by Calculated Risk on 6/15/2016 08:48:00 PM

Wednesday, June 15, 2016

Thursday: CPI, Unemployment Claims, Homebuilder Survey, Philly Fed Mfg Survey

Thursday:

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 270 thousand initial claims, up from 264 thousand the previous week.

• Also at 8:30 AM, The Consumer Price Index for May from the BLS. The consensus is for a 0.3% increase in CPI, and a 0.2% increase in core CPI.

• Also at 8:30 AM, the Philly Fed manufacturing survey for June. The consensus is for a reading of 2.0, up from -1.8.

• At 10:00 AM, The June NAHB homebuilder survey. The consensus is for a reading of 59, up from 58 in May. Any number above 50 indicates that more builders view sales conditions as good than poor.

Lawler: The More Things Change ...

by Calculated Risk on 6/15/2016 05:11:00 PM

From housing economist Tom Lawler:

Below is an excerpt from a news story about mortgage credit standards. I’ve deleted the names of people quoted in the story, and I’ve left blank two references to the time periods being discussed (A and B). Read this excerpt, and before looking below, and try to guess what year “A” refers to and what period “B” refers to.

If you have not been in a lender's office lately but plan to apply for a mortgage soon, brace yourself for surprises. Gone are the breezy days when some lenders routinely stretched debt-to-income ratios or overlooked past credit problems. Mortgage specialists say getting a home loan in ___A___ can be a lot rougher than it used to be.________________________________________________

"Lenders are very concerned these days about the debt exposure of consumers. Someone out there with a shaky credit history may find it more difficult to get a mortgage than back in _____B_______ when the economy was rolling along," says Michael L. Wilson, deputy director of the U.S. League of Savings Institutions.

"There's definitely a tightening up. Lenders are more aware of the risk involved in making mortgage loans.”

One signal of change is the decline of the "low doc" or "no doc" mortgage, which excused those with large down payments from the need to produce most documentation on their income or debt loads. These days most mortgages are traditional, full documentation loans.

But there's more to the story than the near extinction of low or no doc loans. Even with traditional loans, lenders have become more demanding and nitpicky about paper work, mortgage specialists say. "Lenders are going into that dot the `i' and cross the `t' situation.”

"It's true that the whole lending environment has gotten more conservative. But for the average home buyer, it's not so conservative that they're being frozen out of the market. There are just more hoops to jump through.”

Answers:

A - 1991

B - the mid-80’s

Mortgage lending standards, for a host of different reasons, loosened considerably later in the 1990’s, and by the end of that decade were considerably easier than the “historic” norm – though they were not as ridiculously easy as was seen during the subsequent six years.

FOMC Projections and Press Conference

by Calculated Risk on 6/15/2016 02:07:00 PM

Statement here. No change to policy.

As far as the "Appropriate timing of policy firming", participants generally think there will be one or two rate hikes in 2016 (down from two to three in March).

The FOMC projections for inflation are still on the low side through 2018.

Yellen press conference on YouTube here.

On the projections, GDP was revised down for 2016 and 2017.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Change in Real GDP1 | 2016 | 2017 | 2018 | |

| Jun 2016 | 1.9 to 2.0 | 1.9 to 2.2 | 1.8 to 2.1 | |

| Mar 2016 | 2.1 to 2.3 | 2.0 to 2.3 | 1.8 to 2.1 | |

The unemployment rate was at 4.7% in May, however the unemployment rate projection for Q4 2016 was not revised down.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Unemployment Rate2 | 2016 | 2017 | 2018 | |

| Jun 2016 | 4.6 to 4.8 | 4.5 to 4.7 | 4.4 to 4.8 | |

| Mar 2016 | 4.6 to 4.8 | 4.5 to 4.7 | 4.5 to 5.0 | |

As of April, PCE inflation was up only 1.1% from April 2015. With the recent increase in oil and gasoline prices, the range of PCE inflation projections was narrowed, and was revised up slightly for 2016.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| PCE Inflation1 | 2016 | 2017 | 2018 | |

| Jun 2016 | 1.3 to 1.7 | 1.7 to 2.0 | 1.9 to 2.0 | |

| Mar 2016 | 1.0 to 1.6 | 1.7 to 2.0 | 1.9 to 2.0 | |

PCE core inflation was up 1.6% in April year-over-year. Core PCE inflation was revised up for 2016.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Core Inflation1 | 2016 | 2017 | 2018 | |

| Jun 2016 | 1.6 to 1.8 | 1.7 to 2.0 | 1.9 to 2.0 | |

| Mar 2016 | 1.4 to 1.7 | 1.7 to 2.0 | 1.9 to 2.0 | |

FOMC Statement: No Change to Policy

by Calculated Risk on 6/15/2016 02:00:00 PM

Information received since the Federal Open Market Committee met in April indicates that the pace of improvement in the labor market has slowed while growth in economic activity appears to have picked up. Although the unemployment rate has declined, job gains have diminished. Growth in household spending has strengthened. Since the beginning of the year, the housing sector has continued to improve and the drag from net exports appears to have lessened, but business fixed investment has been soft. Inflation has continued to run below the Committee's 2 percent longer-run objective, partly reflecting earlier declines in energy prices and in prices of non-energy imports. Market-based measures of inflation compensation declined; most survey-based measures of longer-term inflation expectations are little changed, on balance, in recent months.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee currently expects that, with gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace and labor market indicators will strengthen. Inflation is expected to remain low in the near term, in part because of earlier declines in energy prices, but to rise to 2 percent over the medium term as the transitory effects of past declines in energy and import prices dissipate and the labor market strengthens further. The Committee continues to closely monitor inflation indicators and global economic and financial developments.

Against this backdrop, the Committee decided to maintain the target range for the federal funds rate at 1/4 to 1/2 percent. The stance of monetary policy remains accommodative, thereby supporting further improvement in labor market conditions and a return to 2 percent inflation.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. In light of the current shortfall of inflation from 2 percent, the Committee will carefully monitor actual and expected progress toward its inflation goal. The Committee expects that economic conditions will evolve in a manner that will warrant only gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run. However, the actual path of the federal funds rate will depend on the economic outlook as informed by incoming data.

The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction, and it anticipates doing so until normalization of the level of the federal funds rate is well under way. This policy, by keeping the Committee's holdings of longer-term securities at sizable levels, should help maintain accommodative financial conditions.

Voting for the FOMC monetary policy action were: Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Lael Brainard; James Bullard; Stanley Fischer; Esther L. George; Loretta J. Mester; Jerome H. Powell; Eric Rosengren; and Daniel K. Tarullo.

emphasis added

Fed: Industrial Production decreased 0.4% in May

by Calculated Risk on 6/15/2016 09:22:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production decreased 0.4 percent in May after increasing 0.6 percent in April. Declines in the indexes for manufacturing and utilities in May were slightly offset by a small gain for mining. The output of manufacturing moved down 0.4 percent, led by a large step-down in the production of motor vehicles and parts; factory output aside from motor vehicles and parts edged down 0.1 percent. The index for utilities fell 1.0 percent, as a drop in the output of electric utilities was partly offset by a gain for natural gas utilities. After eight straight monthly declines, the production at mines moved up 0.2 percent. At 103.6 percent of its 2012 average, total industrial production in May was 1.4 percent below its year-earlier level. Capacity utilization for the industrial sector decreased 0.4 percentage point in May to 74.9 percent, a rate that is 5.1 percentage points below its long-run (1972–2015) average.

emphasis added

Click on graph for larger image.

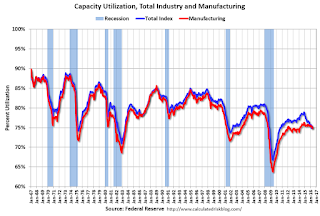

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 8.2 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 74.9% is 5.1% below the average from 1972 to 2015 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased 0.4% in May to 103.6. This is 18.5% above the recession low, and 2.0% below the pre-recession peak.

This was below expectations of a 0.1% decrease.

MBA: "Mortgage Applications Decrease in Latest MBA Weekly Survey"

by Calculated Risk on 6/15/2016 07:01:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending June 10, 2016. The previous week’s results included an adjustment for the Memorial Day holiday.

...

The Refinance Index decreased 1 percent from the previous week. The seasonally adjusted Purchase Index decreased 5 percent from one week earlier. The unadjusted Purchase Index increased 17 percent compared with the previous week and was 16 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to its lowest level since January 2015, 3.79 percent, from 3.83 percent, with points decreasing to 0.32 from 0.33 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity was higher in 2015 than in 2014, but it was still the third lowest year since 2000.

Refinance activity increased a little this year since rates have declined.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The purchase index is "16 percent higher than the same week one year ago".

Tuesday, June 14, 2016

Wednesday: FOMC Statement, Industrial Production, PPI, Empire State Mfg

by Calculated Risk on 6/14/2016 08:21:00 PM

From Tim Duy at Bloomberg: Not June, Not Likely July, More Likely September

The best-laid plans can come undone by the tiniest of things.Wednesday:

In this case a slip in the data—a low print on nonfarm payrolls that may prove no more than a statistical bump—put a June interest rate hike out of reach for the Federal Reserve and probably a July one as well. That leaves September in focus as the next chance for the U.S. central bank to tighten policy—if the data hold.

...

The FOMC statement will be followed by a press conference. There Yellen will steer a middle ground between optimism and pessimism. Keeping a July hike in play will be her primary objective. With even her believing the economy is near full employment, the Fed will not yet give up on the story that an economic bounce in the second quarter will be sufficient to justify a rate hike in July.

Bottom Line: The optimistic tale spun by Yellen tells us that the Fed is ready and willing to hike rates. But that pesky little detail of a consistent data narrative to justify such a move continues to elude policymakers. The lack of supportive data has stripped them of a chance to hike rates in June, and also leaves July as an unlikely candidate. Turn your eyes to September.

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The Producer Price Index for May from the BLS. The consensus is for a 0.3% increase in prices, and a 0.2% increase in core PPI.

• Also at 8:30 AM, the New York Fed Empire State manufacturing survey for June. The consensus is for a reading of -3.5, up from -9.0.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for May. The consensus is for a 0.1% decrease in Industrial Production, and for Capacity Utilization to decrease to 75.2%.

• At 2:00 PM, FOMC Meeting Announcement. No change to the Fed Funds rate is expected at this meeting.

• Also at 2:00 PM, FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

• At 2:30 PM, Fed Chair Janet Yellen holds a press briefing following the FOMC announcement.

Off Topic: #NothingCanBeDone

by Calculated Risk on 6/14/2016 06:20:00 PM

Last year I wrote a post bemoaning the defeatist attitude of so many policymakers Defeatists Policies #NothingCanBeDone

The main topic was economics, but I also mentioned guns ...

And we also hear "nothing can be done" about the ongoing mass shooting in the U.S., even though most Americans support stricter background checks, longer waiting periods, and restricting certain types of weapons. Reagan supported gun control, but not this Congress. Something can be done - and will be done eventually. Hopefully "Before some ol' fool come around here, Wanna shoot either you or me".Something can be done. And it SHOULD be done today.

U.S. Population Distribution by Age, 1900 through 2060

by Calculated Risk on 6/14/2016 12:23:00 PM

By request, here is a repeat of animations of the U.S population by age and distribution, from 1900 through 2060. The population data and estimates are from the Census Bureau (actual through 2010 and projections through 2060).

Note: For distribution, here are the same graphs using a slider (the user can look at individual slides).

There are many interesting points - the Depression baby bust, the baby boom, the 2nd smaller baby bust following the baby boom, the "echo" boom" and more. What jumps out at me are the improvements in health care. And also that the largest cohorts will all soon be under 40. Heck, in the last frame (2060), any remaining Boomers will be in those small (but growing) 95 to 99, and 100+ cohorts.

The first graph is by distribution (updates every 2 seconds).

The second graph is by age. Population is in thousands (not labeled)! Prior to 1940, the oldest group in the Census data was "75+". From 1940 through 1985, the oldest group was "85+". Starting in 1990, the oldest group is 100+.

NFIB: Small Business Optimism Index increased in May

by Calculated Risk on 6/14/2016 10:15:00 AM

Earlier from the National Federation of Independent Business (NFIB): Small Business Optimism Rises Modestly in May

The Index of Small Business Optimism rose two tenths of a point in May to 93.8 ... according to the National Federation of Independent Business’ (NFIB) monthly economic survey released today. ...

Fifty-six percent reported hiring or trying to hire (up 3 points), but 48 percent reported few or no qualified applicants for the positions they were trying to fill. Hiring activity increased substantially, but apparently the “failure rate” also rose as more owners found it hard to identify qualified applicants. ... Twenty-seven percent of all owners reported job openings they could not fill in the current period, down 2 points, but historically strong.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 93.8 in May.