by Calculated Risk on 3/16/2016 04:30:00 PM

Wednesday, March 16, 2016

Comments on February Housing Starts

Earlier: Housing Starts increased to 1.178 Million Annual Rate in February

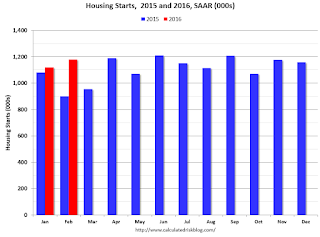

The housing starts report this morning was above consensus, and there were upward revisions to the prior two months - a strong report. Starts were up 30.9% from February 2015, but February was especially weak last year (see the first graph).

The key take away from the report is that multi-family growth is slowing, and single family growth is ongoing.

The comparison for February was easy, and the year-over-year comparison will be easy in March too.

After March, I expect much less growth year-over-year.

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily over the last few years, and completions (red line) have lagged behind - but completions have been catching up (more deliveries), and will continue to follow starts up (completions lag starts by about 12 months).

Multi-family completions are increasing sharply year-over-year.

I think most of the growth in multi-family starts is probably behind us - in fact multi-family starts might have peaked in June 2015 (at 510 thousand SAAR) - although I expect solid multi-family starts for a few more years (based on demographics).

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

The housing recovery continues, but I expect less growth from multi-family going forward.

FOMC Projections and Press Conference

by Calculated Risk on 3/16/2016 02:09:00 PM

Statement here. No change to policy.

As far as the "Appropriate timing of policy firming", participants generally think there will be two, maybe three, rate hikes in 2016 (down from three to four in December).

The FOMC projections for inflation are still on the low side through 2018.

Yellen press conference here.

On the projections, GDP was revised down for 2016.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Change in Real GDP1 | 2016 | 2017 | 2018 | |

| Mar 2016 | 2.1 to 2.3 | 2.0 to 2.3 | 1.8 to 2.1 | |

| Dec 2015 | 2.3 to 2.5 | 2.0 to 2.3 | 1.8 to 2.2 | |

The unemployment rate was at 4.9% in February, so the unemployment rate projections for Q4 2016 were lowered slightly.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Unemployment Rate2 | 2016 | 2017 | 2018 | |

| Mar 2016 | 4.6 to 4.8 | 4.5 to 4.7 | 4.5 to 5.0 | |

| Dec 2015 | 4.6 to 4.8 | 4.6 to 4.8 | 4.6 to 5.0 | |

As of January, PCE inflation was up only 1.3% from January 2015. and the projections for Q4 were lowered.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| PCE Inflation1 | 2016 | 2017 | 2018 | |

| Mar 2016 | 1.0 to 1.6 | 1.7 to 2.0 | 1.9 to 2.0 | |

| Dec 2015 | 1.2 to 1.7 | 1.8 to 2.0 | 1.9 to 2.0 | |

PCE core inflation was up 1.7% in January year-over-year. The Fed sees little pickup in inflation going forward.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Core Inflation1 | 2016 | 2017 | 2018 | |

| Mar 2016 | 1.4 to 1.7 | 1.7 to 2.0 | 1.9 to 2.0 | |

| Dec 2015 | 1.5 to 1.7 | 1.7 to 2.0 | 1.9 to 2.0 | |

FOMC Statement: No Change to Policy, Concern about Global developments

by Calculated Risk on 3/16/2016 02:02:00 PM

Note: Fewer rate hikes expected.

FOMC Statement:

Information received since the Federal Open Market Committee met in January suggests that economic activity has been expanding at a moderate pace despite the global economic and financial developments of recent months. Household spending has been increasing at a moderate rate, and the housing sector has improved further; however, business fixed investment and net exports have been soft. A range of recent indicators, including strong job gains, points to additional strengthening of the labor market. Inflation picked up in recent months; however, it continued to run below the Committee's 2 percent longer-run objective, partly reflecting declines in energy prices and in prices of non-energy imports. Market-based measures of inflation compensation remain low; survey-based measures of longer-term inflation expectations are little changed, on balance, in recent months.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee currently expects that, with gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace and labor market indicators will continue to strengthen. However, global economic and financial developments continue to pose risks. Inflation is expected to remain low in the near term, in part because of earlier declines in energy prices, but to rise to 2 percent over the medium term as the transitory effects of declines in energy and import prices dissipate and the labor market strengthens further. The Committee continues to monitor inflation developments closely.

Against this backdrop, the Committee decided to maintain the target range for the federal funds rate at 1/4 to 1/2 percent. The stance of monetary policy remains accommodative, thereby supporting further improvement in labor market conditions and a return to 2 percent inflation.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. In light of the current shortfall of inflation from 2 percent, the Committee will carefully monitor actual and expected progress toward its inflation goal. The Committee expects that economic conditions will evolve in a manner that will warrant only gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run. However, the actual path of the federal funds rate will depend on the economic outlook as informed by incoming data.

The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction, and it anticipates doing so until normalization of the level of the federal funds rate is well under way. This policy, by keeping the Committee's holdings of longer-term securities at sizable levels, should help maintain accommodative financial conditions.

Voting for the FOMC monetary policy action were: Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Lael Brainard; James Bullard; Stanley Fischer; Loretta J. Mester; Jerome H. Powell; Eric Rosengren; and Daniel K. Tarullo. Voting against the action was Esther L. George, who preferred at this meeting to raise the target range for the federal funds rate to 1/2 to 3/4 percent.

emphasis added

Key Measures Show Inflation slightly above 2% in February

by Calculated Risk on 3/16/2016 11:16:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.8% annualized rate) in February. The 16% trimmed-mean Consumer Price Index also rose 0.2% (2.6% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for February here. Motor fuel was down 81% annualized in February.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers fell 0.2% (-2.0% annualized rate) in February. The CPI less food and energy rose 0.3% (3.4% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.4%, the trimmed-mean CPI rose 2.0%, and the CPI less food and energy also rose 2.3%. Core PCE is for January and increased 1.7% year-over-year.

On a monthly basis, median CPI was at 2.8% annualized, trimmed-mean CPI was at 2.6% annualized, and core CPI was at 3.4% annualized.

On a year-over-year basis, three of these measures are at or above 2%.

Using these measures, inflation has been moving up, and three of the measures are at or above the Fed's target (Core PCE is still below).

Fed: Industrial Production decreased 0.5% in February

by Calculated Risk on 3/16/2016 09:23:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production decreased 0.5 percent in February after increasing 0.8 percent in January. Sizable declines in the indexes for both utilities and mining in February outweighed a gain of 0.2 percent for manufacturing. The output of utilities dropped 4.0 percent, as unseasonably warm weather curbed the demand for heating. Mining production fell 1.4 percent and has decreased nearly 1.3 percent per month, on average, over the past six months. At 106.3 percent of its 2012 average, total industrial production in February was 1.0 percent below its year-earlier level. Capacity utilization for the industrial sector decreased 0.4 percentage point in February to 76.7 percent, a rate that is 3.3 percentage points below its long-run (1972–2015) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 10.2 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 76.7% is 3.3% below the average from 1972 to 2015 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased 0.5% in February to 106.3. This is 21.9% above the recession low, and 1.1% above the pre-recession peak.

This was below expectations of a 0.2% decrease.

Housing Starts increased to 1.178 Million Annual Rate in February

by Calculated Risk on 3/16/2016 08:39:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in February were at a seasonally adjusted annual rate of 1,178,000. This is 5.2 percent above the revised January estimate of 1,120,000 and is 30.9 percent above the February 2015 rate of 900,000.

Single-family housing starts in February were at a rate of 822,000; this is 7.2 percent above the revised January figure of 767,000. The February rate for units in buildings with five units or more was 341,000.

Building Permits:

Privately-owned housing units authorized by building permits in February were at a seasonally adjusted annual rate of 1,167,000. This is 3.1 percent below the revised January rate of 1,204,000, but is 6.3 percent above the February 2015 estimate of 1,098,000.

Single-family authorizations in February were at a rate of 731,000; this is 0.4 percent above the revised January figure of 728,000. Authorizations of units in buildings with five units or more were at a rate of 401,000 in February.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) increased in February. Multi-family starts are up 19% year-over-year.

Single-family starts (blue) increased in February and are up 37% year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low),

Total housing starts in February were above expectations - especially strong for single family starts - and starts for December and January were revised up. A strong report. I'll have more later ...

MBA: Mortgage Applications Decreased in Latest Weekly Survey, Purchase Applications up 33% YoY

by Calculated Risk on 3/16/2016 07:00:00 AM

From the MBA: Refinance Applications Continue to Drop in Latest MBA Weekly Survey

Mortgage applications decreased 3.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 11, 2016.

...

The Refinance Index decreased 6 percent from the previous week. The seasonally adjusted Purchase Index increased 0.3 percent to its highest level since January 2016. The unadjusted Purchase Index increased 1 percent compared with the previous week and was 33 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 3.94 percent from 3.89 percent, with points increasing to 0.42 from 0.38 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity was higher in 2015 than in 2014, but it was still the third lowest year since 2000.

Refinance activity has picked up recently as rates have declined.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 33% higher than a year ago.

Tuesday, March 15, 2016

Wednesday: FOMC, Housing Starts, CPI, Industrial Production

by Calculated Risk on 3/15/2016 06:40:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Housing Starts for February. Total housing starts decreased to 1.099 million (SAAR) in January. Single family starts decreased to 731 thousand SAAR in January. The consensus for 1.146 million, up from the January rate.

• Also at 8:30 AM, The Consumer Price Index for February from the BLS. The consensus is for a 0.3% decrease in CPI, and a 0.2% increase in core CPI.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for February. The consensus is for a 0.2% decrease in Industrial Production, and for Capacity Utilization to decrease to 76.9%.

• At 2:00 PM, FOMC Meeting Announcement. No change to the Fed Funds rate is expected at this meeting.

• Also at 2:00 PM, FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

• At 2:30 PM, Fed Chair Janet Yellen holds a press briefing following the FOMC announcement.

FNC: Residential Property Values increased 6.4% year-over-year in January

by Calculated Risk on 3/15/2016 03:28:00 PM

In addition to Case-Shiller, and CoreLogic, I'm also watching the FNC, Zillow and several other house price indexes.

FNC released their January 2016 index data. FNC reported that their Residential Price Index™ (RPI) indicates that U.S. residential property values decreased 0.3% from December to January (Composite 100 index, not seasonally adjusted).

The 10 city MSA decreased 0.4% (NSA), the 20-MSA RPI decreased 0.3%, and the 30-MSA RPI decreased 0.4% in January. These indexes are not seasonally adjusted (NSA), and are for non-distressed home sales (excluding foreclosure auction sales, REO sales, and short sales).

From FNC: FNC Index: January Home Prices Down 0.3

According to the latest FNC Residential Price Index™ (RPI), U.S. home prices in January showed a seasonal decline, down 0.3% from December, reflecting flat home sales during the same period. On a year-over-year basis, home prices rose 6.4% from December 2015.Notes: In addition to the composite indexes, FNC presents price indexes for 30 MSAs. FNC also provides seasonally adjusted data.

“January is typically a slow month for housing activity, and month-over-month fluctuations in home prices tend to reflect that,” said Yanling Mayer, FNC’s housing economist and Director of Research.

...

In Houston, home prices were down 2.0%, or an average of 1.2% per month in the last 3 months, likely impacted by job losses in the energy sector from collapsing oil prices.

The index is still down 14.3% from the peak in 2006 (not inflation adjusted).

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change based on the FNC index (four composites) through January 2016. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

Most of the other indexes are also showing the year-over-year change in the mid single digit range.

Note: The January Case-Shiller index will be released on Tuesday, March 29th.

Goldman: "We see the cyclical 'participation gap' as nearly closed"

by Calculated Risk on 3/15/2016 12:31:00 PM

A few excerpts from a research piece by Goldman Sachs economist David Mericle: Breaking Down the Rebound in the Participation Rate

The labor force participation rate has risen 0.5 percentage points (pp) since its September low. ... The largest contributors to the rebound have been, in descending order, declines in the share of the population in school, retired, disabled, and not wanting to work. Participation rates for all age groups have risen, reflecting declines in the share of young people in school, in the share of prime-age workers in all non-participation categories, and in the share of older people retired.

At this point, we see the cyclical “participation gap” as nearly closed. While some types of non-participators could be drawn into a very hot labor market, our baseline expectation is that the participation rate will decline by 0.25pp per year from its current level.

...

our forecast for the breakeven rate of payroll growth at 85k.

Click on graph for larger image.

Click on graph for larger image.CR Note: This graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate (blue line) increased in February to 62.9%. This is the percentage of the working age population in the labor force.

I agree with Mericle that most of the "participation gap" has closed, and I expect the participation rate to decline further over the next decade.

Note: A large portion of the recent decline in the participation rate is due to long term trends and demographics.

Also note that Mericle estimates that payroll growth of 85,000 per month will keep the unemployment rate unchanged.