by Calculated Risk on 9/21/2016 09:57:00 AM

Wednesday, September 21, 2016

AIA: Architecture Billings Index declines in August

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Billings Index slips, overall outlook remains positive

On the heels of six out of seven months of increasing levels of demand for design services, the Architecture Billings Index (ABI) fell just below the positive mark. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the August ABI score was 49.7, down from the mark of 51.5 in the previous month. This score reflects a decrease in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 61.8, up sharply from a reading of 57.5 the previous month.Note that multi-family is positive again, so we might see another pickup in multi-family starts.

“This is only the second month this year where demand for architectural services has declined and it is only by a fraction of a point,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “Given the solid numbers for new design contracts and project inquiries, it doesn’t appear that this is the beginning of a broader downturn in the design and construction industry.”

...

• Regional averages: South (55.2), Midwest (52.8), West (49.0), Northeast (44.9)

• Sector index breakdown: mixed practice (51.8), multi-family residential (50.9), commercial / industrial (50.8), institutional (50.7)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 49.7 in August, down from 51.5 in July. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 9 of the last 12 months, suggesting a further increase in CRE investment through mid-2017.

MBA: "Mortgage Applications Decrease in Latest Weekly Survey"

by Calculated Risk on 9/21/2016 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 7.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 16, 2016. The prior week’s results included an adjustment for the Labor Day holiday.

... The Refinance Index decreased 8 percent from the previous week to the lowest level since June 2016. The seasonally adjusted Purchase Index decreased 7 percent from one week earlier. The unadjusted Purchase Index increased 15 percent compared with the previous week and was 3 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to its highest level since June 2016, 3.70 percent, from 3.67 percent, with points increasing to 0.38 from 0.36 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity has increased this year since rates have declined.

Last week I noted "Based on the increase in mortgage rates over the last few days, I'd expect refinance activity to decline soon", and it looks like activity is now declining. Rates would have to take another step down to see a pickup in refinance activity.

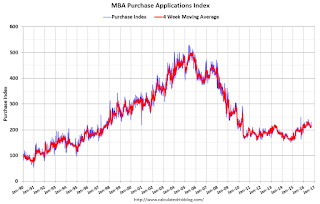

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The purchase index is only "3 percent higher than the same week one year ago".

Tuesday, September 20, 2016

Wednesday: FOMC Announcement

by Calculated Risk on 9/20/2016 07:54:00 PM

Here is a Review of FOMC Projections

And a few excerpts from a piece by Goldman Sachs economists Zach Pandl and Jan Hatzius: FOMC Preview: How Much Is Really a-Changin?

[W]e now see very low chances of a rate increase ... By our count, seven FOMC participants would prefer to raise the funds rate next week, and two seem to be leaning that way. In these situations, the FOMC will often use the post-meeting statement to help forge a compromise. We should therefore expect a more hawkish tone in the statement and press conference.Wednesday:

While we expect some tough talk, our best guess is that the statement will be sufficiently noncommittal to keep markets unsure about the prospects of a rate hike this year—in part because the timing of the November meeting limits the committee’s ability to provide very strong signals. Shifting to a “nearly balanced” risk assessment could keep markets on notice, but this phrasing has been absent since December, possibly reflecting Chair Yellen’s own preferences. It’s a close call, but we think the committee will probably use different language.

In the Summary of Economic Projections (SEP), we look for lower GDP growth for this year and a reduction in the longer-run estimate. Projections for unemployment and core inflation will likely be unchanged. Reflecting the discussion among policymakers about low equilibrium rates, we expect the “dot plot” to show a slower pace of funds rate increases over the coming years, with the 2017 and 2018 median dots falling by 50bp—though this is also a close call.

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• During the day, The AIA's Architecture Billings Index for August (a leading indicator for commercial real estate).

• At 2:00 PM, the FOMC Meeting Announcement. No change to the Fed Funds rate is expected at this meeting.

• Also at 2:00 PM, FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

• At 2:30 PM, Fed Chair Janet Yellen holds a press briefing following the FOMC announcement.

Look Back: In 2006 I predicted House Prices would fall 40%+ in the Bay Area

by Calculated Risk on 9/20/2016 03:42:00 PM

A reader asked about an old (and I suppose bold at the time) prediction ...

In 2006 I wrote Bay Area: How far will prices fall?

In the comments to the previous post I suggested that Bay Area prices might fall 40%+ in real terms over 5 to 7 years. ac asked how I came up with that estimate, and Lester suggested somewhat impolitely that the estimate did not match my "moderate, professorial tone".So how far did prices fall?

According to Case-Shiller, prices in San Francisco peaked in March 2006 with the index at 219.31. Prices bottomed in San Francisco in May of 2009 at 119.97. That was a nominal decline of 45% (real of 50%), however in a shorter period than I expected - probably because of the boom in tech. Most areas bottomed in early 2012 (the expected 5 to 7 years).

Other areas of the Bay Area probably did worse.

As I noted in 2006, I predicted the price decline based on previous housing busts, and factored in the larger bubble.

But what have I done lately? Nothing bold, unless this counts. I think we can agree those recession calls were incorrect.

Comments on August Housing Starts

by Calculated Risk on 9/20/2016 12:59:00 PM

Earlier: Housing Starts increased to 1.142 Million Annual Rate in August

The housing starts report this morning was below consensus, however there were upward revisions to the prior two months.

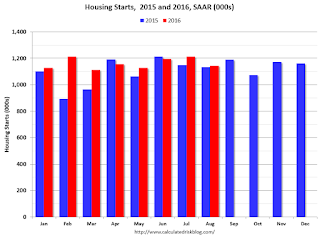

This first graph shows the month to month comparison between 2015 (blue) and 2016 (red).

Year-to-date starts are up 6.1% compared to the same period in 2015. My guess was starts would increase 4% to 8% in 2016, and that still looks about right.

Multi-family starts are up 0.3% year-to-date, and single-family starts are up 9.1% year-to-date.

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily over the last few years, and completions (red line) have lagged behind - but completions have been catching up (more deliveries, although this has dipped lately). Completions lag starts by about 12 months.

I think most of the growth in multi-family starts is probably behind us - in fact multi-family starts probably peaked in June 2015 (at 510 thousand SAAR) - although I expect solid multi-family starts for a few more years (based on demographics).

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

BLS: Unemployment Rates stable in 41 states in August

by Calculated Risk on 9/20/2016 10:12:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were significantly higher in August in 6 states, lower in 3 states, and stable in 41 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today.

...

South Dakota and New Hampshire had the lowest jobless rates in August, 2.9 percent and 3.0 percent, respectively. Alaska had the highest unemployment rate, 6.8 percent.

emphasis added

Click on graph for larger image.

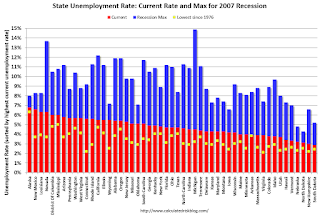

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement. The yellow squares are the lowest unemployment rate per state since 1976.

The states are ranked by the highest current unemployment rate. Alaska, at 6.8%, had the highest state unemployment rate.

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).Currently no state has an unemployment rate at or above 7% (light blue); Only five states and D.C are at or above 6% (dark blue). The states are Alaska (6.8%), New Mexico (6.6%), Louisiana (6.3%), Nevada (6.3%), D.C. (6.0%), and Mississippi (6.0%).

Housing Starts decreased to 1.142 Million Annual Rate in August

by Calculated Risk on 9/20/2016 08:38:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in August were at a seasonally adjusted annual rate of 1,142,000. This is 5.8 percent below the revised July estimate of 1,212,000, but is 0.9 percent above the August 2015 rate of 1,132,000.

Single-family housing starts in August were at a rate of 722,000; this is 6.0 percent below the revised July figure of 768,000. The August rate for units in buildings with five units or more was 403,000.

Building Permits:

Privately-owned housing units authorized by building permits in August were at a seasonally adjusted annual rate of 1,139,000. This is 0.4 percent below the revised July rate of 1,144,000 and is 2.3 percent below the August 2015 estimate of 1,166,000.

Single-family authorizations in August were at a rate of 737,000; this is 3.7 percent above the revised July figure of 711,000. Authorizations of units in buildings with five units or more were at a rate of 370,000 in August.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased in August compared to July. Multi-family starts are up 4.7% year-over-year.

Single-family starts (blue) decreased in August, and are down 1.2% year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low),

Total housing starts in August were below expectations, however combined starts for June and July were revised up slightly. I'll have more later ...

Monday, September 19, 2016

Tuesday: Housing Starts

by Calculated Risk on 9/19/2016 06:39:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Steady to Slightly Higher

Mortgage Rates were unchanged for a third straight day, although several lenders did raise rates at the end of the day. ... Lenders continue quoting conventional 30yr fixed rates of 3.5% on top tier scenarios, with the runners-up being 3.625% and 3.375% in that order.Tuesday:

Keep in mind that Wednesday afternoon brings the FOMC Announcement (where the Fed releases its updated policy statement). This can be a significant source of volatility for rates markets. That said, volatility could already be picking up as the Bank of Japan releases its own policy update earlier in the morning. Although markets (and rates) can go either way in response to these events, big, negative reactions tend to happen faster and more abruptly than big, positive reactions.

emphasis added

• At 8:30 AM ET, Housing Starts for August. Total housing starts increased to 1.211 million (SAAR) in July. Single family starts increased to 770 thousand SAAR in July. The consensus for 1.190 million, down from the July rate.

• At 10:00 AM, Regional and State Employment and Unemployment (Monthly) for August 2016

Kolko: "Unpacking the Jump In Median Household Income"

by Calculated Risk on 9/19/2016 01:05:00 PM

From Jed Kolko, chief economist at Indeed, formerly chief economist at Trulia.

Last week the Census reported large gains in median household income in two different surveys: 5.2% from the Current Population Survey’s March 2016 Annual Social and Economic Supplement (ASEC), and 3.8% from the 2015 American Community Survey (ACS). But these are slippery measures, and several thoughtful responses (here, here, and here) catalogued numerous cautions, including the limitations of these self-reported Census survey data relative to administrative data.

A particularly important concern when interpreting these income gains is whether households are changing. The share of young adults living in their parents’ homes has climbed sharply since 2005 and continues to rise, according to last week’s data release. Their earnings count toward their parents’ household income – so larger households mean higher household incomes, even if individuals’ earnings don’t change. Fortunately, the surveys released last week aren’t just about income; they’re also the definitive sources on households and living arrangements, so we can unpack the change in median household income and assess whether changing household structure had an effect.

Both the ASEC and ACS show a that the number of adults per household was essentially unchanged between 2014 and 2015. (The two surveys actually cover different time periods, but for simplicity I’m calling them 2014-to-2015 changes. See note at end.) The number of adults (18+) per household rose a slight 0.2% in the ACS and was flat in the ASEC. The increase in young adults living at home, noted above, is only part of the broader changes in living arrangements; at the same time as more young adults are living with parents, a rising share of households are single-person. Changes in household size, therefore, explain essentially none of the increase in median household income.

A different factor, however, explains some of the jump in household income. More adults were working in 2015 than in 2014. The number of workers per household increased 1.1% in the ASEC and 0.5% in the ACS: this includes all workers, regardless of how many hours per week or weeks per year they worked. The number of full-time, year-round workers per household increased more: 1.2% in the ASEC and 1.7% in the ACS.

| Change, 2014-2015, in: | ASEC | ACS |

|---|---|---|

| adults (18+) per household | 0.0% | 0.2% |

| workers (all types, any age) per household | 1.1% | 0.5% |

| full-time, year-round workers (any age) per household | 1.2% | 1.7% |

| median earnings: full-time, year-round workers | 2.9% | 2.8% |

| median income: households (as published) | 5.2% | 3.8% |

Still, the percentage increases in workers per household and full-time, year-round workers per household were smaller than the percentage increases in median household income. That suggests that even after accounting for changing in household size and changes in employment rates, earnings per worker rose. And, in fact, both surveys report that explicitly: median earnings for full-time, year-round workers rose 2.9% in the ASEC and 2.8% in the ACS.

In theory the change in median household income should be pretty close to the sum of the change in earnings per full-time, year-round workers and the change in full-time, year-round workers per household. But they’re not, in either survey. That’s because medians don’t behave as neatly as means do when you try to combine or disaggregate them; it’s also because income encompasses more than work-related earnings (e.g. investment income); and there are margins of error around all of these survey-data estimates.

Despite these caveats, consistent results emerge from the two surveys. Even with the rising share of young adults living with parents, household size was essentially unchanged and therefore does not explain the rise in median household incomes. Both employment rates (especially full-time, year-round employment) and per-worker earnings rose, and the percentage rise in earnings was larger than the percentage rise in employment. Most of the jump in median household income, therefore, appears to be rising earnings, with rising employment playing an important supporting role. The labor market improved for workers on both of these fronts: the rise in median household income is indeed good news.

Methodology notes and data sources:

ASEC: estimates for households, adult population, workers, and full-time year-round workers are based on my calculations from the microdata file and exclude group quarters. The estimate of per-worker earnings is based on the Census PINC05 files. Note that the increase in median earnings for full-time, year-round workers is higher than those for men and women separately as shown in the published report, even when averaged properly; such as the quirky properties of medians. The ASEC was conducted in March 2016, and income refers to the 2015 calendar year.

ACS: estimates for households, adult population, workers, full-time year-round workers, and per-working earnings are from Factfinder tables S2002, S2601A, B23027, and B25002. Adult population excludes group quarters; workers include adults in group quarters (not possible to separate them using the published tables). The ACS was conducted on a rolling basis through 2015, and income refers to the previous twelve months.

Here’s a longer explanation of the differences between the ASEC and the ACS, especially the time periods covered.

NAHB: Builder Confidence increases to 65 in September

by Calculated Risk on 9/19/2016 10:05:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 65 in September, up from 59 in August. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Surges in September

Builder confidence in the market for newly built, single-family homes in September jumped six points to 65 from a downwardly revised August reading of 59 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) released today. This marks the highest HMI level since October 2015.

...

“With the inventory of new and existing homes remaining tight, builders are confident that if they can build more homes they can sell them,” said NAHB Chief Economist Robert Dietz. “Though solid job creation and low interest rates are also fueling demand, builders continue to be hampered by supply-side constraints that include shortages of labor and lots.”

...

All three HMI components moved higher in September. The component measuring current sales expectations rose six points to 71 and the gauge charting sales expectations in the next six months increased five points to also stand at 71. The index measuring traffic of prospective buyers posted a four-point gain to 48.

The three-month moving averages for HMI scores posted gains in three out of the four regions. The Northeast and South each registered a one-point gain to 42 and 64, respectively, while the West rose four points to 73. The Midwest was unchanged at 55.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was above the consensus forecast of 60, and is another solid reading.