by Calculated Risk on 3/11/2016 03:00:00 PM

Friday, March 11, 2016

Merle Hazard: "How Long (Will Interest Rates Stay Low)?"

A new song from Merle Hazard called "How Long (Will Interest Rates Stay Low)?"

Enjoy!

Mortgage Equity Withdrawal Slightly Negative in Q4

by Calculated Risk on 3/11/2016 11:41:00 AM

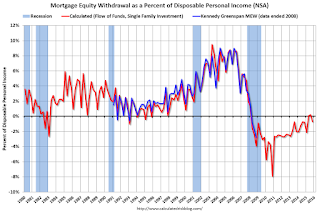

Note: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008.

The following data is calculated from the Fed's Flow of Funds data (released last week) and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity - hence the name "MEW", but there is still little (but increasing) MEW right now - and normal principal payments and debt cancellation (modifications, short sales, and foreclosures).

For Q4 2015, the Net Equity Extraction was a negative $24 billion, or a negative 0.7% of Disposable Personal Income (DPI) . MEW for Q2 and Q3 was slightly positive - the first positive MEW since Q1 2008 -and the decline in Q4 was probably seasonal.

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

Note: This data is still heavily impacted by debt cancellation and foreclosures.

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding increased by $22 billion in Q4.

The Flow of Funds report also showed that Mortgage debt has declined by almost $1.3 trillion since the peak. This decline is mostly because of debt cancellation per foreclosures and short sales, and some from modifications. There has also been some reduction in mortgage debt as homeowners paid down their mortgages so they could refinance.

With residential investment increasing, and a slower rate of debt cancellation, MEW will likely turn positive.

For reference:

Dr. James Kennedy also has a simple method for calculating equity extraction: "A Simple Method for Estimating Gross Equity Extracted from Housing Wealth". Here is a companion spread sheet (the above uses my simple method).

For those interested in the last Kennedy data included in the graph, the spreadsheet from the Fed is available here.

Goldman: "Quits and Gross Hiring Are Mostly Back to Normal"

by Calculated Risk on 3/11/2016 08:57:00 AM

A few excerpts from a research piece by Goldman Sachs economist Daan Struyven: Quits and Gross Hiring Are Mostly Back to Normal

Two years ago, Fed Chair Janet Yellen introduced a “dashboard” of labor market indicators that included two measures of worker flows, the hiring rate and the quit rate. At the time, these two measures reinforced the case that there was more labor market slack than the headline unemployment rate suggested.Struyven is referring to the JOLTS. Here is a graph from the recent report:

Today, the hiring and quit rates have recovered substantially to levels nearly in line with historical averages and consistent with the current U6 underemployment rate. This recovery of gross job flows has arguably had two positive effects. First, industry-level data suggest that higher turnover may have contributed to faster wage growth. Second, the increase in the hiring rate may have made it easier for unemployed workers to re-enter employment.

But the recovery in dynamism still looks somewhat incomplete. In particular, re-employment rates for the long-term unemployed have yet to fully normalize. We see this as an indication that despite considerable progress, the labor market has not yet fully healed.

Click on graph for larger image.

Click on graph for larger image.This graph shows levels for job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in December to 5.607 million from 5.346 million in November.

The number of job openings (yellow) are up 15% year-over-year compared to December 2014.

Quits are up 13% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

As Struyven notes, the hiring and quit rates have recovered to "historical averages".

Thursday, March 10, 2016

Fannie Mae: "Millennials ... Are the Driving Force Behind the Recent Surge in Apartment Demand"

by Calculated Risk on 3/10/2016 06:23:00 PM

From Patrick Simmons at Fannie Mae: Housing Myths, Debunked: Millennials, Not Baby Boomers, Are the Driving Force Behind the Recent Surge in Apartment Demand

By far, the most important generational driver of apartment demand growth between 2009 and 2014 was the Millennials. Millennials have been reaching adulthood and entering the housing market in large numbers in recent years. For many of these new housing market entrants, the first step in their housing careers after leaving the parental nest has been occupancy of an apartment. As can be seen from the chart at bottom-left when the 2014 button is selected, Millennials’ demand for apartments increased by millions between 2009 and 2014, far outpacing the demand growth from Boomers. In fact, the increase in Millennials’ consumption of apartments during this period was more than 10 times that of Boomers, as can be seen when the “All cohorts” button is selected.Check out the interactive graphic.

This is related to my post earlier this week, see: Demographics: Renting vs. Owning. The huge surge in the prime rental age group is nearing the end, and over the next decade, there will be a pickup in the key 30 to 39 demographic (homebuyers).

Hotel Occupancy in 2016: Tracking Just Behind 2015

by Calculated Risk on 3/10/2016 03:07:00 PM

Here is an update on hotel occupancy from HotelNewsNow.com: STR: US hotel results for week ending 5 March

he U.S. hotel industry reported mixed results in the three key performance metrics during the week of 28 February through 5 March 2016, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The occupancy rate should continue to increase into the Spring, and then increase further during the Summer travel period.

In year-over-year comparisons, the industry’s occupancy decreased 1.0% to 63.7%. Average daily rate for the week was up 3.3% to US$120.62, and revenue per available room increased 2.3% to US$76.89.

emphasis added

The red line is for 2016, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.

The red line is for 2016, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.2015 was the best year on record for hotels.

So far 2016 is just behind 2015. Still a solid start to the year.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Fed's Flow of Funds: Household Net Worth increased in Q4

by Calculated Risk on 3/10/2016 12:38:00 PM

The Federal Reserve released the Q4 2015 Flow of Funds report today: Flow of Funds.

According to the Fed, household net worth increased in Q4 compared to Q3:

The net worth of households and nonprofits rose to $86.8 trillion during the fourth quarter of 2015. The value of directly and indirectly held corporate equities increased $758 billion and the value of real estate rose $458 billion.Household net worth was at $86.8 trillion in Q4 2015, up from $85.2 trillion in Q3.

The Fed estimated that the value of household real estate increased to $22.0 trillion in Q4 2015. The value of household real estate is still $0.5 trillion below the peak in early 2006 (not adjusted for inflation).

Click on graph for larger image.

Click on graph for larger image.The first graph shows Households and Nonprofit net worth as a percent of GDP. Household net worth, as a percent of GDP, is higher than the peak in 2006 (housing bubble), and above the stock bubble peak.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

This ratio was increasing gradually since the mid-70s, and then we saw the stock market and housing bubbles.

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952. Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q4 2015, household percent equity (of household real estate) was at 56.9% - up from Q3, and the highest since Q2 2006. This was because of an increase in house prices in Q4 (the Fed uses CoreLogic).

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So the approximately 50+ million households with mortgages have far less than 56.7% equity - and several million still have negative equity.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Mortgage debt increased by $22 billion in Q4.

Mortgage debt has declined by $1.27 trillion from the peak. Studies suggest most of the decline in debt has been because of foreclosures (or short sales), but some of the decline is from homeowners paying down debt (sometimes so they can refinance at better rates).

The value of real estate, as a percent of GDP, was up in Q4, and is somewhat above the average of the last 30 years (excluding bubble).

CoreLogic: "1 Million US Borrowers Regained Equity in 2015"

by Calculated Risk on 3/10/2016 09:58:00 AM

From CoreLogic: CoreLogic Reports 1 Million US Borrowers Regained Equity in 2015

CoreLogic ... today released a new analysis showing 1 million borrowers regained equity in 2015, bringing the total number of mortgaged residential properties with equity at the end of Q4 2015 to approximately 46.3 million, or 91.5 percent of all mortgaged properties. Nationwide, borrower equity increased year over year by $682 billion in Q4 2015. The CoreLogic analysis also indicates approximately 120,000 properties lost equity in the fourth quarter of 2015 compared to the third quarter of 2015.On states:

The total number of mortgaged residential properties with negative equity stood at 4.3 million, or 8.5 percent, in Q4 2015. This is an increase of 2.9 percent quarter over quarter from 4.2 million homes, or 8.3 percent, in Q3 2015 and a decrease of 19.1 percent year over year from 5.3 million homes, or 10.7 percent, compared with Q4 2014. ...

For the homes in negative equity status, the national aggregate value of negative equity was $311 billion at the end of Q4 2015, increasing approximately $5.5 billion, or 1.8 percent, from $305.5 billion in Q3 2015. On a year-over-year basis, the value of negative equity declined overall from $348 billion in Q4 2014, representing a decrease of 10.7 percent in 12 months.

...

“In Q4 of last year home equity increased by $680 billion or 11.5 percent, the 13th consecutive quarter of double digit growth," said Frank Nothaft, chief economist for CoreLogic. “The improvement in equity reflects positive home prices and continued deleveraging of mortgage balances by households.”

emphasis added

Nevada had the highest percentage of mortgaged residential properties in negative equity at 18.7 percent, followed by Florida (17.1 percent), Illinois (14.6 percent), Arizona (14 percent), and Rhode Island (13.5 percent). These top five states combined account for 30.8 percent of negative equity in the U.S., but only 16.5 percent of outstanding mortgages.Note: The share of negative equity is still very high in Nevada and Florida, but down from a year ago.

Click on graph for larger image.

Click on graph for larger image.This graph shows the distribution of home equity in Q4 2015 compared to Q3 2015. In Q4, approximately 3.0% of residential properties had 25% or more negative equity.

For reference, three years ago, in Q3 2012, 9.6% of residential properties had 25% or more negative equity.

Weekly Initial Unemployment Claims decrease to 259,000

by Calculated Risk on 3/10/2016 08:39:00 AM

The DOL reported:

In the week ending March 5, the advance figure for seasonally adjusted initial claims was 259,000, a decrease of 18,000 from the previous week's revised level. The previous week's level was revised down by 1,000 from 278,000 to 277,000. The 4-week moving average was 267,500, a decrease of 2,500 from the previous week's revised average. The previous week's average was revised down by 250 from 270,250 to 270,000.The previous week was revised down.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 267,500.

This was below the consensus forecast of 275,000. The low level of the 4-week average suggests few layoffs.

Wednesday, March 09, 2016

Thursday: Unemployment Claims, Quarterly Services, Flow of Funds

by Calculated Risk on 3/09/2016 07:27:00 PM

Brent oil prices closed above $40 today according to Bloomberg. WTI futures closed at $38.21.

From Reuters: U.S. crude hits three-month high on gasoline drawdown, OPEC speculation

Oil prices rose as much as 5 percent on Wednesday, with U.S. crude hitting three-month highs after a big gasoline inventory drawdown amid improving demand overshadowed growing record high crude stockpiles.Thursday:

Speculation that top producers might agree soon to an output freeze also supported crude oil.

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for 275 thousand initial claims, down from 278 thousand the previous week.

• At 10:00 AM, the Q4 Quarterly Services Report from the Census Bureau.

• At 12:00 PM, Q4 Flow of Funds Accounts of the United States from the Federal Reserve.

• At 2:00 PM, The Monthly Treasury Budget Statement for February.

Update: Energy expenditures as a percentage of consumer spending

by Calculated Risk on 3/09/2016 04:11:00 PM

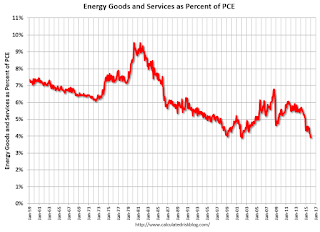

Here is a graph of expenditures on energy goods and services as a percent of total personal consumption expenditures through January 2016.

This is one of the measures that Professor Hamilton at Econbrowser looks at to evaluate any drag on GDP from energy prices.

Click on graph for larger image.

Data source: BEA Table 2.3.5U.

The huge spikes in energy prices during the oil crisis of 1973 and 1979 are obvious. As is the increase in energy prices during the 2001 through 2008 period.

In February 2016, WTI oil prices averaged close to $30 per barrel, down from $32 in January, so when PCE data for February is released on March 28th, we will probably see energy expenditures as a percent of PCE, were at all time lows. However, the new lows will not last long since oil prices have increased in March.