by Calculated Risk on 3/30/2016 11:27:00 AM

Wednesday, March 30, 2016

Zillow Forecast: Expect Slightly Slower Growth in February for the Case-Shiller Indexes

The Case-Shiller house price indexes for January were released yesterday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Zillow: February Case-Shiller Forecast: More of the Same, But Slightly Slower

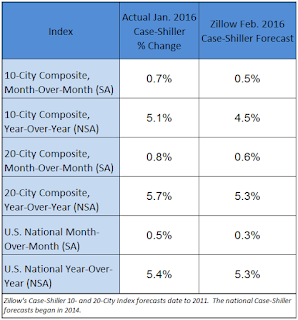

The January Case-Shiller indices grew at the exact same annual pace as December. Looking ahead, expect all three February Case-Shiller indices to show similar but slightly slower slower growth, with the 10-City Composite Index expected to register sub-5 percent annual growth for the first time in months, according to Zillow’s February Case-Shiller forecast.The year-over-year change for the 10-city and 20-city indexes, and the Case-Shiller National index, will probably be slightly lower in the February report than in the January report.

The February Case-Shiller National Index is expected to gain another 0.3 percent in February from January, down from 0.5 percent growth in January from December. We expect the 10-City Index to grow 4.5 percent year-over-year, and the 20-City Index to grow 5.3 percent over the same period. The National Index also looks set to rise 5.3 percent year-over-year.

All SPCS forecasts are shown in the table below. These forecasts are based on today’s January Case-Shiller data release and the February 2016 Zillow Home Value Index (ZHVI). The February Case-Shiller Composite Home Price Indices will not be officially released until Tuesday, April 26.

ADP: Private Employment increased 200,000 in March

by Calculated Risk on 3/30/2016 08:19:00 AM

Private sector employment increased by 200,000 jobs from February to March according to the March ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was close to the consensus forecast for 203,000 private sector jobs added in the ADP report.

...

Goods-producing employment rose by 9,000 jobs in March, up from a downwardly revised 2,000 in February. The construction industry added 17,000 jobs, which was down from February’s 24,000. Meanwhile, manufacturing added 3,000 jobs after losing 9,000 the previous month.

Service-providing employment rose by 191,000 jobs in March, down from 204,000 in February.

...

Mark Zandi, chief economist of Moody’s Analytics, said, “The job market continues on its amazing streak. The March job gain of 200,000 is consistent with average monthly job growth of the past more than four years. The only industry reducing payrolls is energy as has been the case for over a year. All indications are that the job machine will remain in high gear.”

The BLS report for March will be released Friday, and the consensus is for 210,000 non-farm payroll jobs added in March.

MBA: "Refinance Applications Down, Purchase Applications Up in Latest MBA Weekly Survey"

by Calculated Risk on 3/30/2016 07:00:00 AM

From the MBA: Refinance Applications Down, Purchase Applications Up in Latest MBA Weekly Survey

Mortgage applications decreased 1.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 25, 2016.

...

The Refinance Index decreased 3 percent from the previous week. The seasonally adjusted Purchase Index increased 2 percent from one week earlier. The unadjusted Purchase Index increased 3 percent compared with the previous week and was 21 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 3.94 percent from 3.93 percent, with points increasing to 0.36 from 0.35 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity was higher in 2015 than in 2014, but it was still the third lowest year since 2000.

Refinance activity picked up earlier this year as rates declined.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 21% higher than a year ago.

Tuesday, March 29, 2016

Mortgage News Daily: "Mortgage Rates Drop After Yellen Speech"

by Calculated Risk on 3/29/2016 06:34:00 PM

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, the ADP Employment Report for March. This report is for private payrolls only (no government). The consensus is for 203,000 payroll jobs added in March, down from 214,000 in February.

From Matthew Graham at Mortgage News Daily: Mortgage Rates Drop After Yellen Speech

Mortgage rates moved decisively lower today, following a speech from Fed Chair Janet Yellen. ... In fact, the MBS gains were so steep that most lenders didn't adjust rates to fully account for the market movement. This is typical when volatility increases, for better or worse. If markets are able to hold current levels, rates would continue to drop. As it stands, the most prevalent conventional 30yr fixed quote on top tier scenarios is now easily back down to 3.75%, with many lenders pushing back into 3.625%. Just last week, there were quite a few lenders up at 3.875%.Here is a table from Mortgage News Daily:

emphasis added

Real Prices and Price-to-Rent Ratio in January

by Calculated Risk on 3/29/2016 02:51:00 PM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 5.4% year-over-year in January

The year-over-year increase in prices is mostly moving sideways now around 5%. In January, the index was up 5.4% YoY.

In the earlier post, I graphed nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $274,000 today adjusted for inflation (37%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

It has been almost ten years since the bubble peak. In the Case-Shiller release this morning, the National Index was reported as being 3.3% below the bubble peak. However, in real terms, the National index is still about 17% below the bubble peak.

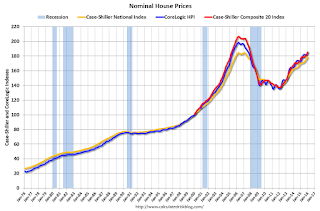

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) is back to October 2005 levels, and the Case-Shiller Composite 20 Index (SA) is back to April 2005 levels, and the CoreLogic index (NSA) is back to June 2005.

Real House Prices

In real terms, the National index is back to January 2004 levels, the Composite 20 index is back to September 2003, and the CoreLogic index back to January 2004.

In real terms, house prices are back to late 2003 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to August 2003 levels, the Composite 20 index is back to May 2003 levels, and the CoreLogic index is back to August 2003.

In real terms, and as a price-to-rent ratio, prices are back to late 2003 levels - and the price-to-rent ratio maybe moving a little more sideways now.

Yellen: The Outlook, Uncertainty, and Monetary Policy

by Calculated Risk on 3/29/2016 12:25:00 PM

From Fed Chair Janet Yellen: The Outlook, Uncertainty, and Monetary Policy. Excerpts on risks:

Although the baseline outlook has changed little on balance since December, global developments pose ongoing risks. These risks appear to have contributed to the financial market volatility witnessed both last summer and in recent months.

One concern pertains to the pace of global growth, which is importantly influenced by developments in China. There is a consensus that China's economy will slow in the coming years as it transitions away from investment toward consumption and from exports toward domestic sources of growth. There is much uncertainty, however, about how smoothly this transition will proceed and about the policy framework in place to manage any financial disruptions that might accompany it. These uncertainties were heightened by market confusion earlier this year over China's exchange rate policy.

A second concern relates to the prospects for commodity prices, particularly oil. For the United States, low oil prices, on net, likely will boost spending and economic activity over the next few years because we are still a major oil importer. But the apparent negative reaction of financial markets to recent declines in oil prices may in part reflect market concern that the price of oil was nearing a financial tipping point for some countries and energy firms. In the case of countries reliant on oil exports, the result might be a sharp cutback in government spending; for energy-related firms, it could entail significant financial strains and increased layoffs. In the event oil prices were to fall again, either development could have adverse spillover effects to the rest of the global economy.

If such downside risks to the outlook were to materialize, they would likely slow U.S. economic activity, at least to some extent, both directly and through financial market channels as investors respond by demanding higher returns to hold risky assets, causing financial conditions to tighten. But at the same time, we should not ignore the welcome possibility that economic conditions could turn out to be more favorable than we now expect. The improvement in the labor market in 2014 and 2015 was considerably faster than expected by either FOMC participants or private forecasters, and that experience could be repeated if, for example, the economic headwinds we face were to abate more quickly than anticipated. For these reasons, the FOMC must watch carefully for signs that the economy may be evolving in unexpected ways, good or bad.

emphasis added

Case-Shiller: National House Price Index increased 5.4% year-over-year in January

by Calculated Risk on 3/29/2016 09:22:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for January ("January" is a 3 month average of November, December and January prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Price Increases Continue in January According to the S&P/Case-Shiller Home Price Indices

The S&P/Case-Shiller U.S. National Home Price Index, covering all nine U.S. census divisions, recorded a slightly higher year-over-year gain with a 5.4% annual increase in January 2016. The 10-City Composite is up slightly at 5.1% for the year. The 20-City Composite’s year-over-year gain is 5.7%. After seasonal adjustment, the National, 10-City Composite, and 20-City Composite rose 0.5%, 0.8%, and 0.7%, respectively, from the prior month.

...

Before seasonal adjustment, the National Index, the 10-City Composite, and the 20-City Composite all remained unchanged in January. After seasonal adjustment, all three composites reported strong advances. Eleven of 20 cities reported increases in January before seasonal adjustment; after seasonal adjustment, all 20 cities increased for the month

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 11.8% from the peak, and up 0.5% in January (SA).

The Composite 20 index is off 10.2% from the peak, and up 0.8% (SA) in January.

The National index is off 3.3% from the peak, and up 0.7% (SA) in January. The National index is up 30.6% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 5.1% compared to January 2015.

The Composite 20 SA is up 5.7% year-over-year..

The National index SA is up 5.4% year-over-year.

Prices increased (SA) in 20 of the 20 Case-Shiller cities in December seasonally adjusted. (Prices increased in 11 of the 20 cities NSA) Prices in Las Vegas are off 37.8% from the peak.

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.As an example, at the peak, prices in Phoenix were 127% above the January 2000 level. Then prices in Phoenix fell slightly below the January 2000 level, and are now up 57% above January 2000 (57% nominal gain in almost 16 years).

These are nominal prices, and real prices (adjusted for inflation) are up about 40% since January 2000 - so the increase in Phoenix from January 2000 until now is about 17% above the change in overall prices due to inflation.

Seven cities - Charlotte, Boston, Dallas, Denver, Portland, San Francisco and Seattle. Detroit prices are only 5% above the January 2000 level.

I'll have more on house prices later.

Monday, March 28, 2016

Tuesday: Yellen, Case-Shiller House Prices

by Calculated Risk on 3/28/2016 09:21:00 PM

Tuesday:

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for January. Although this is the January report, it is really a 3 month average of November, December and January prices. The consensus is for a 5.8% year-over-year increase in the Comp 20 index for January. The Zillow forecast is for the National Index to increase 5.6% year-over-year in January.

• At 12:20 PM, Speech by Fed Chair Janet Yellen, Economic Outlook and Monetary Policy, At the Economic Club of New York Luncheon, New York, New York

ATA Trucking Index increased 7.2% in February

by Calculated Risk on 3/28/2016 04:39:00 PM

From the ATA: ATA Truck Tonnage Index Jumps 7.2% in February

American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index jumped 7.2% in February, following a revised 0.3% reduction during January. In February, the index equaled 144 (2000=100), up from 134.3 in January. February’s level is an all-time high.

Compared with February 2015, the SA index was up 8.6%, which was up from January’s 1.1% year-over-year gain.

...

“While it is nice to see a strong February, I caution everyone not read too much into it,” said ATA Chief Economist Bob Costello. “The strength was mainly due to a weaker than average January, including bad winter storms, thus there was some catch-up going on in February. Normally, fleets report large declines to ATA in February tonnage, in the range of 5.4% to 6.7% over the last three years. So, the small increase this year yielded a big seasonally adjusted gain. If March is strong, then I’ll get more excited.

“I’m still concerned about the elevated inventories throughout the supply chain. Last week, the Census Bureau reported that relative to sales, inventories rose again in January, which is troubling.” he said. “We need those inventories reduced before trucking can count on more consistent, better freight volumes.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

The index is now up 8.6% year-over-year.

Black Knight: House Price Index up 0.1% in January, Up 5.3% year-over-year

by Calculated Risk on 3/28/2016 01:38:00 PM

Note: I follow several house price indexes (Case-Shiller, CoreLogic, Black Knight, Zillow, FHFA, FNC and more). Note: Black Knight uses the current month closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From Black Knight: Black Knight Home Price Index Report: January Transactions; U.S. Home Prices Up 0.1 Percent for the Month; Up 5.3 Percent Year-Over-Year

• U.S. home prices were basically flat for the month, rising just 0.1% from December, and up 5.3% on a year-over- year basisThe year-over-year increase in the index has been about the same for the last year.

• This puts national home prices up 26.7% since the bottom of the market at the start of 2012

• At $253K, the national level HPI is now just 5.4% off its June 2006 peak of $267K (this last has been revised slightly - from $268K - due to additional historical data)

• New York again led gains among the states with 0.9 percent month-over-month appreciation, while Illinois saw the most negative movement at -0.4 percent

• Of the nation’s 40 largest metros, 9 hit new peaks:

◦Austin, TX ($287K)

◦Dallas, TX ($220K)

◦Denver, CO ($327K)

◦Houston, TX ($220K)

◦Kansas City, MO ($173K)

◦Nashville, TN ($222K)

◦Portland, OR ($326K)

◦San Francisco, CA ($728K)

◦San Jose, CA ($867K)