by Calculated Risk on 9/02/2016 08:30:00 AM

Friday, September 02, 2016

August Employment Report: 151,000 Jobs, 4.9% Unemployment Rate

From the BLS:

Total nonfarm payroll employment increased by 151,000 in August, and the unemployment rate remained at 4.9 percent, the U.S. Bureau of Labor Statistics reported today. Employment continued to trend up in several service-providing industries.

...

The change in total nonfarm payroll employment for June was revised down from +292,000 to +271,000, and the change for July was revised up from +255,000 to +275,000. With these revisions, employment gains in June and July combined were 1,000 less than previously reported.

...

In August, average hourly earnings for all employees on private nonfarm payrolls rose by 3 cents to $25.73. Over the year, average hourly earnings have risen by 2.4 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Total payrolls increased by 151 thousand in August (private payrolls increased 126 thousand).

Payrolls for June and July were revised down by a combined 1 thousand.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In August, the year-over-year change was 2.45 million jobs. A solid gain.

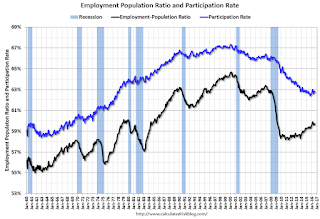

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate was unchanged in August at 62.8%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics.

The Labor Force Participation Rate was unchanged in August at 62.8%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics. The Employment-Population ratio was unchanged at 59.7% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate was unchanged in August at 4.9%.

This was below expectations of 175,000 jobs. Still a decent report.

I'll have much more later ...

Thursday, September 01, 2016

Friday: Jobs, Trade Deficit

by Calculated Risk on 9/01/2016 07:01:00 PM

Friday:

• At 8:30 AM ET, Employment Report for August. The consensus is for an increase of 175,000 non-farm payroll jobs added in August, down from the 255,000 non-farm payroll jobs added in July. The consensus is for the unemployment rate to decrease to 4.8%.

• Also at 8:30 AM, Trade Balance report for July from the Census Bureau. The consensus is for the U.S. trade deficit to be at $41.3 billion in July from $44.5 billion in June.

• At 10:00 AM, Manufacturers' Shipments, Inventories and Orders (Factory Orders) for July. The consensus is a 2.0% increase in orders.

From Tim Duy at Fed Watch: Thoughts Ahead Of The Employment Report

The August employment report has come to be seen as the deciding factor in the Fed's upcoming decision on rates. See Sam Fleming at the Financial Times here. Maybe this is the case, maybe not. I hope not. Hinging policy on the first print of nonfarm payrolls - a volatile, heavily revised number - would be pretty low quality policy making.

...

Bottom Line: Regardless of the outcome of the employment report, good or bad, I don't see good case for moving this month. Too many questions about the forecast, and they still face persistently low inflation and asymmetric policy risks. But all that said, there seems to be a large swath of voting members ready to get behind a rate hike. I think the low odds on a rate hike in September is the market's way of telling the Fed that if they do hike, it would be a mistake.

Goldman's August NFP Preview

by Calculated Risk on 9/01/2016 05:37:00 PM

A few excerpts from Goldman Sachs' August Payroll Preview by economist Elad Pashtan:

We expect a 165k increase in nonfarm payroll employment in August, below consensus expectations for a 180k gain. ...

The unemployment rate is likely to decline to 4.8%, while average hourly earnings were likely flat in August and up 2.3% over the past year.

...

Our below-consensus forecast primarily reflects seasonal quirks specific to the August payroll period. Since 2011, August payroll growth has fallen short of Bloomberg consensus expectations by an average of 49k, only to be revised up by an average of 71k in subsequent releases. Industry-level payroll data indicate that the education sector (specifically, education services and state & local government employment, the latter largely reflecting public schools) accounts for much of the upward revision, which mostly occurs from the first to the second estimate of payroll growth. In our view, the initial August weakness and subsequent revisions reflects seasonal adjustment challenges related to shifts in the timing of school calendars. Since this pattern failed to hold last year, we are estimating a more conservative 20k impact this year.

emphasis added

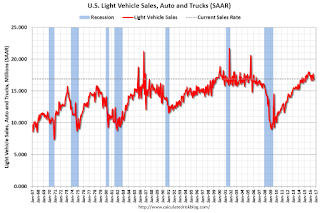

U.S. Light Vehicle Sales decrease to 16.9 million annual rate in August

by Calculated Risk on 9/01/2016 03:09:00 PM

Based on a preliminary estimate from WardsAuto (ex-Porsche), light vehicle sales were at a 16.89 million SAAR in August.

That is down about 5% from August 2015, and down 5.0% from the 17.77 million annual sales rate last month.

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for August (red, light vehicle sales of 16.89 million SAAR from WardsAuto).

This was below the consensus forecast of 17.1 million SAAR (seasonally adjusted annual rate).

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Sales for 2016 - through the first eight months - are up slightly from the comparable period last year.

After increasing significantly for several years following the financial crisis, auto sales are now moving mostly sideways ...

Construction Spending unchanged in July

by Calculated Risk on 9/01/2016 11:59:00 AM

Earlier today, the Census Bureau reported that overall construction spending was "nearly the same" as in June:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during July 2016 was estimated at a seasonally adjusted annual rate of $1,153.2 billion, nearly the same as the revised June estimate of $1,153.5 billion. The July figure is 1.5 percent above the July 2015 estimate of $1,135.9 billion.Private spending increased and public spending decreased in July:

Spending on private construction was at a seasonally adjusted annual rate of $875.0 billion, 1.0 percent above the revised June estimate of $866.5 billion. ...

In July, the estimated seasonally adjusted annual rate of public construction spending was $278.2 billion, 3.1 percent below the revised June estimate of $287.0 billion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Residential and public spending have slumped a little recently.

Private residential spending has been generally increasing, but is 34% below the bubble peak.

Non-residential spending is now 3.6% the peak in January 2008 (nominal dollars).

Public construction spending is now 15% below the peak in March 2009.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 2%. Non-residential spending is up 7% year-over-year. Public spending is down 7% year-over-year.

Looking forward, all categories of construction spending should increase in 2016. Residential spending is still fairly low, non-residential is increasing, and public spending is also generally increasing after several years of austerity.

This was well below the consensus forecast of a 0.6% increase for July, however construction spending for the previous two months were revised up.

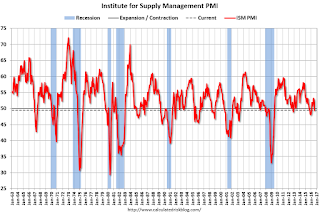

ISM Manufacturing index decreased to 49.4 in August

by Calculated Risk on 9/01/2016 10:11:00 AM

The ISM manufacturing index indicated contraction in August. The PMI was at 49.4% in August, down from 52.6% in July. The employment index was at 48.3%, down from 49.4% in July, and the new orders index was at 49.1%, down from 56.9% in July.

From the Institute for Supply Management: August 2016 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector contracted in August following five consecutive months of expansion, while the overall economy grew for the 87th consecutive month, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee. "The August PMI® registered 49.4 percent, a decrease of 3.2 percentage points from the July reading of 52.6 percent. The New Orders Index registered 49.1 percent, a decrease of 7.8 percentage points from the July reading of 56.9 percent. The Production Index registered 49.6 percent, 5.8 percentage points lower than the July reading of 55.4 percent. The Employment Index registered 48.3 percent, a decrease of 1.1 percentage points from the July reading of 49.4 percent. Inventories of raw materials registered 49 percent, a decrease of 0.5 percentage point from the July reading of 49.5 percent. The Prices Index registered 53 percent, a decrease of 2 percentage points from the July reading of 55 percent, indicating higher raw materials prices for the sixth consecutive month. Manufacturing contracted in August for the first time since February of this year, as only six of our 18 industries reported an increase in new orders in August (down from 12 in July), and only eight of our 18 industries reported an increase in production in August (down from nine in July)."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was below expectations of 52.2%, and suggests manufacturing contracted in August following five months of expansion.

Weekly Initial Unemployment Claims increased to 263,000

by Calculated Risk on 9/01/2016 08:33:00 AM

The DOL reported:

In the week ending August 27, the advance figure for seasonally adjusted initial claims was 263,000, an increase of 2,000 from the previous week's unrevised level of 261,000. The 4-week moving average was 263,000, a decrease of 1,000 from the previous week's unrevised average of 264,000.The previous week was unrevised.

There were no special factors impacting this week's initial claims. This marks 78 consecutive weeks of initial claims below 300,000, the longest streak since 1970.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 263,000.

This was lower than the consensus forecast of 265,000. The low level of claims suggests relatively few layoffs.

Wednesday, August 31, 2016

Thursday: Unemployment Claims, ISM Mfg Index, Construction Spending, Auto Sales

by Calculated Risk on 8/31/2016 06:19:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 265 thousand initial claims, up from 261 thousand the previous week.

• At 10:00 AM, the ISM Manufacturing Index for August. The consensus is for the ISM to be at 52.2, down from 52.6 in July. The employment index was at 49.4% in July, and the new orders index was at 56.9%.

• Also at 10:00 AM, Construction Spending for July. The consensus is for a 0.6% increase in construction spending.

• All day, Light vehicle sales for August. The consensus is for light vehicle sales to decrease to 17.1 million SAAR in August, from 17.8 million in July (Seasonally Adjusted Annual Rate).

Restaurant Performance Index increased slightly in July

by Calculated Risk on 8/31/2016 01:15:00 PM

Here is a minor indicator I follow from the National Restaurant Association: RPI ticks up slightly

Although same-store sales and customer traffic levels remain somewhat uneven, the National Restaurant Association’s Restaurant Performance Index (RPI) registered a modest increase in July. The RPI stood at 100.6 in July, up 0.3 percent from June.

“The primary driver of the modest RPI gain in July was positive capital expenditure levels,” said Hudson Riehle, senior vice president of research for the National Restaurant Association.

“While there is some volatility among index components, especially when looking at the current situation, operators’ plans for capital expenditures six months out remain solid. This fits in with how operators’ outlook for the future remains overall positive despite general economic choppiness,” Riehle said.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The index increased to 100.6 in July, up from 100.3 in June. (above 100 indicates expansion).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month.

NAR: Pending Home Sales Index increased 1.3% in July, up 1.4% year-over-year

by Calculated Risk on 8/31/2016 10:05:00 AM

From the NAR: Pending Home Sales Tick Up in July

Pending home sales expanded in most of the country in July and reached their second highest reading in over a decade, according to the National Association of Realtors®. Only the Midwest saw a dip in contract activity last month.This was above expectations of a 0.6% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in August and September.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, rose 1.3 percent to 111.3 in July from a downwardly revised 109.9 in June and is now 1.4 percent higher than July 2015 (109.8). The index is now at its second highest reading this year after April (115.0).

...

he PHSI in the Northeast moved up 0.8 percent to 96.8 in July, and is now 1.1 percent above a year ago. In the Midwest the index decreased 2.9 percent to 105.8 in July, and is now 1.1 percent lower than July 2015.

Pending home sales in the South inched higher (0.8 percent) to an index of 123.9 in July and are now 0.4 percent higher than last July. The index in the West surged 7.3 percent in July to 108.7, and is now 6.2 percent above a year ago.

emphasis added