by Calculated Risk on 5/01/2016 10:35:00 AM

Sunday, May 01, 2016

Energy expenditures as a percentage of PCE hit another All Time Low in March

Note: Last month I noted that energy expenditures as a percentage of PCE had hit an all time low. Here is an update through the March 2016 PCE report.

Below is a graph of expenditures on energy goods and services as a percent of total personal consumption expenditures through March 2016.

This is one of the measures that Professor Hamilton at Econbrowser looks at to evaluate any drag on GDP from energy prices.

Click on graph for larger image.

Data source: BEA Table 2.3.5U.

The huge spikes in energy prices during the oil crisis of 1973 and 1979 are obvious. As is the increase in energy prices during the 2001 through 2008 period.

In March 2016, energy expenditures as a percentage of PCE declined to another all time low of just under 3.7%.

However, WTI oil prices increased from $30.32 per barrel in February to $37.55 in March - so energy as a percentage of PCE will probably increase a little over the next few months.

Saturday, April 30, 2016

Schedule for Week of May 1, 2016

by Calculated Risk on 4/30/2016 11:21:00 AM

The key report this week is the April employment report on Friday.

Other key indicators include April vehicle sales, the April ISM manufacturing and non-manufacturing indexes, and the March trade deficit.

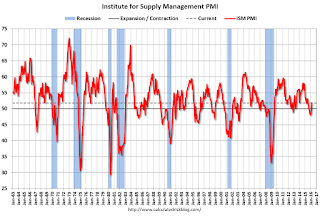

10:00 AM: ISM Manufacturing Index for April. The consensus is for the ISM to be at 51.5, down from 51.8 in March.

10:00 AM: ISM Manufacturing Index for April. The consensus is for the ISM to be at 51.5, down from 51.8 in March.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion at 51.8% in March. The employment index was at 48.1%, and the new orders index was at 58.3%.

10:00 AM: Construction Spending for March. The consensus is for a 0.5% increase in construction spending.

2:00 PM ET: the April 2016 Senior Loan Officer Opinion Survey on Bank Lending Practices from the Federal Reserve.

All day: Light vehicle sales for April. The consensus is for light vehicle sales to increase to 17.3 million SAAR in April from 16.6 million in March (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for April. The consensus is for light vehicle sales to increase to 17.3 million SAAR in April from 16.6 million in March (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the March sales rate.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for April. This report is for private payrolls only (no government). The consensus is for 193,000 payroll jobs added in April, down from 200,000 added in March.

8:30 AM: Trade Balance report for March from the Census Bureau.

8:30 AM: Trade Balance report for March from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through February. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $41.4 billion in March from $47.1 billion in February.

10:00 AM: the ISM non-Manufacturing Index for April. The consensus is for index to increase to 54.7 from 54.5 in March.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for March. The consensus is a 0.6% increase in orders.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 262 thousand initial claims, up from 257 thousand the previous week.

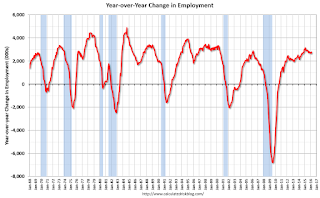

8:30 AM: Employment Report for April. The consensus is for an increase of 200,000 non-farm payroll jobs added in April, down from the 215,000 non-farm payroll jobs added in March.

The consensus is for the unemployment rate to decline to 4.9%.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In March, the year-over-year change was 2.80 million jobs.

A key will be the change in real wages.

3:00 PM: Consumer credit from the Federal Reserve. The consensus is for a $15.8 billion increase in credit.

April 2016: Unofficial Problem Bank list declines to 214 Institutions

by Calculated Risk on 4/30/2016 08:09:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for April 2016.

Changes and comments from surferdude808:

Update on the Unofficial Problem Bank List for April 2016. During the month, the list fell from 222 institutions to 214 after nine removals and one addition. Assets dropped by $2.2 billion to an aggregate $62.4 billion. A year ago, the list held 342 institutions with assets of $105.1 billion.

Actions have been terminated against U.S. Century Bank, Doral, FL ($910 million); Community Bank of Florida, Inc., Homestead, FL ($485 million); Florida Capital Bank, National Association, Jacksonville, FL ($341 million); Advantage Bank, Loveland, CO ($265 million); Transcapital Bank, Sunrise, FL ($169 million); Mountain Valley Bank, Dunlap, TN ($96 million); Bank of Newington, Newington, GA ($87 million); and Rocky Mountain Bank & Trust, Florence, CO ($65 million).

Trust Company Bank, Memphis, TN ($21 million) exited the list via failure becoming the second bank to fail in 2016.

Added this month was First Community National Bank, Cuba, MO ($207 million). Also, the FDIC issued a Prompt Corrective Action order against Proficio Bank, Cottonwood Heights, UT ($110 million), which has been on the list since March 2014.

Friday, April 29, 2016

Fannie Mae: Mortgage Serious Delinquency rate declined in March, Lowest since June 2008

by Calculated Risk on 4/29/2016 04:07:00 PM

Fannie Mae reported today that the Single-Family Serious Delinquency rate declined in March to 1.44%, down from 1.52% in February. The serious delinquency rate is down from 1.78% in March 2015.

This is the lowest rate since June 2008.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Note: Freddie Mac has not reported for March yet.

The Fannie Mae serious delinquency rate has only fallen 0.34 percentage points over the last year - the pace of improvement has slowed - and at that pace the serious delinquency rate will not be below 1% until 2017.

The "normal" serious delinquency rate is under 1%, so maybe Fannie Mae serious delinquencies will be close to normal some time in late 2017. This elevated delinquency rate is mostly related to older loans - the lenders are still working through the backlog.

Lawler:Updated Table of Distressed Sales and All Cash Sales for Selected Cities in March

by Calculated Risk on 4/29/2016 12:26:00 PM

Economist Tom Lawler sent me an updated table below of short sales, foreclosures and all cash sales for selected cities in March.

On distressed: Total "distressed" share is down in all of these markets.

Short sales and foreclosures are down in all of these areas.

The All Cash Share (last two columns) is mostly declining year-over-year. As investors continue to pull back, the share of all cash buyers continues to decline.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Mar- 2016 | Mar- 2015 | Mar- 2016 | Mar- 2015 | Mar- 2016 | Mar- 2015 | Mar- 2016 | Mar- 2015 | |

| Las Vegas | 5.9% | 8.3% | 7.1% | 9.3% | 13.0% | 17.6% | 27.7% | 32.4% |

| Reno** | 3.0% | 5.0% | 3.0% | 8.0% | 6.0% | 13.0% | ||

| Phoenix | 2.1% | 3.2% | 2.3% | 4.2% | 4.5% | 7.4% | 24.6% | 27.5% |

| Sacramento | 4.5% | 5.4% | 5.5% | 6.9% | 10.0% | 12.4% | 17.3% | 19.3% |

| Minneapolis | 2.5% | 3.0% | 10.9% | 12.4% | 13.4% | 15.4% | ||

| Mid-Atlantic | 4.4% | 4.7% | 13.6% | 14.0% | 18.0% | 18.8% | 18.3% | 18.2% |

| So. California* | 3.1% | 4.0% | 3.9% | 5.1% | 7.0% | 9.1% | 22.7% | 25.2% |

| Bay Area CA* | 2.2% | 2.8% | 2.5% | 2.9% | 4.7% | 5.7% | 24.0% | 24.3% |

| Riverside | 2.4% | 3.5% | 3.2% | 5.0% | 5.6% | 8.5% | 18.2% | 19.2% |

| San Bernardino | 2.4% | 4.1% | 3.2% | 5.2% | 5.6% | 9.3% | 20.7% | 21.8% |

| Florida SF | 2.7% | 3.9% | 12.0% | 21.0% | 14.7% | 25.0% | 32.0% | 38.8% |

| Florida C/TH | 1.6% | 2.5% | 9.5% | 15.3% | 11.1% | 17.8% | 62.0% | 66.2% |

| Miami MSA SF | 3.9% | 6.6% | 13.9% | 19.6% | 17.7% | 26.2% | 32.9% | 40.0% |

| Miami MSA C/TH | 1.9% | 3.0% | 12.6% | 19.1% | 14.5% | 22.1% | 64.2% | 69.6% |

| Spokane | 11.5% | 18.1% | ||||||

| Chicago (city) | 19.6% | 21.9% | ||||||

| Hampton Roads | 18.2% | 22.7% | ||||||

| Spokane | 11.5% | 18.1% | ||||||

| Northeast Florida | 19.9% | 30.9% | ||||||

| Spokane | 11.5% | 18.1% | ||||||

| Rhode Island | 14.0% | 17.3% | ||||||

| Toledo | 30.6% | 32.7% | ||||||

| Tucson | 25.8% | 32.0% | ||||||

| Knoxville | 22.1% | 22.9% | ||||||

| Peoria | 21.6% | 23.7% | ||||||

| Georgia*** | 21.0% | 23.2% | ||||||

| Omaha | 16.3% | 16.1% | ||||||

| Pensacola | 17.0% | 28.0% | 28.3% | 33.4% | ||||

| Richmond VA MSA | 9.8% | 11.9% | 17.3% | 18.0% | ||||

| Memphis**** | 15.0% | 15.3% | 32.3% | 37.6% | ||||

| Springfield IL** | 11.2% | 12.1% | 18.1% | N.A. | ||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

Chicago PMI declines in April, Final April Consumer Sentiment at 89.0

by Calculated Risk on 4/29/2016 10:08:00 AM

Chicago PMI: April Chicago Business Barometer Down 3.2 Points to 50.4

The Chicago Business Barometer decreased 3.2 points to 50.4 in April from 53.6 in March led by a fall in New Orders and a sharp drop in Order Backlogs. It marks a slow start to the second quarter, with most measures down from levels seen a year earlier.This was below the consensus forecast of 53.4.

...

The decline in the Barometer was led by a fall in New Orders, leaving it at the lowest level since December 2015.

...

Chief Economist of MNI Indicators Philip Uglow said, “This was a disappointing start to the second quarter, with the Barometer barely above the neutral 50 mark in April. Against a backdrop of softer domestic demand and the slowdown abroad, panellists are now more worried about the impact a rate hike might have on business than they were at the same time last year.”

emphasis added

Click on graph for larger image.

The final University of Michigan consumer sentiment index for April was at 89.0, down from 91.0 in March:

"Consumer sentiment continued its slow decline in late April due to weakening expectations for future growth, although their views of current economic conditions remained positive. All of the April decline was in the Expectations component, which fell by 4.8% from one month ago and by 12.6% from a year ago and by 14.7% from its January 2015 peak. The retreat from the 2015 peaks was evident across a wide range of expectations about prospects for the national economy. The size of the decline, while troublesome, is still far short of indicating an impending recession. The decline is all the more remarkable given that consumers' assessments of current economic conditions, including their personal finance, have remained largely unchanged at very positive levels during the past year."

emphasis added

Personal Income increased 0.4% in March, Spending increased 0.1%

by Calculated Risk on 4/29/2016 08:33:00 AM

The BEA released the Personal Income and Outlays report for March:

Personal income increased $57.4 billion, or 0.4 percent, ... according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $12.8 billion, or 0.1 percent.On inflation: The PCE price index increased 0.8 percent year-over-year due to the sharp decline in oil prices. The core PCE price index (excluding food and energy) increased 1.6 percent year-over-year in March (slightly lower than in February).

...

Real PCE -- PCE adjusted to remove price changes -- increased less than 0.1 percent in March, compared with an increase of 0.3 percent in February. ... The price index for PCE increased 0.1 percent in March, in contrast to a decrease of 0.1 percent in February. The PCE price index, excluding food and energy, increased 0.1 percent, compared with an increase of 0.2 percent.

The March PCE price index increased 0.8 percent from March a year ago. The March PCE price index, excluding food and energy, increased 1.6 percent from March a year ago.

Thursday, April 28, 2016

Friday: Personal Income and Outlays, Chicago PMI, Consumer Sentiment

by Calculated Risk on 4/28/2016 09:17:00 PM

From Merrill Lynch on April NFP:

Nonfarm payroll growth likely posted a solid 200,000 in April, driven once more by service-providing firms. Of this, government hiring likely contributed 5,000, which is a more modest clip than the 20,000 pop in March. ...Friday:

We look for the unemployment rate to hold at 5.0%, assuming the participation rate holds steady. However, there is a risk it heads higher, following the recent trend, which could boost the unemployment rate. The participation rate has seen an impressive recovery since September of last year, rising to 63% from 62.4%. A robust labor market has attracted many workers back into the labor market, and it is more likely than not that this trend generally continues in the near term. However, increased labor supply also means delayed wage pressures: we are looking for only 0.2% monthly growth in average hourly earnings. This would leave the yoy growth rate unchanged at 2.3%, though this is still greater than the 2% pace seen earlier in this cycle. ...

• At 8:30 AM ET, Personal Income and Outlays for March. The consensus is for a 0.3% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• At 9:45 AM, Chicago Purchasing Managers Index for April. The consensus is for a reading of 53.4, down from 53.6 in March.

• At 10:00 AM, University of Michigan's Consumer sentiment index (final for April). The consensus is for a reading of 90.4, up from the preliminary reading 89.7.

HVS: Q1 2016 Homeownership and Vacancy Rates

by Calculated Risk on 4/28/2016 04:45:00 PM

Earlier today, the Census Bureau released the Residential Vacancies and Homeownership report for Q1 2016.

This report is frequently mentioned by analysts and the media to track household formation, the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. The Census Bureau is investigating the differences between the HVS, ACS and decennial Census, and analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate, except as a guide to the trend.

The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate decreased to 63.5% in Q1, from 63.8% in Q4.

I'd put more weight on the decennial Census numbers - and given changing demographics, the homeownership rate is probably close to a bottom.

Once again - this probably shows the general trend, but I wouldn't rely on the absolute numbers.

I think the Reis quarterly survey (large apartment owners only in selected cities) is a much better measure of the rental vacancy rate, but this does suggest the rental vacancy rate might have bottomed.

The quarterly HVS is the most timely survey on households, but there are many questions about the accuracy of this survey.

Overall this suggests that vacancies and the homeownership rate are probably close to the bottom.

Q1 GDP: Investment

by Calculated Risk on 4/28/2016 01:45:00 PM

The graph below shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter trailing average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

In the graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

The dashed gray line is the contribution from the change in private inventories.

Residential investment (RI) increased at a 14.8% annual rate in Q1. Equipment investment decreased at a 8.6% annual rate, and investment in non-residential structures decreased at a 10.7% annual rate. On a 3 quarter trailing average basis, RI (red) is positive, equipment (green) is close to zero, and nonresidential structures (blue) is negative.

Nonresidential investment in structures typically lags the recovery, however investment in energy and power provided a boost early in this recovery - and is now causing a decline. Other areas of nonresidential are now increasing significantly. I'll post more on the components of non-residential investment once the supplemental data is released.

I expect investment to be solid going forward (except for energy and power), and for the economy to continue to grow at a steady pace.

The second graph shows residential investment as a percent of GDP.

Residential Investment as a percent of GDP has been increasing, but is only just above the bottom of the previous recessions - and I expect RI to continue to increase for the next few years.

I'll break down Residential Investment into components after the GDP details are released.

Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.