by Calculated Risk on 2/29/2016 08:11:00 AM

Monday, February 29, 2016

Black Knight: House Price Index up 0.1% in December, Up 5.5% year-over-year

Note: I follow several house price indexes (Case-Shiller, CoreLogic, Black Knight, Zillow, FHFA, FNC and more). Note: Black Knight uses the current month closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From Black Knight: Black Knight Home Price Index Report: December Transactions U.S. Home Prices Up 0.1 Percent for the Month; Up 5.5 Percent Year-Over-Year

• U.S. home prices were up 0.1 percent for the month, and have gained 5.5 percent from one year agoThe year-over-year increase in the index has been about the same for the last year.

• At $253K, the national level HPI remains 5.3 percent off its June 2006 peak of $268K, and up 27 percent from the market’s bottom in January 2012

• Among the 20 largest states tracked by Black Knight, New York and Texas both hit new peaks in December

• Of the nation’s 40 largest metros, 8 hit new peaks – Austin, TX; Dallas, TX; Denver, CO; Houston, TX; Nashville, TN; Portland OR, San Antonio, TX and San Francisco, CA

Sunday, February 28, 2016

Sunday Night Futures

by Calculated Risk on 2/28/2016 08:21:00 PM

Last week the FDIC released its “Quarterly Banking Profile” for Q4 2015.

Declines in expenses for litigation at a few large banks combined with moderate revenue growth to lift fourth-quarter net income at FDIC-insured institutions to $40.8 billion, an increase of $4.4 billion (11.9 percent) compared with fourth quarter 2014. The improving trend in earnings was widespread.

...

The number of insured institutions on the FDIC’s “Problem List” declined from 203 to 183 during the quarter, and total assets of problem institutions fell from $51.1 billion to $46.8 billion. For all of 2015, there were 305 mergers of insured institutions, one new charter was added, and eight banks failed.

Click on graph for larger image.

Click on graph for larger image.On the REO front, the report showed that the carrying value of one-to-four family REO properties at FDIC institutions declined to $4.66 billion at the end of December, down from $4.91 billion at then end of September and $5.98 billion at the end of 2014.

REO is down from $14.6 billion in 2010.

Weekend:

• Schedule for Week of February 21, 2016

• February 2016: Unofficial Problem Bank list declines to 228 Institutions

Monday:

• At 9:45 AM ET, Chicago Purchasing Managers Index for February. The consensus is for a reading of 52.9, down from 55.6 in January.

• At 10:00 AM, Pending Home Sales Index for January. The consensus is for a 0.5% increase in the index.

• At 10:30 AM, Dallas Fed Manufacturing Survey for February.

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures and DOW futures are mostly unchanged (fair value).

Oil prices were up over the last week with WTI futures at $32.69 per barrel and Brent at $35.00 per barrel. A year ago, WTI was at $50, and Brent was at $61 - so prices are down about 40% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $1.75 per gallon (down about $0.65 per gallon from a year ago).

Hotel Occupancy in 2016: Tracking Record Year

by Calculated Risk on 2/28/2016 11:19:00 AM

Here is an update on hotel occupancy from HotelNewsNow.com: STR: US results for week ending 20 February

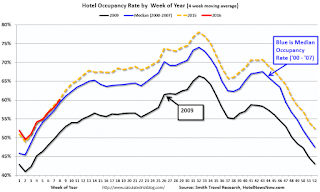

The U.S. hotel industry reported positive results in the three key performance metrics during the week of 14-20 February 2016, according to data from STR, Inc.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The occupancy rate should continue to increase into the Spring, and then increased further during the Summer travel period.

In year-over-year measurements, the industry’s occupancy increased 0.6% to 64.3%. Average daily rate for the week was up 2.1% to US$120.04. Revenue per available room rose 2.7% to US$77.17.

emphasis added

The red line is for 2016, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.

The red line is for 2016, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.2015 was the best year on record for hotels.

So far 2016 is tracking 2015. A solid start to the year.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Saturday, February 27, 2016

February 2016: Unofficial Problem Bank list declines to 228 Institutions

by Calculated Risk on 2/27/2016 02:56:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for February 2016.

Changes and comments from surferdude808:

Update on the Unofficial Problem Bank List for February 2016. During the month, the list fell from 238 institutions to 228 after 11 removals and two additions. Assets dropped by $3.5 billion to an aggregate $66.0 billion. The asset total was updated to reflect fourth quarter figures, which resulted in a small increase of $728 million. A year ago, the list held 357 institutions with assets of $109.2 billion. This past week, the FDIC released fourth quarter industry results and an update on the Official Problem Bank List. FDIC said the official list held 183 problem banks, a decline of 20 during the quarter. Over the same horizon, the unofficial list declined by 27 banks.

Actions have been terminated against Centrue Bank, Streator, IL ($942 million Ticker: TRUE); Four Oaks Bank & Trust Company, Four Oaks, NC ($690 million); OneUnited Bank, Boston, MA ($649 million); New Peoples Bank, Inc., Honaker, VA ($634 million; Highlands Union Bank, Abingdon, VA ($618 million Ticker: HBKA); Arthur State Bank, Union, SC ($459 million); The First National Bank of Russell Springs, Russell Springs, KY ($206 million); The First National Bank of Absecon, Absecon, NJ ($147 million Ticker: ASCN); Asian Bank, Philadelphia, PA ($130 million); F&M Bank and Trust Company, Hannibal, MO ($114 million); and Ruby Valley National Bank, Twin Bridges, MT ($91 million).

Gateway Bank, FSB, Oakland, CA ($142 million) found a merger partner in order to get off the list. [UPDATE: This was an error, Gateway did not merge.]

Additions this month were Dieterich Bank, N.A., Dieterich, IL ($574 million) and Louisa Community Bank, Louisa, KY ($32 million).

Schedule for Week of February 28, 2016

by Calculated Risk on 2/27/2016 08:09:00 AM

The key report this week is the February employment report on Friday.

Other key indicators include February vehicle sales, the February ISM manufacturing and non-manufacturing indexes, and the January trade deficit.

9:45 AM: Chicago Purchasing Managers Index for February. The consensus is for a reading of 52.9, down from 55.6 in January.

10:00 AM: Pending Home Sales Index for January. The consensus is for a 0.5% increase in the index.

10:30 AM: Dallas Fed Manufacturing Survey for February.

10:00 AM: ISM Manufacturing Index for February. The consensus is for the ISM to be at 48.5, up from 48.2 in January.

10:00 AM: ISM Manufacturing Index for February. The consensus is for the ISM to be at 48.5, up from 48.2 in January.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated contraction at 48.2% in January. The employment index was at 45.9%, and the new orders index was at 51.5%.

10:00 AM: Construction Spending for January. The consensus is for a 0.5% increase in construction spending.

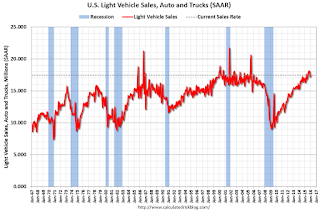

All day: Light vehicle sales for February. The consensus is for light vehicle sales to increase to 17.6 million SAAR in February from 17.5 million in January (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for February. The consensus is for light vehicle sales to increase to 17.6 million SAAR in February from 17.5 million in January (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the January sales rate.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for February. This report is for private payrolls only (no government). The consensus is for 185,000 payroll jobs added in February, down from 206,000 in January.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 270 thousand initial claims, down from 272 thousand the previous week.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for January. The consensus is a 2.0% increase in orders.

10:00 AM: the ISM non-Manufacturing Index for February. The consensus is for index to decrease to 53.1 in February from 53.5 in January.

8:30 AM: Employment Report for February. The consensus is for an increase of 190,000 non-farm payroll jobs added in February, up from the 151,000 non-farm payroll jobs added in January.

The consensus is for the unemployment rate to be unchanged at 4.9%.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In December, the year-over-year change was 2.67 million jobs.

A key will be the change in real wages.

8:30 AM: Trade Balance report for January from the Census Bureau.

8:30 AM: Trade Balance report for January from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through December. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the trade deficit to be at $43.9 billion from $43.4 billion in December.

Friday, February 26, 2016

Freddie Mac: Mortgage Serious Delinquency rate increased slightly in January

by Calculated Risk on 2/26/2016 02:30:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate increased in January to 1.33% from 1.32% in December. Freddie's rate is down from 1.86% in January 2015.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Note: Fannie Mae is expected to report early next week.

Although the rate is generally declining, the "normal" serious delinquency rate is under 1%.

The serious delinquency rate has fallen 0.53 percentage points over the last year, and at that rate of improvement, the serious delinquency rate will not be below 1% until the second half of this year.

I expect an above normal level of Fannie and Freddie distressed sales through 2016 (mostly in judicial foreclosure states).

Earlier: February Consumer Sentiment at 91.7

by Calculated Risk on 2/26/2016 12:29:00 PM

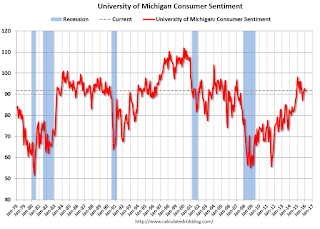

The University of Michigan consumer sentiment index for February was at 91.7, up from the preliminary reading of 90.7, and down from 92.0 in January:

"Consumer confidence nearly recovered the entire small loss it recorded at mid month, with the Sentiment Index finishing February just 0.3 Index-points below January. Although consumers are not as optimistic as at the start of last year, the Sentiment Index is just 6.5% below the cyclical peak of 98.1 set in January 2015. Such a small decline is hardly consistent with the onset of a downturn in consumer spending. ...This was above the consensus forecast of 91.0.

...

Most of the decline from last year’s peak has been in how consumers view year-ahead prospects for the economy, while the outlook for their personal financial situation has improved to its best level in ten years."

emphasis added

Click on graph for larger image.

Personal Income increased 0.5% in January, Spending increased 0.5%

by Calculated Risk on 2/26/2016 08:45:00 AM

The BEA released the Personal Income and Outlays report for January:

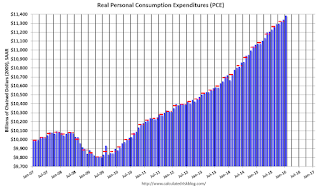

Personal income increased $79.6 billion, or 0.5 percent ... in January, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $63.0 billion, or 0.5 percent.The following graph shows real Personal Consumption Expenditures (PCE) through January 2016 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.4 percent in January, compared with an increase of 0.2 percent in December. ... The price index for PCE increased 0.1 percent in January, in contrast to a decrease of 0.1 percent in December. The PCE price index, excluding food and energy, increased 0.3 percent, compared with an increase of 0.1 percent.

The January PCE price index increased 1.3 percent from January a year ago. The January PCE price index, excluding food and energy, increased 1.7 percent from January a year ago.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was above consensus expectations. And the increase in PCE was also above the consensus. A solid start for 2016.

On inflation: The PCE price index increased 1.3 percent year-over-year due to the sharp decline in oil prices. The core PCE price index (excluding food and energy) increased 1.7 percent year-over-year in January.

Q4 GDP Revised Up to 1.0% Annual Rate

by Calculated Risk on 2/26/2016 08:33:00 AM

From the BEA: Gross Domestic Product: Fourth Quarter 2015 (Second Estimate)

Real gross domestic product -- the value of the goods and services produced by the nation’s economy less the value of the goods and services used up in production, adjusted for price changes -- increased at an annual rate of 1.0 percent in the fourth quarter of 2015, according to the "second" estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 2.0 percent.Here is a Comparison of Second and Advance Estimates. PCE growth was revised down from 2.2% to 2.0%. Residential investment was revised down from 8.1% to 8.0%. This was above the consensus forecast.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the increase in real GDP was 0.7 percent. With this second estimate for the fourth quarter, the general picture of economic growth remains the same; private inventory investment decreased less than previously estimated ...

emphasis added

Thursday, February 25, 2016

Friday: GDP, Personal Income and Outlays, Consumer Sentiment

by Calculated Risk on 2/25/2016 06:58:00 PM

Some interesting analysis from Romer and Romer:

According to an analysis by Gerald Friedman, Senator Sanders’s proposed policies would result in average annual output growth of 5.3% over the next decade, and average monthly job creation of close to 300,000.1 As a result, output in 2026 would be 37% higher than it would have been without the policies, and employment would be 16% higher.Friday:

Although we share many of Senator Sanders’s values and enthusiastically support some of his goals, such as greater public investment in infrastructure and education, we also believe it is vitally important to be realistic about the impact of policies on the performance of the overall economy. For this reason, it is worth examining Friedman’s analysis carefully. Moreover, Friedman has made available an extensive report describing his methodology and assumptions, allowing others to examine the specifics of his analysis.

Unfortunately, careful examination of Friedman’s work confirms the old adage, “if something seems too good to be true, it probably is.” We identify three fundamental problems in Friedman’s analysis. ...

• At 8:30 AM ET, Gross Domestic Product, 4th quarter 2015 (Second estimate). The consensus is that real GDP increased 0.4% annualized in Q4, revised down from 0.7%.

• At 10:00 AM, Personal Income and Outlays for January. The consensus is for a 0.4% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• Also at 10:00 AM,University of Michigan's Consumer sentiment index (final for February). The consensus is for a reading of 91.0, up from the preliminary reading 90.7.