by Calculated Risk on 9/19/2016 08:50:00 AM

Monday, September 19, 2016

Hotels: "Demand Growth Slows, Supply Growth Increases"

First here is the weekly data from HotelNewsNow.com: STR: US hotel results for week ending 10 September

he U.S. hotel industry recorded mixed results in the three key performance metrics during the week of 4-10 September 2016, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In year-over-year comparisons, the industry’s occupancy fell 1.4% to 62.8%. However, average daily rate increased 1.8% to US$118.58, and revenue per available room was nearly flat (+0.3% to US$74.45).

emphasis added

The red line is for 2016, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.

The red line is for 2016, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.2015 was the best year on record for hotels.

So far 2016 is tracking just behind 2015, and well ahead of the median rate.

Also 2016 is tracking ahead of 2000 (the previous 2nd best year).

The Summer travel period has ended, and the occupancy rate has declined seasonally. The occupancy rate will now increase as business travel picks up in the Fall.

The second graph is from a Smith Travel Research data presentation. This shows that demand is slowing and supply is increasing. This suggests the occupancy rate will decline in 2017.

The second graph is from a Smith Travel Research data presentation. This shows that demand is slowing and supply is increasing. This suggests the occupancy rate will decline in 2017. This graph is from a data presentation by STR. These presentations are available here with a free registration (including local data depending on presentation).

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Sunday, September 18, 2016

Sunday Night Futures

by Calculated Risk on 9/18/2016 08:06:00 PM

From James Hamilton at Econbrowser: Why didn’t the recent oil price decline help the U.S. economy more? A few excerpts:

Baumeister and Kilian update those calculations and conclude that there was a significant boost to consumer spending, noting that real consumption spending grew on average by 3.1% over the two years since oil prices began falling in 2014:Q3 compared with only 2.0% during the preceding two years. ... But gains to consumer spending were mostly offset by a drop in oil-related investment spending.Weekend:

...

Their paper examined a number of details of the economic response. The bottom line is that there seemed to be little net stimulus to the U.S. economy from the collapse in oil prices.

• Schedule for Week of Sept 18, 2016

Monday:

• At 10:00 AM ET, The September NAHB homebuilder survey. The consensus is for a reading of 60, unchanged from 60 in August. Any number above 50 indicates that more builders view sales conditions as good than poor.

From CNBC: Pre-Market Data and Bloomberg futures: S&P futures are up 6 and DOW futures are up 55 (fair value).

Oil prices were down over the last week with WTI futures at $43.67 per barrel and Brent at $46.29 per barrel. A year ago, WTI was at $45, and Brent was at $47 - so prices are down slightly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.21 per gallon (down about $0.10 per gallon from a year ago).

Preview: Existing Home Sales

by Calculated Risk on 9/18/2016 12:29:00 PM

Last month I suggested taking the "under" on the consensus for existing home sales based on housing economist Tom Lawler's analysis. This month the consensus is probably a little low.

The NAR will report August Existing Home Sales on Thursday, September at 10:00 AM.

The consensus, according to Bloomberg, is that the NAR will report sales of 5.44 million. Housing economist Tom Lawler estimates the NAR will report sales of 5.49 million on a seasonally adjusted annual rate (SAAR) basis, up from 5.39 million SAAR in July.

Housing economist Tom Lawler has been sending me his predictions of what the NAR will report for over 6 years. The table below shows the consensus for each month, Lawler's predictions, and the NAR's initial reported level of sales.

Lawler hasn't always been closer than the consensus, but usually when there has been a fairly large spread between Lawler's estimate and the "consensus", Lawler has been closer.

NOTE: There have been times when Lawler "missed", but then he pointed out an apparent error in the NAR data - and the subsequent revision corrected that error. As an example, see: The “Curious Case” of Existing Home Sales in the South in April

Over the last six years, the consensus average miss was 150 thousand, and Lawler's average miss was 70 thousand.

Many analysts now change their "forecast" after Lawler's estimate is posted, so the consensus has improved a little recently!

| Existing Home Sales, Forecasts and NAR Report millions, seasonally adjusted annual rate basis (SAAR) | |||

|---|---|---|---|

| Month | Consensus | Lawler | NAR reported1 |

| May-10 | 6.20 | 5.83 | 5.66 |

| Jun-10 | 5.30 | 5.30 | 5.37 |

| Jul-10 | 4.66 | 3.95 | 3.83 |

| Aug-10 | 4.10 | 4.10 | 4.13 |

| Sep-10 | 4.30 | 4.50 | 4.53 |

| Oct-10 | 4.50 | 4.46 | 4.43 |

| Nov-10 | 4.85 | 4.61 | 4.68 |

| Dec-10 | 4.90 | 5.13 | 5.28 |

| Jan-11 | 5.20 | 5.17 | 5.36 |

| Feb-11 | 5.15 | 5.00 | 4.88 |

| Mar-11 | 5.00 | 5.08 | 5.10 |

| Apr-11 | 5.20 | 5.15 | 5.05 |

| May-11 | 4.75 | 4.80 | 4.81 |

| Jun-11 | 4.90 | 4.71 | 4.77 |

| Jul-11 | 4.92 | 4.69 | 4.67 |

| Aug-11 | 4.75 | 4.92 | 5.03 |

| Sep-11 | 4.93 | 4.83 | 4.91 |

| Oct-11 | 4.80 | 4.86 | 4.97 |

| Nov-11 | 5.08 | 4.40 | 4.42 |

| Dec-11 | 4.60 | 4.64 | 4.61 |

| Jan-12 | 4.69 | 4.66 | 4.57 |

| Feb-12 | 4.61 | 4.63 | 4.59 |

| Mar-12 | 4.62 | 4.59 | 4.48 |

| Apr-12 | 4.66 | 4.53 | 4.62 |

| May-12 | 4.57 | 4.66 | 4.55 |

| Jun-12 | 4.65 | 4.56 | 4.37 |

| Jul-12 | 4.50 | 4.47 | 4.47 |

| Aug-12 | 4.55 | 4.87 | 4.82 |

| Sep-12 | 4.75 | 4.70 | 4.75 |

| Oct-12 | 4.74 | 4.84 | 4.79 |

| Nov-12 | 4.90 | 5.10 | 5.04 |

| Dec-12 | 5.10 | 4.97 | 4.94 |

| Jan-13 | 4.90 | 4.94 | 4.92 |

| Feb-13 | 5.01 | 4.87 | 4.98 |

| Mar-13 | 5.03 | 4.89 | 4.92 |

| Apr-13 | 4.92 | 5.03 | 4.97 |

| May-13 | 5.00 | 5.20 | 5.18 |

| Jun-13 | 5.27 | 4.99 | 5.08 |

| Jul-13 | 5.13 | 5.33 | 5.39 |

| Aug-13 | 5.25 | 5.35 | 5.48 |

| Sep-13 | 5.30 | 5.26 | 5.29 |

| Oct-13 | 5.13 | 5.08 | 5.12 |

| Nov-13 | 5.02 | 4.98 | 4.90 |

| Dec-13 | 4.90 | 4.96 | 4.87 |

| Jan-14 | 4.70 | 4.67 | 4.62 |

| Feb-14 | 4.64 | 4.60 | 4.60 |

| Mar-14 | 4.56 | 4.64 | 4.59 |

| Apr-14 | 4.67 | 4.70 | 4.65 |

| May-14 | 4.75 | 4.81 | 4.89 |

| Jun-14 | 4.99 | 4.96 | 5.04 |

| Jul-14 | 5.00 | 5.09 | 5.15 |

| Aug-14 | 5.18 | 5.12 | 5.05 |

| Sep-14 | 5.09 | 5.14 | 5.17 |

| Oct-14 | 5.15 | 5.28 | 5.26 |

| Nov-14 | 5.20 | 4.90 | 4.93 |

| Dec-14 | 5.05 | 5.15 | 5.04 |

| Jan-15 | 5.00 | 4.90 | 4.82 |

| Feb-15 | 4.94 | 4.87 | 4.88 |

| Mar-15 | 5.04 | 5.18 | 5.19 |

| Apr-15 | 5.22 | 5.20 | 5.04 |

| May-15 | 5.25 | 5.29 | 5.35 |

| Jun-15 | 5.40 | 5.45 | 5.49 |

| Jul-15 | 5.41 | 5.64 | 5.59 |

| Aug-15 | 5.50 | 5.54 | 5.31 |

| Sep-15 | 5.35 | 5.56 | 5.55 |

| Oct-15 | 5.41 | 5.33 | 5.36 |

| Nov-15 | 5.32 | 4.97 | 4.76 |

| Dec-15 | 5.19 | 5.36 | 5.46 |

| Jan-16 | 5.32 | 5.36 | 5.47 |

| Feb-16 | 5.30 | 5.20 | 5.08 |

| Mar-16 | 5.27 | 5.27 | 5.33 |

| Apr-16 | 5.40 | 5.44 | 5.45 |

| May-16 | 5.64 | 5.55 | 5.53 |

| Jun-16 | 5.48 | 5.62 | 5.57 |

| Jul-16 | 5.52 | 5.41 | 5.39 |

| Aug-16 | 5.44 | 5.49 | --- |

| 1NAR initially reported before revisions. | |||

Saturday, September 17, 2016

Schedule for Week of Sept 18, 2016

by Calculated Risk on 9/17/2016 08:11:00 AM

The key economic reports this week are August housing starts and Existing Home Sales.

The FOMC meets on Tuesday and Wednesday, and no change to policy is expected.

10:00 AM: The September NAHB homebuilder survey. The consensus is for a reading of 60, unchanged from 60 in August. Any number above 50 indicates that more builders view sales conditions as good than poor.

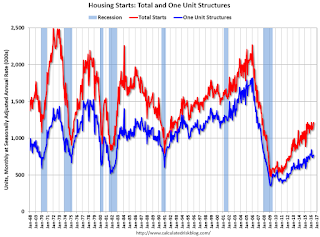

8:30 AM: Housing Starts for August.

8:30 AM: Housing Starts for August. Total housing starts increased to 1.211 million (SAAR) in July. Single family starts increased to 770 thousand SAAR in July.

The consensus for 1.190 million, down from the July rate.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for August 2016

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for August (a leading indicator for commercial real estate).

2:00 PM: FOMC Meeting Announcement. No change to the Fed Funds rate is expected at this meeting.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Janet Yellen holds a press briefing following the FOMC announcement.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 261 thousand initial claims, up from 260 thousand the previous week.

8:30 AM ET: Chicago Fed National Activity Index for August. This is a composite index of other data.

9:00 AM: FHFA House Price Index for July 2016. This was originally a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.4% month-to-month increase for this index.

10:00 AM: Existing Home Sales for August from the National Association of Realtors (NAR). The consensus is for 5.44 million SAAR, up from 5.39 million in July.

10:00 AM: Existing Home Sales for August from the National Association of Realtors (NAR). The consensus is for 5.44 million SAAR, up from 5.39 million in July.Housing economist Tom Lawler expects the NAR to report sales of 5.49 million SAAR in August, up 1.9% from July’s preliminary pace.

No major releases scheduled.

Friday, September 16, 2016

Lawler: Early Read on Existing Home Sales in August

by Calculated Risk on 9/16/2016 04:43:00 PM

From housing economist Tom Lawler:

Based on publicly-available state and local realtor/MLS reports from across the country released through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.49 million in August, up 1.9% from July’s preliminary pace and up 3.8% from last August’s seasonally adjusted pace. Unadjusted sales last month should register a significantly larger YOY increase than seasonally adjusted sales, as there were two more business days this August compared to last August.

Local realtor/MLS data also suggest that existing home listings in aggregate declined slightly last month, and I project that the inventory of existing homes for sale as estimated by the NAR for the end of August will be 2.11 million, down 0.9% from July’s preliminary estimate and down 7.0% from last August.. Finally, local realtor/MLS data suggest that the NAR’s estimate of the median existing single-family home sales price for August will be up about 6.3% from last August.

CR Note: The NAR is scheduled to release August existing home sales on Thursday, September 22nd. The consensus is for 5.39 million SAAR in August. Take the over!

Mortgage Equity Withdrawal Slightly Positive in Q2

by Calculated Risk on 9/16/2016 02:00:00 PM

Note: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008.

The following data is calculated from the Fed's Flow of Funds data (released today) and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity - hence the name "MEW", but there is still little (but increasing) MEW right now - and normal principal payments and debt cancellation (modifications, short sales, and foreclosures).

For Q2 2016, the Net Equity Extraction was a positive $7 billion, or a positive 0.2% of Disposable Personal Income (DPI) . With revisions, this is the first positive MEW since Q1 2008 - and MEW will probably be positive in Q3 this year too (there is a seasonal pattern for MEW).

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

Note: This data is impacted by debt cancellation and foreclosures, but much less than a few years ago.

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding increased by $56 billion in Q2.

The Flow of Funds report also showed that Mortgage debt has declined by almost $1.3 trillion since the peak. This decline is mostly because of debt cancellation per foreclosures and short sales, and some from modifications. There has also been some reduction in mortgage debt as homeowners paid down their mortgages so they could refinance.

With a slower rate of debt cancellation, MEW will likely stay positive.

For reference:

Dr. James Kennedy also has a simple method for calculating equity extraction: "A Simple Method for Estimating Gross Equity Extracted from Housing Wealth". Here is a companion spread sheet (the above uses my simple method).

For those interested in the last Kennedy data included in the graph, the spreadsheet from the Fed is available here.

Fed's Flow of Funds: Household Net Worth increased in Q2

by Calculated Risk on 9/16/2016 01:03:00 PM

The Federal Reserve released the Q2 2016 Flow of Funds report today: Flow of Funds.

According to the Fed, household net worth increased in Q2 compared to Q1:

The net worth of households and nonprofits rose to $89.1 trillion during the second quarter of 2016. The value of directly and indirectly held corporate equities increased $452 billion and the value of real estate increased $474 billion.Household net worth was at $89.1 trillion in Q2 2016, up from $88.0 trillion in Q1 2016.

The Fed estimated that the value of household real estate increased to $22.3 trillion in Q2. The value of household real estate is just below the bubble peak in early 2006 (not adjusted for inflation, and including new construction).

Click on graph for larger image.

Click on graph for larger image.The first graph shows Households and Nonprofit net worth as a percent of GDP. Household net worth, as a percent of GDP, is higher than the peak in 2006 (housing bubble), and above the stock bubble peak.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

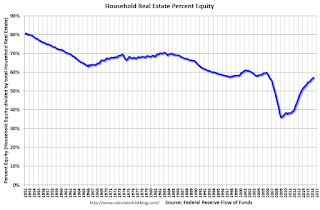

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952. Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q2 2016, household percent equity (of household real estate) was at 57.1% - up from Q1, and the highest since Q2 2006. This was because of an increase in house prices in Q2 (the Fed uses CoreLogic).

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So the approximately 50+ million households with mortgages have far less than 57.1% equity - and a few million homeowners still have negative equity.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Mortgage debt increased by $56 billion in Q2.

Mortgage debt has declined by $1.27 trillion from the peak. Studies suggest most of the decline in debt has been because of foreclosures (or short sales), but some of the decline is from homeowners paying down debt (sometimes so they can refinance at better rates).

The value of real estate, as a percent of GDP, was up in Q2, and is above the average of the last 30 years (excluding bubble).

Key Measures Show Inflation close to 2% in August

by Calculated Risk on 9/16/2016 11:12:00 AM

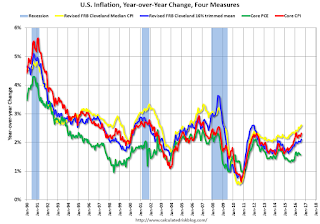

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.8% annualized rate) in August. The 16% trimmed-mean Consumer Price Index also rose 0.2% (2.6% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for August here.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.2% (2.4% annualized rate) in August. The CPI less food and energy rose 0.3% (3.1% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.6%, the trimmed-mean CPI rose 2.1%, and the CPI less food and energy also rose 2.3%. Core PCE is for June and increased 1.6% year-over-year.

On a monthly basis, median CPI was at 2.8% annualized, trimmed-mean CPI was at 2.6% annualized, and core CPI was at 3.1% annualized.

Using these measures, inflation has generally been moving up, and most of these measures are at or above the Fed's target (Core PCE is still below).

Early Look at 2017 Cost-Of-Living Adjustments and Maximum Contribution Base

by Calculated Risk on 9/16/2016 08:58:00 AM

The BLS reported this morning:

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 0.7 percent over the last 12 months to an index level of 234.909 (1982-84=100). For the month, the index increased 0.1 percent prior to seasonal adjustment.CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U, and is not seasonally adjusted (NSA).

• In 2014, the Q3 average of CPI-W was 234.242. In the previous year, 2013, the average in Q3 of CPI-W was 230.327. That gave an increase of 1.7% for COLA for 2015.

• In 2015, the Q3 average of CPI-W was 233.278. That was a decline of 0.4% from 2014, however, by law, the adjustment is never negative so the benefits remained the same this year (in 2016).

Since the previous highest Q3 average was in 2014 (not 2015), at 234.242, we have to compare Q3 this year to two years ago.

Click on graph for larger image.

Click on graph for larger image.This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

Note: The year labeled for the calculation, and the adjustment is effective for December of that year (received by beneficiaries in January of the following year).

CPI-W was up 0.7% year-over-year in August, and although this is early - we need the data for July, August and September - my guess is COLA will be slightly positive this year.

Contribution and Benefit Base

The law prohibits an increase in the contribution and benefit base if COLA is not greater than zero, so there was no change in the contribution and benefit base for 2016. However if the there is even a small increase in COLA (it will be close this year), the contribution base will be adjusted using the National Average Wage Index (and catch up for last year).

From Social Security: Cost-of-Living Adjustment Must Be Greater Than Zero

... ... any amount that is directly dependent for its value on the COLA would not increase. For example, the maximum Supplemental Security Income (SSI) payment amounts would not increase if there were no COLA.The contribution base will be adjusted using the National Average Wage Index. This is based on a one year lag. The National Average Wage Index is not available for 2015 yet, but wages probably increased again in 2015. If wages increased again last year, then the contribution base next year will increase to around $125,000 from the current $118,500.

... if there were no COLA, section 230(a) of the Social Security Act prohibits an increase in the contribution and benefit base (Social Security's maximum taxable earnings), which normally increases with increases in the national average wage index. Similarly, the retirement test exempt amounts would not increase ...

Remember - this is an early look. We still need the data for September, but it appears COLA will be slightly positive and the contribution base will increase significantly for next year.

CPI increased 0.2% in August, Core CPI up 2.3% YoY

by Calculated Risk on 9/16/2016 08:39:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent in August on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index rose 1.1 percent before seasonal adjustment.I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI. This was above the consensus forecast of a 0.1% increase for CPI, and also above the forecast of a 0.2% increase in core CPI.

The seasonally adjusted increase in the all items index was caused by a rise in the index for all items less food and energy. It increased 0.3 percent in August, as the indexes for shelter and medical care advanced. ...

The all items index rose 1.1 percent for the 12 months ending August, a larger increase than the 0.8-percent rise for the 12 months ending July. The index for all items less food and energy rose 2.3 percent for the 12 months ending August.

emphasis added