decline since $5.9 billion back in July 2015. A year ago, the list held 388 institutions with assets of $122.5 billion.

Actions have been terminated against Sun National Bank, Vineland, NJ ($2.3b Ticker: SNBC); Bridgeview Bank Group, Bridgeview, IL ($1.1b); Malvern Federal Savings Bank, Paoli, PA ($649m); Village Bank, Midlothian, VA ($420m Ticker: VBFC); Heritage Bank, Jonesboro, GA ($395m Ticker: CCFH); Community Shores Bank, Muskegon, MI ($190m); Securant Bank & Trust, Menomonee Falls, WI ($178m); Prairie Community Bank, Marengo, IL ($105m); Auburn Savings Bank, FSB, Auburn, ME ($72m Ticker: ABBB); and The Citizens State Bank and Trust Company, Woodbine, KS ($17m).

Two banks found their way off the list by finding merger partners including Mother Lode Bank, Sonora, CA ($70m Ticker: MOLB); and Home Federal Savings and Loan Association of Nebraska, Lexington, NE ($54m).

Schedule for Week of January 31, 2016

by Calculated Risk on 1/30/2016 08:11:00 AM

The key report this week is the January employment report on Friday.

Other key indicators include January vehicle sales, the January ISM manufacturing and non-manufacturing indexes, and the December trade deficit.

8:30 AM ET: Personal Income and Outlays for December. The consensus is for a 0.3% increase in personal income, and for a 0.1% increase in personal spending. And for the Core PCE price index to increase 0.1%.

10:00 AM: ISM Manufacturing Index for January. The consensus is for the ISM to be at 48.3, up from 48.2 in December.

10:00 AM: ISM Manufacturing Index for January. The consensus is for the ISM to be at 48.3, up from 48.2 in December.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated contraction at 48.2% in December. The employment index was at 48.3%, and the new orders index was at 49.2%.

10:00 AM: Construction Spending for December. The consensus is for a 0.6% increase in construction spending.

1:00 PM: Discussion, Fed Vice Chairman Stanley Fischer, Recent Monetary Policy, Council on Foreign Relations Event: C. Peter McColough Series on International Economics, New York, N.Y.

All day: Light vehicle sales for January. The consensus is for light vehicle sales to increase to 17.5 million SAAR in January from 17.2 million in December (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for January. The consensus is for light vehicle sales to increase to 17.5 million SAAR in January from 17.2 million in December (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the December sales rate.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for January. This report is for private payrolls only (no government). The consensus is for 190,000 payroll jobs added in January, down from 257,000 in December.

10:00 AM: the ISM non-Manufacturing Index for January. The consensus is for index to be increased to 55.5 in January from 55.3 in December.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 280 thousand initial claims, up from 278 thousand the previous week.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for December. The consensus is a 2.8% decrease in orders.

8:30 AM: Employment Report for January. The consensus is for an increase of 188,000 non-farm payroll jobs added in January, down from the 292,000 non-farm payroll jobs added in December.

The consensus is for the unemployment rate to be unchanged at 5.0%.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In December, the year-over-year change was 2.65 million jobs.

A key will be the change in real wages - and as the unemployment rate falls, wage growth should pickup.

8:30 AM: Trade Balance report for December from the Census Bureau.

8:30 AM: Trade Balance report for December from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through October. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $43.0 billion in December from $42.4 billion in November.

3:00 PM: Consumer Credit for December from the Federal Reserve. The consensus is for an increase of $16.5 billion in credit.

Friday, January 29, 2016

Philly Fed: State Coincident Indexes increased in 39 states in December

by Calculated Risk on 1/29/2016 04:45:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for December 2015. In the past month, the indexes increased in 39 states, decreased in seven, and remained stable in four, for a one-month diffusion index of 64. Over the past three months, the indexes increased in 41 states, decreased in seven, and remained stable in two, for a three-month diffusion index of 68.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In December, 41 states had increasing activity (including minor increases).

Five states have seen declines over the last 6 months, in order they are Wyoming (worst), North Dakota, Alaska, Montana, and Louisiana - mostly due to the decline in oil prices.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is mostly green now.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is mostly green now.Source: Philly Fed.

Q4 GDP: Investment

by Calculated Risk on 1/29/2016 01:01:00 PM

The graph below shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter trailing average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

In the graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

The dashed gray line is the contribution from the change in private inventories.

Note: This can't be used blindly. Residential investment is so low as a percent of the economy that the small decline early last year was not a concern.

Residential investment (RI) increased at a 8.1% annual rate in Q4. Equipment investment decreased at a 2.5% annual rate, and investment in non-residential structures decreased at a 5.3% annual rate. On a 3 quarter trailing average basis, RI (red) and equipment (green) are both positive, and nonresidential structures (blue) is slightly negative.

Note: Nonresidential investment in structures typically lags the recovery, however investment in energy and power provided a boost early in this recovery - and is now causing a slight decline. Other areas of nonresidential are now increasing significantly. I'll post more on the components of non-residential investment once the supplemental data is released.

I expect investment to be solid going forward (except for energy and power), and for the economy to continue to grow at a steady pace.

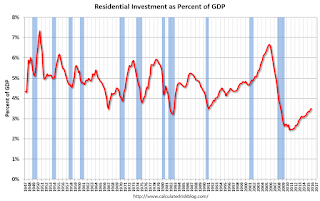

The second graph shows residential investment as a percent of GDP.

Residential Investment as a percent of GDP has been increasing, but is only just above the bottom of the previous recessions - and I expect RI to continue to increase for the next few years.

I'll break down Residential Investment into components after the GDP details are released.

Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

Chicago PMI increases Sharply, Final January Consumer Sentiment at 92.0

by Calculated Risk on 1/29/2016 10:04:00 AM

Chicago PMI: Jan Chicago Business Barometer Jumps 12.7 Points to 55.6

The Chicago Business Barometer bounced back sharply in January, increasing 12.7 points to 55.6 from 42.9 in December, the highest pace of growth in a year.This was well above the consensus forecast of 45.5.

...

Chief Economist of MNI Indicators Philip Uglow said, “While the surge in activity in January marks a positive start to the year, it follows significant weakness in the previous two months, with the latest rise not sufficient to offset the previous falls in output and orders. Previously, surges of such magnitude have not been maintained so we would expect to see some easing in February. Still, even if activity does moderate somewhat next month, the latest increase supports the view that GDP will bounce back in Q1 following the expected slowdown in Q4.”

emphasis added

Click on graph for larger image.

The final University of Michigan consumer sentiment index for January was at 92.0, down from 92.6 in December:

"Consumer confidence has remained largely unchanged, as the January reading was just 0.6% below last month's level. The small downward revisions were due to stock market declines that were reflected in the erosion of household wealth, as well as weakened prospects for the national economy. The interviews conducted from last Friday until early this week provide no evidence that the East Coast blizzard influenced the data."

emphasis added

BEA: Real GDP increased at 0.7% Annualized Rate in Q4

by Calculated Risk on 1/29/2016 08:37:00 AM

From the BEA: Gross Domestic Product: Fourth Quarter and Annual 2015 (Advance Estimate)

Real gross domestic product -- the value of the goods and services produced by the nation’s economy less the value of the goods and services used up in production, adjusted for price changes -- increased at an annual rate of 0.7 percent in the fourth quarter of 2015, according to the "advance" estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 2.0 percent.The advance Q4 GDP report, with 0.7% annualized growth, was below expectations of a 0.9% increase.

...

The increase in real GDP in the fourth quarter primarily reflected positive contributions from personal consumption expenditures (PCE), residential fixed investment, and federal government spending that were partly offset by negative contributions from private inventory investment, exports, and nonresidential fixed investment. Imports, which are a subtraction in the calculation of GDP, increased.

The deceleration in real GDP in the fourth quarter primarily reflected a deceleration in PCE and downturns in nonresidential fixed investment, in exports, and in state and local government spending that were partly offset by a smaller decrease in private inventory investment, a deceleration in imports, and an acceleration in federal government spending.

emphasis added

Personal consumption expenditures (PCE) increased at a 2.2% annualized ratein Q4, down from 3.0% in Q3. Residential investment (RI) increased at a 8.1% pace. However equipment investment decreased at a 2.5% annualized rate, and investment in non-residential structures decreased at a 5.3% pace (due to the decline in oil prices).

The key negatives were investment in inventories (subtracted 0.45 percentage point), trade (subtracted 0.47 percentage point) and investment in nonresidential structures (subtracted 0.15 percentage points).

I'll have more later ...