by Calculated Risk on 4/04/2016 07:12:00 PM

Monday, April 04, 2016

Tuesday: Trade Deficit, Job Openings, ISM non-Mfg

Tuesday:

• Early: Reis Q1 2016 Apartment Survey of rents and vacancy rates.

• At 8:30 AM ET, Trade Balance report for February from the Census Bureau. The consensus is for the U.S. trade deficit to be at $46.2 billion in February from $45.7 billion in January.

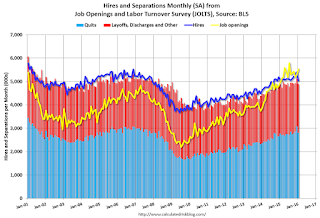

• At 10:00 AM, Job Openings and Labor Turnover Survey for February from the BLS. Jobs openings increased in January to 5.541 million from 5.281 million in December. The number of job openings (yellow) were up 11% year-over-year, and Quits were up 1% year-over-year.

• Also at 10:00 AM, the ISM non-Manufacturing Index for March. The consensus is for index to increase to 54.0 from 53.4 in February.

From Matthen Graham at Mortgage News Daily: Mortgage Rates Steady at 6-Week Lows

Mortgage rates stayed steady today, beginning the first full week of April right in line with the lowest levels in roughly 6 weeks, depending on the lender. Most are offering conventional 30yr fixed quotes at 3.625% on top tier scenarios, with a few lenders an eighth of a percent higher or lower.

A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 4/04/2016 01:51:00 PM

A few key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

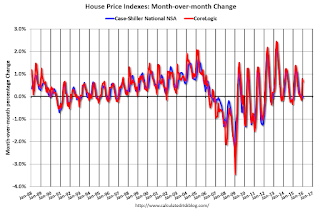

This graph shows the month-to-month change in the CoreLogic and NSA Case-Shiller National index since 1987 (both through September). The seasonal pattern was smaller back in the '90s and early '00s, and increased since the bubble burst.

The Case-Shiller index was slightly negative month-to-month in January, however the Corelogic index was positive.

The seasonal factor has started to decrease, and I expect that over the next several years - as the percent of distressed sales declines further and recent history is included in the factors - the seasonal factors will move back towards more normal levels. However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.

Reis: Office Vacancy Rate declined in Q1 to 16.2%

by Calculated Risk on 4/04/2016 10:46:00 AM

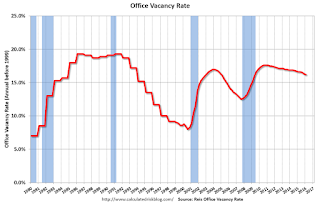

Reis released their Q1 2016 Office Vacancy survey this morning. Reis reported that the office vacancy rate declined to 16.2% in Q1, from 16.3% in Q4. This is down from 16.6% in Q1 2015, and down from the cycle peak of 17.6%.

From Reis Senior Economist and Director of Research Ryan Severino:

Although vacancy only declined by 10 basis points this quarter to 16.2%, the steady drumbeat of vacancy declines should be taken as a heartening sign.

Given the relative weakness during this recovery phase, it is realistic to expect that any acceleration in vacancy compression will occur gradually and inconsistently. The vacancy rate has now declined in six of the last seven quarters and remains at its lowest level since the second quarter of 2009 when it was at 16%. Although construction and net absorption both pulled back a bit this quarter, the trend over time is for both of those metrics to increase, not decrease. Therefore, a pullback this quarter should not be interpreted as a retrenchment in the market. Moreover, beginning the year with a compression in vacancy, which has not occurred consistently during this recovery, positions the market well. 10 basis points is in line with our forecast for 2016 and leaves the possibility that the market could slightly surprise to the upside if office-using employment growth remains robust.

...

Asking and effective rents both grew by 0.9% during the first quarter, marking the twenty-second consecutive quarter of asking and effective rent growth. These growth rates marginally exceeded last quarter's asking and effective rent growth of 0.8%. Consequently, the year-over-year rent growth figures were little changed versus the fourth quarter. When looking at rent growth over time, it is apparent that it is slowly, but surely gaining momentum, with quarterly increases creeping their way toward 1%, a relatively strong growth rate, especially for a market with a 16.2% vacancy rate. However, that apparent inconsistency stems from the fact that a handful of markets, particularly the technology-oriented markets, are outperforming by such a wide margin that they are pulling the rental growth rates above the level that would normally be associated with a 16.2% vacancy rate. The outliers are clearly skewing the overall results. Otherwise, the majority of markets are still at very nascent stages of rent growth.

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis reported the vacancy rate was at 16.2% in Q1.

Office vacancy data courtesy of Reis.

Black Knight February Mortgage Monitor

by Calculated Risk on 4/04/2016 08:01:00 AM

Black Knight Financial Services (BKFS) released their Mortgage Monitor report for February today. According to BKFS, 4.45% of mortgages were delinquent in February, down from 5.09% in February, and the lowest since April 2007. BKFS also reported that 1.30% of mortgages were in the foreclosure process, down from 1.72% a year ago.

This gives a total of 5.75% delinquent or in foreclosure.

Press Release: Black Knight’s February Mortgage Monitor: Negative Equity Rates Improve, But Lowest-Priced Homes Continue to Struggle; “Serial Refinancers” Played Large Role in 2015 Refi Wave

Today, the Data & Analytics division of Black Knight Financial Services, Inc. released its latest Mortgage Monitor Report, based on data as of the end of February 2016. This month, in light of its recent reports on rising equity levels nationwide, Black Knight looked at those on the other end of the spectrum and found that as of the end of 2015, there were still 3.2 million borrowers in negative equity positions, representing $126 billion in underwater first and second lien housing debt. While negative equity rates continue to improve on the national level, the recovery is decidedly imbalanced in terms of both home price levels and geography. As Black Knight Data & Analytics Senior Vice President Ben Graboske explained, borrowers whose homes are in the lowest tier of home prices continue to struggle with high negative equity rates.

“Throughout 2015, the negative equity population in the U.S. decreased by over 30 percent, bringing another 1.5 million homeowners out from underwater on their mortgages,” said Graboske. “However, even after four years of improvement, the recovery has not reached all corners. When we looked at the population by home price levels, we found that over half of the nation’s underwater properties are in the lowest 20 percent of their respective markets. That’s the highest share on record. In fact, while the national negative equity rate is now 6.5 percent, for homes in the lowest price tier, it’s over 16 percent. Furthermore, this group is seeing a slower recovery than the nation as a whole. At the current rate of improvement, it would take more than five years for the negative equity rate in this lowest price tier to reach 2005 levels – roughly two-and-a-half years longer than homes in the top 20 percent.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from Black Knight shows the mortgage performance.

From Black Knight:

The national delinquency rate is now 4.45 percent, the lowest it’s been since April 2007

February’s nearly 13 percent decline in mortgage delinquencies was largest one-month drop in 10 years; FHA loans led the way, seeing a 17 percent decline

Loans curing from a more delinquent status were up 67 percent from January, marking the highest one month volume of cures in 3 years at 645,000

With a 59,000 drop in inventory, the 90+ delinquency rate fell by 7 percent month-over month and is now below 750,000 for the first time since 2007

And on negative equity from Black Knight:

And on negative equity from Black Knight:The inventory of loans in negative equity positions dropped by 31 percent (1.5 million) in 2015There is much more in the mortgage monitor.

At a total of 3.2 million, or 6.5 percent of all homeowners with a mortgage, this represents significant improvement from the peak in 2010, but is still well above “normal” levels

In Nevada, where home prices are still 34 percent below their peak, over 14 percent of borrowers are underwater on their mortgages, the largest share in the nation

Sunday, April 03, 2016

Sunday Night Futures

by Calculated Risk on 4/03/2016 08:22:00 PM

This is amusing. Logan Mohtashami wrote an article on April 1st titled The U.S. Economy Is About To Crash.

Although an April Fools joke, Logan told me the post was very popular since most people didn't realize it was a joke because of the title. This is why yellow journalism thrives.

Weekend:

• Schedule for Week of April 3, 2016

Monday:

• Early: Reis Q1 2016 Office Survey of rents and vacancy rates.

• At 10:00 AM,

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are down 3 and DOW futures are down 20 (fair value).

Oil prices were down over the last week with WTI futures at $36.34 per barrel and Brent at $38.37 per barrel. A year ago, WTI was at $49, and Brent was at $56 - so prices are down about 25% to 32% year-over-year, respectively.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.06 per gallon (down almost $0.35 per gallon from a year ago).

The El Niño Bust in California

by Calculated Risk on 4/03/2016 11:10:00 AM

From Accuweather: El Nino-induced snow proves to be 'disappointing' for drought-stricken California

Much-needed mountain snow and rain returned to California this winter, but fell short of expectations amid a super El Niño.Here are some excellent graphs showing snow water content in the Sierra. This was close to an average year in the Northern Sierra, but below average in Central and South. There was more rain and snow than the previous four years, but this will still be considered year 5 of the drought.

The official snow season for California's Sierra Nevada came to an end at the start of April on a below-normal note and one that AccuWeather Senior Meteorologist Ken Clark called "disappointing."

The amount of water stored in the snow for the entire mountain chain averaged 14 percent below normal on April 1, according to the California Cooperative Snow Surveys.

The northern Sierra fared better than the southern Sierra with the amount of water in the snow averaging only 5 percent below normal, compared to the 27 percent below normal in the south.

"The numbers are not anywhere near what many had wanted going into the winter," Clark said. "The much-heralded El Niño brought more snow than the previous four years, but that was not hard to accomplish."

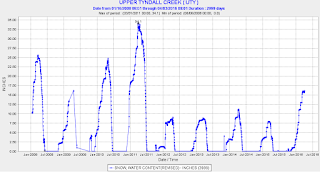

Note: For Pacific Crest Trail and John Muir Trail hikers, I recommend using the Upper Tyndall Creek sensor to track the snow conditions. This is the fifth dry year in a row along the JMT, but there should be more water along the trail this summer than the previous four years, and still not too much snow on the passes.

Note: For Pacific Crest Trail and John Muir Trail hikers, I recommend using the Upper Tyndall Creek sensor to track the snow conditions. This is the fifth dry year in a row along the JMT, but there should be more water along the trail this summer than the previous four years, and still not too much snow on the passes.This graph shows the snow water content for Upper Tyndall Creek for the last 9 years. There is more snow than the previous four years, but that isn't saying much.

Saturday, April 02, 2016

Schedule for Week of April 3, 2016

by Calculated Risk on 4/02/2016 08:09:00 AM

This will be a light week for economic data.

The key economic report is the trade balance on Tuesday.

Also the quarterly Reis surveys for office, apartment and malls will be released this week.

Early: Reis Q1 2016 Office Survey of rents and vacancy rates.

10:00 AM ET: The Fed will release the monthly Labor Market Conditions Index (LMCI).

Early: Reis Q1 2016 Apartment Survey of rents and vacancy rates.

8:30 AM: Trade Balance report for February from the Census Bureau.

8:30 AM: Trade Balance report for February from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through January. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $46.2 billion in February from $45.7 billion in January.

10:00 AM: Job Openings and Labor Turnover Survey for February from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for February from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in January to 5.541 million from 5.281 million in December.

The number of job openings (yellow) were up 11% year-over-year, and Quits were up 1% year-over-year.

10:00 AM: the ISM non-Manufacturing Index for March. The consensus is for index to increase to 54.0 from 53.4 in February.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

Early: Reis Q1 2016 Mall Survey of rents and vacancy rates.

2:00 PM: The Fed will release the FOMC Minutes for the Meeting of March 15-16, 2016

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 272 thousand initial claims, down from 276 thousand the previous week.

3:00 PM: Consumer credit from the Federal Reserve. The consensus is for a $14 billion increase in credit.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for February. The consensus is for a 0.2% decrease in inventories.

Friday, April 01, 2016

Public and Private Sector Payroll Jobs: Carter, Reagan, Bush, Clinton, Bush, Obama

by Calculated Risk on 4/01/2016 07:33:00 PM

By request, here is another update of an earlier post through the March 2016 employment report including all revisions.

NOTE: Several readers have asked if I could add a lag to these graphs (obviously a new President has zero impact on employment for the month they are elected). But that would open a debate on the proper length of the lag, so I'll just stick to the beginning of each term.

Note: We frequently use Presidential terms as time markers - we could use Speaker of the House, or any other marker.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

First, here is a table for private sector jobs. The top two private sector terms were both under President Clinton. Reagan's 2nd term saw about the same job growth as during Carter's term. Note: There was a severe recession at the beginning of Reagan's first term (when Volcker raised rates to slow inflation) and a recession near the end of Carter's term (gas prices increased sharply and there was an oil embargo).

| Term | Private Sector Jobs Added (000s) |

|---|---|

| Carter | 9,041 |

| Reagan 1 | 5,360 |

| Reagan 2 | 9,357 |

| GHW Bush | 1,510 |

| Clinton 1 | 10,884 |

| Clinton 2 | 10,082 |

| GW Bush 1 | -811 |

| GW Bush 2 | 415 |

| Obama 1 | 1,921 |

| Obama 2 | 8,2971 |

| 138 months into 2nd term: 10,480 pace. | |

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). President George H.W. Bush only served one term, and President Obama is in the third year of his second term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (yellow) took office.

There was a recession towards the end of President G.H.W. Bush (purple) term, and Mr Clinton (light blue) served for eight years without a recession.

Click on graph for larger image.

Click on graph for larger image.The first graph is for private employment only.

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 811,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 396,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased slightly under President G.H.W. Bush (purple), with 1,510,000 private sector jobs added.

Private sector employment increased by 20,966,000 under President Clinton (light blue), by 14,717,000 under President Reagan (yellow), and 9,041,000 under President Carter (dashed green).

There were only 1,921,000 more private sector jobs at the end of Mr. Obama's first term. Thirty eight months into Mr. Obama's second term, there are now 10,218,000 more private sector jobs than when he initially took office.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, and 2010.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, and 2010. The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs).

However the public sector has declined significantly since Mr. Obama took office (down 497,000 jobs). This has been a significant drag on overall employment.

And a table for public sector jobs. Public sector jobs declined the most during Obama's first term, and increased the most during Reagan's 2nd term.

| Term | Public Sector Jobs Added (000s) |

|---|---|

| Carter | 1,304 |

| Reagan 1 | -24 |

| Reagan 2 | 1,438 |

| GHW Bush | 1,127 |

| Clinton 1 | 692 |

| Clinton 2 | 1,242 |

| GW Bush 1 | 900 |

| GW Bush 2 | 844 |

| Obama 1 | -708 |

| Obama 2 | 2111 |

| 138 months into 2nd term, 267 pace | |

Looking forward, I expect the economy to continue to expand through 2016 (at least), so I don't expect a sharp decline in private employment as happened at the end of Mr. Bush's 2nd term (In 2005 and 2006 I was warning of a coming down turn due to the bursting of the housing bubble - and I predicted a recession in 2007).

For the public sector, the cutbacks are clearly over. Right now I'm expecting some increase in public employment during Obama's 2nd term, but nothing like what happened during Reagan's second term.

Below is a table of the top three presidential terms for private job creation (they also happen to be the three best terms for total non-farm job creation).

Clinton's two terms were the best for both private and total non-farm job creation, followed by Reagan's 2nd term.

Currently Obama's 2nd term is on pace to be the 2nd best ever for private job creation. However, with very few public sector jobs added, Obama's 2nd term is only on pace to be the fourth best for total job creation.

Note: Only 211 thousand public sector jobs have been added during the first thirty eight months of Obama's 2nd term (following a record loss of 708 thousand public sector jobs during Obama's 1st term). This is about 15% of the public sector jobs added during Reagan's 2nd term!

| Top Employment Gains per Presidential Terms (000s) | ||||

|---|---|---|---|---|

| Rank | Term | Private | Public | Total Non-Farm |

| 1 | Clinton 1 | 10,884 | 692 | 11,576 |

| 2 | Clinton 2 | 10,082 | 1,242 | 11,312 |

| 3 | Reagan 2 | 9,357 | 1,438 | 10,795 |

| Obama 21 | 8,297 | 211 | 7,871 | |

| Pace2 | 10,480 | 267 | 10,747 | |

| 138 Months into 2nd Term 2Current Pace for Obama's 2nd Term | ||||

The last table shows the jobs needed per month for Obama's 2nd term to be in the top three presidential terms. Right now it looks like Obama's 2nd term will be in the top 3 for private employment, but not for total employment gains.

| Average Jobs needed per month (000s) for remainder of Obama's 2nd Term | ||||

|---|---|---|---|---|

| to Rank | Private | Total | ||

| #1 | 259 | 307 | ||

| #2 | 179 | 282 | ||

| #3 | 106 | 229 | ||

U.S. Light Vehicle Sales decline to 16.45 million annual rate in March

by Calculated Risk on 4/01/2016 03:31:00 PM

Based on an estimate from WardsAuto, light vehicle sales were at a 16.45 million SAAR in March.

That is down about 4% from March 2015, and down about 6% from the 17.43 million annual sales rate last month.

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for March (red, light vehicle sales of 16.45 million SAAR from WardsAuto).

This was well below the consensus forecast of 17.6 million SAAR (seasonally adjusted annual rate).

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

This was below expectations, however sales for 2016 - through the first three months - are still up about 3% from the comparable period last year.

Construction Spending decreased 0.5% in February

by Calculated Risk on 4/01/2016 12:35:00 PM

The Census Bureau reported that overall construction spending decreased 0.5% in February compared to January:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during February 2016 was estimated at a seasonally adjusted annual rate of $1,144.0 billion, 0.5 percent below the revised January estimate of $1,150.1 billion. The February figure is 10.3 percent above the February 2015 estimate of $1,037.5 billion.Both private and public spending decreased in February:

Spending on private construction was at a seasonally adjusted annual rate of $846.2 billion, 0.1 percent below the revised January estimate of $847.2 billion. ...

In February, the estimated seasonally adjusted annual rate of public construction spending was $297.8 billion, 1.7 percent below the revised January estimate of $302.8 billion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending has been increasing, but is 34% below the bubble peak.

Non-residential spending is only 4% below the peak in January 2008 (nominal dollars).

Public construction spending is now 9% below the peak in March 2009.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 11%. Non-residential spending is up 11% year-over-year. Public spending is up 9% year-over-year.

Looking forward, all categories of construction spending should increase in 2016. Residential spending is still very low, non-residential is increasing (except oil and gas), and public spending is also increasing after several years of austerity.

This was below the consensus forecast of a 0.2% increase for February, however construction spending for December and January were revised up. Overall construction spending is up 10.3% year-over-year, a solid increase.