by Calculated Risk on 6/29/2016 04:35:00 PM

Wednesday, June 29, 2016

Zillow Forecast: Expect About the Same Growth in May for the Case-Shiller Indexes

The Case-Shiller house price indexes for April were released yesterday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Zillow: May Case-Shiller Forecast: April's Modest Monthly Slowdown Should Continue

April Case-Shiller data showed seasonally adjusted monthly home price growth that was slightly weaker than expected, and annual growth at a pace in line with recent months. Looking ahead, Zillow’s May Case-Shiller forecast calls for more of the same, with seasonally adjusted monthly growth in the 10- and 20-city indices falling slightly from April while annual growth stays largely flat.The year-over-year change for the 20-city index will probably be slightly lower in the May report than in the April report. The change for the National index will probably be about the same.

The May Case-Shiller National Index is expected to grow 5 percent year-over-year and 0.1 percent month-to-month, both unchanged from April. We expect the 10-City Index to grow 4.7 percent year-over-year and 0.1 percent from April. The 20-City Index is expected to grow 5.3 percent between May 2015 and May 2016 and 0.1 percent from April.

Zillow’s May Case-Shiller forecast is shown in the table below. These forecasts are based on today’s April Case-Shiller data release and the May 2016 Zillow Home Value Index (ZHVI). The May Case-Shiller Composite Home Price Indices will not be officially released until Tuesday, July 26.

Freddie Mac: Mortgage Serious Delinquency rates declined in May

by Calculated Risk on 6/29/2016 01:01:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate decreased in May to 1.11% from 1.15% in April. Freddie's rate is down from 1.58% in May 2015.

This is the lowest rate since August 2008.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Although the rate is generally declining, the "normal" serious delinquency rate is under 1%.

The Freddie Mac serious delinquency rate has fallen 0.47 percentage points over the last year, and at that rate of improvement, the serious delinquency rate will be below 1% in a few months.

Note: Fannie Mae reported yesterday.

NAR: Pending Home Sales Index decreased 3.7% in May, down 0.2% year-over-year

by Calculated Risk on 6/29/2016 10:02:00 AM

From the NAR: Pending Home Sales Skid in May

After steadily increasing for three straight months, pending home sales letup in May and declined year-over-year for the first time in almost two years, according to the National Association of Realtors®. All four major regions experienced a cutback in contract activity last month.This was below expectations of a 1.0% decrease for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in June and July.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, slid 3.7 percent to 110.8 in May from a downwardly revised 115.0 in April and is now slightly lower (0.2 percent) than May 2015 (111.0). With last month’s decline, the index reading is still the third highest in the past year, but declined year-over-year for the first time since August 2014.

...

The PHSI in the Northeast dropped 5.3 percent to 93.0 in May, and is now unchanged from a year ago. In the Midwest the index slipped 4.2 percent to 108.0 in May, and is now 1.8 percent below May 2015.

Pending home sales in the South declined 3.1 percent to an index of 126.6 in May but are still 0.6 percent higher than last May. The index in the West decreased 3.4 percent in May to 102.6, and is now 0.1 percent below a year ago..

emphasis added

Personal Income increased 0.2% in May, Spending increased 0.4%

by Calculated Risk on 6/29/2016 08:37:00 AM

The BEA released the Personal Income and Outlays report for May:

Personal income increased $37.1 billion, or 0.2 percent ... according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $53.5 billion, or 0.4 percent.The following graph shows real Personal Consumption Expenditures (PCE) through February 2016 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.3 percent in May, compared with an increase of 0.8 percent in April. ... The price index for PCE increased 0.2 percent in May, compared with an increase of 0.3 percent in April. The PCE price index, excluding food and energy, increased 0.2 percent, the same increase as in April.

The May PCE price index increased 0.9 percent from May a year ago. The May PCE price index, excluding food and energy, increased 1.6 percent from May a year ago.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was slightly less than expected. And the increase in PCE was at the 0.4% increase consensus.

On inflation: The PCE price index increased 0.9 percent year-over-year due to the sharp decline in oil prices. The core PCE price index (excluding food and energy) increased 1.6 percent year-over-year in May.

Using the two-month method to estimate Q2 PCE growth, PCE was increasing at a 4.1% annual rate in Q2 2016 (using the mid-month method, PCE was increasing 4.1%). This suggests solid PCE growth in Q2.

MBA: "Mortgage Applications Decrease in Latest Weekly Survey"

by Calculated Risk on 6/29/2016 07:01:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending June 24, 2016.

...

The Refinance Index decreased 2 percent from the previous week. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier. The unadjusted Purchase Index decreased 4 percent compared with the previous week and was 13 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) to its lowest level since May 2013, 3.75 percent, from 3.76 percent, with points increasing to 0.36 from 0.33 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity has increased a little this year since rates have declined.

30-year fixed rates would probably have to fall below 3.35% (the previous low - getting close) before there is a large increase in refinance activity.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The purchase index is "13 percent higher than the same week one year ago".

Tuesday, June 28, 2016

Wednesday: Personal Income and Outlays, Pending Home Sales

by Calculated Risk on 6/28/2016 08:21:00 PM

NOTE: Fed Chair Yellen was scheduled to participate in a "Policy Panel" at the ECB Forum on Central Banking in Portugal on Wednesday. She has cancelled. Mark Carney, Governor of the Bank of England and Chairman of the G20's Financial Stability Board, has also cancelled.

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Personal Income and Outlays for May. The consensus is for a 0.3% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• At 10:00 AM, Pending Home Sales Index for May. The consensus is for a 1.0% decrease in the index.

From Matthew Graham at Mortgage News Daily: Mortgage Rates Lower Despite Bond Market Weakness

Mortgage rates fell modestly today despite some weakness in underlying bond markets. Typically, when bond yields (which move inversely with bond prices) are rising, mortgage rates tend to be higher as well. That wasn't the case today for a few reasons. The most obvious reason is that bond markets didn't move that much. [30 year fixed mortgage rates are between 3 3/8% and 3 1/2% on best scenarios]Here is a table from Mortgage News Daily:

emphasis added

Fannie Mae: Mortgage Serious Delinquency rate declined in May

by Calculated Risk on 6/28/2016 04:23:00 PM

Fannie Mae reported today that the Single-Family Serious Delinquency rate declined in May to 1.38%, down from 1.40% in April. The serious delinquency rate is down from 1.70% in May 2015.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

This is the lowest rate since June 2008.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Although the rate is generally declining, the "normal" serious delinquency rate is under 1%.

The Fannie Mae serious delinquency rate has fallen 0.32 percentage points over the last year, and at that rate of improvement, the serious delinquency rate will not be below 1% until the second half of 2017.

.

Earlier from Richmond Fed: Manufacturing Activity Declined in June

by Calculated Risk on 6/28/2016 02:51:00 PM

Earlier from the Richmond Fed: Manufacturing Sector Activity Declined; New Orders Decreased, Firms Continued to Increase Wages

Fifth District manufacturing activity weakened in June, according to the most recent survey by the Federal Reserve Bank of Richmond. New orders and shipments declined this month, while backlogs decreased further compared to last month. Manufacturing employment softened, while firms continued to increase wages.This was the last of the regional Fed surveys for June.

...

Overall, manufacturing conditions weakened in June. The composite index for manufacturing dropped to a reading of −7. ...

Manufacturing hiring softened in June. The index leveled off to a reading of −1, compared to last month's reading of 4. The average workweek index dropped 10 points this month to end −4. Average wage growth remained on pace with last month; that index slipped only one point to end at a reading of 14.

emphasis added

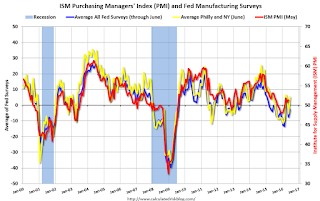

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through June), and five Fed surveys are averaged (blue, through June) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through May (right axis).

It seems likely the ISM manufacturing index will show expansion in June. The consensus is for the ISM to be at 51.5, up from 51.3 in May.

Real Prices and Price-to-Rent Ratio in April

by Calculated Risk on 6/28/2016 11:58:00 AM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 5.0% year-over-year in April

The year-over-year increase in prices is mostly moving sideways now around 5%. In April, the index was up 5.0% YoY.

In the earlier post, I graphed nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $274,000 today adjusted for inflation (37%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

It has been almost ten years since the bubble peak. In the Case-Shiller release this morning, the National Index was reported as being 3.0% below the bubble peak. However, in real terms, the National index is still about 17.1% below the bubble peak.

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) is back to November 2005 levels, and the Case-Shiller Composite 20 Index (SA) is back to June 2005 levels, and the CoreLogic index (NSA) is back to June 2005.

Real House Prices

In real terms, the National index is back to January 2004 levels, the Composite 20 index is back to November 2003, and the CoreLogic index back to November 2003.

In real terms, house prices are back to late 2003 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to August 2003 levels, the Composite 20 index is back to June 2003 levels, and the CoreLogic index is back to April 2003.

In real terms, and as a price-to-rent ratio, prices are back to late 2003 - and the price-to-rent ratio maybe moving a little more sideways now.

Case-Shiller: National House Price Index increased 5.0% year-over-year in April

by Calculated Risk on 6/28/2016 09:12:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for April ("April" is a 3 month average of February, March and April prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Prices Continue Gains in April According to the S&P/Case-Shiller Home Price Indices

The S&P/Case-Shiller U.S. National Home Price Index, covering all nine U.S. census divisions, reported a 5.0% annual gain in April, down from 5.1% the previous month. The 10-City Composite posted a 4.7% annual increase, down from 4.8% in March. The 20-City Composite reported a yearover-year gain of 5.4%, down from 5.5% from the prior month.

...

Before seasonal adjustment, the National Index posted a month-over-month gain of 1.0% in April. The 10-City Composite recorded a 1.0% month-over-month increase, while the 20-City Composite posted a 1.1% increase in April. After seasonal adjustment, the National Index recorded a 0.1% month-overmonth increase, the 10-City Composite posted a 0.3% increase, and the 20-City Composite reported a 0.5% month-over-month increase. After seasonal adjustment, 15 cities saw prices rise, two cities were unchanged, and three cities experienced negative monthly prices changes.

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 10.6% from the peak, and up 0.3% in April (SA).

The Composite 20 index is off 9.0% from the peak, and up 0.5% (SA) in April.

The National index is off 3.0% from the peak, and up 0.1% (SA) in April. The National index is up 31.0% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 4.7% compared to April 2015.

The Composite 20 SA is up 5.4% year-over-year..

The National index SA is up 5.0% year-over-year.

Note: According to the data, prices increased in 16 of 20 cities month-over-month seasonally adjusted.

I'll have more later.