by Calculated Risk on 3/28/2016 10:36:00 AM

Monday, March 28, 2016

Dallas Fed: "Texas Manufacturing Activity Rebounds in March"

From the Dallas Fed: Texas Manufacturing Activity Rebounds in March

Texas factory activity expanded slightly in March, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rebounded to positive territory this month—coming in at 3.3—after two months of negative readings.This was the last of the regional Fed surveys for March.

...

Perceptions of broader business conditions remained negative but showed signs of slight stabilization in March. The general business activity index jumped 18 points but remained negative for a 15th month, posting a reading of -13.6. The company outlook index posted a fourth negative reading in a row but edged up to -11.0.

Labor market indicators reflected continued decline in March. The employment index was largely unchanged at -10.3, with 12 percent of firms noting net hiring and 22 percent noting net layoffs. The hours worked index remained negative for a third month in a row but edged up to -5.6.

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through March), and five Fed surveys are averaged (blue, through March) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through February (right axis).

It seems likely the ISM manufacturing index will show expansion in March following five months of contraction. The consensus is the ISM index will increase to 50.5% from 49.5% in February (above 50 is expansion).

NAR: Pending Home Sales Index increased 3.5% in February, up 0.7% year-over-year

by Calculated Risk on 3/28/2016 10:03:00 AM

From the NAR: Pending Home Sales Move Forward in February

The Pending Home Sales Index, a forward-looking indicator based on contract signings, rose 3.5 percent to 109.1 in February from a downwardly revised 105.4 in January and is now 0.7 percent above February 2015 (108.3). Although the index has now increased year-over-year for 18 consecutive months, last month's annual gain was the smallest.This was above expectations of a 1.5% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in March and April.

...

The PHSI in the Northeast declined 0.2 percent to 94.0 in February, but is still 12.6 percent above a year ago. In the Midwest the index shot up 11.4 percent to 112.6 in February, and is now 2.5 percent above February 2015.

Pending home sales in the South increased 2.1 percent to an index of 122.4 in February but are 0.4 percent lower than last February. The index in the West climbed 0.7 percent in February to 96.4, but is now 6.2 percent below a year ago.

emphasis added

Personal Income increased 0.2% in February, Spending increased 0.1%

by Calculated Risk on 3/28/2016 08:40:00 AM

The BEA released the Personal Income and Outlays report for February:

Personal income increased $23.7 billion, or 0.2 percent ... according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $11.0 billion, or 0.1 percent.The following graph shows real Personal Consumption Expenditures (PCE) through February 2016 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.2 percent in February, in contrast to a decrease of less than 0.1 percent in January. ... The price index for PCE decreased 0.1 percent in February, in contrast to an increase of 0.1 percent in January. The PCE price index, excluding food and energy, increased 0.1 percent, compared with an increase of 0.3 percent.

The February PCE price index increased 1.0 percent from February a year ago. The February PCE price index, excluding food and energy, increased 1.7 percent from February a year ago.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was larger than expected. And the increase in PCE was at the 0.1% increase consensus.

On inflation: The PCE price index increased 1.0 percent year-over-year due to the sharp decline in oil prices. The core PCE price index (excluding food and energy) increased 1.7 percent year-over-year in February.

Using the two-month method to estimate Q1 PCE growth, PCE was increasing at a 1.8% annual rate in Q1 2016 (using the mid-month method, PCE was increasing 1.6%). This suggests sluggish PCE growth in Q1.

Sunday, March 27, 2016

Monday: Personal Income and Outlays, Pending Home Sales

by Calculated Risk on 3/27/2016 08:02:00 PM

This immigration program has really boosted sales in certain California and New York areas, from the WSJ: U.S. Immigration Program for Foreign Investors Sees Demand Surge

The program, known as EB-5, received applications from 17,691 investors in 2015, up from 11,744 in 2014 and 6,554 in 2013, according to figures released last week by U.S. Citizenship and Immigration Services.Weekend:

...

The EB-5 program offers green cards to aspiring immigrants who invest at least $500,000 into certain businesses that have been determined to create at least 10 jobs per investor.

First created in 1990, EB-5 was barely used until the aftermath of the 2008 recession, when real-estate developers realized it offered a cheap and accessible form of financing when banks were reluctant to lend. The program has since become mainstream within the real-estate development world, particularly among high-end developers in New York, who recruit heavily in China.

• Schedule for Week of March 27, 2016

Monday:

• At 8:30 AM ET, Personal Income and Outlays for February. The consensus is for a 0.1% increase in personal income, and for a 0.1% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• At 10:00 AM, Pending Home Sales Index for February. The consensus is for a 1.5% increase in the index.

• At 10:30 AM, Dallas Fed Manufacturing Survey for March. This is the last of the regional Fed manufacturing surveys for March.

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are up 4 and DOW futures are up 44 (fair value).

Oil prices were mixed over the last week with WTI futures at $39.75 per barrel and Brent at $40.64 per barrel. A year ago, WTI was at $46, and Brent was at $54 - so prices are down about 15% to 22% year-over-year, respectively.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.04 per gallon (down almost $0.40 per gallon from a year ago).

Hotels: Supply increased faster than Demand in January and February

by Calculated Risk on 3/27/2016 10:22:00 AM

From HotelNewsNow.com: Freitag’s 5: US RevPAR growth underwhelms in February

1. RevPAR has now grown for 72 monthsAnd weekly data from HotelNewsNow.com: STR: US hotel results for week ending 19 March

Even though the numbers are small, they are positive. We expect them to be so for the next 18 months. Just like last month, RevPAR growth was driven by average daily rate, as occupancies are on a declining trajectory:

This should not come as a surprise because we have been warning about pipeline growth for a while. But it shows that when the weather does not cooperate and the U.S. economy catches a mild cold, there is an immediate impact on occupancies. However, the 61.7% occupancy for February is still the second-highest occupancy ever recorded.

2. Supply growth has outpaced demand growth for two consecutive months

Demand increased only 0.6%. It is worth pointing out that demand is still growing, so while that continues to be true we are breaking demand records every month.

But 0.6% growth sounds pretty flat, and with the increase in supply of 1.6% you get the occupancy decline as described above. As I suggested last month, the supply uptick is a sequential 0.1% (from +1.5% in January), but it is also worth emphasizing that it represents a doubling of the supply percent change from February 2015, which at the time was 0.8% growth.

The U.S. hotel industry reported positive results in the three key performance metrics during the week of 13-19 March 2016, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The occupancy rate should continue to increase into the Spring, and then increase further during the Summer travel period.

In year-over-year comparisons, the industry’s occupancy increased 1.9% to 70.5%. Average daily rate for the week was up 4.2% to US$127.72. Revenue per available room increased 6.2% to US$90.04.

emphasis added

The red line is for 2016, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.

The red line is for 2016, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.2015 was the best year on record for hotels.

So far 2016 is just behind 2015.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Saturday, March 26, 2016

Schedule for Week of March 27, 2016

by Calculated Risk on 3/26/2016 02:02:00 PM

The key report this week is the March employment report on Friday.

Other key indicators include March vehicle sales, the March ISM manufacturing index, February Personal income and outlays, and the January Case-Shiller house price index.

Fed Chair Janet Yellen speaks on Tuesday on the "Economic Outlook and Monetary Policy".

8:30 AM ET: Personal Income and Outlays for February. The consensus is for a 0.1% increase in personal income, and for a 0.1% increase in personal spending. And for the Core PCE price index to increase 0.2%.

10:00 AM: Pending Home Sales Index for February. The consensus is for a 1.5% increase in the index.

10:30 AM: Dallas Fed Manufacturing Survey for March. This is the last of the regional Fed manufacturing surveys for March.

9:00 AM: S&P/Case-Shiller House Price Index for January. Although this is the January report, it is really a 3 month average of November, December and January prices.

9:00 AM: S&P/Case-Shiller House Price Index for January. Although this is the January report, it is really a 3 month average of November, December and January prices.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the December 2015 report (the Composite 20 was started in January 2000).

The consensus is for a 5.8% year-over-year increase in the Comp 20 index for January. The Zillow forecast is for the National Index to increase 5.6% year-over-year in January.

12:20 PM: Speech by Fed Chair Janet Yellen, Economic Outlook and Monetary Policy, At the Economic Club of New York Luncheon, New York, New York

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for March. This report is for private payrolls only (no government). The consensus is for 203,000 payroll jobs added in March, down from 214,000 in February.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 266 thousand initial claims, up from 265 thousand the previous week.

9:45 AM: Chicago Purchasing Managers Index for March. The consensus is for a reading of 50.3, up from 47.6 in February.

8:30 AM: Employment Report for March. The consensus is for an increase of 210,000 non-farm payroll jobs added in March, down from the 242,000 non-farm payroll jobs added in February.

The consensus is for the unemployment rate to be unchanged at 4.9%.

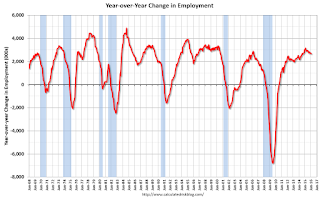

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In February, the year-over-year change was 2.67 million jobs.

A key will be the change in real wages.

10:00 AM: ISM Manufacturing Index for March. The consensus is for the ISM to be at 50.5, up from 49.5 in February.

10:00 AM: ISM Manufacturing Index for March. The consensus is for the ISM to be at 50.5, up from 49.5 in February.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated contraction at 49.5% in February. The employment index was at 48.5%, and the new orders index was at 51.5%.

10:00 AM: Construction Spending for February. The consensus is for a 0.2% increase in construction spending.

All day: Light vehicle sales for March. The consensus is for light vehicle sales to increase to 17.6 million SAAR in March from 17.5 million in February (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for March. The consensus is for light vehicle sales to increase to 17.6 million SAAR in March from 17.5 million in February (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the February sales rate.

10:00 AM: University of Michigan's Consumer sentiment index (final for March). The consensus is for a reading of 90.9, up from the preliminary reading 91.0.

March 2016: Unofficial Problem Bank list declines to 222 Institutions, Q1 2016 Transition Matrix

by Calculated Risk on 3/26/2016 11:21:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for March 2016.

Changes and comments from surferdude808:

Update on the Unofficial Problem Bank List for March 2016. During the month, the list fell from 228 institutions to 222 after eight removals and two additions. Assets dropped by $1.4 billion to an aggregate $64.6 billion. A year ago, the list held 349 institutions with assets of $106.2 billion.

This month, actions have been terminated against Bank of Washington, Washington, MO ($599 million); Community First Bank, Inc., Walhalla, SC ($355 million); Union National Bank and Trust Company of Elgin, Elgin, IL ($311 million); First State Bank, Mesquite, TX ($172 million Ticker: CFOK); American Bank of Baxter Springs, Baxter Springs, KS ($91 million); Freedom Bank, Columbia Falls, MT ($58 million); and Pacific West Bank, West Linn, OR ($54 million Ticker: PWBO).

North Milwaukee State Bank, Milwaukee, WI ($67 million) exited the list through failure on March 11, 2016. This is first failed bank since October 2, 2015.

The additions this month were both from Kentucky -- Peoples Bank & Trust Company of Hazard, Hazard, KY ($278 million) and Blue Grass Federal Savings and Loan Association, Paris, KY ($38 million). Perhaps in a few months, the list will begin to see new additions from banks operated in local economies where the oil & gas industry is a large driver.

With it being the end of the first quarter, we bring an updated transition matrix to detail how banks are moving off the Unofficial Problem Bank List. Since the Unofficial Problem Bank List was first published on August 7, 2009 with 389 institutions, a total of 1,705 institutions have appeared on a weekly or monthly list at some point. There have been 1,483 institutions that have transitioned through the list. Departure methods include 837 action terminations, 396 failures, 236 mergers, and 14 voluntary liquidations. The first quarter of 2015 started with 250 institutions on the list, so the 28 action terminations during the quarter reduced the list by 11.2 percent. Of the 389 institutions on the first published list, 26 or 6.7 percent still remain more than six years later. The 396 failures represent 23.2 percent of the 1,705 institutions that have made an appearance on the list. This failure rate is well above the 10-12 percent rate frequently cited in media reports on the failure rate of banks on the FDIC's official list.

| Unofficial Problem Bank List | |||

|---|---|---|---|

| Change Summary | |||

| Number of Institutions | Assets ($Thousands) | ||

| Start (8/7/2009) | 389 | 276,313,429 | |

| Subtractions | |||

| Action Terminated | 162 | (61,658,424) | |

| Unassisted Merger | 40 | (10,183,639) | |

| Voluntary Liquidation | 4 | (10,584,114) | |

| Failures | 157 | (184,803,449) | |

| Asset Change | (2,514,219) | ||

| Still on List at 3/31/2016 | 26 | 6,569,584 | |

| Additions after 8/7/2009 | 196 | 58,049,809 | |

| End (3/31//2016) | 222 | 64,619,393 | |

| Intraperiod Deletions1 | |||

| Action Terminated | 675 | 276,185,701 | |

| Unassisted Merger | 196 | 78,425,969 | |

| Voluntary Liquidation | 10 | 2,324,142 | |

| Failures | 239 | 119,641,968 | |

| Total | 1,120 | 476,577,780 | |

| 1Institution not on 8/7/2009 or 3/31/2016 list but appeared on a weekly list. | |||

Friday, March 25, 2016

DOT: Vehicle Miles Driven increased 2.0% year-over-year in January

by Calculated Risk on 3/25/2016 01:32:00 PM

The Department of Transportation (DOT) reported today:

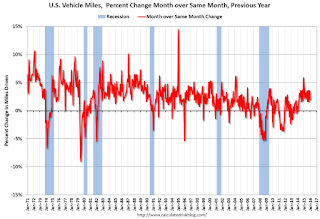

Travel on all roads and streets changed by 2.0% (4.8 billion vehicle miles) for January 2016 as compared with January 2015.The following graph shows the rolling 12 month total vehicle miles driven to remove the seasonal factors.

Travel for the month is estimated to be 240.7 billion vehicle miles.

The seasonally adjusted vehicle miles traveled for January 2016 is 264.3 billion miles, a 2.7% (7.0 billion vehicle miles) increase over January 2015. It also represents a -0.8% change (-2.1 billion vehicle miles) compared with December 2015.

The rolling 12 month total is moving up - mostly due to lower gasoline prices - after moving sideways for several years.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Miles driven (rolling 12) had been below the previous peak for 85 months - an all time record - before reaching a new high for miles driven in January 2015.

The second graph shows the year-over-year change from the same month in the previous year.

In January 2015, gasoline averaged $2.06 per gallon according to the EIA. That was down from January 2015 when prices averaged $2.21 per gallon.

In January 2015, gasoline averaged $2.06 per gallon according to the EIA. That was down from January 2015 when prices averaged $2.21 per gallon.Gasoline prices aren't the only factor - demographics are also important. However, with lower gasoline prices, miles driven on a rolling 12 month basis, is setting new highs each month.

BLS: Unemployment Rate decreased in 22 States in February

by Calculated Risk on 3/25/2016 10:19:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were little changed in February. Twenty-two states had unemployment rate decreases from January, 8 states had increases, and 20 states and the District of Columbia had no change, the U.S. Bureau of Labor Statistics reported today.

...

New Hampshire and South Dakota had the lowest jobless rates in February, 2.7 percent each, followed by North Dakota, 2.9 percent. Alaska had the highest rate, 6.6 percent, closely followed by Mississippi and West Virginia, 6.5 percent each.

Click on graph for larger image.

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement. The yellow squares are the lowest unemployment rate per state since 1976.

The states are ranked by the highest current unemployment rate. Alaska, at 6.6%, had the highest state unemployment rate.

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).Currently no state has an unemployment rate at or above 7% (light blue); Only seven states are at or above 6% (dark blue).

Q4 GDP Revised Up to 1.4% Annual Rate

by Calculated Risk on 3/25/2016 08:34:00 AM

From the BEA: Gross Domestic Product: Fourth Quarter 2015 (Third Estimate)

Real gross domestic product -- the value of the goods and services produced by the nation's economy less the value of the goods and services used up in production, adjusted for price changes -- increased at an annual rate of 1.4 percent in the fourth quarter of 2015, according to the "third" estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 2.0 percent.Here is a Comparison of Third and Second Estimates. PCE growth was revised up from 2.0% to 2.4%. Residential investment was revised up from 8.0% to 10.1%. This was above the consensus forecast.

The GDP estimate released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was 1.0 percent. With this third estimate for the fourth quarter, the general picture of economic growth remains largely the same; personal consumption expenditures (PCE) increased more than previously estimated ...

emphasis added