by Calculated Risk on 3/07/2016 08:01:00 AM

Monday, March 07, 2016

Black Knight January Mortgage Monitor

Black Knight Financial Services (BKFS) released their Mortgage Monitor report for January today. According to BKFS, 5.09% of mortgages were delinquent in January, up from 4.78% in December. BKFS reported that 1.30% of mortgages were in the foreclosure process.

This gives a total of 6.39% delinquent or in foreclosure.

Press Release: Black Knight’s Mortgage Monitor: Declining Interest Rates Boost Refinanceable Population by 1.5 Million in First Six Weeks of 2016; $20 Billion in Potential Annual Savings

Today, the Data & Analytics division of Black Knight Financial Services, Inc. (NYSE: BKFS) released its latest Mortgage Monitor Report, based on data as of the end of January 2016. After mortgage interest rates fell by 30 basis points in the first six weeks of 2016, Black Knight revisited its recent analysis of the population of refinanceable borrowers that could both qualify for and benefit from refinancing their 30year mortgages. Using broad-based eligibility criteria, Black Knight found this population has grown significantly since the start of the year. As Black Knight Data & Analytics Senior Vice President Ben Graboske explained, millions of mortgage holders could potentially save thousands of dollars per year by refinancing at today’s rates.

“When Black Knight last looked at the refinanceable population just two months ago, there were 5.2 million potential candidates, and that number was on the decline,” said Graboske. “That analysis was shortly after the Federal Reserve raised its target rate by 25 basis points, at which time the prevailing wisdom was that mortgage interest rates would rise in response. Global economic shocks then sent investors looking for the safety of U.S. Treasuries, driving down yields on benchmark 10-year bonds. Mortgage interest rates began to fall in defiance of prevailing wisdom, and the refinanceable population grew by 30 percent in the first six weeks of 2016. As a result, an additional 1.5 million mortgage holders could now likely both qualify for and benefit from refinancing, bringing the total number of potential refinance candidates to 6.7 million.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from Black Knight shows their estimate of refinance candidates.

From Black Knight:

Recent interest rate declines have given 1.5 million additional borrowers incentive to refinance

The total refinanceable population of 6.7 million has grown by 30 percent in just the first six weeks of 2016

This drastic rise above the 5.2 million potential refinance candidates is driven by the number of borrowers with current interest rates is in the 4.5 percent range

An on the increase in delinquencies from Black Knight (calendar driven):

An on the increase in delinquencies from Black Knight (calendar driven):This January’s delinquency rate increase appears to be primarily calendar-drivenThere is much more in the mortgage monitor.

Sunday month-ends typically result in delinquency rate increases as servicers are unable to process any payments made on the last two calendar days of the month

The five largest monthover-month increases seen in the past three years have all come in months ending on a Sunday

It is typical to see a partial, but not full, recovery the following month

Sunday, March 06, 2016

Sunday Night Futures

by Calculated Risk on 3/06/2016 07:56:00 PM

From Ben Leubsdorf at the WSJ: The Hurdles to Getting U.S. Workers Off the Sidelines

The labor-force participation rate, which stood at 66% on the eve of the recession [slumped] to a 38-year low of 62.4% last fall ... Now the strongest run of hiring since the end of the 1990s is drawing would-be job seekers off the sidelines, pushing the rate steadily up since September. It hit 62.9% in February.Long term trends and demographics suggest the participation rate will continue to decline.

But powerful forces independent of the business cycle are exerting a strong downward pressure, with the wave of baby-boomer retirements topping the list. The participation rate may keep climbing in the short term, but many private and government economists believe it will resume its decline soon enough.

Weekend:

• Schedule for Week of March 6, 2016

• Update: Labor Force Participation

Monday:

• At 10:00 AM ET, The Fed will release the monthly Labor Market Conditions Index (LMCI).

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are down 7 and DOW futures are down 48 (fair value).

Oil prices were up over the last week with WTI futures at $36.21 per barrel and Brent at $39.00 per barrel. A year ago, WTI was at $50, and Brent was at $60 - so prices are down about 30% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $1.82 per gallon (down about $0.65 per gallon from a year ago).

Update: Labor Force Participation

by Calculated Risk on 3/06/2016 11:11:00 AM

Note: By request, I'm updating the graphs in this post from last year.

A significant decline in the participation rate was expected based on demographics (there is an ongoing debate about how much is due to demographics, and how much of the decline is cyclical - however, as I've pointed out many times, a careful analysis suggests most of the decline is due to demographics).

But what about the decline in the prime working age labor force participation rate?

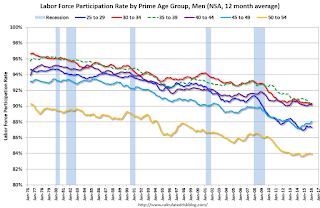

Each month I post the following graph of the participation rate and employment-population rate for prime working age (25 to 54 years old) workers. The following graph is through the February report.

The 25 to 54 participation rate increased in February to 81.2%, and the 25 to 54 employment population ratio increased to 77.8%.

A couple of key points:

1) Analyzing and forecasting the labor force participation requires looking at a number of factors. Everyone is aware that there is a large cohort has moved into the 50 to 70 age group, and that that has pushing down the overall participation rate. Another large cohort has been moving into the 16 to 24 year old age group - and many in this cohort are staying in school (a long term trend that has accelerated recently) - and that is another key factor in the decline in the overall participation rate.

2) But there are other long term trends. One of these trends is for a decline in the participation rate for prime working age men (25 to 54 years old). For some reasons, see: Possible Reasons for the Decline in Prime-Working Age Men Labor Force Participation and on demographics from researchers at the Atlanta Fed: "Reasons for the Decline in Prime-Age Labor Force Participation"

First, here is a graph of the participation rate by 5 year age groups for the years 2000, 2005, 2010, and 2015.

1) the participation rate for the "prime working age" (25 to 54) is fairly flat (the six highest participation rates).

2) However, the lowest participation rate is for the 50 to 54 age group.

3) And notice that the participation rate for EACH prime age group was declining BEFORE the recession. (Dark blue is January 2000, and light blue is January 2005).

Everyone is aware that there large cohorts moving into retirement - and a large cohort in the 20 to 24 age group - but there has also been in a shift in the prime working age groups.

Since the lowest prime participation is for the 50 to 54 age group (the second lowest is for the 25 to 29 age group), lets focus on those two groups. The 50 to 54 age group is the red line (now the second largest percentage of the prime working age) and the 25 to 29 age group is the blue line (now the largest percentage). Just these shifts in prime demographics would lead to a somewhat lower prime working age participation rate. Overall, the impact of this shift is small compared to long term trends.

Special Update Comment: The 25 to 29 age group is now the largest group in the prime working age. This is probably a reason productivity has been low - these people are in more entry level jobs at this point of their careers. Productivity was also low when the baby boomers were in their 20s. It appears demographics is important for productivity too.

Lets focus on just one age group and just for men to look at the long term trend.

This fourth graph shows the 40 to 44 year old men participation rate since 1976 (note the scale doesn't start at zero to better show the change).

There is a clear downward trend, and a researcher looking at this trend in the year 2000 might have predicted the 40 to 44 year old men participation rate would about the level as today (see trend line).

Clearly there are other factors than "economic weakness" causing this downward trend. I listed some reasons a few months ago, and new research from Pew Research suggests stay-at-home dads is one of the reasons: Growing Number of Dads Home with the Kids

Note: This is a rolling 12 month average to remove noise (data is NSA), and the scale doesn't start at zero to show the change.

Clearly there is a downward trend for all 5 year age groups. When arguing about the decline in the prime participation rate, we need to take these long term trends into account.

The bottom line is that the participation rate was declining for prime working age workers before the recession, there the key is understand and adjusting for the long term trend..

Here is a look at the participation rate of women in the prime working age groups over time.

Note: This is a rolling 12 month average to remove noise (data is NSA), and the scale doesn't start at zero to show the change.

For women, the participation rate increased significantly until the late 90s, and then started declining slowly. This is a more complicated story than for men, and that is why I used prime working age men to show the gradual downward decline in participation that has been happening for decades (and is not just recent economic weakness).

The bottom line is that the participation rate was declining for prime working age workers before the recession, there are several reasons for this decline (not just recent "economic weakness") and the prime working age participation rate is probably close to expected without the recession.

Saturday, March 05, 2016

Schedule for Week of March 6, 2016

by Calculated Risk on 3/05/2016 08:12:00 AM

This will be a very light week for economic data.

10:00 AM ET: The Fed will release the monthly Labor Market Conditions Index (LMCI).

3:00 PM: Consumer Credit for January from the Federal Reserve. The consensus is for an increase of $16.5 billion in credit.

9:00 AM ET: NFIB Small Business Optimism Index for February.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 275 thousand initial claims, down from 278 thousand the previous week.

10:00 AM: The Q4 Quarterly Services Report from the Census Bureau.

12:00 PM: Q4 Flow of Funds Accounts of the United States from the Federal Reserve.

2:00 PM: The Monthly Treasury Budget Statement for February.

No economic releases scheduled.

Friday, March 04, 2016

WSJ: Oil Prices up 37% since Low in February

by Calculated Risk on 3/04/2016 07:42:00 PM

From the WSJ: Oil Prices Jump as Drilling Drops

Light, sweet crude for April delivery settled up $1.35, or 3.9%, Friday at $35.92 a barrel on the New York Mercantile Exchange, the highest settlement since Jan. 5. Prices are up 37% from the 13-year low reached last month.

For the week, U.S. crude was up 9.6%.

...

U.S. oil output has fallen from a peak in April as companies sharply cut spending on new drilling, but it hasn’t declined as much as some investors expected because producers increased their efficiency and lowered drilling costs. Some analysts say U.S. production is due to drop more quickly this year because companies have announced new budget cuts in recent weeks.

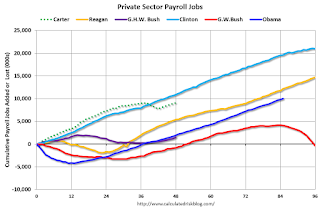

Public and Private Sector Payroll Jobs: Carter, Reagan, Bush, Clinton, Bush, Obama

by Calculated Risk on 3/04/2016 03:55:00 PM

By request, here is another update of an earlier post through the February employment report including all revisions.

NOTE: Several readers have asked if I could add a lag to these graphs (obviously a new President has zero impact on employment for the month they are elected). But that would open a debate on the proper length of the lag, so I'll just stick to the beginning of each term.

Note: We frequently use Presidential terms as time markers - we could use Speaker of the House, or any other marker.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

First, here is a table for private sector jobs. The top two private sector terms were both under President Clinton. Reagan's 2nd term saw about the same job growth as during Carter's term. Note: There was a severe recession at the beginning of Reagan's first term (when Volcker raised rates to slow inflation) and a recession near the end of Carter's term (gas prices increased sharply and there was an oil embargo).

| Term | Private Sector Jobs Added (000s) |

|---|---|

| Carter | 9,041 |

| Reagan 1 | 5,360 |

| Reagan 2 | 9,357 |

| GHW Bush | 1,510 |

| Clinton 1 | 10,884 |

| Clinton 2 | 10,082 |

| GW Bush 1 | -811 |

| GW Bush 2 | 415 |

| Obama 1 | 1,921 |

| Obama 2 | 8,1231 |

| 137 months into 2nd term: 10,538 pace. | |

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). President George H.W. Bush only served one term, and President Obama is in the third year of his second term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (yellow) took office.

There was a recession towards the end of President G.H.W. Bush (purple) term, and Mr Clinton (light blue) served for eight years without a recession.

Click on graph for larger image.

Click on graph for larger image.The first graph is for private employment only.

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 811,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 396,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased slightly under President G.H.W. Bush (purple), with 1,510,000 private sector jobs added.

Private sector employment increased by 20,966,000 under President Clinton (light blue), by 14,717,000 under President Reagan (yellow), and 9,041,000 under President Carter (dashed green).

There were only 1,921,000 more private sector jobs at the end of Mr. Obama's first term. Thirty seven months into Mr. Obama's second term, there are now 10,044,000 more private sector jobs than when he initially took office.

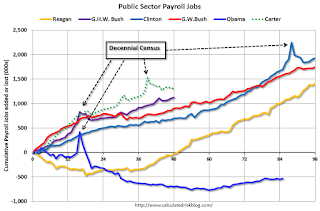

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, and 2010.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, and 2010. The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs).

However the public sector has declined significantly since Mr. Obama took office (down 537,000 jobs). These job losses had mostly been at the state and local level, but more recently at the Federal level. This has been a significant drag on overall employment.

And a table for public sector jobs. Public sector jobs declined the most during Obama's first term, and increased the most during Reagan's 2nd term.

| Term | Public Sector Jobs Added (000s) |

|---|---|

| Carter | 1,304 |

| Reagan 1 | -24 |

| Reagan 2 | 1,438 |

| GHW Bush | 1,127 |

| Clinton 1 | 692 |

| Clinton 2 | 1,242 |

| GW Bush 1 | 900 |

| GW Bush 2 | 844 |

| Obama 1 | -708 |

| Obama 2 | 1711 |

| 137 months into 2nd term, 222 pace | |

Looking forward, I expect the economy to continue to expand through 2016 (at least), so I don't expect a sharp decline in private employment as happened at the end of Mr. Bush's 2nd term (In 2005 and 2006 I was warning of a coming down turn due to the bursting of the housing bubble - and I predicted a recession in 2007).

For the public sector, the cutbacks are clearly over. Right now I'm expecting some increase in public employment during Obama's 2nd term, but nothing like what happened during Reagan's second term.

Below is a table of the top three presidential terms for private job creation (they also happen to be the three best terms for total non-farm job creation).

Clinton's two terms were the best for both private and total non-farm job creation, followed by Reagan's 2nd term.

Currently Obama's 2nd term is on pace to be the 2nd best ever for private job creation. However, with very few public sector jobs added, Obama's 2nd term is only on pace to be the fourth best for total job creation.

Note: Only 171 thousand public sector jobs have been added during the first thirty seven months of Obama's 2nd term (following a record loss of 708 thousand public sector jobs during Obama's 1st term). This is about 12% of the public sector jobs added during Reagan's 2nd term!

| Top Employment Gains per Presidential Terms (000s) | ||||

|---|---|---|---|---|

| Rank | Term | Private | Public | Total Non-Farm |

| 1 | Clinton 1 | 10,884 | 692 | 11,576 |

| 2 | Clinton 2 | 10,082 | 1,242 | 11,312 |

| 3 | Reagan 2 | 9,357 | 1,438 | 10,795 |

| Obama 21 | 7,703 | 168 | 7,871 | |

| Pace2 | 10,271 | 224 | 10,495 | |

| 137 Months into 2nd Term 2Current Pace for Obama's 2nd Term | ||||

The last table shows the jobs needed per month for Obama's 2nd term to be in the top three presidential terms. Right now it looks like Obama's 2nd term will be in the top 3 for private employment, but not for total employment gains.

| Average Jobs needed per month (000s) for remainder of Obama's 2nd Term | ||||

|---|---|---|---|---|

| to Rank | Private | Total | ||

| #1 | 251 | 298 | ||

| #2 | 178 | 275 | ||

| #3 | 112 | 227 | ||

Comments: A Strong Employment Report

by Calculated Risk on 3/04/2016 01:00:00 PM

This was a strong employment report.

The unemployment rate was unchanged at 4.9% even as the participation rate increased (another strong household survey). Not only was the headline number above the consensus forecast, but revisions were up for the previous two months. This was strong job growth.

Earlier: February Employment Report: 242,000 Jobs, 4.9% Unemployment Rate

A few more numbers: Total employment is now 5.1 million above the previous peak. Total employment is up 13.8 million from the employment recession low.

Private payroll employment increased 230,000 in February, and private employment is now 5.5 million above the previous peak. Private employment is up 14.3 million from the recession low.

In February, the year-over-year change was 2.67 million jobs.

Employment-Population Ratio, 25 to 54 years old

In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

The 25 to 54 participation rate increased in February to 81.2%, and the 25 to 54 employment population ratio increased to 77.8%. The participation rate for this group might increase a little more (or at least stabilize for a couple of years) - although the participation rate has been trending down for this group since the late '90s.

Average Hourly Earnings

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth was at 2.2% YoY in February. This series is noisy, however overall wage growth is trending up.

Note: CPI has been running under 2%, so there has been real wage growth.

Part Time for Economic Reasons

The number of persons employed part time for economic reasons (also referred to as involuntary part-time workers) was unchanged in February at 6.0 million and has shown little movement since November. These individuals, who would have preferred full-time employment, were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of persons working part time for economic reasons was little changed in February. This level suggests slack still in the labor market.

These workers are included in the alternate measure of labor underutilization (U-6) that declined to 9.7% in February - the lowest level since May 2008.

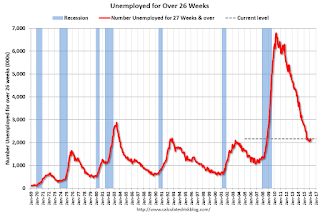

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 2.165 million workers who have been unemployed for more than 26 weeks and still want a job. This was up from 2.089 million in January.

This is generally trending down, but is still high.

There are still signs of slack (as example, part time workers for economic reasons and elevated U-6), but there also signs the labor market is tightening. Overall this was a strong employment report.

Trade Deficit Increased in January to $45.7 Billion

by Calculated Risk on 3/04/2016 10:06:00 AM

Earlier the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $45.7 billion in January, up $1.0 billion from $44.7 billion in December, revised. January exports were $176.5 billion, $3.8 billion less than December exports. January imports were $222.1 billion, $2.8 billion less than December imports.The trade deficit was larger than the consensus forecast of $43.9 billion.

The first graph shows the monthly U.S. exports and imports in dollars through January 2016.

Click on graph for larger image.

Click on graph for larger image.Imports increased and exports decreased in December.

Exports are 6% above the pre-recession peak and down 7% compared to January 2015; imports are 4% below the pre-recession peak, and down 5% compared to January 2015.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil imports averaged $32.06 in January, down from $36.60 in December, and down from $58.96 in January 2015. The petroleum deficit has generally been declining and is the major reason the overall deficit has declined since early 2012.

The trade deficit with China decreased to $28.9 billion in January, from $28.6 billion in January 2015. The deficit with China is a substantial portion of the overall deficit.

February Employment Report: 242,000 Jobs, 4.9% Unemployment Rate

by Calculated Risk on 3/04/2016 08:30:00 AM

From the BLS:

Total nonfarm payroll employment increased by 242,000 in February, and the unemployment rate was unchanged at 4.9 percent, the U.S. Bureau of Labor Statistics reported today. Employment gains occurred in health care and social assistance, retail trade, food services and drinking places, and private educational services. Job losses continued in mining.

...

The change in total nonfarm payroll employment for December was revised from +262,000 to +271,000, and the change for January was revised from +151,000 to +172,000. With these revisions, employment gains in December and January combined were 30,000 more than previously reported.

...

In February, average hourly earnings for all employees on private nonfarm payrolls declined by 3 cents to $25.35, following an increase of 12 cents in January. Average hourly earnings have risen by 2.2 percent over the year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Total payrolls increased by 242 thousand in February (private payrolls increased 230 thousand).

Payrolls for December and January were revised down by a combined 30 thousand.

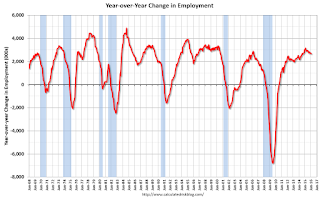

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In February, the year-over-year change was 2.67 million jobs. A solid gain.

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate increased in February to 62.9%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics.

The Labor Force Participation Rate increased in February to 62.9%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics. The Employment-Population ratio increased to 59.8% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate was unchanged in February at 4.9%.

This was well above expectations of 190,000 jobs, and with the upward revisions to prior months, this was a strong report.

I'll have much more later ...

Thursday, March 03, 2016

Friday: Employment Report, Trade Deficit

by Calculated Risk on 3/03/2016 07:44:00 PM

Hotel occupancy is mostly tracking 2015 (the record year for hotel occupancy). And RevPar is up about 3%. From HotelNewsNow: STR: US hotel results for week ending 27 February

In year-over-year comparisons, the industry’s occupancy was nearly flat (-0.2% to 64.2%). Average daily rate for the week was up 3.3% to US$119.50, and revenue per available room increased 3.1% to US$76.76.Friday:

• At 8:30 AM ET, Employment Report for February. The consensus is for an increase of 190,000 non-farm payroll jobs added in February, up from the 151,000 non-farm payroll jobs added in January. The consensus is for the unemployment rate to be unchanged at 4.9%.

• Also at 8:30 AM, the Trade Balance report for January from the Census Bureau. The consensus is for the trade deficit to be at $43.9 billion from $43.4 billion in December.