by Calculated Risk on 10/11/2016 07:51:00 PM

Tuesday, October 11, 2016

Wednesday: Job Openings, FOMC Minutes

From Matthew Graham at Mortgage News Daily: Mortgage Rate Trend is Not Your Friend

Mortgage Rates were higher again today, marking the 9th straight day without any improvement. 3.625% is quickly becoming the most prevalent conventional 30yr fixed quotes on top tier scenarios, though quite a few lenders remain at 3.5%.Wednesday:

emphasis added

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, Job Openings and Labor Turnover Survey for August from the BLS. Jobs openings increased in July to 5.871 million from 5.643 million in June.

• At 2:00 PM, The Fed will release the FOMC minutes for the Meeting of September 20-21.

Fed Economic Letter: "What Is the New Normal for U.S. Growth?"

by Calculated Risk on 10/11/2016 04:35:00 PM

From economist John Fernald at the San Francisco Fed: What Is the New Normal for U.S. Growth?

This Economic Letter argues that the new normal pace for GDP growth, in real (inflation-adjusted) terms, might plausibly fall in the range of 1½ to 1¾%. This estimate is based on trends in demographics, education, and productivity. The aging and retirement of the baby boom generation is expected to hold down employment growth relative to population growth. Further, educational attainment has plateaued, reducing the contribution of labor quality to productivity growth. The slower forecast for overall GDP growth assumes that, apart from these effects, productivity growth is relatively normal, if modest—in line with its pace for most of the period since 1973.CR Note: I've made the argument before, based on demographics, that 2% is the new 4% for GDP.

...

This slower pace of growth has numerous implications. For workers, it means slow growth in average wages and living standards. For businesses, it implies relatively modest growth in sales. For policymakers, it suggests a low “speed limit” for the economy and relatively modest growth in tax revenue. It also suggests a lower equilibrium or neutral rate of interest (Williams 2016).

Boosting productivity growth above this modest pace will depend primarily on whether the private sector can find new and improved ways of doing business. Still, policy changes may help. For example, policies to improve education and lifelong learning can help raise labor quality and, thereby, labor productivity. Improving infrastructure can complement private activities. Finally, providing more public funding for research and development can make new innovations more likely in the future (Jones and Williams, 1998).

Dr. Fernald also discussed the impact of education attainment:

[F]uture educational attainment will add less to productivity growth. In recent decades, educational attainment of younger individuals has plateaued. This reduces productivity growth via increases in labor quality, which measures the combined contribution of education and experience. Labor quality has added about 0.4 percentage points to annual productivity growth since 1973. However, by early next decade, labor quality will contribute only about 0.10 to 0.20 percentage points to annual productivity growth (Bosler et al. 2016).

On its own, then, reduced labor quality growth suggests marking down productivity and GDP projections by at least two-tenths of a percentage point and possibly more.

Demographics: Renting vs. Owning

by Calculated Risk on 10/11/2016 02:03:00 PM

Note; This is an update to a post I wrote last year.

It was more than six years ago that we started discussing the turnaround for apartments. Then, in January 2011, I attended the NMHC Apartment Strategies Conference in Palm Springs, and the atmosphere was very positive.

The drivers in 2011 were 1) very low new supply, and 2) strong demand (favorable demographics, and people moving from owning to renting).

The move "from owning to renting" is probably over, and demographics for apartments are still somewhat positive - but less favorable than 6 years ago. Also much more supply has come online. Slowing demand and more supply for apartments is why I think growth in multi-family starts will slow this year (or maybe be flat compared to 2015).

On demographics, a large cohort had been moving into the 20 to 29 year old age group (a key age group for renters). Going forward, a large cohort will be moving into the 30 to 39 age group (a key for ownership).

Note: Household formation would be a better measure than population, but reliable data for households is released with a long lag.

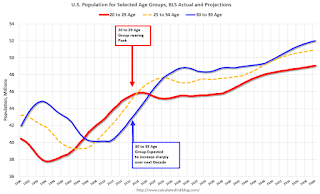

This graph shows the longer term trend for three key age groups: 20 to 29, 25 to 34, and 30 to 39 (the groups overlap).

This graph is from 1990 to 2060 (all data from BLS: current to 2060 is projected).

We can see the surge in the 20 to 29 age group (red). Once this group exceeded the peak in earlier periods, there was an increase in apartment construction. This age group will peak in 2018 (until the 2030s), and the 25 to 34 age group (orange, dashed) will peak in 2023. This suggests demand for apartments will soften in a few years.

For buying, the 30 to 39 age group (blue) is important (note: see Demographics and Behavior for some reasons for changing behavior). The population in this age group is increasing, and will increase significantly over the next decade.

This demographics is positive for home buying, and this is a key reason I expect single family housing starts to continue to increase in coming years.

Update: Framing Lumber Prices Up Year-over-year

by Calculated Risk on 10/11/2016 12:01:00 PM

Here is another update on framing lumber prices. Early in 2013 lumber prices came close to the housing bubble highs.

The price increases in early 2013 were due to a surge in demand (more housing starts) and supply constraints (framing lumber suppliers were working to bring more capacity online).

Prices didn't increase as much early in 2014 (more supply, smaller "surge" in demand).

In 2015, even with the pickup in U.S. housing starts, prices were down year-over-year. Note: Multifamily starts do not use as much lumber as single family starts, and there was a surge in multi-family starts. This decline in 2015 was also probably related to weakness in China.

Prices in 2016 are now up year-over-year.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through early October 2016 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are up 20% from a year ago, and CME futures are up about 40% year-over-year.

NFIB: Small Business Optimism Index "dips" in September

by Calculated Risk on 10/11/2016 09:31:00 AM

From the National Federation of Independent Business (NFIB): Small Business Optimism Dips Lower Before Election

The net percent of small business owners who expect better business conditions in the next six months jumped 12 points last month, according to the NFIB Small Business Economic Trends Report (SBET), released today, but that gain was erased by significantly weaker inventories and hard-to-fill job openings.

...

The Index of Small Business Optimism fell 0.3 points to 94.1, another monthly decline, and four points below the 40 year average of 98. ...

Fifty-eight percent reported hiring or trying to hire (up 2 points), but 48 percent reported few or no qualified applicants for the positions they were trying to fill. Seventeen percent of owners cited the difficulty of finding qualified workers as their single most important business problem. This issue ranks second behind taxes but tied with the cost of regulation and red tape.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index decreased to 94.1 in September.

Monday, October 10, 2016

Duy: Jobs Data Keeps Hawks Sidelined

by Calculated Risk on 10/10/2016 05:52:00 PM

From Tim Duy: Jobs Data Keeps Hawks Sidelined

Federal Reserve hawks face an array of labor market data that threatens a key pillar holding up their policy view. That pillar is the assertion that monthly nonfarm payroll growth over roughly 100k will soon force unemployment far below the natural rate, thus placing the US economy in grave danger from inflationary forces. By this view, the decline of unemployment long ago justified further rate hikes. Hawks failed to anticipate that the unemployment rate would flatten out at 5 percent despite steady payrolls growth. This outcome does not fit in their worldview. Fundamentally, they were supply-side pessimists. The recent strength in labor force growth suggests their pessimism was sorely misplaced and undermines their argument for immediate rate hikes. The key elements of the FOMC - the permanent voters - now stand as supply-side optimists and are prepared to hold rates at current levels through the next meeting, and perhaps even longer. A December rate hike is still not a foregone conclusion.There is much more in the post.

...

Bottom Line: A November rate hike remains dead. We have two labor reports until the December meeting. A continuation of recent trends would leave a rate hike at that meeting in doubt. Odds favor that meeting currently, but it is not a foregone conclusion. The doves are supply-side optimists. They want to let this rebound run for as long as possible. And remember, those closest to Federal Reserve Chair Janet Yellen are now those that inhabit the halls of Constitution Ave. Be wary of the words of hawkish Fed presidents; they have been very misleading this year.

Off-Topic: Litmus Test Moments and the Debate

by Calculated Risk on 10/10/2016 02:01:00 PM

Important Note: I've been writing this blog for 12 years, and I've written about economic policies, but I've avoided politics - until this year. On economics, I like to be able to link back to my posts about the housing bubble, that house prices might fall 40% or more in some areas, that the economy was bottoming in 2009, that house prices bottomed in early 2012, and on and on. In the future, I expect I will link back to my posts about Mr. Trump - and show that I criticized him early, often, and in the harshest terms - and show that I was on the right side of history.

The presidential "debate" last night was disgusting. We heard every extreme conspiracy theory, and a "candidate" for President having to apologize for his sexual comments.

A few truths: Trump lies repeatedly, he knows nothing about economics, and he is a disgusting person (his comments were not locker room comments). And his threat to jail his political opponent will be discussed and criticized for centuries.

Back in May, I wrote A Comment on Litmus Test Moments. I gave an example of some litmus test moments (issues that will come back and haunt people if they were on the wrong side - like the housing bubble). I argued that rejecting Trump will be a "litmus test" in the future.

I updated the post in August, see: Update on Litmus Test Moments.

Some advice: Rejecting Trump sooner is better than later, but publicly rejecting him before the election is critical. Here is a Republican Congressional Candidate rejecting Trump today:

Dr. Christopher Peters, the Republican candidate in Iowa’s 2nd Congressional district, is announcing today that he will not vote for Donald Trump for president. ...Send a message to the future! It is important that Trump loses and loses badly. You will feel better about yourself in a few years when you can honestly say you didn't vote for Trump. It will be even better if you can point to a public post opposing Trump written before the election (twitter, Facebook, blog, etc). You will thank me later.

“I should have spoken out against him much earlier, and regret that I failed to do so,” Peters adds.

Q3 Review: Ten Economic Questions for 2016

by Calculated Risk on 10/10/2016 09:59:00 AM

At the end of last year, I posted Ten Economic Questions for 2016. I followed up with a brief post on each question. The goal was to provide an overview of what I expected in 2016 (I don't have a crystal ball, but I think it helps to outline what I think will happen - and understand - and change my mind, when the outlook is wrong).

By request, here is a quick Q3 review. I've linked to my posts from the beginning of the year, with a brief excerpt and a few comments:

10) Question #10 for 2016: How much will housing inventory increase in 2016?

Right now my guess is active inventory will increase in 2016 (inventory will decline seasonally in December and January, but I expect to see inventory up again year-over-year in 2016). I don't expect a double digit surge in inventory, but maybe a mid-single digit increase year-over-year. If correct, this will keep house price increases down in 2015 (probably lower than the 5% or so gains in 2014 and 2015).According to the August NAR report on existing home sales, inventory was down 10.1% year-over-year in August, and the months-of-supply was at 4.7 months. It now appears inventory will decrease in 2016. I changed my view on this earlier this year.

Two of the key reasons inventory is low: 1) A large number of single family home and condos were converted to rental units. Last year, housing economist Tom Lawler estimated there were 17.5 million renter occupied single family homes in the U.S., up from 10.7 million in 2000. Many of these houses were purchased by investors, and rents have increased substantially, and the investors are not selling (even though prices have increased too). Most of these rental conversions were at the lower end, and that is limiting the supply for first time buyers. 2) Baby boomers are aging in place (people tend to downsize when they are 75 or 80, in another 10 to 20 years for the boomers). Instead we are seeing a surge in home improvement spending, and this is also limiting supply.

9) Question #9 for 2016: What will happen with house prices in 2016?

Low inventories, and a decent economy suggests further price increases in 2016. However I expect we will see prices up less in 2016, than in 2015, as measured by these house price indexes - mostly because I expect more inventory.If is early, but the recently released Case-Shiller data showed prices up 5.1% year-over-year in July. The price increase is a little lower than in 2015 (prices were up 5.25% nationally in 2015), even with less inventory.

8) Question #8 for 2016: How much will Residential Investment increase?

My guess is growth of around 4% to 8% in 2016 for new home sales, and about the same percentage growth for housing starts. Also I think the mix between multi-family and single family starts will shift a little more towards single family in 2016.Through August, starts were up 6.1% year-over-year compared to the same period in 2015. New home sales were up 13.3% year-over-year. My guess is starts will increase about 4% to 8% this year (as expected), new home sales will be little higher.

7) Question #7 for 2016: What about oil prices in 2016?

It is impossible to predict an international supply disruption, however if a significant disruption happens, then prices will move higher. Continued weakness in Europe and China seems likely, however sluggish demand will be somewhat offset by less tight oil production. It seems like the key oil producers (Saudi, etc) will continue production at current levels. This suggests in the short run (2016) that prices will stay low, but probably move up a little in 2016. I'll guess WTI will be up from the current price [WTI at $38 per barrel] by December 2016 (but still under $50 per barrel).As of this morning, WTI futures are at $51 per barrel.

6) Question #6 for 2016: Will real wages increase in 2016?

For this post the key point is that nominal wages have been only increasing about 2% per year with some pickup in 2015. As the labor market continues to tighten, we should start see more wage pressure as companies have to compete more for employees. I expect to see some further increase in nominal wage increases in 2016 (perhaps over 3% later in the year). The year-over-year change in real wages will depend on inflation, and I expect headline CPI to pickup some this year as the impact on headline inflation of declining oil prices fades.Through September, nominal hourly wages were up 2.6% year-over-year. This is a pickup from last year - and wage growth appears to be trending up. It looks like Wages will increase at a faster rate in 2016.

5) Question #5 for 2016: Will the Fed raise rates in 2016, and if so, by how much?

I've seen several people arguing the Fed will be cutting rates by the end of 2016 - I think that is unlikely. Instead I think the Fed will be cautious - and they will not want to reverse course. Right now I think something around three rate hikes in 2016 is likely.Events have pushed the Fed to delay rate increases, and it now looks like zero or one are the most likely number of rate hikes in 2016. My guess right now is the Fed will hike rates in December.

4) Question #4 for 2016: Will the core inflation rate rise in 2016? Will too much inflation be a concern in 2016?

Due to some remaining slack in the labor market (example: elevated level of part time workers for economic reasons), I expect these measures of inflation will be close to the Fed's target in 2016.It is early, but inflation has moved up close to the Fed target through August.

So currently I think core inflation (year-over-year) will increase further in 2016, but too much inflation will not be a serious concern in 2016.

3) Question #3 for 2016: What will the unemployment rate be in December 2016?

Depending on the estimate for the participation rate and job growth (next question), it appears the unemployment rate will decline to around 4.5% by December 2016. My guess is based on the participation rate declining slightly in 2016 and for decent job growth in 2016 (however less in 2016 than in 2015).The unemployment rate was 5.0% in September, unchanged from 5.0% in December. I still expect the unemployment rate to decline later this year.

2) Question #2 for 2016: How many payroll jobs will be added in 2016?

Energy related construction hiring will decline in 2016, but I expect other areas of construction to be solid. For manufacturing, growth in the auto sector will probably slow this year, but the drag on manufacturing employment from the strong dollar should be less in 2016.Through September 2016, the economy has added 1.6 million jobs; or 178,000 per month. It now appears employment gains will be lower than in 2015 (as expected), and somewhat below 200,000 per month in 2016.

As I mentioned above, in addition to layoffs in the energy sector, exporters will have a difficult year - but probably not the severe contraction as in 2015, and more companies will have difficulty finding qualified candidates. Even with some boost from lower oil prices - and some additional public hiring, I expect total jobs added to be lower in 2016 than in 2015.

So my forecast is for gains of around 200,000 payroll jobs per month in 2015. Lower than in 2015, but another solid year for employment gains given current demographics.

1) Question #1 for 2016: How much will the economy grow in 2016?

In addition, the sharp decline in oil prices should be a net positive for the US economy in 2016. And, hopefully, the negative impact from the strong dollar will fade in 2016. The most likely growth rate is in the mid-2% range again ...GDP growth was sluggish again in the first half (just up 1.1% annualized), and GDP is now tracking 2.1% in Q3.

Currently it looks like 2016 is unfolding mostly as expected with some key exceptions (one of the reasons I write down what I think will happen). I changed my view on Fed rate hikes earlier this year, and now I expect only 1 hike in 2016. I've also revised down my outlook for GDP and existing home inventory is declining again this year.

Residential investment, house prices, oil prices, inflation, wage growth and employment are unfolding about as I expected.

Sunday, October 09, 2016

Sunday Night Futures

by Calculated Risk on 10/09/2016 08:16:00 PM

Sunday Night from 9:00 PM to 10:30 PM ET: the Second Presidential Debate, at Washington University in St. Louis, St. Louis, MO.

From Politifact Live fact-checking the second Trump, Clinton presidential debate

Weekend:

• Schedule for Week of Oct 9, 2016

Monday:

• At 10:00 AM ET, The Fed will release the monthly Labor Market Conditions Index (LMCI).

From CNBC: Pre-Market Data and Bloomberg futures: S&P futures and DOW futures are mostly unchanged (fair value).

Oil prices were up over the last week with WTI futures at $49.23 per barrel and Brent at $51.32 per barrel. A year ago, WTI was at $46, and Brent was at $49 - so oil prices are UP year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.26 per gallon (down about 5 cents per gallon from a year ago).

Hotels: Occupancy Rate on Track to be 2nd Best Year

by Calculated Risk on 10/09/2016 11:18:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 1 October

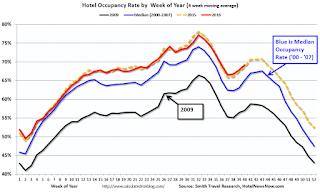

The U.S. hotel industry recorded positive results in the three key performance metrics during the week of 25 September through 1 October 2016, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In year-over-year comparisons, the industry’s occupancy increased 1.8% to 70.0%. Average daily rate (ADR) was up 1.3% to US$126.95. Revenue per available room (RevPAR) grew 3.2% to US$88.83.

emphasis added

The red line is for 2016, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.

The red line is for 2016, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.2015 was the best year on record for hotels.

So far 2016 is tracking just behind 2015, and well ahead of the median rate.

Year-to-date, the three best years are:

2015: 67.5% average occupancy.

2016: 67.3% average.

2000: 66.9% average.

For hotels, this is now the Fall business travel season that will continue for another month or so - and then the occupancy rate will decline into the holiday season.

Data Source: STR, Courtesy of HotelNewsNow.com