by Calculated Risk on 10/17/2016 08:33:00 AM

Monday, October 17, 2016

NY Fed: October "General business conditions index slipped five points to -6.8"

From the NY Fed: Empire State Manufacturing Survey

Business activity continued to decline in New York State, according to firms responding to the October 2016 Empire State Manufacturing Survey. The headline general business conditions index slipped five points to -6.8.This was below the consensus forecast of 1.0, and suggests manufacturing contracted in the NY region in October.

...

After reaching their lowest levels of the year last month, both labor market indexes rose, but remained negative. The employment index increased ten points to -4.7 and the average workweek index edged up one point to -10.4, indicating that employment counts and hours worked continued to decline.

...

Indexes for the six-month outlook suggested that respondents were more optimistic about future conditions than in September. The index for future business conditions increased two points to 36.0.

Sunday, October 16, 2016

Sunday Night Futures

by Calculated Risk on 10/16/2016 08:23:00 PM

Weekend:

• Schedule for Week of Oct 16, 2016

Monday:

• At 8:30 AM ET, The New York Fed Empire State manufacturing survey for October. The consensus is for a reading of 1.0, up from -2.0.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for September. The consensus is for a 0.2% increase in Industrial Production, and for Capacity Utilization to increase to 75.6%.

From CNBC: Pre-Market Data and Bloomberg futures: S&P futures and DOW futures are down slightly (fair value).

Oil prices were up over the last week with WTI futures at $50.04 per barrel and Brent at $51.74 per barrel. A year ago, WTI was at $47, and Brent was at $49 - so oil prices are UP year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.23 per gallon (down about 5 cents per gallon from a year ago).

LA area Port Traffic: Exports up Year-over-year in September

by Calculated Risk on 10/16/2016 12:48:00 PM

From Port of Long Beach: September Cargo Weighed Down by Hanjin Bankruptcy

Port of Long Beach container volumes declined 16.6 percent year-over-year in September, as the effects of the Hanjin bankruptcy reached West Coast ports.Special note: Now that the expansion to the Panama Canal has been completed, some of the traffic that used the ports of Los Angeles and Long Beach will eventually go through the canal. This could impact TEUs on the West Coast in the future.

Longshore workers moved 546,805 twenty-foot equivalent units last month. This included 282,945 TEUs in imports, down 15 percent from September 2015, a month which capped off the Port’s best quarter ever. Exports dropped to 120,383 TEUs, a decrease of 4.2 percent. Empties were 27.2 percent lower at 143,476 TEUs.

Port officials said the number of containers handled during September was impacted not only by reduced calls by Hanjin-operated ships, but also by the absence of Hanjin containers on vessels operated by fellow CKYHE Alliance members. Hanjin Shipping containers account for approximately 12.3 percent of the Port’s total containerized volume.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.On a rolling 12 month basis, inbound traffic was down 0.4% compared to the rolling 12 months ending in August. Outbound traffic was up 0.5% compared to 12 months ending in August.

The downturn in exports last year was probably due to the slowdown in China and the stronger dollar. Now exports are picking up a little.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year). In general exports might have started increasing, and imports have been gradually increasing.

Saturday, October 15, 2016

Schedule for Week of Oct 16, 2016

by Calculated Risk on 10/15/2016 08:08:00 AM

The key economic reports this week are September housing starts, Existing Home Sales and Consumer Price Index (CPI).

For manufacturing, September industrial production, and the October New York and Philly Fed manufacturing surveys, will be released this week.

A key focus will be on the third Presidential debate on Wednesday, Oct 19th.

8:30 AM ET: The New York Fed Empire State manufacturing survey for October. The consensus is for a reading of 1.0, up from -2.0.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for September.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for September.This graph shows industrial production since 1967.

The consensus is for a 0.2% increase in Industrial Production, and for Capacity Utilization to increase to 75.6%.

8:30 AM: The Consumer Price Index for September from the BLS. The consensus is for 0.3% increase in CPI, and a 0.2% increase in core CPI.

10:00 AM: The October NAHB homebuilder survey. The consensus is for a reading of 63, down from 65 in September. Any number above 50 indicates that more builders view sales conditions as good than poor.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Housing Starts for September.

8:30 AM: Housing Starts for September. Total housing starts decreased to 1.142 million (SAAR) in August. Single family starts decreased to 722 thousand SAAR in August.

The consensus for 1.180 million, up from the August rate.

During the day: The AIA's Architecture Billings Index for September (a leading indicator for commercial real estate).

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

At 9:00 PM ET, the Third Presidential Debate, at University of Nevada, Las Vegas, Las Vegas, NV

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 250 thousand initial claims, up from 246 thousand the previous week. Note: I expect a larger increase in claims than the consensus due to Hurricane Matthew.

8:30 AM: the Philly Fed manufacturing survey for October. The consensus is for a reading of 7.0, up from 12.8.

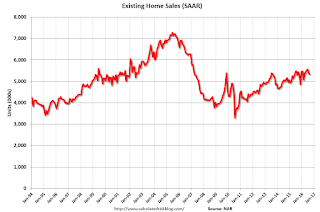

10:00 AM: Existing Home Sales for September from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for September from the National Association of Realtors (NAR).The consensus is for 5.35 million SAAR, up from 5.33 million in August.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for September 2016

Friday, October 14, 2016

Q3 GDP Forecasts

by Calculated Risk on 10/14/2016 08:43:00 PM

From the Altanta Fed: GDPNow

The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2016 is 1.9 percent on October 14, down from 2.1 percent on October 7. The forecast of third-quarter real personal consumption expenditures growth fell from 2.9 percent to 2.6 percent after this morning's retail sales report from the U.S. Census Bureau.From the NY Fed Nowcasting Report

emphasis added

The FRBNY Staff Nowcast stands at 2.3% for 2016:Q3 and 1.6% for 2016:Q4.From Merrill Lynch:

Retail sales increased 0.6% in September, as expected. However, "core" retail sales which nets out autos, building materials and gasoline, only increased 0.1%. This was below the consensus expectation of 0.4%. The August data were not revised but July retail sales were lowered to show a decline of 0.2% versus the prior estimate of a drop of 0.1%. As such, despite the fact that we were forecasting 0.1% mom for September core sales, our tracking estimate for GDP declined due to the downward revision to July. We sliced 0.2pp from our tracking, bringing our estimate of 3Q GDP growth to 2.7%.CR Note: Looks like real GDP growth around 2.0% to 2.5% in Q3.

Sacramento Housing in September: Sales up 3%, Active Inventory down 3.5% YoY

by Calculated Risk on 10/14/2016 01:50:00 PM

During the recession, I started following the Sacramento market to look for changes in the mix of houses sold (equity, REOs, and short sales). For a few years, not much changed. But in 2012 and 2013, we saw some significant changes with a dramatic shift from distressed sales to more normal equity sales.

This data suggests healing in the Sacramento market and other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In September, total sales were up 2.9% from September 2015, and conventional equity sales were up 4.8% compared to the same month last year.

In September, 4.5% of all resales were distressed sales. This was down from 5.7% last month, and down from 6.8% in September 2015.

The percentage of REOs was at 2.9% in August, and the percentage of short sales was 1.6%.

Here are the statistics.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional (equity) sales that started in 2012 (blue) as the percentage of distressed sales declined sharply.

Active Listing Inventory for single family homes decreased 3.5% year-over-year (YoY) in September. This was the seventeenth consecutive monthly YoY decrease in inventory in Sacramento.

Cash buyers accounted for 14.8% of all sales (frequently investors).

Summary: This data suggests a normal market with few distressed sales, and less investor buying - but with limited inventory.

Preliminary October Consumer Sentiment declines to 87.9

by Calculated Risk on 10/14/2016 10:08:00 AM

The preliminary University of Michigan consumer sentiment index for October was at 87.9, down from 91.2 in September.

he Sentiment Index slipped in early October to its lowest level since last September and the second lowest level in the past two years. The early October loss was concentrated among households with incomes below $75,000, whose Index fell to its lowest level since August of 2014. In contrast, confidence among upper income households remained unchanged in early October from last month, and more importantly, at a level that was nearly identical to its average in the prior twenty-four months (98.3 vs. 98.2). Perhaps the most concerning figure was a decline in the Expectations Index, which fell to its lowest level in the past two years, again mainly due to declines among households with incomes below $75,000. It is likely that the uncertainty surrounding the presidential election had a negative impact, especially among lower income consumers, and without that added uncertainty, the confidence measures may not have weakened.

emphasis added

Click on graph for larger image.

Retail Sales increased 0.6% in September

by Calculated Risk on 10/14/2016 08:38:00 AM

On a monthly basis, retail sales increased 0.6 percent from August to September (seasonally adjusted), and sales were up 2.7% from September 2015.

From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for September, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $459.8 billion, an increase of 0.6 percent from the previous month, and 2.7 percent above September 2015. ... The July 2016 to August 2016 percent change was revised from down 0.3 percent to down 0.2 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.5% in September.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales ex-gasoline increased by 3.3% on a YoY basis.

Retail and Food service sales ex-gasoline increased by 3.3% on a YoY basis.The increase in September was at expectations and the previous two months were revised up; a solid report.

Thursday, October 13, 2016

Friday: Retail Sales, PPI, Yellen

by Calculated Risk on 10/13/2016 07:11:00 PM

Friday:

• At 8:30 AM ET, The Producer Price Index for September from the BLS. The consensus is for a 0.2% increase in prices, and a 0.1% increase in core PPI.

• Also at 8:30 AM, Retail sales for September will be released. The consensus is for 0.6% increase in retail sales in September.

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for August. The consensus is for a 0.1% increase in inventories.

• Also at 10:00 AM, University of Michigan's Consumer sentiment index (preliminary for October). The consensus is for a reading of 92.0, up from 91.2 in August.

• At 1:30 PM, Speech by Fed Chair Janet Yellen, Macroeconomic Research After the Crisis, At the Federal Reserve Bank of Boston’s Annual Research Conference: The Elusive "Great" Recovery: Causes and Implications for Future Business Cycle Dynamics, Boston, Massachusetts

Merrill on September CPI

by Calculated Risk on 10/13/2016 03:34:00 PM

Here is an excerpt from Merrill Lynch research piece today on September CPI to be released next week:

Consumer prices likely rose by 0.3% mom in September, lifting the year-on-year rate to 1.5%. We see a healthy gain in energy prices (up 2.6% mom), although food prices were likely once again weak. Excluding food and energy, we see a mere 0.1% mom increase: the previous months’ gain looks outsized, particularly for medical care commodities prices and we could get some payback. In this scenario, the year-on-year rate for core CPI could slow slightly to 2.2%This probably means that CPI-W will be positive year-over-year, and the Cost-of-Living-Adjustment (COLA) will be positive for next year (although small). But even with a small increase in COLA, the contribution base will increase significantly.