by Calculated Risk on 8/10/2016 10:11:00 AM

Wednesday, August 10, 2016

BLS: Job Openings "little changed" in June

From the BLS: Job Openings and Labor Turnover Summary

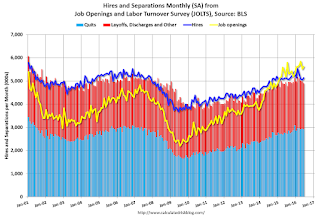

The number of job openings was little changed at 5.6 million on the last business day of June, the U.S. Bureau of Labor Statistics reported today.> ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

The number of quits held steady in June at 2.9 million. The quits rate was 2.0 percent. Over the month, the number of quits was little changed for total private and increased for government (+18,000). The number of quits increased in state and local government education (+20,000) and was little changed in all other industries.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for June, the most recent employment report was for July.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in June to 5.624 million from 5.514 million in May.

The number of job openings (yellow) are up 9% year-over-year.

Quits are up 6% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

This is solid report with job openings just a little below the record high set in April 2016.

MBA: "Mortgage Applications Increase in Latest Weekly Survey"

by Calculated Risk on 8/10/2016 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 7.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 5, 2016.

... The Refinance Index increased 10 percent from the previous week. ... The seasonally adjusted Purchase Index increased 3 percent from one week earlier. The unadjusted Purchase Index increased 2 percent compared with the previous week and was 13 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 3.65 percent from 3.67 percent, with points increasing to 0.34 from 0.30 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity has increased this year since rates have declined.

However it would take another significant move down in mortgage rates to see a large increase in refinance activity.

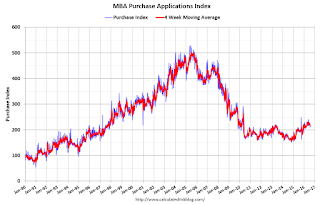

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The purchase index is "13 percent higher than the same week one year ago".

Tuesday, August 09, 2016

Update: "Scariest jobs chart ever"

by Calculated Risk on 8/09/2016 08:01:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, Job Openings and Labor Turnover Survey for June from the BLS. Jobs openings decreased in May to 5.500 million from 5.845 million in April. The number of job openings were up 2% year-over-year, and Quits were up 5% year-over-year.

During and following the 2007 recession, every month I posted a graph showing the percent jobs lost during the recession compared to previous post-WWII recessions.

Some people started calling this the "scariest jobs chart ever". In 2009 it was pretty scary!

I retired the graph in May 2014 when employment finally exceeded the pre-recession peak.

I keep getting asked if I could post an update to the graph, and here it is through the July 2016 report.

This graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. Since exceeding the pre-recession peak in May 2014, employment is now 4.3% above the previous peak.

Note: I ended the lines for most previous recessions when employment reached a new peak, although I continued the 2001 recession too on this graph. The downturn at the end of the 2001 recession is the beginning of the 2007 recession. I don't expect a downturn for employment any time soon (unlike in 2007 when I was forecasting a recession).

EIA: "Gasoline prices at 16-week low, expected to average less than $2 a gallon by December"

by Calculated Risk on 8/09/2016 05:13:00 PM

The EIA released the Short-Term Energy Outlook today. From the STEO:

• EIA expects the retail price of regular gasoline to average $2.19/gal during the 2016 summer driving season (April through September), 6 cents/gal lower than projected in last month's STEO and 44 cents/gal lower than the price in summer 2015. EIA expects that the U.S. average retail price of regular gasoline reached a peak of $2.37/gal in June and will fall to an average of $2.05/gal in September and to an average of $1.92/gal in December.

• The monthly average spot price of Brent crude oil decreased by $3/b in July to $45/b, which was the first monthly decrease since January 2016. Significant outages of global oil supply contributed to rising oil prices during the second quarter of 2016. However, concerns about future economic growth related to the United Kingdom's June 23 vote to exit the European Union and the easing of supply disruptions in Canada contributed to falling oil prices in late June. Prices continued to fall in July because of concerns about high levels of U.S. and global petroleum product inventories, despite relatively strong demand, and because of growing U.S. oil rig counts. The Baker Hughes U.S. active oil rig count increased for six consecutive weeks in July and early August, the longest stretch of weekly increases in almost a year.

• EIA expects consistent global oil inventory draws to begin in mid-2017. The expectation of inventory draws contributes to accelerating price increases in the second quarter of 2017, with price increases continuing later in 2017. Brent prices are forecast to average $52/b in 2017, unchanged from last month's STEO. Forecast Brent prices average $58/b in the fourth quarter of 2017, reflecting the potential for more significant inventory draws beyond the forecast period.

Las Vegas Real Estate in July: Sales down 10% YoY, Inventory down 1%

by Calculated Risk on 8/09/2016 01:41:00 PM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported Southern Nevada Home Prices Keep Climbing Amid Tight Supply, GLVAR Housing Statistics for July 2016

“The local housing market is having a pretty solid summer so far,” said 2016 GLVAR President Scott Beaudry, a longtime local REALTOR®. “Home prices have been going up gradually. And although we sold fewer homes and condos in July than we did during the previous month and year, sales have been running ahead of last year’s pace. Our tight inventory might finally be slowing down our sales pace. Sales slipped the most during July for lower-priced homes. This suggests it’s getting harder for entry-level buyers to find the homes they want.”1) Overall sales were down 9.6% year-over-year.

According to GLVAR, the total number of existing local homes, condominiums and townhomes sold in July was 3,447, down from 3,815 total sales in July of 2015. Compared to the same month one year ago, 7.2 percent fewer homes, and 4.2 percent fewer condos and townhomes sold in July.

...

By the end of July, GLVAR reported 7,338 single-family homes listed without any sort of offer. That’s down 1.3 percent from one year ago. For condos and townhomes, the 1,212 properties listed without offers in July represented a 48.0 percent decrease from one year ago.

...

As in past months, GLVAR continued to track declines in distressed sales and a corresponding increase in traditional home sales, where lenders are not controlling the transaction. In July, 5.7 percent of all local sales were short sales – when lenders allow borrowers to sell a home for less than what they owe on the mortgage. That’s down from 7.1 percent of all sales one year ago. Another 5.9 percent of all July sales were bank-owned, down from 7.7 percent one year ago.

emphasis added

2) Active inventory is down 1.3% from a year ago.

NY Fed: Household Debt Increased Slightly in Q2 2016, Delinquency Rates Declined

by Calculated Risk on 8/09/2016 11:00:00 AM

The Q2 report was released today: Household Debt and Credit Report.

From the NY Fed: Household Debt Balances Increase Slightly, Boosted By Growth In Auto Loan And Credit Card Balances

The Federal Reserve Bank of New York’s Center for Microeconomic Data today issued its Quarterly Report on Household Debt and Credit, which reported that household debt increased by $35 billion (a 0.3 percent increase) to $12.29 trillion during the second quarter of 2016. This moderate growth was driven by increases in auto loan and credit card debt, which increased by $32 billion and $17 billion respectively. Mortgage debt declined by $7 billion in the second quarter, after a $120 billion increase in the first quarter, and student loan balances were roughly flat. Meanwhile, this quarter saw improvements in overall delinquency rates and another historical low (over the 18 years of the data sample) in new foreclosures. ...

Overall delinquency rates improved, continuing the trend in place since 2010. In the second quarter, 4.8 percent of outstanding debt was in some stage of delinquency down from 5 percent previous quarter, and 5.6 percent in the second quarter of 2015. There were 82,000 consumers with new foreclosure notations on their credit reports – another low in the 18-year history of this data set.

...

"Today's report highlights a positive ongoing trend in household debt," said Donghoon Lee, Research Officer at the New York Fed. "Delinquency rates continue to improve, even as credit has become more widely available."

emphasis added

Click on graph for larger image.

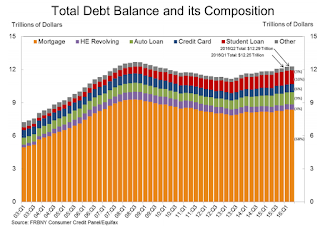

Click on graph for larger image.Here are two graphs from the report:

The first graph shows aggregate consumer debt increased in Q2. Household debt peaked in 2008, and bottomed in Q2 2013.

Mortgage debt decreased in Q2, from the NY Fed:

Mortgage balances, the largest component of household debt, were essentially flat in the second quarter of 2016. Mortgage balances shown on consumer credit reports on June 30 stood at $8.36 trillion, a $7 billion drop from the first quarter of 2016. Balances on home equity lines of credit (HELOC) also dropped by $7 billion, to $478 billion. Non-housing debt balances rose in the second quarter; with increases of $32 billion and $17 billion in auto loans and credit cards, respectively, and a slight decline in student loan balances (-$2 billion).

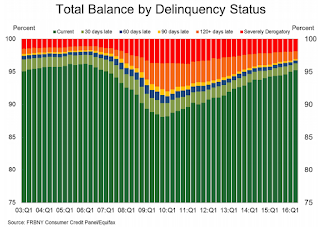

The second graph shows the percent of debt in delinquency. The percent of delinquent debt is declining, although there is still a larger than normal percent of debt 90+ days delinquent (Yellow, orange and red).

The second graph shows the percent of debt in delinquency. The percent of delinquent debt is declining, although there is still a larger than normal percent of debt 90+ days delinquent (Yellow, orange and red). The overall delinquency rate decreased in Q2 to 4.8%. From the NY Fed:

Overall delinquency rates improved again in 2016Q2. As of June 30, 4.8% of outstanding debt was in some stage of delinquency. Of the $589 billion of debt that is delinquent, $407 billion is seriously delinquent (at least 90 days late or “severely derogatory”).There are a number of credit graphs at the NY Fed site.

NFIB: Small Business Optimism Index increased Slightly in July

by Calculated Risk on 8/09/2016 08:37:00 AM

From the National Federation of Independent Business (NFIB): Small Business Optimism Plateaus

The Index of Small Business Optimism rose one-tenth of a point in July to 94.6 ... according to the National Federation of Independent Business (NFIB).

Reported job creation remained weak in July, with the seasonally adjusted average employment change per firm posting a decline of -0.03 workers per firm, although better than June’s -0.17 reading. Fifty-three percent reported hiring or trying to hire (down 3 points), but 46 percent reported few or no qualified applicants for the positions they were trying to fill. Fourteen percent of owners cited the difficulty of finding qualified workers as their Single Most Important Business Problem. ... Twenty-six percent of all owners reported job openings they could not fill in the current period, down 3 points from, the highest reading in this recovery.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 94.6 in July.

Monday, August 08, 2016

Tuesday: Small Business Index, Q2 2016 Household Debt and Credit Report

by Calculated Risk on 8/08/2016 09:02:00 PM

Tuesday:

• At 9:00 AM ET: NFIB Small Business Optimism Index for July.

• 10:00 AM: Monthly Wholesale Trade: Sales and Inventories for June. The consensus is for no change in inventories.

• 11:00 AM: The New York Fed will release their Q2 2016 Household Debt and Credit Report

From Matthew Graham at Mortgage News Daily: Mortgage Rates Threatening to Break Post-Brexit Range

Mortgage rates continued higher today, extending a sharp move that began on Friday following stronger-than-expected employment data. There are two distinctly different ways to look at the current rate environment. On the one hand, the average conventional 30yr fixed rate continues hovering in the mid 3's on top tier scenarios. While that's not quite as low as it was in early July, or on some occasions in 2012-2013, it's still in the territory of "all-time lows" in the big picture.Here is a table from Mortgage News Daily:

On the other hand, current rates are near the highest levels in just over a month. This means they're 'threatening'--for lack of a better term--to break out of the low range that followed The UK's vote to leave the EU (Brexit).

emphasis added

Update: U.S. Heavy Truck Sales

by Calculated Risk on 8/08/2016 02:27:00 PM

The following graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the July 2016 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the recession, falling to a low of 181 thousand in April 2009, on a seasonally adjusted annual rate basis (SAAR). Since then sales increased more than 2 1/2 times, and hit 486 thousand SAAR in November 2015.

Heavy truck sales have since declined - due to the weakness in the oil sector - and were at 399 thousand SAAR in July.

Even with the recent oil related decline, heavy truck sales are still above the average (and median) of the last 20 years.

Click on graph for larger image.

Phoenix Real Estate in July: Sales down 2%, Inventory up 3% YoY

by Calculated Risk on 8/08/2016 11:15:00 AM

This is a key housing market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

Inventory was up 3.3% year-over-year in July. This is the fifth consecutive months with a YoY increase in inventory, following fifteen consecutive months of YoY declines in Phoenix. This could be a significant change.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in June were down 1.8% year-over-year.

2) Cash Sales (frequently investors) were down to 19.7% of total sales.

3) Active inventory is now up 3.3% year-over-year.

More inventory (a theme in 2014) - and less investor buying - suggested price increases would slow sharply in 2014. And prices increases did slow in 2014, only increasing 2.4% according to Case-Shiller.

In 2015, with falling inventory, prices increased a little faster - Prices were up 6.3% in 2015 according to Case-Shiller.

Now inventory is increasing a little again, and - if this trend continues in Phoenix - price increases will probably slow in Phoenix. Prices in Phoenix are up 1.5% through May (about a 3.6% annual rate) - slower than in 2015.

| July Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash Sales | Percent Cash | Active Inventory | YoY Change Inventory | |

| Jul-08 | 5,9741 | --- | --- | --- | 54,5272 | --- |

| Jul-09 | 9,095 | 52.2% | 3,269 | 35.9% | 38,024 | ---2 |

| Jul-10 | 7,101 | -21.9% | 2,901 | 40.9% | 42,887 | 12.8% |

| Jul-11 | 8,397 | 18.3% | 3,779 | 45.0% | 27,663 | -35.5% |

| Jul-12 | 7,152 | -14.8% | 3,214 | 44.9% | 20,384 | -26.3% |

| Jul-13 | 8,214 | 14.8% | 2,944 | 35.8% | 20,049 | -1.6% |

| Jul-14 | 6,790 | -17.3% | 1,681 | 24.8% | 27,081 | 35.1% |

| Jul-15 | 7,915 | 16.6% | 1,731 | 21.9% | 22,940 | -15.3% |

| Jul-16 | 7,775 | -1.8% | 1,534 | 19.7% | 23,695 | 3.3% |

| 1 July 2008 does not include manufactured homes, ~100 more 2 July 2008 Inventory includes pending | ||||||