by Calculated Risk on 9/07/2016 08:37:00 PM

Wednesday, September 07, 2016

Thursday: Unemployment Claims

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for 264 thousand initial claims, up from 263 thousand the previous week.

• At 10:00 AM: The Q2 Quarterly Services Report from the Census Bureau.

• At 3:00 PM, Consumer Credit for July from the Federal Reserve. The consensus is for credit to increase $15.6 billion.

From Tim Duy at Fed Watch: Is Pushing Unemployment Lower A Risky Strategy?

The unemployment is closing in on the Fed's estimate of the natural rate of unemployment ... Consequently, Fed hawks are pushing for a rate hike sooner than later in an effort to prevent the economy from "overhearing." This overheating is argued to set the stage for the next recession.

...

Bottom Line: The Fed thinks the costs of undershooting their estimate of the natural rate of unemployment outweigh the benefits. I am skeptical they are doing the calculus right on this one. I would be more convinced they had it right if I sensed that placed greater weight on the possibility that they are too pessimistic about the natural rate. I would be more convinced if they were already at their inflation target. And I would be more convinced if their analysis of why tightening cycles end in recessions was a bit more introspective. Was it destiny or repeated policy error? But none of these things seem to be true.

Phoenix Real Estate in August: Sales up 14%, Inventory up 3% YoY

by Calculated Risk on 9/07/2016 04:33:00 PM

This is a key housing market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

Inventory was up 3.4% year-over-year in August. This is the sixth consecutive month with a YoY increase in inventory, following fifteen consecutive months of YoY declines in Phoenix. This could be a significant change.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in August were up 13.6% year-over-year.

2) Cash Sales (frequently investors) were down to 20.3% of total sales.

3) Active inventory is now up 3.4% year-over-year.

More inventory (a theme in 2014) - and less investor buying - suggested price increases would slow sharply in 2014. And prices increases did slow in 2014, only increasing 2.4% according to Case-Shiller.

In 2015, with falling inventory, prices increased a little faster - Prices were up 6.3% in 2015 according to Case-Shiller.

Now inventory is increasing a little again, and - if this trend continues in Phoenix - price increases will probably slow in Phoenix. Prices in Phoenix are up 1.6% through June (about a 3.2% annual rate) - slower than in 2015.

| August Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash Sales | Percent Cash | Active Inventory | YoY Change Inventory | |

| Aug-08 | 5,660 | --- | 1,004 | 17.7% | 53,5691 | --- |

| Aug-09 | 8,008 | 41.5% | 2,849 | 35.6% | 38,085 | -28.9% |

| Aug-10 | 7,358 | -8.1% | 3,129 | 42.5% | 44,307 | 16.3% |

| Aug-11 | 8,712 | 18.4% | 3,953 | 45.4% | 26,983 | -39.1% |

| Aug-12 | 7,574 | -13.1% | 3,382 | 44.7% | 20,934 | -22.4% |

| Aug-13 | 7,055 | -6.9% | 2,409 | 34.1% | 21,444 | 2.4% |

| Aug-14 | 6,431 | -8.8% | 1,621 | 25.2% | 26,138 | 21.9% |

| Aug-15 | 7,023 | 9.2% | 1,588 | 22.6% | 22,554 | -13.7% |

| Aug-16 | 7,975 | 13.6% | 1,616 | 20.3% | 23,318 | 3.4% |

| 1 August 2008 probably includes pending listings | ||||||

Fed's Beige Book: "Upward wage pressures increased and were moderate on balance"

by Calculated Risk on 9/07/2016 02:18:00 PM

Fed's Beige Book "Prepared at the Federal Reserve Bank of San Francisco and based on information collected on or before August 29, 2016."

Reports from the twelve Federal Reserve Districts suggest that national economic activity continued to expand at a modest pace on balance during the reporting period of July through late August. Most Districts reported a "modest" or "moderate" pace of overall growth. However, Kansas City and New York reported no change in activity, and Philadelphia and Richmond noted that, while still expanding, activity slowed from the previous period. ...And on real estate:

Labor market conditions remained tight in most Districts, with moderate payroll growth noted in general. Upward wage pressures increased further and were moderate on balance, with more rapid gains reported for workers with selected specialized skill sets. Price increases remained slight overall.

emphasis added

Activity in residential real estate markets expanded further in most Districts. Growth in residential construction activity was moderate across many Districts but robust in San Francisco, where contacts reported that contractors are bumping up against capacity constraints for new projects. In Minneapolis, strong growth in the construction of single-family units was offset somewhat by a slowdown in the construction of multifamily units. Contacts in Dallas reported that demand for low- to mid-priced homes remained strong, while demand for higher priced homes softened in Dallas and New York, and was flat in Chicago. By contrast, sales in Cleveland were equally skewed toward the entry-level and high-end segments of the market. Boston, Richmond, Philadelphia, and St. Louis noted that home sales slowed in some areas of their Districts due to shortages of available units. Recent house price appreciation was reported to be modest in general. Contacts in several Districts were optimistic about future growth prospects, except in Kansas City, where respondents expect further declines in sales and inventories in the months ahead.Interesting comment on wage pressures. Real estate is decent.

Commercial real estate activity expanded further in most Districts. Construction and sales rose only slightly in Boston, Kansas City, and St. Louis but grew at a faster clip in Cleveland and Dallas. In the Atlanta District, construction activity expanded moderately, but contractors reported tight supply conditions, with construction backlogs of one to two years. Contacts in Richmond and New York noted strong growth in industrial construction, and vacancy rates for industrial space fell to 10-year lows in the latter District. Commercial leasing activity strengthened in New York, Richmond, and San Francisco, but grew at a softer pace in Philadelphia, where contacts described the market as in a "lull, not a retreat." Vacancy rates on commercial properties increased along with completions in the Kansas City District. Commercial rents edged up in various Districts, including in Dallas and San Francisco. Contacts in several Districts cited only modest expectations for sales and construction activity moving forward, due in part to economic uncertainty surrounding the November elections.

Employment: Preliminary annual benchmark revision shows downward adjustment of 150,000 jobs

by Calculated Risk on 9/07/2016 10:15:00 AM

The BLS released the preliminary annual benchmark revision showing 150,000 fewer payroll jobs as of March 2016. The final revision will be published when the January 2017 employment report is released in February 2017. Usually the preliminary estimate is pretty close to the final benchmark estimate.

The annual revision is benchmarked to state tax records. From the BLS:

In accordance with usual practice, the Bureau of Labor Statistics (BLS) is announcing the preliminary estimate of the upcoming annual benchmark revision to the establishment survey employment series. The final benchmark revision will be issued on February 3, 2017, with the publication of the January 2017 Employment Situation news release.Using the preliminary benchmark estimate, this means that payroll employment in March 2016 was 150,000 lower than originally estimated. In February 2017, the payroll numbers will be revised down to reflect the final estimate. The number is then "wedged back" to the previous revision (March 2015).

Each year, the Current Employment Statistics (CES) survey employment estimates are benchmarked to comprehensive counts of employment for the month of March. These counts are derived from state unemployment insurance (UI) tax records that nearly all employers are required to file. For national CES employment series, the annual benchmark revisions over the last 10 years have averaged plus or minus three-tenths of one percent of total nonfarm employment. The preliminary estimate of the benchmark revision indicates a downward adjustment to March 2016 total nonfarm employment of -150,000 (-0.1 percent). ...

Construction was revised up by 40,000 jobs, and manufacturing revised up by 51,000 jobs. The key downward revisions were for retail trade of -120,000, Professional and business services of -133,000 and education and health of -98,000.

This preliminary estimate showed 224,000 fewer private sector jobs, and 74,000 additional government jobs (as of March 2016).

BLS: Job Openings increased in July to Record High

by Calculated Risk on 9/07/2016 10:09:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings increased to 5.9 million on the last business day of July, the U.S. Bureau of Labor Statistics reported today. Hires and separations were little changed at 5.2 million and 4.9 million, respectively. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

The number of quits was essentially unchanged in July at 3.0 million. The quits rate was 2.1 percent. Over the month, the number of quits was little changed for total private and decreased for government (-21,000). Quits decreased in state and local government education (-25,000). The number of quits was little changed in all four regions.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for July, the most recent employment report was for August.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in July to 5.871 million from 5.643 million in June.

The number of job openings (yellow) are up 1% year-over-year.

Quits are up 9% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

This is solid report with job openings just above the previous record high set in April 2016.

MBA: "Mortgage Applications Increase Slightly in Latest Weekly Survey"

by Calculated Risk on 9/07/2016 07:00:00 AM

From the MBA: Mortgage Applications Slightly Increase in Latest MBA Weekly Survey

Mortgage applications increased 0.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 2, 2016.

... The Refinance Index increased 1 percent from the previous week. The seasonally adjusted Purchase Index increased 1 percent from one week earlier. The unadjusted Purchase Index decreased 1 percent compared with the previous week and was 7 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 3.68 percent from 3.67 percent, with points increasing to 0.37 from 0.33 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity has increased this year since rates have declined.

However it would take another significant move down in mortgage rates to see a large increase in refinance activity.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The purchase index is "7 percent higher than the same week one year ago".

Tuesday, September 06, 2016

Wednesday: JOLTS, Beige Book, Preliminary Annual Employment Benchmark Revision

by Calculated Risk on 9/06/2016 06:21:00 PM

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM: Job Openings and Labor Turnover Survey for July from the BLS. Jobs openings increased in June to 5.624 million from 5.514 million in May. The number of job openings were up 9% year-over-year, and Quits were up 6% year-over-year.

• Also at 10:00 AM, the 2016 Current Employment Statistics (CES) Preliminary Benchmark Revision.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

On the Benchmark Revision: Tomorrow, the BLS will release the preliminary annual Benchmark Revision for the Current Employment Statistics. The final revision will be published next February when the January 2017 employment report is released. Usually the preliminary estimate is pretty close to the final benchmark estimate.

The annual revision is benchmarked to state tax records. From the BLS:

Each year, the Current Employment Statistics (CES) survey estimates are benchmarked to comprehensive counts of employment from the Quarterly Census of Employment and Wages (QCEW) for the month of March. These counts are derived from state unemployment insurance (UI) tax records that nearly all employers are required to file. On September 7, 2016 at 10:00 a.m. (EST) the Bureau of Labor Statistics (BLS) will release the preliminary estimate of the annual benchmark revision to the establishment survey employment series.With the release of the final benchmark estimate in February, total payroll employment in March 2016 will changed by the amount of the revision. The number is then "wedged back" to the previous revision (March 2015).

For details on the benchmark revision process, see from the BLS Benchmark Article Over the last 3 years, the benchmark revision has subtracted an average of about 75,000 jobs.

My interview with Barry Ritholtz

by Calculated Risk on 9/06/2016 01:03:00 PM

When I was in New York last week, I had the opportunity to sit down with Barry Ritholtz for almost two hours. It was a great discussion (Barry was too kind).

From Ritholtz at Bloomberg: Bill McBride and the Case for Facts

This week on Masters in Business podcast I chat with Bill McBride of Calculated Risk, widely regarded as one of the best economics blogs.

McBride was famously right -- in public, in print and in real time -- about the impending housing collapse in 2006, the financial meltdown in 2008, the economic rebound in 2009 and the housing recovery in 2010. In our discussion, we talked about how the Calculated Risk blog developed, why it is data- and fact-driven, and why he so rarely offers his own opinions on anything economic. ...

You can hear the full interview, including the podcast extras, by streaming [at Bloomberg]; you can also download the podcast at iTunes, Soundcloud or Bloomberg.

ISM Non-Manufacturing Index decreased to 51.4% in August

by Calculated Risk on 9/06/2016 10:03:00 AM

The August ISM Non-manufacturing index was at 51.4%, down from 55.5% in July. The employment index decreased in August to 50.7%, down from 51.4% in July. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management:August 2016 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in August for the 79th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 51.4 percent in August, 4.1 percentage points lower than the July reading of 55.5 percent. This represents continued growth in the non-manufacturing sector at a slower rate. The Non-Manufacturing Business Activity Index decreased substantially to 51.8 percent, 7.5 percentage points lower than the July reading of 59.3 percent, reflecting growth for the 85th consecutive month, at a notably slower rate in August. The New Orders Index registered 51.4 percent, 8.9 percentage points lower than the reading of 60.3 percent in July. The Employment Index decreased 0.7 percentage point in August to 50.7 percent from the July reading of 51.4 percent. The Prices Index decreased 0.1 percentage point from the July reading of 51.9 percent to 51.8 percent, indicating prices increased in August for the fifth consecutive month. According to the NMI®, 11 non-manufacturing industries reported growth in August. The majority of the respondents’ comments indicate that there has been a slowing in the level of business for their respective companies."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was below the consensus forecast of 55.5, and suggests slower expansion in August than in July.

CoreLogic: House Prices up 6.0% Year-over-year in July

by Calculated Risk on 9/06/2016 09:12:00 AM

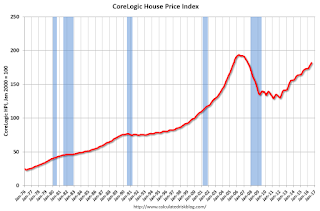

Notes: This CoreLogic House Price Index report is for July. The recent Case-Shiller index release was for June. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic US Home Price Report Shows Prices Up 6 Percent Year Over Year in July 2016

Home prices nationwide, including distressed sales, increased year over year by 6 percent in July 2016 compared with July 2015 and increased month over month by 1.1 percent in July 2016 compared with June 2016, according to the CoreLogic HPI.

...

“If mortgage rates continue to remain relatively low and job growth continues, as most forecasters expect, then home purchases are likely to rise in the coming year,” said Dr. Frank Nothaft, chief economist for CoreLogic. “The increased sales will support further price appreciation, and according to the CoreLogic Home Price Index, home prices are projected to rise about 5 percent over the next year.”

“The strongest home price gains continue to be in the western region,” said Anand Nallathambi, president and CEO of CoreLogic. “As evidence, the Denver, Portland and Seattle metropolitan areas all recorded double-digit appreciation over the past year.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 1.1% in July (NSA), and is up 6.0% over the last year.

This index is not seasonally adjusted, and this was another solid month-to-month increase.

The index is still 6.1% below the bubble peak in nominal terms (not inflation adjusted).

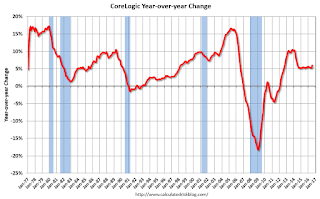

The second graph shows the YoY change in nominal terms (not adjusted for inflation).

The second graph shows the YoY change in nominal terms (not adjusted for inflation).The YoY increase had been moving sideways over the last two years.

The year-over-year comparison has been positive for fifty four consecutive months.