by Calculated Risk on 6/17/2016 12:59:00 PM

Friday, June 17, 2016

Comments on May Housing Starts

Earlier: Housing Starts decreased to 1.164 Million Annual Rate in May

The housing starts report this morning was close to consensus, and there were upward revisions to the prior two months (combined). Also starts were up 9.5% from May 2015.

The key take away from the report is that multi-family is slowing, and single family growth is ongoing year-over-year.

This graph shows the month to month comparison between 2015 (blue) and 2016 (red).

Year-to-date starts are up 10.2% compared to the same period in 2015, but that will slow further with the more difficult comparisons for the remainder of the year.

Multi-family starts are up 2.5% year-to-date, and single-family starts are up 14.5% year-to-date.

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily over the last few years, and completions (red line) have lagged behind - but completions have been catching up (more deliveries), and will continue to follow starts up (completions lag starts by about 12 months).

I think most of the growth in multi-family starts is probably behind us - in fact multi-family starts probably peaked in June 2015 (at 510 thousand SAAR) - although I expect solid multi-family starts for a few more years (based on demographics).

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

The housing recovery continues, however I expect most of the growth will be from single family going forward.

BLS: Unemployment Rates stable in 41 states in May

by Calculated Risk on 6/17/2016 10:18:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were significantly higher in May in 5 states, lower in 4 states and the District of Columbia, and stable in 41 states, the U.S. Bureau of Labor Statistics reported today.

...

South Dakota and New Hampshire had the lowest jobless rates in May, 2.5 percent and 2.7 percent, respectively. The rate in Arkansas (3.8 percent) set a new series low. (All region, division, and state series begin in 1976.) Alaska had the highest unemployment rate, 6.7 percent.

emphasis added

Click on graph for larger image.

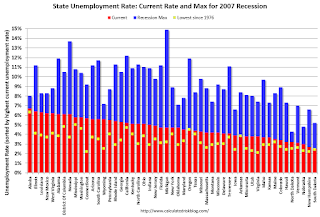

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement. The yellow squares are the lowest unemployment rate per state since 1976.

The states are ranked by the highest current unemployment rate. Alaska, at 6.7%, had the highest state unemployment rate.

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).Currently no state has an unemployment rate at or above 7% (light blue); Only seven states and D.C are at or above 6% (dark blue).

Housing Starts decreased to 1.164 Million Annual Rate in May

by Calculated Risk on 6/17/2016 08:38:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in May were at a seasonally adjusted annual rate of 1,164,000. This is 0.3 percent below the revised April estimate of 1,167,000, but is 9.5 percent above the May 2015 rate of 1,063,000.

Single-family housing starts in May were at a rate of 764,000; this is 0.3 percent above the revised April figure of 762,000. The May rate for units in buildings with five units or more was 396,000

Building Permits:

Privately-owned housing units authorized by building permits in May were at a seasonally adjusted annual rate of 1,138,000. This is 0.7 percent above the revised April rate of 1,130,000, but is 10.1 percent below the May 2015 estimate of 1,266,000.

Single-family authorizations in May were at a rate of 726,000; this is 2.0 percent below the revised April figure of 741,000. Authorizations of units in buildings with five units or more were at a rate of 381,000 in May.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased in May compared to April. Multi-family starts are up 8% year-over-year.

Single-family starts (blue) increased in May, and are up 10% year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low),

Total housing starts in May were close to expectations, and combined starts for March and April were revised up slightly. I'll have more later ...

Thursday, June 16, 2016

Friday: Housing Starts

by Calculated Risk on 6/16/2016 08:45:00 PM

Friday:

• At 8:30 AM,Housing Starts for May. Total housing starts increased to 1.172 million (SAAR) in April. Single family starts increased to 778 thousand SAAR in April. The consensus is for 1.160 million in May, down from the April rate.

• At 10:00 AM, Regional and State Employment and Unemployment for May 2016

From Matthew Graham at Mortgage News Daily: Mortgage Rates Deeper into 3-Year Lows

[W]e find ourselves well into the lowest rates in more than three years, even if the pace of improvement is lagging the drop in US Treasury rates. ... The average lender is now down to 3.5% in terms of conventional 30yr fixed quotes for top tier scenarios.Mortgage rates are getting close to all time lows.

Lawler: Early Read on Existing Home Sales in May

by Calculated Risk on 6/16/2016 04:45:00 PM

From housing economist Tom Lawler:

Based on publicly-available state and local realtor/MLS reports from across the country released through today, I project that May existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.55 million in May, up 1.8% from April’s preliminary pace and up 4.9% from last May’s seasonally adjusted pace. Unadjusted sales should show a slightly higher YOY % gain, reflecting this May’s higher business-day count.

Local realtor/MLS data also suggest that existing home listings increased only slightly on the month (and by less than last May’s MoM gain), and I project that the inventory of existing homes for sale as estimated by the NAR for the end of May will be 2.16 million, up 0.9% from April’s preliminary estimate and down 5.3% from last May. Finally, I project that the NAR’s estimate of the median existing single-family home sales price for May will be up 5.3% YOY.

CR Note: The NAR is scheduled to release May Existing Home sales next Wednesday, and the early consensus is 5.64 million SAAR (probably too high).

Lawler: Single-Family Home Production in 2015: Small Number, Big Homes

by Calculated Risk on 6/16/2016 02:45:00 PM

From housing economist Tom Lawler: Single-Family Home Production in 2015: Small Number, Big Homes

At the beginning of June the Census Bureau released its annual report for 2015 on the characteristics of new privately-owned residential structures, including but not limited to square footage, number of bedrooms and bathrooms, type of wall material, and sales prices. In terms of single-family homes completed last year, one of the more striking aspects of the report was the incredibly small number of modestly-sized single-family homes completed last year. Below is a summary of homes completed from 1999 to 2015 by square-footage ranges.

Of the estimated 648,000 single-family homes completed last year, just 136,000, or 21%, were homes with square footage of less than 1,800. The number of “moderately-sized” single-family homes completed in 2015 was little changed 2011, when overall single-family home completions hit at a “record” low. In sharp contrast, the number of homes with 3,000 or more square feet of floor area last year was up 76% from 2011’s level.

| Single-Family Homes Completed by Square Footage | |||||||

|---|---|---|---|---|---|---|---|

| Number of houses (in thousands) by square feet | |||||||

| Year | Total | Under 1,400 | 1,400 to 1,799 | 1,800 to 2,399 | 2,400 to 2,999 | 3,000 to 3,999 | 4,000 or more |

| 1999 | 1,270 | 197 | 276 | 370 | 211 | 157 | 59 |

| 2000 | 1,242 | 178 | 268 | 363 | 208 | 158 | 66 |

| 2001 | 1,256 | 167 | 261 | 359 | 222 | 172 | 75 |

| 2002 | 1,325 | 172 | 283 | 375 | 240 | 180 | 76 |

| 2003 | 1,386 | 179 | 279 | 401 | 251 | 199 | 77 |

| 2004 | 1,532 | 186 | 311 | 433 | 291 | 219 | 92 |

| 2005 | 1,636 | 165 | 317 | 467 | 306 | 262 | 119 |

| 2006 | 1,654 | 164 | 312 | 452 | 326 | 263 | 137 |

| 2007 | 1,218 | 120 | 220 | 335 | 227 | 202 | 115 |

| 2008 | 819 | 104 | 146 | 219 | 138 | 127 | 84 |

| 2009 | 520 | 66 | 106 | 139 | 89 | 72 | 48 |

| 2010 | 496 | 66 | 96 | 135 | 87 | 75 | 37 |

| 2011 | 447 | 57 | 84 | 111 | 79 | 76 | 40 |

| 2012 | 483 | 53 | 83 | 126 | 93 | 88 | 40 |

| 2013 | 569 | 46 | 89 | 154 | 115 | 110 | 56 |

| 2014 | 620 | 48 | 87 | 162 | 131 | 127 | 66 |

| 2015 | 648 | 49 | 87 | 171 | 138 | 132 | 72 |

Click on graph for larger image.

Click on graph for larger image.Here is a chart showing the historical median square footage of single-family homes completed.

It is a little difficult to compare the distribution of single-family homes completed in recent years relative to earlier decades, because Census has changed the square-footage ranges in its reports over time. However, from 1999 to 2007 there are data for both the “old” ranges and the “new” ranges, and by looking at some historical relationships one can approximate completions for various ranges over time, which I have done in the table below.

| Average Annual Single-Family Homes Completed by Square Feeet of Floor Area | ||||||

|---|---|---|---|---|---|---|

| Total | <1,600 | 1,600- 1,999 | 2000- 2,399 | 2,400- 2,999 | 3,000+ | |

| 1973-79 | 1,140 | 574 | 259 | 158 | 94 | 55 |

| 1980-89 | 978 | 453 | 207 | 134 | 108 | 75 |

| 1990-99 | 1,070 | 319 | 242 | 189 | 170 | 151 |

| 2000-09 | 1,259 | 269 | 261 | 224 | 230 | 274 |

| 2010 | 496 | 111 | 101 | 85 | 87 | 112 |

| 2011 | 447 | 96 | 86 | 70 | 79 | 116 |

| 2012 | 483 | 92 | 91 | 79 | 93 | 128 |

| 2013 | 569 | 88 | 104 | 97 | 115 | 166 |

| 2014 | 620 | 89 | 106 | 102 | 131 | 193 |

| 2015 | 648 | 90 | 109 | 108 | 138 | 204 |

| (LEHC estimates based on Census data. Totals may not add up due to rounding). | ||||||

There have been numerous articles over the last year or two discussing some of the possible reasons for the dearth of construction of moderately-sized (and priced) single-family homes over the past few years, and I won’t today discuss the “why’s.” However, it seems highly unlikely that single-family starts (and completions) will move back up to more “historic” levels unless there is a rebound in the construction of “smaller,” and less expensive, homes.

Key Measures Show Inflation close to 2% in May

by Calculated Risk on 6/16/2016 11:15:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.3% (3.2% annualized rate) in May. The 16% trimmed-mean Consumer Price Index rose 0.2% (2.1% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for May here. Motor fuel was up 64% annualized in May.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.2% (2.6% annualized rate) in May. The CPI less food and energy rose 0.2% (2.5% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.5%, the trimmed-mean CPI rose 2.0%, and the CPI less food and energy also rose 2.2%. Core PCE is for April and increased 1.6% year-over-year.

On a monthly basis, median CPI was at 3.2% annualized, trimmed-mean CPI was at 2.1% annualized, and core CPI was at 2.5% annualized.

Using these measures, inflation has been moving up, and most of these measures are at or above the Fed's target (Core PCE is still below).

NAHB: Builder Confidence increases to 60 in June

by Calculated Risk on 6/16/2016 10:04:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 60 in June, up from 58 in May. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Rises Two Points in June

After holding steady for the past four months, builder confidence in the market for newly constructed single-family homes rose two points in June to a level of 60 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI). This is the highest reading since January 2016.

...

“Rising home sales, an improving economy and the fact that the HMI gauge measuring future sales expectations is running at an eight-month high are all positive factors indicating that the housing market should continue to move forward in the second half of 2016,” said NAHB Chief Economist Robert Dietz.

...

All three HMI components posted gains in June. The component gauging current sales conditions rose one point to 64, the index charting sales expectations in the next six months increased five points to 70, and the component measuring buyer traffic climbed three points to 47.

Looking at the three-month moving averages for regional HMI scores, the South registered a two-point uptick to 61 and the West rose one point to 68. The Northeast dropped two points to 39 and the Midwest fell one point to 57.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was above the consensus forecast of 59, and a solid reading.

Philly Fed Manufacturing Survey showed Expansion in June

by Calculated Risk on 6/16/2016 08:58:00 AM

From the Philly Fed: June 2016 Manufacturing Business Outlook Survey

Firms responding to the Manufacturing Business Outlook Survey reported little growth this month. Though the indicator for general activity was positive in June, other broad indicators continued to reflect general weakness in business conditions. The indicators for both employment and work hours remained negative. Forecasts of future activity weakened from last month but continued to suggest that manufacturers expect growth over the next six months.This was above the consensus forecast of a reading of 2.0 for June.

...

The diffusion index for current activity rose almost 7 points, to 4.7, and returned to positive territory this month after two consecutive negative readings ...

The survey’s labor market indicators suggest continued weak employment conditions. The employment index was negative for the sixth consecutive month, falling from –3.3 in May to –10.9 in June. Though nearly 72 percent of the firms reported no change in employment this month, the percentage reporting decreases (20 percent) exceeded the percentage reporting increases (9 percent).

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The yellow line is an average of the NY Fed (Empire State) and Philly Fed surveys through June. The ISM and total Fed surveys are through May.

The average of the Empire State and Philly Fed surveys turned positive in June (yellow). This suggests the ISM survey will probably indicate expansion this month.

Weekly Initial Unemployment Claims increase to 277,000

by Calculated Risk on 6/16/2016 08:33:00 AM

The DOL reported:

In the week ending June 11, the advance figure for seasonally adjusted initial claims was 277,000, an increase of 13,000 from the previous week's unrevised level of 264,000. The 4-week moving average was 269,250, a decrease of 250 from the previous week's unrevised average of 269,500.The previous week was unrevised.

There were no special factors impacting this week's initial claims. This marks 67 consecutive weeks of initial claims below 300,000, the longest streak since 1973.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 269,250.

This was higher than the consensus forecast. The low level of claims suggests relatively few layoffs.