by Calculated Risk on 3/19/2016 08:11:00 AM

Saturday, March 19, 2016

Schedule for Week of March 20, 2016

The key reports this week are the third estimate of Q4 GDP, and February Existing and New Home sales.

8:30 AM ET: Chicago Fed National Activity Index for February. This is a composite index of other data.

10:00 AM: Existing Home Sales for February from the National Association of Realtors (NAR). The consensus is for 5.34 million SAAR, down from 5.47 million in January.

10:00 AM: Existing Home Sales for February from the National Association of Realtors (NAR). The consensus is for 5.34 million SAAR, down from 5.47 million in January.Economist Tom Lawler expects the NAR to report sales of 5.20 million SAAR for February.

9:00 AM: FHFA House Price Index for January 2016. This was originally a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.6% month-to-month increase for this index.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for March.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: New Home Sales for February from the Census Bureau.

10:00 AM: New Home Sales for February from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the January sales rate.

The consensus is for a increase in sales to 510 thousand Seasonally Adjusted Annual Rate (SAAR) in February from 494 thousand in January.

During the day: The AIA's Architecture Billings Index for February (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 268 thousand initial claims, up from 265 thousand the previous week.

8:30 AM: Durable Goods Orders for February from the Census Bureau. The consensus is for a 3.0% decrease in durable goods orders.

11:00 AM: Kansas City Fed Survey of Manufacturing Activity for March.

8:30 AM ET: Gross Domestic Product, 4th quarter 2015 (Third estimate). The consensus is that real GDP increased 1.0% annualized in Q4, unrevised from the second estimate.

10:00 AM ET: Regional and State Employment and Unemployment (Monthly) for February 2016 from BLS.

Friday, March 18, 2016

When will I make another "Big" economic call?

by Calculated Risk on 3/18/2016 02:45:00 PM

A short note: Over the years, I've made several significant economic calls. For example, I predicted a recession in 2007, a recovery in 2009 (link is first in a series of posts), the top for housing prices in early 2006 and the bottom for housing prices in early 2012. I do not have a crystal ball, and I've missed some calls - but by watching the data closely, I've been pretty lucky overall.

Sometimes people ask me when I'll make another call. I don't know; I'm very data dependent!

But I was wondering if this counts? Back in December I wrote The Endless Parade of Recession Calls. I concluded:

Looking at the economic data, the odds of a recession in 2016 are very low (extremely unlikely in my view). Someday I'll make another recession call, but I'm not even on recession watch now.So far that looks correct. And I'm still not on recession watch.

Fed: Q4 Household Debt Service Ratio Very Low

by Calculated Risk on 3/18/2016 11:59:00 AM

The Fed's Household Debt Service ratio through Q4 2015 was released Mar 14th: Household Debt Service and Financial Obligations Ratios. I used to track this quarterly back in 2005 and 2006 to point out that households were taking on excessive financial obligations.

These ratios show the percent of disposable personal income (DPI) dedicated to debt service (DSR) and financial obligations (FOR) for households. Note: The Fed changed the release in Q3 2013.

The household Debt Service Ratio (DSR) is the ratio of total required household debt payments to total disposable income.This data has limited value in terms of absolute numbers, but is useful in looking at trends. Here is a discussion from the Fed:

The DSR is divided into two parts. The Mortgage DSR is total quarterly required mortgage payments divided by total quarterly disposable personal income. The Consumer DSR is total quarterly scheduled consumer debt payments divided by total quarterly disposable personal income. The Mortgage DSR and the Consumer DSR sum to the DSR.

The limitations of current sources of data make the calculation of the ratio especially difficult. The ideal data set for such a calculation would have the required payments on every loan held by every household in the United States. Such a data set is not available, and thus the calculated series is only an approximation of the debt service ratio faced by households. Nonetheless, this approximation is useful to the extent that, by using the same method and data series over time, it generates a time series that captures the important changes in the household debt service burden.

Click on graph for larger image.

Click on graph for larger image.The graph shows the Total Debt Service Ratio (DSR), and the DSR for mortgages (blue) and consumer debt (yellow).

The overall Debt Service Ratio increased slightly in Q4, and has been moving sideways and is near a record low. Note: The financial obligation ratio (FOR) increased slightly in Q4 and is also near a record low (not shown)

The DSR for mortgages (blue) are near the low for the last 35 years. This ratio increased rapidly during the housing bubble, and continued to increase until 2007. With falling interest rates, and less mortgage debt (mostly due to foreclosures), the mortgage ratio has declined significantly.

The consumer debt DSR (yellow) has been increasing for the last three years.

This data suggests aggregate household cash flow has improved.

Preliminary March Consumer Sentiment decreases to 90.0

by Calculated Risk on 3/18/2016 10:04:00 AM

The preliminary University of Michigan consumer sentiment index for March was at 90.0, down from 91.7 in February:

Consumer confidence eased in early March due to increased concerns about prospects for the economy as well as the expectation that gas prices would inch upward during the year ahead. All of the decline during the past year has been in the Expectations Index, which was due to a weakening outlook for the pace of growth in the national economy. While consumers do not anticipate a recession, they no longer expect the economy to outperform the 2.4% rate of economic growth recorded in the past two years. In contrast, personal financial expectations remained strong in early March, comparable to the favorable levels recorded nearly a decade ago. Overall, it would appear that consumers have accommodated slower economic growth as well as rising gas prices without an accompanying rise in uncertainty about their own personal financial situation. The most important element supporting consumers' optimism is their conviction that the slower pace of economic growth will not have an appreciable impact on maintaining the jobless rate at about its current low level. The data are still consistent with a 2.7% rate of growth in personal consumption expenditures during 2016.This was below the consensus forecast of 92.2.

emphasis added

Click on graph for larger image.

Thursday, March 17, 2016

Lawler: Early Read on Existing Home Sales in February

by Calculated Risk on 3/17/2016 03:55:00 PM

From housing economist Tom Lawler:

Based on publicly-available local realtor/MLS reports from across the country released through today, I project that US existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.2 million in February, down 4.9% from January’s preliminary pace and up 4.6% from last January’s seasonally adjusted pace. On an unadjusted basis I project that the year-over-year % increase in home sales in February was pretty close to January’s YOY gain. However, while this January had one fewer business day than last January, this February (in a Leap Year) had one more business day than last February. As a result, while the YOY increase in seasonally adjusted sales in January (11.5%) was well above the YOY gain in unadjusted sales (7.5%), the opposite should be the case in February.

On the inventory front, local realtor/MLS reports suggest that the NAR’s estimate of the number of existing homes for sale at the end of February should be about 1.84 million, up 1.1% from January and down 3.2% from a year earlier.

Finally, local realtor/MLS data suggest that the NAR’s estimate of the median existing single-family home sales price in February should be about 5.8% higher than last February.

CR Note: The NAR is scheduled to release February existing home sales on Monday, March 21st. The early consensus is for sales of 5.30 million SAAR.

Metrostudy: “LOTS to Talk About”

by Calculated Risk on 3/17/2016 12:01:00 PM

This is from Metrostudy chief economist Brad Hunter:

When I forecast housing starts, I find that it is vital to check on the supply of vacant developed lots in each market. Some markets have severe shortages, and others have excess, at least in certain submarkets. One metric that is informative is the pace of “lot deliveries,” meaning the number of lots that reach the stage of development just before the builder begins pouring the foundation (the “start”).

There has been a fascinating dynamic lately, with regard to lot deliveries. Nationwide, the pace of lot deliveries has stayed far below the pace of housing starts through this entire recovery. Lot deliveries increased by 37% over the past two years, while starts (lot absorption) rose by 23%. Even with that increase, the lot production pace has yet to catch up with the pace of home building in many markets. In the nation as a whole, lot production has just caught up with the pace of new home construction.

In some markets, we now are seeing an important new trend: the lines have crossed. The pace of lot development began leading the pace of starts in 2015 in some markets. When that happens, we know that an increased level of home construction is planned. We can then confidently forecast a higher level of housing starts in those areas.

There are several markets are showing this strongly-bullish indicator. I see it most pronounced in Austin, Southern California, Indianapolis, Las Vegas (yes, Las Vegas), Naples/Ft. Myers, and Houston.

In Austin, the pace of lot development has gone from being half of the pace of starts to 36% HIGHER than the pace of starts. In Naples/Ft. Myers, the pace of lot development has gone 20% above starts. This is a relatively small market, but it is growing rapidly.

We saw the same pattern in Dallas and Jacksonville, with lot development surging in 2014, and then falling throughout 2015.

We will be watching these markets with great interest over the next few months to see if this trend accelerates, or if it more markets join the ranks of those with recent slowdowns. Homebuilder executives are telling me that they are finally starting to say “no” to land deals, now that land and lot prices are back to, or above, the price levels of the previous peak in many markets. This new discipline in land buying could feed into a lower pace of lot development, but then again, increased price resistance by builders may force land sellers to get more reasonable with prices and terms, and that would allow lot development and starts to rise further (and at a nice clip) for the next several years.

CR Note: This was from Metrostudy chief economist Brad Hunter.

Philly Fed Manufacturing Survey showed Expansion in March

by Calculated Risk on 3/17/2016 11:59:00 AM

Earlier from the Philly Fed: March 2016 Manufacturing Business Outlook Survey

Firms responding to the Manufacturing Business Outlook Survey reported an improvement in business conditions this month. The indicator for general activity rose sharply in March to its first positive reading in seven months. Other broad indicators offered similar signals of growth: The indexes for shipments and new orders also rose notably. Firms continued to report overall weak employment. With respect to the manufacturers’ forecasts, the survey’s future indicators also showed significant improvement this month.This was above the consensus forecast of a reading of -1.4 for March.

...

The diffusion index for current activity increased from a reading of -2.8 in February to 12.4 this month, its first positive reading in seven months ...

The survey’s indicators of employment improved but suggest continued weakness. The employment index increased 4 points but remained slightly negative at -1.1.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The yellow line is an average of the NY Fed (Empire State) and Philly Fed surveys through March. The ISM and total Fed surveys are through February.

The average of the Empire State and Philly Fed surveys increased sharply in March (yellow). This suggests the ISM survey might be above 50 this month.

BLS: Jobs Openings increased in January

by Calculated Risk on 3/17/2016 10:15:00 AM

From the BLS: Job Openings and Labor Turnover Summary

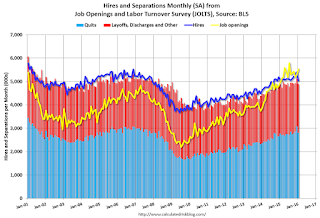

The number of job openings rose to 5.5 million on the last business day of January, the U.S. Bureau of Labor Statistics reported today. Hires declined to 5.0 million while separations edged down to 4.9 million. Within separations, the quits rate was 2.0 percent, and the layoffs and discharges rate was 1.2 percent. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

The number of quits fell to 2.8 million (-284,000) in January. The quits rate was 2.0 percent.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for January, the most recent employment report was for February.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in January to 5.541 million from 5.281 million in December.

The number of job openings (yellow) are up 11% year-over-year compared to January 2015.

Quits are up 1% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

This is another solid report, and job openings are just below the record high set in July 2015.

Weekly Initial Unemployment Claims increase to 265,000

by Calculated Risk on 3/17/2016 08:36:00 AM

The DOL reported:

In the week ending March 12, the advance figure for seasonally adjusted initial claims was 265,000, an increase of 7,000 from the previous week's revised level. The previous week's level was revised down by 1,000 from 259,000 to 258,000. The 4-week moving average was 268,000, an increase of 750 from the previous week's revised average. The previous week's average was revised down by 250 from 267,500 to 267,250.The previous week was revised down.

There were no special factors impacting this week's initial claims. This marks 54 consecutive weeks of initial claims below 300,000, the longest streak since 1973.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 268,000.

This was below the consensus forecast of 270,000. The low level of the 4-week average suggests few layoffs.

Wednesday, March 16, 2016

Thursday: Unemployment Claims, Philly Fed Mfg Survey, Job Openings

by Calculated Risk on 3/16/2016 09:20:00 PM

Thursday:

• At 8:30 AM,The initial weekly unemployment claims report will be released. The consensus is for 270 thousand initial claims, up from 259 thousand the previous week.

• Also at 8:30 AM, The Philly Fed manufacturing survey for March. The consensus is for a reading of -1.4, up from -2.8.

• At 10:00 AM, Job Openings and Labor Turnover Survey for January from the BLS. Jobs openings increased in December to 5.607 million from 5.346 million in November.