by Calculated Risk on 10/13/2016 11:33:00 AM

Thursday, October 13, 2016

A Recession in the Next Four Years?

The WSJ surveyed 59 "academic, business and financial economists" about the possibility of a recession in the next four years: Economists Believe a Recession Is Likely Within Next Four Years

The U.S. must face one of two scenarios: Either the next president will face a recession in office, or the U.S. will have the longest economic expansion in its history.Four years seems like forever and I usually only forecast out a year or a little more.

... Economists in The Wall Street Journal’s latest monthly survey of economists put the odds of the next downturn happening within the next four years at nearly 60%.

That is ... a recognition that throughout its history the American economy has never grown for more than a decade without a recession. Over the course of the next four years, something—whether exhaustion of the economy’s cyclical momentum, a policy mistake from the Federal Reserve or some outside shock—could knock the economy off course.

“We do not think expansions die of ‘old age’ but there’s more probability that a shock will hit the U.S. economy further out in the horizon,” said Lewis Alexander, chief U.S. economist at investment bank Nomura.

Looking back to 2005, I argued the housing bubble - and coming bust - would probably take the economy into recession. However it wasn't until January 2007 that I predicted a recession (and the recession started in December 2007).

That was a pretty obvious reason for a recession, and it took almost two years after the housing bust started for the recession to materialize. I don't currently see anything that will cause a recession.

I don't know about the odds in the next four years, but I doubt there will be a recession in 2017 (and 2018 seems unlikely too - but that is still a long time from now).

Weekly Initial Unemployment Claims at 246,000, 4-Week Average Lowest Since 1973

by Calculated Risk on 10/13/2016 08:33:00 AM

The DOL reported:

In the week ending October 8, the advance figure for seasonally adjusted initial claims was 246,000, unchanged from the previous week's revised level. The previous week's level was revised down by 3,000 from 249,000 to 246,000. The 4-week moving average was 249,250, a decrease of 3,500 from the previous week's revised average. This is the lowest level for this average since November 3, 1973 when it was 244,000. The previous week's average was revised down by 750 from 253,500 to 252,750.The previous week was revised down.

There were no special factors impacting this week's initial claims. This marks 84 consecutive weeks of initial claims below 300,000, the longest streak since 1970.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 249,250.

This was lower than the consensus forecast of 254,000. The low level of claims suggests relatively few layoffs.

Wednesday, October 12, 2016

Mortgage Rates at 4-Month Highs

by Calculated Risk on 10/12/2016 08:05:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates at 4-Month Highs

In and of itself, today wasn't too bad of a day. Mortgage Rates were only slightly higher, and were generally unfazed by the release of the Minutes from the most recent Fed meeting. Market participants were concerned about the Minutes making a clearer case for a rate hike at the next meeting. Ultimately, the Minutes didn't tell us anything we didn't already know and bond markets (which dictate mortgage rates) improved.Here is a table from Mortgage News Daily:

Now for the unfortunate aspects of the day! When we consider today in the context of the past 9 days, we see that it prolongs a depressingly long losing streak. Mortgage rates haven't moved lower since September 27th. Moreover, they're roughly a quarter point higher since then! As for today's bond market improvements, they were merely enough to get bonds back near yesterday's latest levels, due to significant overnight weakness. In other words, bonds lost more ground overnight and this morning than they were able to gain back this afternoon.

3.625% is now the most prevalent conventional 30yr fixed quote on top tier scenarios, but several lenders remain at 3.5%.

emphasis added

FOMC Minutes: "Could be greater scope for economic growth without putting undue pressure on labor markets"

by Calculated Risk on 10/12/2016 02:08:00 PM

Different views: Some FOMC members think that waiting might lead to later larger rate increases - and a recession. Other think "there could be greater scope for economic growth without putting undue pressure on labor markets". Most of the key FOMC members are in the second group.

From the Fed: Minutes of the Federal Open Market Committee, September 20-21, 2016 . Excerpts:

In their discussion of the outlook, participants considered the likelihood of, and the potential benefits and costs associated with, a more pronounced undershooting of the longer-run normal rate of unemployment than envisioned in their modal forecasts. A number of participants noted that they expected the unemployment rate to run somewhat below its longer-run normal rate and saw a firming of monetary policy over the next few years as likely to be appropriate. A few participants referred to historical episodes when the unemployment rate appeared to have fallen well below its estimated longer-run normal level. They observed that monetary tightening in those episodes typically had been followed by recession and a large increase in the unemployment rate. Several participants viewed this historical experience as relevant for the Committee's current decisionmaking and saw it as providing evidence that waiting too long to resume the process of policy firming could pose risks to the economic expansion, or noted that a significant increase in unemployment would have disproportionate effects on low-skilled workers and minority groups. Some others judged this historical experience to be of limited applicability in the present environment because the economy was growing only modestly above trend, inflation was below the Committee's 2 percent objective, and inflation expectations were low--circumstances that differed markedly from those earlier episodes. Moreover, the increase in labor force participation over the past year suggested that there could be greater scope for economic growth without putting undue pressure on labor markets; it was also noted that the longer-run normal rate of unemployment could be lower than previously thought, with a similar implication. Participants agreed that it would be useful to continue to analyze and discuss the dynamics of the adjustment of the economy and labor markets in circumstances when unemployment falls well below its estimated longer-run normal rate.

emphasis added

BLS: Job Openings decreased in August

by Calculated Risk on 10/12/2016 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings decreased to 5.4 million on the last business day of August, the U.S. Bureau of Labor Statistics reported today. Hires and separations were little changed at 5.2 million and 5.0 million, respectively. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

The number of quits was essentially unchanged in August at 3.0 million. The quits rate was 2.1 percent. Over the month, the number of quits was little changed for total private and for government.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for August, the most recent employment report was for September.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings decreased in August to 5.443 million from 5.831 million in July.

The number of job openings (yellow) are up 3% year-over-year.

Quits are up 4% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Even with the decline in Job Openings, this is another solid report.

MBA: "Mortgage Applications Decrease in Latest Weekly Survey"

by Calculated Risk on 10/12/2016 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 6.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 7, 2016.

... The Refinance Index decreased 8 percent from the previous week, to its lowest level since June 2016. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 27 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to its highest level since September 2016, 3.68 percent, from 3.62 percent, with points increasing to 0.35 from 0.32 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity has increased this year since rates have declined. Since rates are up a little recently, refinance activity has declined a little.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The purchase index was "27 percent higher than the same week one year ago". Don't read too much into the year-over-year increase - remember last year there was a sharp increase in applications the week prior to the TILA-RESPA regulatory change, and the following week applications plunged 28%. Since this is a comparison to the week following the regulatory change, applications are up year-over-year. This will smooth out soon.

Tuesday, October 11, 2016

Wednesday: Job Openings, FOMC Minutes

by Calculated Risk on 10/11/2016 07:51:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rate Trend is Not Your Friend

Mortgage Rates were higher again today, marking the 9th straight day without any improvement. 3.625% is quickly becoming the most prevalent conventional 30yr fixed quotes on top tier scenarios, though quite a few lenders remain at 3.5%.Wednesday:

emphasis added

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, Job Openings and Labor Turnover Survey for August from the BLS. Jobs openings increased in July to 5.871 million from 5.643 million in June.

• At 2:00 PM, The Fed will release the FOMC minutes for the Meeting of September 20-21.

Fed Economic Letter: "What Is the New Normal for U.S. Growth?"

by Calculated Risk on 10/11/2016 04:35:00 PM

From economist John Fernald at the San Francisco Fed: What Is the New Normal for U.S. Growth?

This Economic Letter argues that the new normal pace for GDP growth, in real (inflation-adjusted) terms, might plausibly fall in the range of 1½ to 1¾%. This estimate is based on trends in demographics, education, and productivity. The aging and retirement of the baby boom generation is expected to hold down employment growth relative to population growth. Further, educational attainment has plateaued, reducing the contribution of labor quality to productivity growth. The slower forecast for overall GDP growth assumes that, apart from these effects, productivity growth is relatively normal, if modest—in line with its pace for most of the period since 1973.CR Note: I've made the argument before, based on demographics, that 2% is the new 4% for GDP.

...

This slower pace of growth has numerous implications. For workers, it means slow growth in average wages and living standards. For businesses, it implies relatively modest growth in sales. For policymakers, it suggests a low “speed limit” for the economy and relatively modest growth in tax revenue. It also suggests a lower equilibrium or neutral rate of interest (Williams 2016).

Boosting productivity growth above this modest pace will depend primarily on whether the private sector can find new and improved ways of doing business. Still, policy changes may help. For example, policies to improve education and lifelong learning can help raise labor quality and, thereby, labor productivity. Improving infrastructure can complement private activities. Finally, providing more public funding for research and development can make new innovations more likely in the future (Jones and Williams, 1998).

Dr. Fernald also discussed the impact of education attainment:

[F]uture educational attainment will add less to productivity growth. In recent decades, educational attainment of younger individuals has plateaued. This reduces productivity growth via increases in labor quality, which measures the combined contribution of education and experience. Labor quality has added about 0.4 percentage points to annual productivity growth since 1973. However, by early next decade, labor quality will contribute only about 0.10 to 0.20 percentage points to annual productivity growth (Bosler et al. 2016).

On its own, then, reduced labor quality growth suggests marking down productivity and GDP projections by at least two-tenths of a percentage point and possibly more.

Demographics: Renting vs. Owning

by Calculated Risk on 10/11/2016 02:03:00 PM

Note; This is an update to a post I wrote last year.

It was more than six years ago that we started discussing the turnaround for apartments. Then, in January 2011, I attended the NMHC Apartment Strategies Conference in Palm Springs, and the atmosphere was very positive.

The drivers in 2011 were 1) very low new supply, and 2) strong demand (favorable demographics, and people moving from owning to renting).

The move "from owning to renting" is probably over, and demographics for apartments are still somewhat positive - but less favorable than 6 years ago. Also much more supply has come online. Slowing demand and more supply for apartments is why I think growth in multi-family starts will slow this year (or maybe be flat compared to 2015).

On demographics, a large cohort had been moving into the 20 to 29 year old age group (a key age group for renters). Going forward, a large cohort will be moving into the 30 to 39 age group (a key for ownership).

Note: Household formation would be a better measure than population, but reliable data for households is released with a long lag.

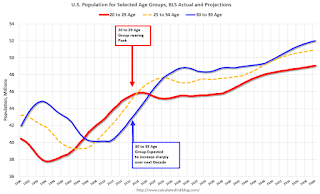

This graph shows the longer term trend for three key age groups: 20 to 29, 25 to 34, and 30 to 39 (the groups overlap).

This graph is from 1990 to 2060 (all data from BLS: current to 2060 is projected).

We can see the surge in the 20 to 29 age group (red). Once this group exceeded the peak in earlier periods, there was an increase in apartment construction. This age group will peak in 2018 (until the 2030s), and the 25 to 34 age group (orange, dashed) will peak in 2023. This suggests demand for apartments will soften in a few years.

For buying, the 30 to 39 age group (blue) is important (note: see Demographics and Behavior for some reasons for changing behavior). The population in this age group is increasing, and will increase significantly over the next decade.

This demographics is positive for home buying, and this is a key reason I expect single family housing starts to continue to increase in coming years.

Update: Framing Lumber Prices Up Year-over-year

by Calculated Risk on 10/11/2016 12:01:00 PM

Here is another update on framing lumber prices. Early in 2013 lumber prices came close to the housing bubble highs.

The price increases in early 2013 were due to a surge in demand (more housing starts) and supply constraints (framing lumber suppliers were working to bring more capacity online).

Prices didn't increase as much early in 2014 (more supply, smaller "surge" in demand).

In 2015, even with the pickup in U.S. housing starts, prices were down year-over-year. Note: Multifamily starts do not use as much lumber as single family starts, and there was a surge in multi-family starts. This decline in 2015 was also probably related to weakness in China.

Prices in 2016 are now up year-over-year.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through early October 2016 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are up 20% from a year ago, and CME futures are up about 40% year-over-year.