by Calculated Risk on 8/02/2016 04:11:00 PM

Tuesday, August 02, 2016

U.S. Light Vehicle Sales increase to 17.8 million annual rate in July

Based on a preliminary estimate from WardsAuto (ex-Jaguar and Porsche), light vehicle sales were at a 17.78 million SAAR in July.

That is up about 2% from July 2015, and up 6.5% from the 16.69 million annual sales rate last month.

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for July (red, light vehicle sales of 17.78 million SAAR from WardsAuto).

This was above the consensus forecast of 17.3 million SAAR (seasonally adjusted annual rate).

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Sales for 2016 - through the first seven months - are up almost 2% from the comparable period last year.

A solid month for auto sales.

A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 8/02/2016 01:00:00 PM

CR Note: This is a repeat of a previous post with updated graphs.

A few key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

This graph shows the month-to-month change in the CoreLogic (through June 2016) and NSA Case-Shiller National index since 1987 (through May 2016). The seasonal pattern was smaller back in the '90s and early '00s, and once the bubble burst.

The seasonal swings are now declining.

The seasonal factor has started to decrease, and I expect that over the next several years - as the percent of distressed sales declines further and recent history is included in the factors - the seasonal factors will move back towards more normal levels. However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.

CoreLogic: House Prices up 5.7% Year-over-year in June

by Calculated Risk on 8/02/2016 09:04:00 AM

Notes: This CoreLogic House Price Index report is for June. The recent Case-Shiller index release was for May. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic US Home Price Report Shows Prices Up 5.7 Percent Year Over Year in June 2016

Home prices nationwide, including distressed sales, increased year over year by 5.7 percent in June 2016 compared with June 2015 and increased month over month by 1.1 percent in June 2016 compared with May 2016, according to the CoreLogic HPI.

...

"Home prices continue to increase across the country, especially in the lower price ranges and in a number of metro areas," said Anand Nallathambi, President and CEO of CoreLogic. "We see prices continuing to increase at a healthy rate over the next year by as much as 5 percent.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 1.1% in June (NSA), and is up 5.7% over the last year.

This index is not seasonally adjusted, and this was a solid month-to-month increase.

The index is still 6.7% below the bubble peak in nominal terms (not inflation adjusted).

The second graph shows the YoY change in nominal terms (not adjusted for inflation).

The second graph shows the YoY change in nominal terms (not adjusted for inflation).The YoY increase had been moving sideways over the last two years.

The year-over-year comparison has been positive for fifty three consecutive months.

Personal Income increased 0.2% in June, Spending increased 0.4%

by Calculated Risk on 8/02/2016 08:34:00 AM

The BEA released the Personal Income and Outlays report for June:

Personal income increased $29.3 billion (0.2 percent) in June according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $24.6 billion (0.2 percent) and personal consumption expenditures (PCE) increased $53.0 billion (0.4 percent).On inflation: The PCE price index increased 0.9 percent year-over-year partially due to the sharp decline in oil prices. The core PCE price index (excluding food and energy) increased 1.6 percent year-over-year in June (same as in May).

...

Real PCE increased 0.3 percent. ... The PCE price index increased 0.1 percent. Excluding food and energy, the PCE price index increased 0.1 percent.

Monday, August 01, 2016

Tuesday: Personal Income & Outlays, July Auto Sales

by Calculated Risk on 8/01/2016 06:37:00 PM

Tuesday:

• At 8:30 AM ET: Personal Income and Outlays for June. The consensus is for a 0.3% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• All day: Light vehicle sales for July. The consensus is for light vehicle sales to increase to 17.3 million SAAR in July, from 16.6 million in June (Seasonally Adjusted Annual Rate).

From Jack Corgel at HotelNewsNow.com: Why oversupply won’t end the current cycle

A common question we hear at CBRE Hotels’ Americas Research is “When will the current up cycle end?” Some inquisitive types go so far as to ask, “How will it end?”Corgel argues there isn't overbuilding this time for several reasons (slow start to adding capacity, tighter lending standards, high construction costs, etc). I haven't thought about how this cycle will end (Hopefully not a major shock).

At the “end” of the past two up cycle phases, the peak rapidly dropped into a deep trough precipitated by tragic and disruptive shocks (i.e., 9/11, financial crisis) that made people hesitant to travel. In the absence of catastrophic events, hotel demand usually falls victim to the natural death of the up cycle. After all, as I have heard some exclaim, this current expansion phase has lasted more than 27 quarters—from Q3 2009 to Q2 2016—so it is likely that a recession is near given that certain past up cycles were either shorter—such as Q1 1975 to Q1 1980—or slightly longer than this recovery, like Q4 1982 to Q3 1990.

Another down cycle might occur as the result of overbuilding, spreading hotel demand thinly enough to cause financial distress and all the unpleasantness that goes along with it. But in this article, I provide three reasons why excessive supply growth is unlikely to produce financial distress in most hotel markets across the U.S. From my current vantage point, a Goldilocks supply scenario is likely to occur over the next few years in most cities: not too many and not too few hotel rooms will come on board.

Fed Survey: Banks tightened Standards on Commercial Real Estate, Residential Real Estate demand strengthened

by Calculated Risk on 8/01/2016 02:22:00 PM

From the Federal Reserve: The July 2016 Senior Loan Officer Opinion Survey on Bank Lending Practices

Regarding loans to businesses, the July survey results indicated that, on balance, banks tightened their standards on commercial and industrial (C&I) and commercial real estate (CRE) loans over the second quarter of 2016. The survey results indicated that demand for C&I loans was little changed, while demand for CRE loans had strengthened during the second quarter on net.

Regarding loans to households, banks reported that standards on all categories of residential real estate (RRE) mortgage loans were little changed, on balance, except for those eligible for purchase by government-sponsored enterprises (known as GSE-eligible mortgage loans), for which a moderate net fraction of banks reported having eased standards, and for subprime residential mortgages, for which a moderate net fraction of banks reported having tightened standards. Banks also reported, on net, that demand for most types of RRE loans strengthened over the second quarter. In addition, banks indicated that changes in standards on consumer loans were mixed, while demand strengthened across all consumer loan types.

...

In addition, banks continued to report in the July 2016 SLOOS that the levels of standards for all types of RRE loans are currently tighter than the midpoints of the ranges observed since 2005. Moreover, banks indicated that consumer loans to subprime borrowers are currently still tighter than their midpoints, while consumer loans to prime borrowers are currently easier than those reference points.

emphasis added

Construction Spending decreased 0.6% in June

by Calculated Risk on 8/01/2016 11:59:00 AM

Earlier today, the Census Bureau reported that overall construction spending decreased 0.6% in June compared to May:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during June 2016 was estimated at a seasonally adjusted annual rate of $1,133.5 billion, 0.6 percent below the revised May estimate of $1,140.9 billion. The June figure is 0.3 percent above the June 2015 estimate of $1,130.5 billion.Private and public spending decreased in June:

Spending on private construction was at a seasonally adjusted annual rate of $851.0 billion, 0.6 percent below the revised May estimate of $856.6 billion. ...

In June, the estimated seasonally adjusted annual rate of public construction spending was $282.5 billion, 0.6 percent below the revised May estimate of $284.3 billion

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

All three categories have slumped recently.

Private residential spending has been generally increasing, but is 34% below the bubble peak.

Non-residential spending is only 2% below the peak in January 2008 (nominal dollars).

Public construction spending is now 13% below the peak in March 2009.

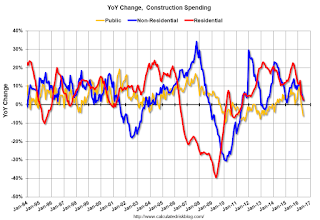

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 3%. Non-residential spending is up 2% year-over-year. Public spending is down 6% year-over-year.

Looking forward, all categories of construction spending should increase in 2016. Residential spending is still fairly low, non-residential is increasing (except oil and gas), and public spending is also generally increasing after several years of austerity.

This was well below the consensus forecast of a 0.6% increase for June, and construction spending for the previous two months were revised down.

ISM Manufacturing index decreased to 52.6 in July

by Calculated Risk on 8/01/2016 10:03:00 AM

The ISM manufacturing index indicated expansion for the fifth consecutive month in July. The PMI was at 52.6% in July, down from 53.2% in June. The employment index was at 49.4%, down from 50.4% in June, and the new orders index was at 56.9%, down from 57.0% in June.

From the Institute for Supply Management: July 2016 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in July for the fifth consecutive month, while the overall economy grew for the 86th consecutive month, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee. "The July PMI® registered 52.6 percent, a decrease of 0.6 percentage point from the June reading of 53.2 percent. The New Orders Index registered 56.9 percent, a decrease of 0.1 percentage point from the June reading of 57 percent. The Production Index registered 55.4 percent, 0.7 percentage point higher than the June reading of 54.7 percent. The Employment Index registered 49.4 percent, a decrease of 1 percentage point from the June reading of 50.4 percent. Inventories of raw materials registered 49.5 percent, an increase of 1 percentage point from the June reading of 48.5 percent. The Prices Index registered 55 percent, a decrease of 5.5 percentage points from the June reading of 60.5 percent, indicating higher raw materials prices for the fifth consecutive month. Manufacturing registered growth in July for the fifth consecutive month, as 12 of our 18 industries reported an increase in new orders in July (same as in June), and nine of our 18 industries reported an increase in production in July (down from 12 in June)."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was below expectations of 53.2%, and suggests manufacturing expanded at a slower pace in July than in June.

Black Knight June Mortgage Monitor: "Brexit’ Effect Increases Refinanceable Population to 8.7 Million"

by Calculated Risk on 8/01/2016 07:01:00 AM

Black Knight Financial Services (BKFS) released their Mortgage Monitor report for June today. According to BKFS, 4.31% of mortgages were delinquent in June, down from 4.79% in June 2015. BKFS also reported that 1.10% of mortgages were in the foreclosure process, down from 1.56% a year ago.

This gives a total of 5.41% delinquent or in foreclosure.

Press Release: Black Knight’s Mortgage Monitor: ‘Brexit’ Effect Increases Refinanceable Population to 8.7 Million; Auto Debt Among Mortgage Holders at Highest Level in at Least 10 Years

Today, the Data & Analytics division of Black Knight Financial Services, Inc. released its latest Mortgage Monitor Report, based on data as of the end of June 2016. After the United Kingdom voted to leave the European Union on June 23, 2016, increased investor interest in U.S. Treasury Bonds again drove down mortgage interest rates. In light of this development, Black Knight analyzed the effect that new multi-year lows in rates are having on the population of 30-year mortgage holders who could both likely qualify for and benefit from refinancing. As Black Knight Data & Analytics Executive Vice President Ben Graboske explained, in the current rate environment, the effect of even slight declines in mortgage interest rates have proven to have far-reaching impact on the refinanceable population, though much less than one might think on home affordability.

“The reality is that, post-‘Brexit,’ mortgage interest rates declined by about 15 basis points – not significant in the grand scheme of things,” said Graboske. “But for 2.8 million borrowers with current rates right at 4.25 percent, this modest decline was enough to put them 75 basis points above today’s prevailing rate, the point at which we consider a borrower to have incentive to refinance. Of these, 1.2 million also meet broad-based eligibility criteria -- loan-to-value ratios of 80 percent or less, credit scores of 720 or higher and are current on their mortgage payments -- bringing the total refinanceable population to 8.7 million, the highest level we’ve seen since late 2012. However, unlike the 66 percent of borrowers Black Knight identified a few months ago, who could have both likely qualified for and had incentive to refinance in the spring of 2015 but for whatever reason didn’t do so, the vast majority of these new candidates did not have such incentive last year. This has produced a nearly 50 percent increase in the number of borrowers with newfound incentive to refinance, which may well be creating a more pronounced impact on refinance applications and originations as these borrowers rush to take advantage.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from Black Knight shows new seriously delinquent loans by vintage. New delinquencies are still coming mostly from bubble-era legacy loans.

From Black Knight:

• Just over 210,000 borrowers that entered 2016 current on their mortgage payments are now 60 or more days delinquent; this is 17,000 below last year, but still about 10 percent above historical standards

• Nearly 60 percent of new seriously delinquent loans are coming from pre-crisis vintages (2007 and earlier), despite those vintages making up just 26 percent of active mortgages

• Over the first half of 2016, one of every 100 borrowers in a pre-2008 vintage mortgage that was current at the beginning of the year is now 60 or more days past due, as compared to just three out of every 1,000 borrowers in a 2008 or later vintage

The second graph shows foreclosure starts. From Black Knight:

The second graph shows foreclosure starts. From Black Knight:

• Total foreclosure starts have now reached historic norms, with Q2 2016 starts volume hitting an 11-year lowStill working through the backlog, but almost back to normal. There is much more in the mortgage monitor.

• Over 55 percent of foreclosure starts continue to be repeats as the industry continues to work through lingering inventory from the crisis

• Looking specifically at first time foreclosure starts, Q2 2016’s 84,300 first time foreclosure starts represent a 20 percent decline from Q2 2015 and the lowest volume seen on record since at least 2000

• The second lowest quarter on record for first time foreclosure starts was Q1 2016, and Q2 represented a 16 percent decrease from that point

• April 2016 saw the lowest total foreclosure starts in 11 years and the lowest one-month volume of first time starts on record

Sunday, July 31, 2016

Monday: ISM Mfg, Construction Spending

by Calculated Risk on 7/31/2016 07:45:00 PM

Weekend:

• Schedule for Week of July 31, 2016

Monday:

• At 10:00 AM ET: ISM Manufacturing Index for July. The consensus is for the ISM to be at 53.2, unchanged from June. The ISM manufacturing index indicated expansion at 53.2% in June. The employment index was at 50.4%, and the new orders index was at 57.0%.

• Also at 10:00 AM: Construction Spending for June. The consensus is for a 0.6% increase in construction spending.

• At 2:00 PM, the July 2016 Senior Loan Officer Opinion Survey on Bank Lending Practices from the Federal Reserve.

From CNBC: Pre-Market Data and Bloomberg futures: S&P are up 3 and DOW futures are up 38 (fair value).

Oil prices were down over the last week with WTI futures at $41.34 per barrel and Brent at $43.25 per barrel. A year ago, WTI was at $47, and Brent was at $53 - so prices are down 15% to 20% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.13 per gallon (down over $0.55 per gallon from a year ago).