by Calculated Risk on 3/24/2016 07:42:00 PM

Thursday, March 24, 2016

Goldman: "Inflation Finally Begins to Firm"

Friday:

• At 8:30 AM ET, Gross Domestic Product, 4th quarter 2015 (Third estimate). The consensus is that real GDP increased 1.0% annualized in Q4, unrevised from the second estimate.

• At 10:00 AM, Regional and State Employment and Unemployment (Monthly) for February 2016 from BLS.

A few excerpts from a research piece by Goldman Sachs economists David Mericle and Chris Mischaikow: Inflation Finally Begins to Firm

Fed officials have long argued that inflation has been soft primarily due to transitory factors and would eventually rise as these influences faded and the labor market tightened. Over the last half year, inflation has picked up substantially in a manner that closely fits the Fed’s narrative. Yet at the March FOMC meeting, both the Committee’s inflation projections and comments from Chair Yellen suggested a puzzlingly skeptical take on the encouraging recent data.

We see three broad reasons for the skepticism of some FOMC participants. First, some see ... one-off factors that are unlikely to persist. Second, others likely see downside risks from recent declines in inflation expectations. Third, some participants likely expect further drag from past or future dollar appreciation. ...

In our view, the FOMC had it right the first time. We expect disinflationary forces to fade further this year, while inflationary pressures should strengthen as the labor market continues to tighten ... As a result, we expect core PCE inflation to reach 1.8% by 2016Q4, 0.2pp above the FOMC’s projection, and headline PCE inflation to reach 1.5%, 0.3pp above the FOMC’s projection.

... As the year progresses, we expect that the FOMC will gradually revise up its inflation projections and ultimately conclude that an even stronger acceleration to 1.8% merits three hikes this year rather than two.

Vehicle Sales Forecast: Sales to Reach All Time High for the Month of March

by Calculated Risk on 3/24/2016 02:00:00 PM

The automakers will report March vehicle sales on Friday, April 1st.

Note: There were 27 selling days in March, up from 25 in March 2015.

From WardsAuto: Forecast: March Sales Set to Hit Record-High

A WardsAuto forecast calls for U.S. automakers to deliver 1.7 million light vehicles this month, a record high for March and the largest volume for any month since July 2005’s 1,804,240 units.Looks like another strong month for vehicle sales.

The forecasted daily sales rate of 61,727 over 27 days is a best-ever March result. This DSR represents a 0.2% improvement from like-2015 (25 days), while total volume for the month would be 8.2% greater than year-ago. If deliveries meet or exceed WardsAuto’s expectations, March will be the eight consecutive month to outpace prior-year on a DSR basis.

...

The report puts the seasonally adjusted annual rate of sales for the month at 17.3 million units, below the 17.4 million SAAR from the first two months of 2016 combined, but well above the 17.1 million SAAR from same-month year-ago.

emphasis added

Kansas City Fed: Regional Manufacturing Activity "remained negative" in March

by Calculated Risk on 3/24/2016 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Remained Negative

The Federal Reserve Bank of Kansas City released the March Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity remained negative.The Kansas City region continues to be hit hard by lower oil prices and the stronger dollar.

“Factories reported another decline in activity in March, although the drop was somewhat smaller than in the previous three months” said Wilkerson.

...

Tenth District manufacturing activity remained negative, while producers’ expectations for future activity weakened. Most price indexes edged higher in March, but remained at low levels.

The month-over-month composite index was -6 in March, up from -12 in February and -9 in January ... The new orders, order backlog, and employment indexes improved slightly but remained in negative territory.

emphasis added

Weekly Initial Unemployment Claims increase to 265,000

by Calculated Risk on 3/24/2016 08:38:00 AM

The DOL reported:

Note: This week's release reflects the annual revision to the weekly unemployment claims seasonal adjustment factors. The seasonal adjustment factors used for the UI Weekly Claims data from 2011 forward, along with the resulting seasonally adjusted values for initial claims and continuing claims, have been revised.The previous week was revised down.

In the week ending March 19, the advance figure for seasonally adjusted initial claims was 265,000, an increase of 6,000 from the previous week's revised level. The previous week's level was revised down by 6,000 from 265,000 to 259,000. The 4-week moving average was 259,750, an increase of 250 from the previous week's revised average. The previous week's average was revised down by 8,500 from 268,000 to 259,500.

There were no special factors impacting this week's initial claims. This marks 55 consecutive weeks of initial claims below 300,000, the longest streak since 1973.

Note: The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 259,750.

This was below the consensus forecast of 268,000. The low level of the 4-week average suggests few layoffs.

Wednesday, March 23, 2016

Thursday: Durable Goods, Unemployment Claims

by Calculated Risk on 3/23/2016 06:58:00 PM

Here is an interesting paper from Jordan Rappaport at the Kansas City Fed: The Limited Supply of Homes

Over the longer term, the supply of homes for purchase should considerably improve as baby boomers increasingly downsize from single-family to multifamily homes. But recent experience suggests that downsizing typically begins when people are in their late seventies, a milestone the leading edge of the baby boomers will not reach for another five years (Rappaport 2015). Until then, the supply of single-family homes for purchase is likely to remain tight, putting continuing upward pressure on home prices.Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for 268 thousand initial claims, up from 265 thousand the previous week.

• Also at 8:30 AM, Durable Goods Orders for February from the Census Bureau. The consensus is for a 3.0% decrease in durable goods orders.

• At 11:00 AM, the Kansas City Fed Survey of Manufacturing Activity for March.

Comments on February New Home Sales

by Calculated Risk on 3/23/2016 03:20:00 PM

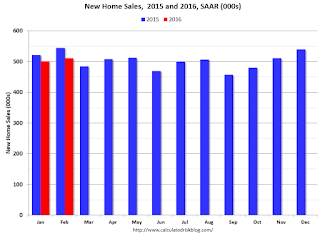

The new home sales report for February was slightly above expectations at 512,000 on a seasonally adjusted annual rate basis (SAAR), and combined sales for November, December and January were revised up.

Sales were down 6.1% year-over-year (YoY) compared to February 2015. However, we have to remember February 2015 was the strongest month of 2015 at 545,000 SAAR. Sales for all of 2015 were 501,000 (up 14.5% from 2014) - and since January and February were especially strong months last year, the YoY comparisons have been difficult so far.

Earlier: New Home Sales increased to 512,000 Annual Rate in February.

This graph shows new home sales for 2015 and 2016 by month (Seasonally Adjusted Annual Rate).

The comparisons for the first two months was difficult. I also expect lower growth this year overall.

Houston (and other oil producing areas) will have a problem this year. Inventory of existing homes is increasing quickly and prices will probably decline in those areas. And that means new home construction will slow in those areas too.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

I expect existing home sales to move more sideways, and I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

AIA: "Modest Expansion for Architecture Billings Index"

by Calculated Risk on 3/23/2016 12:58:00 PM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Modest Expansion for Architecture Billings Index

The Architecture Billings Index saw a dip into negative terrain for the first time in five months in January, but inched back up in February with a small increase in demand for design services. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the February ABI score was 50.3, up slightly from the mark of 49.6 in the previous month. This score reflects a minor increase in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 59.5, up from a reading of 55.3 the previous month.

“March and April are traditionally the busiest months for architecture firms, so we should get a clearer reading of underlying momentum over the next couple of months,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “Hopefully the relatively mild weather conditions recently in most parts of the country will help design and construction activity move ahead at a somewhat faster pace.”

...

• Regional averages: South (51.1), West (49.9), Northeast (49.5), Midwest (49.3)

• Sector index breakdown: multi-family residential (53.0), commercial / industrial (52.3), institutional (48.1), mixed practice (47.7)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 50.3 in February, up from 49.6 in January. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

The multi-family residential market was negative for most of last year - suggesting a slowdown or less growth for apartments - but has been positive for the last five months.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 8 of the last 12 months, suggesting a further increase in CRE investment in 2016.

New Home Sales increased to 512,000 Annual Rate in February

by Calculated Risk on 3/23/2016 10:13:00 AM

The Census Bureau reports New Home Sales in February were at a seasonally adjusted annual rate (SAAR) of 512 thousand.

The previous three months were revised up by a total of 12 thousand (SAAR).

"Sales of new single-family houses in February 2016 were at a seasonally adjusted annual rate of 512,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 2.0 percent above the revised January rate of 502,000, but is 6.1 percent below the February 2015 estimate of 545,000."

emphasis added

Click on graph for larger image.

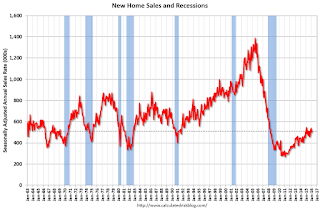

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales since the bottom, new home sales are still fairly low historically.

The second graph shows New Home Months of Supply.

The months of supply was unchanged in February at 5.6 months.

The months of supply was unchanged in February at 5.6 months. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

"The seasonally adjusted estimate of new houses for sale at the end of February was 240,000. This represents a supply of 5.6 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

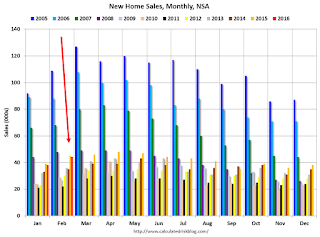

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In February 2016 (red column), 44 thousand new homes were sold (NSA). Last year 45 thousand homes were sold in February.

The all time high for February was 109 thousand in 2005, and the all time low for February was 22 thousand in 2011.

This was close to expectations of 512,000 sales SAAR in February, and prior months were revised up slightly - although sales were down year-over-year. Still a decent report. I'll have more later today.

MBA: Mortgage Applications Decreased in Latest Weekly Survey, Purchase Applications up 25% YoY

by Calculated Risk on 3/23/2016 07:01:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 3.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 18, 2016.

...

The Refinance Index decreased 5 percent from the previous week. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index decreased 1 percent compared with the previous week and was 25 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 3.93 percent from 3.94 percent, with points decreasing to 0.35 from 0.42 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity was higher in 2015 than in 2014, but it was still the third lowest year since 2000.

Refinance activity picked up earlier this year as rate declined.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 25% higher than a year ago.

Black Knight's First Look at February Mortgage Data: Delinquency rate lowest since April 2007

by Calculated Risk on 3/23/2016 12:01:00 AM

From Black Knight: Black Knight Financial Services’ First Look at February Mortgage Data: Delinquencies Fully Recover from January Spike, Hit Lowest Level Since April 2007

• Delinquency rate down 13 percent month-over-month; down nearly 16 percent year-over-yearAccording to Black Knight's First Look report for February, the percent of loans delinquent decreased 12.6% in February compared to January, and declined 15.9% year-over-year.

• Total non-current inventory falls below 3 million for the first time in over eight years

The percent of loans in the foreclosure process declined 0.6% in February and were down 24.6% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 4.45% in February, down from 5.09% in January. This is the lowest delinquency rate since April 2007.

The percent of loans in the foreclosure process declined slightly in February to 1.30%.

The number of delinquent properties, but not in foreclosure, is down 419,000 properties year-over-year, and the number of properties in the foreclosure process is down 211,000 properties year-over-year.

Black Knight will release the complete mortgage monitor for February on April 4th.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Feb 2016 | Jan 2016 | Feb 2015 | Feb 2014 | |

| Delinquent | 4.45% | 5.09% | 5.30% | 5.94% |

| In Foreclosure | 1.30% | 1.30% | 1.72% | 2.30% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 2,252,000 | 2,575,000 | 2,671,000 | 2,994,000 |

| Number of properties in foreclosure pre-sale inventory: | 655,000 | 659,000 | 866,000 | 1,156,000 |

| Total Properties | 2,907,000 | 3,234,000 | 3,537,000 | 4,150,000 |