by Calculated Risk on 7/31/2016 10:09:00 AM

Sunday, July 31, 2016

CoStar: Commercial Real Estate prices increased in June

Here is a price index for commercial real estate that I follow.

From CoStar: Commercial Property Price Growth Rebounds In Second Quarter

CRE PRICE INDICES RESUMED HEALTHY GROWTH IN SECOND QUARTER. After experiencing modest growth in the first quarter of 2016 in the wake of global economic uncertainty, both CCRSI’s national composite price indices ended the second quarter of 2016 on a stronger note as investor confidence rebounded. The value-weighted U.S. Composite Index, which is influenced by the sale of high-quality, larger assets, advanced by 3.3%, while the equal-weighted U.S. Composite Index, which reflects the more numerous sales of smaller properties, rose 2.1% in the second quarter of 2016.

HOWEVER, THE PACE OF PRICE GROWTH HAS MODERATED ON AN ANNUAL BASIS. While price growth resumed in both composite indices during the second quarter of 2016, the rate of increase has dropped into the single digits as of June 2016 from a double-digit annual pace in the 12-month periods ending in June 2014 and June 2015. This suggests the pace of price growth may continue to plateau in 2016 as the current cycle advances. ...

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index indexes.

The value-weighted index increased 1.4% in June and is up 9.0% year-over-year.

The equal-weighted index increased 1.3% in May and is up 6.8% year-over-year.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.

Saturday, July 30, 2016

Schedule for Week of July 31, 2016

by Calculated Risk on 7/30/2016 08:09:00 AM

The key report this week is the July employment report on Friday.

Other key indicators include the June ISM manufacturing and non-manufacturing indexes, July auto sales, and the June trade deficit.

10:00 AM: ISM Manufacturing Index for July. The consensus is for the ISM to be at 53.2, unchanged from 53.2 in June.

10:00 AM: ISM Manufacturing Index for July. The consensus is for the ISM to be at 53.2, unchanged from 53.2 in June.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion at 53.2% in June. The employment index was at 50.4%, and the new orders index was at 57.0%.

10:00 AM: Construction Spending for June. The consensus is for a 0.6% increase in construction spending.

2:00 PM ET: the July 2016 Senior Loan Officer Opinion Survey on Bank Lending Practices from the Federal Reserve.

8:30 AM: Personal Income and Outlays for June. The consensus is for a 0.3% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.1%.

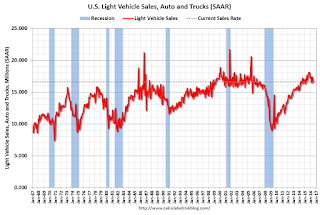

All day: Light vehicle sales for July. The consensus is for light vehicle sales to increase to 17.3 million SAAR in July, from 16.6 million in June (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for July. The consensus is for light vehicle sales to increase to 17.3 million SAAR in July, from 16.6 million in June (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the June sales rate.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for July. This report is for private payrolls only (no government). The consensus is for 165,000 payroll jobs added in July, down from 172,000 added in June.

10:00 AM: the ISM non-Manufacturing Index for July. The consensus is for index to decrease to 56.0 from 56.5 in June.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 265 thousand initial claims, down from 266 thousand the previous week.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for June. The consensus is a 1.8% decrease in orders.

8:30 AM: Employment Report for July. The consensus is for an increase of 185,000 non-farm payroll jobs added in July, down from the 287,000 non-farm payroll jobs added in June.

The consensus is for the unemployment rate to decrease to 4.8%.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In June, the year-over-year change was 2.45 million jobs.

A key will be the change in wages.

8:30 AM: Trade Balance report for June from the Census Bureau.

8:30 AM: Trade Balance report for June from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through May. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $43.0 billion in June from $41.1 billion in May.

3:00 PM: Consumer credit from the Federal Reserve. The consensus is for a $15.5 billion increase in credit.

Friday, July 29, 2016

July 2016: Unofficial Problem Bank list declines to 196 Institutions

by Calculated Risk on 7/29/2016 08:33:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for July 2016.

Changes and comments from surferdude808:

Update on the Unofficial Problem Bank List for July 2016. During the month, the list fell from 203 institutions to 196 after seven removals. Assets dropped by $1.7 billion to an aggregate $58.9 billion. A year ago, the list held 290 institutions with assets of $83.9 billion.

Actions have been terminated against Ponce de Leon Federal Bank, Bronx, NY ($721 million); Pilot Bank, Tampa, FL ($230 million); Native American Bank, National Association, Denver, CO ($83 million); Georgia Heritage Bank, Dallas, GA ($74 million); and Century Bank of Florida, Tampa, FL ($74 million).

Finding merger partners were Tidelands Bank, Mount Pleasant, SC ($464 million Ticker: TDBK) and Calumet County Bank, Brillion, WI ($89 million).

Lawler: Homebuilder Summary Table for Q2 2016

by Calculated Risk on 7/29/2016 04:01:00 PM

CR Note: Housing economist Tom Lawler sent me these summary results for several large publicly-traded builders who have reported results for last quarter.

Lawler notes: CalAtlantic was formed with the merger of Standard Pacific and Ryland, completed in October 2015. The Q2/2015 statistics for CalAtlantic are pro forma statistics for Standard Pacific and Ryland combined. Also, while MDC Holdings has not yet released its “official” results for Q2/2016, it did release preliminary estimates of selected operations statistics for the quarter, which are shown above.

| Net Orders | Settlements | Average Closing Price (000s) | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Qtr. Ended: | 616 | 6/15 | % Chg | 6/16 | 6/15 | % Chg | 6/16 | 6/15 | % Chg |

| D.R. Horton | 11,714 | 10,398 | 12.7% | 10,739 | 9,856 | 9.0% | $290 | 290 | 0.2% |

| Pulte Group | 5,697 | 5,118 | 11.3% | 4,772 | 3,744 | 27.5% | $367 | 332 | 10.5% |

| NVR | 4,324 | 3,796 | 13.9% | 3,581 | 3,175 | 12.8% | $379 | 384 | -1.5% |

| Cal Atlantic | 3,921 | 3,954 | -0.8% | 3,484 | 3,119 | 11.7% | $447 | 427 | 4.7% |

| Beazer Homes | 1,490 | 1,524 | -2.2% | 1,364 | 1,293 | 5.5% | $330 | 318 | 4.0% |

| Meritage Homes | 2,073 | 1,986 | 4.4% | 1,950 | 1,556 | 25.3% | $408 | 380 | 7.4% |

| MDC Holdings | 1,647 | 1,481 | 11.2% | 1,272 | 1,126 | 13.0% | $448 | 410 | 9.3% |

| M/I Homes | 1,354 | 1,100 | 23.1% | 1,042 | 919 | 13.4% | $362 | 340 | 6.5% |

| SubTotal | 32,220 | 29,357 | 9.8% | 28,204 | 24,788 | 13.8% | $354 | $340 | 4.0% |

Restaurant Performance Index declined in June

by Calculated Risk on 7/29/2016 03:36:00 PM

Here is a minor indicator I follow from the National Restaurant Association: RPI continues to show mixed results

As a result of softer sales and a dampened outlook among operators, the National Restaurant Association’s Restaurant Performance Index (RPI) declined for the second consecutive month. The RPI stood at 100.3 in June, down 0.3 percent.

“The uneven trend that the RPI followed during the first half of 2016 was due in large part to choppy same-store sales and customer traffic results,” said Hudson Riehle, senior vice president of research for the National Restaurant Association.

“This uncertainly likely contributed to the Expectations Index dipping to a six-month low in June. However, it’s hard to draw definitive conclusions in either direction right at this point, because the indicators continue to send mixed signals,” Riehle said.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The index decreased to 100.3 in June, down from 100.6 in May. (above 100 indicates expansion).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month.

Q2 GDP: Investment Slump

by Calculated Risk on 7/29/2016 11:52:00 AM

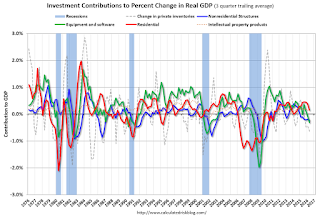

The graph below shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter trailing average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

In the graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

The dashed gray line is the contribution from the change in private inventories.

There was an investment slump in Q2, even though consumer spending was strong (PCE increased at 4.2% annual rate in Q2).

Residential investment (RI) decreased at a 6.1% annual rate in Q2. Equipment investment decreased at a 3.5% annual rate, and investment in non-residential structures decreased at a 7.9% annual rate.

On a 3 quarter trailing average basis, RI (red) is positive, equipment (green) and nonresidential structures (blue) are negative.

Nonresidential investment in structures typically lags the recovery, however investment in energy and power provided a boost early in this recovery - and is now causing a decline. I'll post more on the components of non-residential investment once the supplemental data is released.

I expect investment to pick up going forward (except for maybe energy and power), and for the economy to grow at a steady pace.

The second graph shows residential investment as a percent of GDP.

Residential Investment as a percent of GDP has generally been increasing, but is only just above the bottom of the previous recessions - and I expect RI to continue to increase for the next few years.

I'll break down Residential Investment into components after the GDP details are released.

Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

Although there was an investment slump in Q2 - no worries - residential investment will pickup (still very low), and non-residential (except energy) will also pickup. Investment in inventory has been negative for five consecutive quarters, and that should make a positive contribution soon.

Chicago PMI declines in July, Final July Consumer Sentiment at 90.0

by Calculated Risk on 7/29/2016 10:15:00 AM

Chicago PMI: July Chicago Business Barometer Down 1 Point to 55.8

The MNI Chicago Business Barometer fell 1 point to 55.8 in July from the 1½-year high of 56.8 in June, led by a fall in New Orders. Smaller declines were seen in Production and Order Backlogs, which offset a strong increase in the Employment component.This was above the consensus forecast of 54.0.

The Barometer’s three-month average, though, which provides a better picture of the underlying trend in economic activity, rose to 54.0 from 52.2 in Q2, the highest since February 2015.

...

“Demand and output softened somewhat in July following a solid showing in June but still outperformed the very weak results seen earlier in the year. On the upside, it was the first time since January 2015 that all five Barometer components were above 50. Looking at the three-month average, the Chicago Business Barometer so far suggests economic activity running at a healthier pace in Q3,” said Lorena Castellanos, senior economist at MNI Indicators.

emphasis added

Click on graph for larger image.

The final University of Michigan consumer sentiment index for July was at 90.0, up from the preliminary reading 89.5, and down from 93.5 in June.

"Although confidence strengthened in late July, for the month as a whole the Sentiment Index was still below last month's level mainly due to increased concerns about economic prospects among upper income households. The Brexit vote was spontaneously mentioned by record numbers of households with incomes in the top third (23%), more than twice as frequently as among households with incomes in the bottom two-thirds (11%). Given the prompt rebound in stock prices as well as the tiny direct impact on U.S. trade, it is surprising that concerns about Brexit remained nearly as high in late July as immediately following the Brexit vote. While concerns about Brexit are likely to quickly recede, weaker prospects for the economy are likely to remain. Uncertainties surrounding global economic prospects and the presidential election will keep consumers more cautious in their expectations for future economic growth. "

emphasis added

BEA: Real GDP increased at 1.2% Annualized Rate in Q2

by Calculated Risk on 7/29/2016 08:37:00 AM

From the BEA: Gross Domestic Product: Second Quarter 2016 (Advance Estimate)

Real gross domestic product increased at an annual rate of 1.2 percent in the second quarter of 2016, according to the "advance" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP increased 0.8 percent (revised).The advance Q1 GDP report, with 1.2% annualized growth, was below expectations of a 2.6% increase.

...

The increase in real GDP in the second quarter reflected positive contributions from personal consumption expenditures (PCE) and exports that were partly offset by negative contributions from private inventory investment, nonresidential fixed investment, residential fixed investment, and state and local government spending. Imports, which are a subtraction in the calculation of GDP, decreased.

The acceleration in real GDP growth in the second quarter reflected an acceleration in PCE, an upturn in exports, and smaller decreases in nonresidential fixed investment and in federal government spending. These were partly offset by a larger decrease in private inventory investment, and downturns in residential fixed investment and in state and local government spending.

emphasis added

Personal consumption expenditures (PCE) increased at a 4.2% annualized rate in Q2, up from 1.6% in Q1. Residential investment (RI) decreased at a 6.1% pace. Equipment investment decreased at a 3.5% annualized rate, and investment in non-residential structures decreased at a 7.9% pace (due to the recent decline in oil prices).

The key negatives were investment in inventories (subtracted 1.16 percentage points), fixed investment (subtracted 0.52 percentage point), and government spending (subtracted 0.16 percentage points).

I'll have more later ...

Thursday, July 28, 2016

Friday: Q2 GDP, Chicago PMI, Consumer Sentiment

by Calculated Risk on 7/28/2016 08:14:00 PM

Note: As part of the GDP release tomorrow, the BEA will also release the annual revision. From the BEA:

The annual revision of the national income and product accounts, covering the first quarter of 2013 through the first quarter of 2016, will be released along with the "advance" estimate of GDP for the second quarter of 2016 on July 29. For more information, see “Preview of the Upcoming Annual NIPA Revision” included in the May Survey of Current Business article on “GDP and the Economy”.Friday:

• At 8:30 AM ET, Gross Domestic Product, 2nd quarter 2016 (Advance estimate). The consensus is that real GDP increased 2.6% annualized in Q2. The annual revision will also be released.

• At 9:45 AM, Chicago Purchasing Managers Index for July. The consensus is for a reading of 54.0, down from 56.8 in June.

• At 10:00 AM, University of Michigan's Consumer sentiment index (final for July). The consensus is for a reading of 90.6, up from the preliminary reading 89.5, and down from 93.5 in June.

Fannie Mae: Mortgage Serious Delinquency rate declined in June, Lowest since May 2008

by Calculated Risk on 7/28/2016 05:04:00 PM

Fannie Mae reported today that the Single-Family Serious Delinquency rate declined in June to 1.32%, down from 1.38% in May. The serious delinquency rate is down from 1.66% in June 2015.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

This is the lowest rate since May 2008.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Although the rate is generally declining, the "normal" serious delinquency rate is under 1%.

The Fannie Mae serious delinquency rate has fallen 0.34 percentage points over the last year, and at that rate of improvement, the serious delinquency rate will not be below 1% until the second half of 2017.

Note: Freddie Mac reported yesterday.