by Calculated Risk on 4/09/2016 08:12:00 AM

Saturday, April 09, 2016

Schedule for Week of April 10, 2016

The key economic report this week is March retail sales on Wednesday.

For prices, PPI and CPI will be released this week.

For manufacturing, March Industrial Production and the April NY Fed manufacturing survey will be released this week.

No economic releases scheduled.

9:00 AM ET: NFIB Small Business Optimism Index for March.

2:00 PM: The Monthly Treasury Budget Statement for March.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM ET: Retail sales for March will be released. The consensus is for retail sales to increase 0.1% in March.

8:30 AM ET: Retail sales for March will be released. The consensus is for retail sales to increase 0.1% in March.This graph shows retail sales since 1992 through February 2016. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). On a monthly basis, retail sales were down 0.1% from January to February (seasonally adjusted), and sales were up 3.1% from February 2015.

8:30 AM: The Producer Price Index for March from the BLS. The consensus is for a 0.3% increase in prices, and a 0.2% increase in core PPI.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for February. The consensus is for a 0.1% decrease in inventories.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 270 thousand initial claims, up from 267 thousand the previous week.

8:30 AM: The Consumer Price Index for March from the BLS. The consensus is for a 0.2% increase in CPI, and a 0.2% increase in core CPI.

8:30 AM: NY Fed Empire State Manufacturing Survey for April. The consensus is for a reading of 3.0, up from 0.6.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for March.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for March.This graph shows industrial production since 1967.

The consensus is for a 0.1% decrease in Industrial Production, and for Capacity Utilization to decrease to 75.4%.

10:00 AM: University of Michigan's Consumer sentiment index (preliminary for April). The consensus is for a reading of 91.8, up from 91.0 in March.

10:00 AM ET: Regional and State Employment and Unemployment (Monthly) for March 2016 from BLS.

Friday, April 08, 2016

Sacramento Housing in March: Sales up 4.7%, Inventory down 17% YoY

by Calculated Risk on 4/08/2016 08:00:00 PM

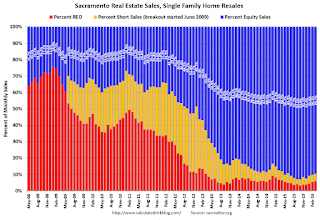

During the recession, I started following the Sacramento market to look for changes in the mix of houses sold (equity, REOs, and short sales). For a few years, not much changed. But in 2012 and 2013, we saw some significant changes with a dramatic shift from distressed sales to more normal equity sales.

This data suggests healing in the Sacramento market and other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In March, total sales were up 4.7% from March 2015, and conventional equity sales were up 6.0% compared to the same month last year.

In March, 10.1% of all resales were distressed sales. This was up from 9.7% last month, and down from 12.4% in March 2015.

The percentage of REOs was at 5.8% in March, and the percentage of short sales was 4.3%.

Here are the statistics.

Press Release: Sales volume jumps 33%, days on market decreases further

Sales volume jumped 33.1% from 1,082 to 1,440 for March. This current number is up 4.7% from March last year (1,376 sales).

...

Although the total Active Listing Inventory increased 12.4% from 1,755 to 1,973, the Months of Inventory decreased from 1.6 months to 1.4 months.

Click on graph for larger image.

Click on graph for larger image. This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional (equity) sales that started in 2012 (blue) as the percentage of distressed sales declined sharply.

Active Listing Inventory for single family homes decreased 17.3% year-over-year (YoY) in March. This was the elventh consecutive monthly YoY decrease in inventory in Sacramento.

Cash buyers accounted for 15.3% of all sales (frequently investors).

Summary: This data suggests a more normal market with fewer distressed sales, more equity sales, and less investor buying - but limited inventory.

WSJ: "Housing Bust Lingers for Generation X"

by Calculated Risk on 4/08/2016 04:19:00 PM

A decade ago I was arguing one of the tragedies of the housing bubble was that many first time buyers would sour on homeownership for a long time, if not forever. Unfortunately that has happened.

From Chris Kirkham at the WSJ: Housing Bust Lingers for Generation X

The group of Americans known as Generation X has suffered more than any other age cohort from the housing bust, according to an analysis of federal data, suggesting homeownership rates for that group could remain depressed for years to come.

...

There are now three million more renters in their 30s and 40s today than 10 years ago, even though the number of households in that age bracket declined, according to data from the Harvard Joint Center.

...

Many people who lost homes to foreclosures or short sales face long waits before lenders will consider them again—up to seven years for foreclosures and up to three years for a short sale. A study last year by the National Association of Realtors estimated that about a third of the 9 million buyers who went through distressed sales or foreclosures between 2006 and 2014 will never return to homeownership.

Q1 Review: Ten Economic Questions for 2016

by Calculated Risk on 4/08/2016 11:59:00 AM

At the end of last year, I posted Ten Economic Questions for 2016. I followed up with a brief post on each question. The goal was to provide an overview of what I expected in 2016 (I don't have a crystal ball, but I think it helps to outline what I think will happen - and understand - and change my mind, when the outlook is wrong).

By request, here is a quick Q1 review (it is very early in the year). I've linked to my posts from the beginning of the year, with a brief excerpt and a few comments:

10) Question #10 for 2016: How much will housing inventory increase in 2016?

Right now my guess is active inventory will increase in 2016 (inventory will decline seasonally in December and January, but I expect to see inventory up again year-over-year in 2016). I don't expect a double digit surge in inventory, but maybe a mid-single digit increase year-over-year. If correct, this will keep house price increases down in 2015 (probably lower than the 5% or so gains in 2014 and 2015).According to the February NAR report on existing home sales, inventory was down 1.1% year-over-year in February, and the months-of-supply was at 4.4 months. I still expect inventory to increase in 2016.

9) Question #9 for 2016: What will happen with house prices in 2016?

Low inventories, and a decent economy suggests further price increases in 2016. However I expect we will see prices up less in 2016, than in 2015, as measured by these house price indexes - mostly because I expect more inventory.If is very early, but the CoreLogic data released this week showed prices up 6.8% year-over-year in February. The CoreLogic year-over-year increase is higher than last year so far.

8) Question #8 for 2016: How much will Residential Investment increase?

My guess is growth of around 4% to 8% in 2016 for new home sales, and about the same percentage growth for housing starts. Also I think the mix between multi-family and single family starts will shift a little more towards single family in 2016.Through February, starts were up 15% year-over-year compared to the same period in 2015 (easy comparison). New home sales were down 4% year-over-year (more difficult comparison).

7) Question #7 for 2016: What about oil prices in 2016?

It is impossible to predict an international supply disruption, however if a significant disruption happens, then prices will move higher. Continued weakness in Europe and China seems likely, however sluggish demand will be somewhat offset by less tight oil production. It seems like the key oil producers (Saudi, etc) will continue production at current levels. This suggests in the short run (2016) that prices will stay low, but probably move up a little in 2016. I'll guess WTI will be up from the current price [WTI at $38 per barrel] by December 2016 (but still under $50 per barrel).As of this morning, WTI futures are just over $39 per barrel.

6) Question #6 for 2016: Will real wages increase in 2016?

For this post the key point is that nominal wages have been only increasing about 2% per year with some pickup in 2015. As the labor market continues to tighten, we should start see more wage pressure as companies have to compete more for employees. I expect to see some further increase in nominal wage increases in 2016 (perhaps over 3% later in the year). The year-over-year change in real wages will depend on inflation, and I expect headline CPI to pickup some this year as the impact on headline inflation of declining oil prices fades.Through March 2016, nominal hourly wages were up 2.3% year-over-year. This is a pickup from last year, and so far it appears wages will increase at a faster rate in 2016.

5) Question #5 for 2016: Will the Fed raise rates in 2016, and if so, by how much?

I've seen several people arguing the Fed will be cutting rates by the end of 2016 - I think that is unlikely. Instead I think the Fed will be cautious - and they will not want to reverse course. Right now I think something around three rate hikes in 2016 is likely.So far zero is correct, but I still expect the FOMC to raise rates a little this year.

4) Question #4 for 2016: Will the core inflation rate rise in 2016? Will too much inflation be a concern in 2016?

Due to some remaining slack in the labor market (example: elevated level of part time workers for economic reasons), I expect these measures of inflation will be close to the Fed's target in 2016.It is early, but inflation has moved up close to the Fed target through February.

So currently I think core inflation (year-over-year) will increase further in 2016, but too much inflation will not be a serious concern in 2016.

3) Question #3 for 2016: What will the unemployment rate be in December 2016?

Depending on the estimate for the participation rate and job growth (next question), it appears the unemployment rate will decline to around 4.5% by December 2016. My guess is based on the participation rate declining slightly in 2016 and for decent job growth in 2016 (however less in 2016 than in 2015).The participation rate increased from 62.7% in December to 63.0% in March, and the unemployment rate was 5.0% in March, unchanged from 5.0% in December. I don't expect the surge in the participation rate to continue, and I still expect the unemployment rate to decline into the mid-4s.

2) Question #2 for 2016: How many payroll jobs will be added in 2016?

Energy related construction hiring will decline in 2016, but I expect other areas of construction to be solid. For manufacturing, growth in the auto sector will probably slow this year, but the drag on manufacturing employment from the strong dollar should be less in 2016.Through March 2016, the economy has added 628,000 thousand jobs; 209,000 per month. I still expect employment gains to average around 200,000 per month in 2016 (lower than in 2014 and 2015, but still solid).

As I mentioned above, in addition to layoffs in the energy sector, exporters will have a difficult year - but probably not the severe contraction as in 2015, and more companies will have difficulty finding qualified candidates. Even with some boost from lower oil prices - and some additional public hiring, I expect total jobs added to be lower in 2016 than in 2015.

So my forecast is for gains of around 200,000 payroll jobs per month in 2015. Lower than in 2015, but another solid year for employment gains given current demographics.

1) Question #1 for 2016: How much will the economy grow in 2016?

In addition, the sharp decline in oil prices should be a net positive for the US economy in 2016. And, hopefully, the negative impact from the strong dollar will fade in 2016. The most likely growth rate is in the mid-2% range again ...Once again, GDP will be sluggish in Q1 (near zero growth).

It is very early in the year. Currently it looks like 2016 is unfolding somewhat as expected - although I'd revise down my forecast for FOMC rate hikes from 3 to 2. As far as the economic data, it is about as expected.

Philly Fed: State Coincident Indexes increased in 43 states in January

by Calculated Risk on 4/08/2016 09:08:00 AM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for January 2016. In the past month, the indexes increased in 43 states, decreased in five, and remained stable in two, for a one-month diffusion index of 76. Over the past three months, the indexes increased in 44 states, decreased in five, and remained stable in one, for a three-month diffusion index of 78.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In January, 43 states had increasing activity.

Four states have seen declines over the last 6 months, in order they are Wyoming (worst), North Dakota, Alaska, and Louisiana - mostly due to the decline in oil prices.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is mostly green now.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is mostly green now.Source: Philly Fed.

Thursday, April 07, 2016

Merrill: "Fading the first quarter GDP fade"

by Calculated Risk on 4/07/2016 09:14:00 PM

The Atlanta Fed GDPNow estimate has fallen to just 0.4% annualized growth for Q1.

The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2016 is 0.4 percent on April 5, down from 0.7 percent on April 1.From Merrill Lynch: Fading the first quarter fade

For the third year in a row, forecasters came into the first quarter looking for 2%-plus GDP growth, only to steadily revise estimates lower. [T]he Atlanta Fed’s GDPNow tracking [has declined] for 1Q in each year. They are far from alone: both we and the consensus have been doing the same thing. This weakness adds to market skepticism about a June Fed hike.CR note: No worries.

In both 2014 and 2015 we faded the weak 1Q data and argued that the recovery remained on track. Today, we see four reasons to reiterate that call. First, outside of the GDP adding up, the data look fine. Second, some of the weakness is likely due to lingering seasonal adjustment problems. Third, the fundamental backdrop points to moderate growth, not a big slowdown. Fourth, and perhaps most important, with potential growth slipping below 2%, and given the normal variation in the data, we should not be surprised to see near-zero quarters on an annual basis.

Hotels: Occupancy Rate Tracking just behind Record Year

by Calculated Risk on 4/07/2016 02:30:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 2 April

The U.S. hotel industry recorded positive year-over-year results in the three key performance metrics during the week of 27 March through 2 April 2016, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The occupancy rate should mostly move sideways for the next couple of months, and then increase further during the Summer travel period.

In comparison with Easter week 2015, the industry’s occupancy rose 6.6% to 66.9%. Average daily rate for the week was up 5.0% to US$121.96. Revenue per available room increased 11.9% to US$81.61.

emphasis added

The red line is for 2016, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.

The red line is for 2016, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.2015 was the best year on record for hotels.

So far 2016 is tracking just behind 2015.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Phoenix Real Estate in March: Sales up 9%, Inventory up YoY

by Calculated Risk on 4/07/2016 11:21:00 AM

This is a key distressed market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

Inventory was up year-over-year in March, following fifteen consecutive months of year-over-year declines in Phoenix. This could be a significant change.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in March were up 8.5% year-over-year.

2) Cash Sales (frequently investors) were down to 24.6% of total sales.

3) Active inventory is now up 3.6% year-over-year.

More inventory (a theme in 2014) - and less investor buying - suggested price increases would slow sharply in 2014. And prices increases did slow in 2014, only increasing 2.4% according to Case-Shiller.

In 2015, with falling inventory, prices increased a little faster - Prices were up 6.3% in 2015 according to Case-Shiller. Inventory is something to watch in 2016!

| March Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash Sales | Percent Cash | Active Inventory | YoY Change Inventory | |

| Mar-08 | 4,303 | --- | 822 | 19.1% | 57,0811 | --- |

| Mar-09 | 7,636 | 77.5% | 2,994 | 39.2% | 49,743 | -12.9% |

| Mar-10 | 8,969 | 17.5% | 3,745 | 41.8% | 42,755 | -14.0% |

| Mar-11 | 9,927 | 10.7% | 4,946 | 49.8% | 37,632 | -12.0% |

| Mar-12 | 8,868 | -10.7% | 4,222 | 47.6% | 21,863 | -41.9% |

| Mar-13 | 8,146 | -8.1% | 3,384 | 41.5% | 20,729 | -5.2% |

| Mar-14 | 6,708 | -17.7% | 2,222 | 33.1% | 30,167 | 45.5% |

| Mar-15 | 7,884 | 17.5% | 2,172 | 27.5% | 26,623 | -11.7% |

| Mar-16 | 8,555 | 8.5% | 2,107 | 24.6% | 27,580 | 3.6% |

| 1 March 2008 probably included pending listings | ||||||

Weekly Initial Unemployment Claims decrease to 267,000

by Calculated Risk on 4/07/2016 08:35:00 AM

The DOL reported:

In the week ending April 2, the advance figure for seasonally adjusted initial claims was 267,000, a decrease of 9,000 from the previous week's unrevised level of 276,000. The 4-week moving average was 266,750, an increase of 3,500 from the previous week's unrevised average of 263,250.The previous week was unrevised.

There were no special factors impacting this week's initial claims. This marks 57 consecutive weeks of initial claims below 300,000, the longest streak since 1973.

Note: The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 266,750.

This was below the consensus forecast of 272,000. The low level of the 4-week average suggests few layoffs.

Wednesday, April 06, 2016

Lawler: Yellen on Household Formations “Not Keeping Up;” What Is Her Data Source?

by Calculated Risk on 4/06/2016 05:30:00 PM

From housing economist Tom Lawler: Yellen on Household Formations “Not Keeping Up;” What Is Her Data Source?

In Federal Reserve Chair Yellen’s surprising “dovish” speech at the Economic Club of New York last week, she noted that a relatively slow pace of household formation was one of the “headwinds” that up to now had continued to restrain the U.S. economy. Here is a brief excerpt from her speech.

“Looking beyond the near term, I anticipate that growth will also be supported by a lessening of some of the headwinds that continue to restrain the U.S. economy, which include weak foreign activity, dollar appreciation, a pace of household formation that has not kept up with population and income growth and so has depressed homebuilding, and productivity growth that has been running at a slow pace by historical standards since the end of the recession.”I found the statement on the “lagging” pace of household formations somewhat fascinating, in that it is pretty widely known by competent housing economists and demographers that there currently are no good, reliable, or timely data on US household formations. Rather, there are multiple and often conflicting estimates of US household formations calculated based on different surveys conducted by the Census Bureau. In fact, there are even conflicting estimates of US household formations based on the SAME survey conducted by Census, but “controlled” to different benchmarks (in one case housing stock estimates, and in another case population estimates).

emphasis added

Since Chair Yellen was focusing on recent developments, I am assuming she was referring to household estimates from the Housing Vacancy Survey, which is a supplement to the Current Population Survey that (among other things) (1) produces estimate of the share of the housing stock that is occupied vs. vacant; and (2) which produces estimates of the number of occupied homes based on these occupancy share estimates and independent estimates of the housing stock from Census’ Population Division. Census released its report for the fourth quarter of 2015 in late January, and the estimates of the occupied housing stock (i.e. households) in that report did at face value suggest anemic growth in US households last year, after explosive growth in the latter part of 2014.

Here is a chart showing (1) quarterly changes in HVS-based household estimates (annualized, both not seasonally adjusted and seasonally adjusted (by me)), and (2) year-over-year changes in HVS-based household estimates.

Here is a chart showing (1) quarterly changes in HVS-based household estimates (annualized, both not seasonally adjusted and seasonally adjusted (by me)), and (2) year-over-year changes in HVS-based household estimates.As the chart suggests, HVS-based US household estimates are incredibly volatile, with most of the “noise” reflecting sizable (and unrealistic) quarterly fluctuations in estimates of the gross vacancy rate (as opposed to the housing stock). The chart also shows that HVS-based US household growth for the fourth quarter of 2014 was inconceivably high, reaching annualized growth of 5.6 million on an unadjusted basis and 4.7 million on a seasonally-adjusted basis. HVS-based household growth from Q4/2013 to Q4.2014 was 1.9 million, the highest YOY gain since the middle of 2005, while HVS-based household growth slowed to a paltry 462,000 from Q4/2014 to Q4/2015.

With respect to the acceleration in HVS-based household growth beginning in the second quarter of 2014, there were reasons unrelated to actual trends to expect an increase. Beginning in April 2014, a new sample based on the Master Address File compiled during Census 2010 was “phased in” to the HVS estimates, with the phase in period being 16 months. To the extent that the previous (and quite dated) sample was at least partly related to the HVS’ overestimate of the gross vacancy rate (as well as the homeownership rate), one would have expected the HVS estimates beginning in the second quarter to (1) show accelerated (and above “actual” household growth; and (2) shown “surprisingly large” declines in the homeownership rate. While the phase-in of the new sample can’t explain the volatility in the HVS estimates, it probably was at least partly behind the acceleration in household estimates Note that a similar but smaller acceleration in HVS based household estimates followed the phase-in of a new sample beginning from April 2004 to July 2005.

Less easy to understand, however, is why the HVS-based household estimates showed such anemic growth last year.

As noted before, the HVS-based household estimates are “controlled” to independent housing stock estimates, and in essence assume that (1) the HVS estimates for occupancy and vacancy shares are “correct,” and (2) the housing stock estimates are correct. Other household estimates from essentially the same survey (the HVS is a supplement to the CPS) but “controlled” to independent population estimates often show decidedly different household growth estimates. These estimates in essence assume that (1) household characteristics from the CPS/ASEC are “correct,” and (2) population estimates (total and by demographic characteristics) are correct. Unfortunately, such estimates are available only with a considerable lag (and only available for March of each year), and the last estimate available is for March 2015. In addition, the “time series” for CPS/ASEC household estimates are for the most part not adjusted to reflect updated estimates for population counts (total and demographic category, such as age). As such, these time series are of limited usefulness.

Even more disconcerting is that CPS-based household estimates by various characteristics (e.g., age of householder, tenure, etc.) are not at all consistent with decennial Census results, and have not been since 2000. It appears as if the implementation of the “Computer Assisted Information Collection” in 1994 is partly behind some of the “issues” of CPS-based household and housing tenure biases since then. (I’ll have more on this issue in a later report).

ACS estimates are a somewhat better “match” to decennial Census results, but such estimates are only available annually, and with a long lag. (The latest available estimates are for 2014).

Given both the huge volatility in, as well as the at times inconsistency of HVS-based household estimates relative to other household estimates, it is not clear how one should interpret last year’s slowdown in HVS-based household estimates.

Stated another way, the “household estimates conundrum” is alive and well, and quite frankly policymakers don’t currently have any reliable timely data on US households.