by Calculated Risk on 9/26/2016 11:23:00 AM

Monday, September 26, 2016

A few Comments on August New Home Sales

The new home sales report for August was strong at 609,000 on a seasonally adjusted annual rate basis (SAAR) - the highest for the month of August since 2007 - and the second highest sales rate since January 2008 (only last month was higher). However combined sales for May, June and July were revised down slightly.

Sales were up 20.6% year-over-year (YoY) compared to August 2015. And sales are up 13.3% year-to-date compared to the same period in 2015.

This is very solid year-over-year growth. And new home sales are much more important for jobs and the economy than existing home sales. Since existing sales are existing stock, the only direct contribution to GDP is the broker's commission. There is usually some additional spending with an existing home purchase - new furniture, etc - but overall the economic impact is small compared to a new home sale.

Earlier: New Home Sales decreased to 609,000 Annual Rate in August.

This graph shows new home sales for 2015 and 2016 by month (Seasonally Adjusted Annual Rate). Sales to date are up 13.3% year-over-year, because of very strong year-over-year growth over the last five months.

Overall I expected lower growth this year, in the 4% to 8% range. Slower growth seemed likely this year because Houston (and other oil producing areas) will have a problem this year. It looks like I was too pessimistic on new home sales this year.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

I expect existing home sales to move more sideways, and I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

This ratio was fairly stable from 1994 through 2006, and then the flood of distressed sales kept the number of existing home sales elevated and depressed new home sales. (Note: This ratio was fairly stable back to the early '70s, but I only have annual data for the earlier years).

In general the ratio has been trending down, and this ratio will probably continue to trend down over the next several years.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales decreased to 609,000 Annual Rate in August

by Calculated Risk on 9/26/2016 10:13:00 AM

The Census Bureau reports New Home Sales in August were at a seasonally adjusted annual rate (SAAR) of 609 thousand.

The previous three months were revised down by a total of 4 thousand (SAAR).

"Sales of new single-family houses in August 2016 were at a seasonally adjusted annual rate of 609,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 7.6 percent below the revised July rate of 659,000, but is 20.6 percent above the August 2015 estimate of 505,000."

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales since the bottom, new home sales are still fairly low historically.

The second graph shows New Home Months of Supply.

The months of supply increased in August to 4.6 months.

The months of supply increased in August to 4.6 months. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

"The seasonally adjusted estimate of new houses for sale at the end of August was 235,000. This represents a supply of 4.6 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In August 2016 (red column), 50 thousand new homes were sold (NSA). Last year 41 thousand homes were sold in August.

The all time high for August was 110 thousand in 2005, and the all time low for August was 23 thousand in August 2010.

This was above expectations of 598,000 sales SAAR in August. A solid report. I'll have more later today.

Black Knight: House Price Index up 0.4% in July, Up 5.3% year-over-year

by Calculated Risk on 9/26/2016 08:12:00 AM

Note: I follow several house price indexes (Case-Shiller, CoreLogic, Black Knight, Zillow, FHFA, FNC and more). Note: Black Knight uses the current month closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From Black Knight: Black Knight Home Price Index Report: July 2016 Transactions, U.S. Home Prices Up 0.4 Percent for the Month; Up 5.3 Percent Year-Over-Year

• U.S. home prices were up 0.4 percent for the month, and have gained 5.3 percent from one year agoThe year-over-year increase in this index has been about the same for the last year.

• At $266K, the U.S. HPI has risen over 33 percent from the market’s bottom and is now within just 0.8 percent of a new national peak

• Home prices in nine of the nation’s 20 largest states and 14 of the 40 largest metros hit new peaks in July

Note that house prices are close to the bubble peak in nominal terms, but not adjusted for inflation.

Sunday, September 25, 2016

Monday: New Home Sales, Presidential Debate

by Calculated Risk on 9/25/2016 07:44:00 PM

I mentioned this on twitter earlier today:

I spoke to a local infill spec builder yesterday who has been asking me for advice for several years (and happy with my advice!). The builder brought up the election ... The spec builder told me he was thinking of voting for Trump because his tax rate would be lower. I asked him "How is business?"

The spec builder told me 2016 was his best year ever, and the last few years have been the best of his career.

So I asked what he thought would happen if Trump was elected?

We discussed The Wall, more deportations, trade disputes and more. He asked for my advice if Trump is elected: I explained that it is not possible to predict exactly what will happen because Trump's proposals all over the place ... and Congress would probably block some of Trump’s proposals.

But in general, my advice would be to scale back on his spec building.

I also told him that all key forecasters are assuming Ms. Clinton will win, so forecasts will be revised (probably down) ... And if Trump is elected, the changing forecasts would mean the markets will be volatile. He noted that his sales always slow when the markets are volatile.

My conclusion was that voting for a lower tax rate – and probably worse business conditions – seems penny-wise and pound foolish.

Weekend:

• Schedule for Week of Sept 25, 2016

Monday:

• At 10:00 AM ET, New Home Sales for August from the Census Bureau. The consensus is for an decrease in sales to 598 thousand Seasonally Adjusted Annual Rate (SAAR) in August from 654 thousand in July.

• At 10:00 AM, Dallas Fed Survey of Manufacturing Activity for September.

• From 9:00 to 10:30 PM ET: the First Presidential Debate at Hofstra University in New York.

From CNBC: Pre-Market Data and Bloomberg futures: S&P futures are up 1 and DOW futures are up 20 (fair value).

Oil prices were up over the last week with WTI futures at $44.85 per barrel and Brent at $46.26 per barrel. A year ago, WTI was at $45, and Brent was at $47 - so prices are down slightly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.20 per gallon (down less than $0.10 per gallon from a year ago).

Vehicle Sales Forecast: Sales to Rebound in September

by Calculated Risk on 9/25/2016 11:22:00 AM

The automakers will report September vehicle sales on Monday, October 3rd.

Note: There were 25 selling days in September, the same as in September 2015.

From WardsAuto: Forecast: U.S. SAAR to Rebound in September

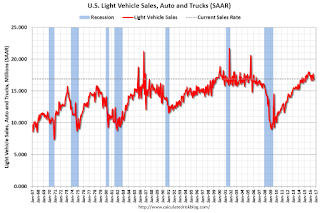

The forecast 17.6 million SAAR is greater than 16.9 million from prior-month and the 17.2 million over the first eight months of the year.This graph shows light vehicle sales since the BEA started keeping data in 1967.

emphasis added

The dashed line is the August sales rate.

The dashed line is the August sales rate.Sales for 2016 - through the first eight months - were up slightly from the comparable period last year.

After increasing significantly for several years following the financial crisis, auto sales are now mostly moving sideways.

Saturday, September 24, 2016

Schedule for Week of Sept 25, 2016

by Calculated Risk on 9/24/2016 08:11:00 AM

The key economic report this week is August New Home Sales. Other key indicators include Personal Income and Outlays for August, and the Case-Shiller House Price Index for July.

Also the third estimate of Q2 GDP will be released.

For manufacturing, the September Richmond and Dallas manufacturing surveys will be released this week.

A key focus will be on the first Presidential debate on Monday.

10:00 AM ET: New Home Sales for August from the Census Bureau.

10:00 AM ET: New Home Sales for August from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the July sales rate.

The consensus is for an decrease in sales to 598 thousand Seasonally Adjusted Annual Rate (SAAR) in August from 654 thousand in July.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for September.

From 9:00 to 10:30 PM: the First Presidential Debate at Hofstra University in New York.

9:00 AM ET: S&P/Case-Shiller House Price Index for July. Although this is the July report, it is really a 3 month average of May, June and July prices.

9:00 AM ET: S&P/Case-Shiller House Price Index for July. Although this is the July report, it is really a 3 month average of May, June and July prices.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the June 2016 report (the Composite 20 was started in January 2000).

The consensus is for a 5.2% year-over-year increase in the Comp 20 index for July. The Zillow forecast is for the National Index to increase 5.0% year-over-year in July.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for September. This is the last of the regional Fed surveys for September.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Durable Goods Orders for August from the Census Bureau. The consensus is for a 1.9% decrease in durable goods orders.

10:00 AM: Testimony by Fed Chair Janet Yellen, Supervision and Regulation, Before the Committee on Financial Services, U.S. House of Representatives

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 260 thousand initial claims, up from 252 thousand the previous week.

8:30 AM: Gross Domestic Product, 2nd quarter 2016 (Third estimate). The consensus is that real GDP increased 1.3% annualized in Q2, up from 1.1% in the second estimate.

10:00 AM: Pending Home Sales Index for August. The consensus is for a 0.5% increase in the index.

5:10 PM: Speech by Fed Chair Janet Yellen, Conversation with conference participants, At the Banking and the Economy: A Forum for Minority Bankers, Federal Reserve Bank of Kansas City, Kansas City, Missouri

8:30 AM ET: Personal Income and Outlays for August. The consensus is for a 0.2% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.2%.

9:45 AM: Chicago Purchasing Managers Index for September. The consensus is for a reading of 52.0, up from 51.5 in August.

10:00 AM: University of Michigan's Consumer sentiment index (final for September). The consensus is for a reading of 90.1, up from the preliminary reading 89.8.

Friday, September 23, 2016

FDIC Closes Bank in Arkansas; Fifth Failed Bank of 2016

by Calculated Risk on 9/23/2016 06:33:00 PM

From the FDIC: Today's Bank, Huntsville, Arkansas, Assumes All of the Deposits of Allied Bank Mulberry, Arkansas

Allied Bank, Mulberry, Arkansas, was closed today by the Arkansas State Banking Department, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Today's Bank, Huntsville, Arkansas, to assume all of the deposits of Allied Bank.The FDIC closed 8 banks last year, and is on pace for 6 or 7 in 2016. The number of failures this year will probably be the lowest since 2007 (3 failures).

...

As of June 30, 2016, Allied Bank had approximately $66.3 million in total assets and $64.7 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $6.9 million. ... Allied Bank is the fifth FDIC-insured institution to fail in the nation this year and the first in Arkansas. The last FDIC-insured institution closed in the state was First Southern Bank, Batesville, Arkansas, on December 17, 2010.

Philly Fed: State Coincident Indexes increased in 39 states in August

by Calculated Risk on 9/23/2016 02:11:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for August 2016. In the past month, the indexes increased in 39 states, decreased in nine, and remained stable in two, for a one-month diffusion index of 60. Over the past three months, the indexes increased in 41 states, decreased in eight, and remained stable in one, for a three month diffusion index of 66.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In August, 39 states had increasing activity.

Six states have seen declines over the last 6 months, in order they are Wyoming (worst), Louisiana, Montana, Kansas, Alaska and Oklahoma - mostly due to the decline in oil prices.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is mostly green now.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is mostly green now.Source: Philly Fed. Note: Complaints about red / green issues can be sent to the Philly Fed.

Unemployment and Wages: "A Dirty Little Secret"

by Calculated Risk on 9/23/2016 10:50:00 AM

I'm reminded of a post I wrote in May 2011: Employment: A dirty little secret

[I]t really isn't much of a secret that Wall Street and corporate America like the unemployment rate to be a little high. But it is "dirty" in the sense that it is unspoken. Higher unemployment keeps wage growth down, and helps with margins and earnings - and higher unemployment also keeps the Fed on the sidelines. Yes, corporations like to see job growth, so people have enough confidence to spend (and they can have a few more customers). And they definitely don't want to see Depression era unemployment - but a slowly declining unemployment rate (even at 9%) with some job growth is considered OK.And from others, like Kash Mansori, also in 2011: Why a Bad Job Market is Good News for Some

[T]his opens up an interesting line of reasoning, one that is certainly not new but which this data reminds us of. If a bad labor market means that workers get a smaller share of the productivity they bring to their employers, then the owners of companies will have a strong preference for a weak labor market. Firms don't like recessions, of course -- it's hard to make money when your sales are falling. But companies do enjoy the way that a very slow recovery in the job market can allow them to keep wages down, and thus keep a larger share of the output of their workers for themselves.And from Paul Krugman in 2013: The Plight of the Employed

And may I suggest that employers, although they’ll never say so in public, like this situation? That is, there’s a significant upside to them from the still-weak economy. I don’t think I’d go so far as to say that there’s a deliberate effort to keep the economy weak; but corporate America certainly isn’t feeling much pain, and the plight of workers is actually a plus from their point of view.The good news is that the unemployment rate has finally declined enough that are seeing a pickup in wage growth.

This graph is from the Atlanta Fed Wage Growth Tracker and shows year-over-year wage growth for job switchers and job stayers:

The Atlanta Fed's Wage Growth Tracker is a measure of the wage growth of individuals. It is constructed using microdata from the Current Population Survey (CPS), and is the median percent change in the hourly wage of individuals observed 12 months apart.This measure is indicating a pickup in wages - especially over the last year or two - and especially for job switchers.

Different policies (more infrastructure spending in 2011, no immediate pivot to austerity) would have boosted employment, and wages would have increased sooner.

Lawler: Table of Distressed Sales and All Cash Sales for Selected Cities in August

by Calculated Risk on 9/23/2016 08:21:00 AM

Economist Tom Lawler sent me the table below of short sales, foreclosures and all cash sales for selected cities in August.

On distressed: Total "distressed" share is down year-over-year in all of these markets.

Short sales and foreclosures are down in all of these areas (except a minor increase in Springfield).

The All Cash Share (last two columns) is mostly declining year-over-year. As investors continue to pull back, the share of all cash buyers continues to decline.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Aug- 2016 | Aug- 2015 | Aug- 2016 | Aug- 2015 | Aug- 2016 | Aug- 2015 | Aug- 2016 | Aug- 2015 | |

| Las Vegas | 4.1% | 6.2% | 5.5% | 7.0% | 9.6% | 13.2% | 25.8% | 28.2% |

| Phoenix | 2.1% | 2.7% | 2.3% | 3.4% | 4.4% | 6.1% | 20.3% | 22.6% |

| Sacramento | 2.9% | 4.3% | 2.9% | 3.8% | 5.8% | 8.0% | 15.3% | 18.8% |

| Minneapolis | 1.1% | 1.7% | 3.8% | 6.1% | 4.9% | 7.8% | 12.1% | 11.7% |

| Mid-Atlantic | 2.8% | 3.2% | 8.6% | 10.5% | 11.4% | 13.7% | 16.7% | 16.5% |

| Florida SF | 2.1% | 3.5% | 8.0% | 16.6% | 10.1% | 20.2% | 27.3% | 33.6% |

| Florida C/TH | 1.4% | 2.3% | 7.3% | 15.3% | 8.6% | 17.6% | 55.0% | 59.7% |

| Miami MSA SF | 2.9% | 5.9% | 9.5% | 17.9% | 12.4% | 23.8% | 26.5% | 32.0% |

| Miami MSA C/TH | 1.7% | 3.0% | 10.0% | 19.2% | 11.7% | 22.2% | 56.1% | 62.9% |

| Chicago (city) | 12.4% | 15.0% | ||||||

| Northeast Florida | 14.2% | 25.8% | ||||||

| Rhode Island | 8.0% | 10.1% | ||||||

| Spokane | 6.1% | 10.0% | ||||||

| Toledo | 24.9% | 30.3% | ||||||

| Tucson | 20.9% | 25.8% | ||||||

| Knoxville | 22.5% | 23.4% | ||||||

| Peoria | 20.2% | 17.2% | ||||||

| Georgia*** | 19.8% | 21.9% | ||||||

| Omaha | 15.2% | 16.9% | ||||||

| Pensacola | 24.3% | 30.6% | ||||||

| Richmond VA | 6.9% | 9.3% | 16.0% | 16.0% | ||||

| Memphis | 8.6% | 12.2% | ||||||

| Springfield IL** | 6.8% | 6.6% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||