by Calculated Risk on 6/10/2016 11:00:00 AM

Friday, June 10, 2016

Earlier: Consumer Sentiment at 94.3, Current Economic Conditions Highest since 2005

Click on graph for larger image.

The University of Michigan consumer sentiment index for June was at 94.3, down from 94.7 in May:

"Consumers were a bit less optimistic in early June due to increased concerns about future economic prospects. The recent data magnified the growing gap between the most favorable assessments of Current Economic Conditions since July 2005, and renewed downward drift of the Expectations Index, which fell by a rather modest 8.6% from the January 2015 peak. The strength recorded in early June was in personal finances, and the weaknesses were in expectations for continued growth in the national economy. Consumers rated their current financial situation at the best levels since the 2007 cyclical peak largely due to wage gains. Prospects for gains in inflation-adjusted incomes in the year ahead were also the most favorable since the 2007 peak, enabled by record low inflation expectations. On the negative side of the ledger, consumers do not think the economy is as strong as it was last year nor do they anticipate the economy will enjoy the same financial health in the year ahead as they anticipated a year ago."Read the highlighted sentences - consumers are very positive on current conditions, but they are concerned about the future.

emphasis added

Mortgage Rates and Ten Year Yield

by Calculated Risk on 6/10/2016 09:38:00 AM

With the ten year yield falling to 1.65%, there has been some discussion about whether mortgage rates will decline to new lows. Based on an historical relationship, 30-year rates should currently be around 3.55%.

As of yesterday, Mortgage News Daily reported: Mortgage Rates Even Closer to All-Time Lows

If rates are able to move any lower from here, that will put them in line with all-time lows. That would connote an average conventional 30yr fixed rate of 3.375%, which isn't too far away considering more than a few lenders are quoting 3.5% on top tier scenarios today. 3.625% remains slightly more prevalent.The graph shows the relationship between the monthly 10 year Treasury Yield and 30 year mortgage rates from the Freddie Mac survey.

emphasis added

Currently the 10 year Treasury yield is at 1.65% and 30 year mortgage rates were at 3.60% according to the Freddie Mac survey last week. The Freddie Mac survey will probably show lower rates this week.

Currently the 10 year Treasury yield is at 1.65% and 30 year mortgage rates were at 3.60% according to the Freddie Mac survey last week. The Freddie Mac survey will probably show lower rates this week.To reach new lows (on the Freddie Mac survey), mortgage rates would have to fall below the 3.35% lows reached in 2012.

For that to happen, based on the historical relationship, the Ten Year yield would have to fall to around 1.5%.

So I don't expect new lows on mortgage rates unless the Ten Year yield falls further - but rates are getting close.

Thursday, June 09, 2016

Merrill Lynch: Some Signs of Slowing at Housing High End

by Calculated Risk on 6/09/2016 07:32:00 PM

A brief except from a research piece by Michelle Meyer at Merrill Lynch: The ding of the trolley

[R]ecent data smells of a slowdown in San Francisco. ... [D]ata suggest inventory remains limited [in San Francisco] so it is not a story of excess supply, but perhaps one of weakening demand given stretched affordability.CR note: Prices have increased sharply in many coastal communities along the West Coast. As Meyer notes, inventory is still limited, so this is probably softening demand (perhaps "stretched affordability"). If it is stretched affordability, prices will probably just flatten out. However if inventory starts to increase significantly, we could see some mild price declines (I don't expect this).

...

Despites weak signals, it is much too early to call the peak in the San Francisco housing market. We have seen these types of wiggles before in the data and this could just be a bump along the way. That said, we think it is prudent to keep a close eye on the upcoming data in the region. ... the trajectory in the housing market in San Francisco could give early indications of trends in other high-end metro areas, which have also shown some signs of weakening at the very high end.

Mortgage Equity Withdrawal Slightly Negative in Q1

by Calculated Risk on 6/09/2016 04:34:00 PM

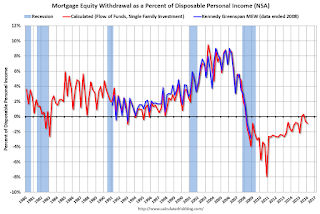

Note: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008.

The following data is calculated from the Fed's Flow of Funds data (released today) and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity - hence the name "MEW", but there is still little (but increasing) MEW right now - and normal principal payments and debt cancellation (modifications, short sales, and foreclosures).

For Q1 2016, the Net Equity Extraction was a negative $30 billion, or a negative 0.9% of Disposable Personal Income (DPI) . MEW for Q2 and Q3 in 2015 was slightly positive - the first positive MEW since Q1 2008 - and MEW will probably be positive in Q2 and Q3 again this year too (there is a seasonal pattern for MEW).

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

Note: This data is still heavily impacted by debt cancellation and foreclosures.

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding increased by $17 billion in Q1.

The Flow of Funds report also showed that Mortgage debt has declined by almost $1.3 trillion since the peak. This decline is mostly because of debt cancellation per foreclosures and short sales, and some from modifications. There has also been some reduction in mortgage debt as homeowners paid down their mortgages so they could refinance.

With residential investment increasing, and a slower rate of debt cancellation, MEW will likely turn positive.

For reference:

Dr. James Kennedy also has a simple method for calculating equity extraction: "A Simple Method for Estimating Gross Equity Extracted from Housing Wealth". Here is a companion spread sheet (the above uses my simple method).

For those interested in the last Kennedy data included in the graph, the spreadsheet from the Fed is available here.

Fed's Flow of Funds: Household Net Worth increased in Q1

by Calculated Risk on 6/09/2016 12:24:00 PM

The Federal Reserve released the Q1 2016 Flow of Funds report today: Flow of Funds.

According to the Fed, household net worth increased in Q1 compared to Q4:

The net worth of households and nonprofits rose to $88.1 trillion during the first quarter of 2016. The value of directly and indirectly held corporate equities decreased $160 billion and the value of real estate rose $498 billion.Household net worth was at $88.1 trillion in Q1 2016, up from $87.2 trillion in Q4 2015.

The Fed estimated that the value of household real estate increased to $22.5 trillion in Q1. The value of household real estate is back to the bubble peak in early 2006 (not adjusted for inflation, and not including new construction).

Click on graph for larger image.

Click on graph for larger image.The first graph shows Households and Nonprofit net worth as a percent of GDP. Household net worth, as a percent of GDP, is higher than the peak in 2006 (housing bubble), and above the stock bubble peak.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

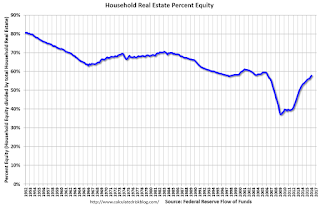

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952. Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q1 2016, household percent equity (of household real estate) was at 57.8% - up from Q4, and the highest since Q1 2006. This was because of an increase in house prices in Q1 (the Fed uses CoreLogic).

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So the approximately 50+ million households with mortgages have far less than 57.8% equity - and several million still have negative equity.

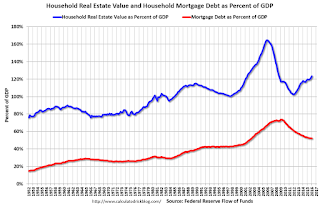

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Mortgage debt increased by $17 billion in Q1.

Mortgage debt has declined by $1.27 trillion from the peak. Studies suggest most of the decline in debt has been because of foreclosures (or short sales), but some of the decline is from homeowners paying down debt (sometimes so they can refinance at better rates).

The value of real estate, as a percent of GDP, was up in Q1, and is somewhat above the average of the last 30 years (excluding bubble).

CoreLogic: "268,000 US Homeowners Regained Equity in the First Quarter of 2016"

by Calculated Risk on 6/09/2016 10:25:00 AM

From CoreLogic: CoreLogic Reports 268,000 US Homeowners Regained Equity in the First Quarter of 2016

CoreLogic ... today released a new analysis showing 268,000 homeowners regained equity in Q1 2016, bringing the total number of mortgaged residential properties with equity at the end of Q1 2016 to approximately 46.7 million, or 92 percent of all mortgaged properties. Nationwide, home equity increased year over year by $762 billion in Q1 2016.On states:

The total number of mortgaged residential properties with negative equity stood at 4 million, or 8 percent of all homes with a mortgage, in Q1 2016. This is a decrease of 6.2 percent quarter over quarter from 4.3 million homes, or 8.5 percent, in Q4 2015 and a decrease of 21.5 percent year over year from 5.1 million homes, or 10.3 percent, compared with Q1 2015. ...

For the homes in negative equity status, the national aggregate value of negative equity was $299.5 billion at the end of Q1 2016, falling approximately $11.8 billion, or 3.8 percent, from $311.3 billion in Q4 2015. On a year-over-year basis, the value of negative equity declined overall from $340 billion in Q1 2015, representing a decrease of 11.8 percent in 12 months.

...

“In just the last four years, equity for homeowners with a mortgage has nearly doubled to $6.9 trillion,” said Frank Nothaft, chief economist for CoreLogic. “The rapid increase in home equity reflects the improvement in home prices, dwindling distressed borrowers and increased principal repayment. These are all positive factors that will provide support to both household balance sheets and the overall economy.”

emphasis added

Nevada had the highest percentage of homes in negative equity at 17.5 percent, followed by Florida (15 percent), Illinois (14.4 percent), Rhode Island (13.3 percent) and Maryland (12.9 percent). Combined, these top five states account for 30.2 percent of negative equity in the U.S., but only 16.5 percent of outstanding mortgages.

Weekly Initial Unemployment Claims decrease to 264,000

by Calculated Risk on 6/09/2016 08:33:00 AM

The DOL reported:

In the week ending June 4, the advance figure for seasonally adjusted initial claims was 264,000, a decrease of 4,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 267,000 to 268,000. The 4-week moving average was 269,500, a decrease of 7,500 from the previous week's revised average. The previous week's average was revised up by 250 from 276,750 to 277,000.The previous week was revised up to 268,000.

There were no special factors impacting this week's initial claims. This marks 66 consecutive weeks of initial claims below 300,000, the longest streak since 1973.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 269,500.

This was lower than the consensus forecast. The low level of claims suggests relatively few layoffs.

Wednesday, June 08, 2016

Thursday: Unemployment Claims, Q1 Flow of Funds

by Calculated Risk on 6/08/2016 07:25:00 PM

Earlier today the Q1 Quarterly Services Report was released. Economist Joseph Brusuelas noted that this should boost Q1 PCE from 1.9% to 2.4% annualized growth rate. That should push up Q1 GDP a little more.

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 270 thousand initial claims, up from 267 thousand the previous week.

• At 10:00 AM, Monthly Wholesale Trade: Sales and Inventories for April. The consensus is for a 0.1% increase in inventories.

• At 12:00 PM, Q1 Flow of Funds Accounts of the United States from the Federal Reserve.

Lehner: "The Housing Trilemma"

by Calculated Risk on 6/08/2016 03:07:00 PM

Josh Lehner, at the Oregon Office of Economic Analysis, has an interesting post today: The Housing Trilemma

Every city wants to have a strong local economy, high quality of life and housing affordability for its residents. Unfortunately these three dimensions represent the Housing Trilemma. A city can achieve success on two but not all three at the same time. Underlying all of these tradeoffs are local policies as well.

Inspired by Kim-Mai Cutler and Cardiff Garcia, I set out to try and quantify the Housing Trilemma across the nation’s 100 largest metropolitan areas. It turns out to be very real. Just eight rank among the top half for all three dimensions of the Housing Trilemma. None rank among the Top 20 in all three. ...

Click on graph for larger image.

Click on graph for larger image.The reason these tradeoffs exist is mostly, but not entirely, due to market forces. People want to live in cities with a strong economy and high quality of life. Increased demand for housing leads to higher prices and lower affordability. Nice places to live get their housing costs bid up due to strong demand. The opposite is true as well. Regions with underperforming economies and a lower quality of life do have better affordability.There is much more in the post.

Here is some data from Josh on the 100 largest MSAs - and how they rank on all three dimensions.

Zillow: Negative Equity Rate declined in Q1 2016

by Calculated Risk on 6/08/2016 12:19:00 PM

From Zillow: Q1 2016 Negative Equity Report: Rust Belt Overtakes Sand States as Nation's Nest of Negative Equity

The national negative equity rate – the share of all homeowners with a mortgage who are underwater, owing more on their mortgage than their home is worth – fell to 12.7 percent in the first quarter of 2016, according to the first quarter Zillow Negative Equity Report. The U.S. negative equity rate is down from 13.1 percent in Q4 2015 and 15.4 percent a year ago, and has fallen or stayed flat from the prior quarter for 16 straight quarters after peaking at 31.4 percent in Q1 2012 (figure 1).The following graph from Zillow shows a time series for negative equit.

emphasis added

Click on graph for larger image.

Click on graph for larger image.From Zillow:

The steady decline in negative equity nationwide has been driven by a consistent recovery in home values over the past several years. But while home values have risen to some extent in a large majority of U.S. markets, some markets have recovered much more quickly than others, and the concentration of negative equity nationwide has shifted from the Southwest and Southeast to the Midwest