by Calculated Risk on 10/24/2016 04:29:00 PM

Monday, October 24, 2016

Lawler: Table of Distressed Sales and All Cash Sales for Selected Cities in September

Economist Tom Lawler sent me the table below of short sales, foreclosures and all cash sales for selected cities in September.

On distressed: Total "distressed" share is down year-over-year in most of these markets.

Short sales and foreclosures are down in most of these areas.

The All Cash Share (last two columns) is mostly declining year-over-year. As investors continue to pull back, the share of all cash buyers continues to decline.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Sep- 2016 | Sep- 2015 | Sep- 2016 | Sep- 2015 | Sep- 2016 | Sep- 2015 | Sep- 2016 | Sep- 2015 | |

| Las Vegas | 4.6% | 6.8% | 6.0% | 7.1% | 10.6% | 13.9% | 26.5% | 26.8% |

| Reno** | 3.0% | 3.0% | 2.0% | 3.0% | 5.0% | 6.0% | ||

| Phoenix | 1.7% | 2.4% | 2.0% | 3.5% | 3.7% | 5.9% | 20.2% | 23.1% |

| Sacramento | 1.4% | 2.9% | 3.1% | 4.1% | 4.5% | 6.9% | 16.3% | 17.6% |

| Minneapolis | 1.1% | 1.9% | 4.3% | 6.6% | 5.4% | 8.5% | 12.8% | 12.5% |

| Mid-Atlantic | 3.1% | 3.9% | 8.9% | 11.1% | 11.9% | 14.9% | 16.5% | 17.5% |

| Florida SF | 2.3% | 3.5% | 7.8% | 16.0% | 10.1% | 19.4% | 28.0% | 34.1% |

| Florida C/TH | 1.6% | 2.1% | 7.0% | 14.3% | 8.6% | 16.4% | 55.8% | 59.7% |

| Miami MSA SF | 3.3% | 5.1% | 9.4% | 18.6% | 12.7% | 23.7% | 28.5% | 33.2% |

| Miami MSA CTH | 2.7% | 2.7% | 9.5% | 18.0% | 12.1% | 20.7% | 58.1% | 63.0% |

| Chicago (city) | 12.1% | 17.5% | ||||||

| Spokane | 7.8% | 7.8% | ||||||

| Northeast Florida | 12.9% | 23.4% | ||||||

| Orlando | 31.3% | 35.5% | ||||||

| Toledo | 28.0% | 26.5% | ||||||

| Tucson | 22.2% | 25.9% | ||||||

| Peoria | 20.5% | 22.3% | ||||||

| Georgia*** | 20.8% | 22.3% | ||||||

| Omaha | 15.5% | 18.1% | ||||||

| Pensacola | 29.1% | 31.4% | ||||||

| Rhode Island | 11.1% | 9.0% | ||||||

| Richmond VA | 8.7% | 10.5% | 18.4% | 15.2% | ||||

| Memphis | 8.8% | 13.1% | ||||||

| Springfield IL** | 9.7% | 10.3% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

DOT: Vehicle Miles Driven increased 3.4% year-over-year in August

by Calculated Risk on 10/24/2016 01:37:00 PM

The Department of Transportation (DOT) reported:

Travel on all roads and streets changed by 3.4% (9.3 billion vehicle miles) for August 2016 as compared with August 2015.The following graph shows the rolling 12 month total vehicle miles driven to remove the seasonal factors.

Travel for the month is estimated to be 284.9 billion vehicle miles.

The seasonally adjusted vehicle miles traveled for August 2016 is 268.6 billion miles, a 2.5% (6.5 billion vehicle miles) increase over August 2015. It also represents a 0.8% decrease (-2.2 billion vehicle miles) compared with July 2016.

The rolling 12 month total is moving up - mostly due to lower gasoline prices - after moving sideways for several years.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Miles driven (rolling 12) had been below the previous peak for 85 months - an all time record - before reaching a new high for miles driven in January 2015.

The second graph shows the year-over-year change from the same month in the previous year. Miles driven are up 3.4% year-over-year.

In August 2016, gasoline averaged $2.28 per gallon according to the EIA. That was down from August 2015 when prices averaged $2.73 per gallon.

In August 2016, gasoline averaged $2.28 per gallon according to the EIA. That was down from August 2015 when prices averaged $2.73 per gallon.Gasoline prices aren't the only factor - demographics are also important. However, with lower gasoline prices, miles driven on a rolling 12 month basis, is setting a new high each month.

WSJ: "Retailers Rushed to Hire for Holidays"

by Calculated Risk on 10/24/2016 10:40:00 AM

From the Eric Morath at the WSJ: Retailers Rushed to Hire for Holidays, a Sign of Tight Labor Market

Retailers geared up to hire holiday-season workers in August this year, an unusually early start showing how competition has intensified for temporary help in a tight labor market.Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. Here is a graph that shows the historical net retail jobs added for October, November and December by year.

Data from job-search site Indeed.com shows retailers, and the warehouse and logistics firms they compete with for seasonal labor, started searching for temporary workers a month earlier than in recent years. This suggests retailers and other firms “anticipate stronger consumer demand and expect that it will be harder to find the people they want to hire,” said Indeed economist Jed Kolko.

Last year, more than one in four retail workers hired in the fourth quarter of 2015 started their jobs in October, the highest share on records back to the 1930s.

Click on graph for larger image.

Click on graph for larger image.This graph really shows the collapse in retail hiring in 2008. Since then seasonal hiring has increased back close to more normal levels.

Note that retailers have been hiring earlier with more seasonal hires in October (red).

Based on the information in the WSJ article, it appears seasonal hiring will be at record levels in October this year.

Chicago Fed "Economic Growth Picked Up in September"

by Calculated Risk on 10/24/2016 08:37:00 AM

From the Chicago Fed: Economic Growth Picked Up in September

Led by improvements in production-related indicators, the Chicago Fed National Activity Index (CFNAI) increased to –0.14 in September from –0.72 in August. All four broad categories of indicators that make up the index increased from August, but in September, all four categories made negative contributions to the index for the second straight month.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, edged down to –0.21 in September from –0.14 in August. September’s CFNAI-MA3 suggests that growth in national economic activity was somewhat below its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was below the historical trend in September (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Sunday, October 23, 2016

Sunday Night Futures

by Calculated Risk on 10/23/2016 08:24:00 PM

Weekend:

• Schedule for Week of Oct 23, 2016

Monday:

• At 8:30 AM ET, the Chicago Fed National Activity Index for September. This is a composite index of other data.

From CNBC: Pre-Market Data and Bloomberg futures: S&P futures and DOW futures are up slightly (fair value).

Oil prices were mixed over the last week with WTI futures at $50.67 per barrel and Brent at $51.61 per barrel. A year ago, WTI was at $44, and Brent was at $47 - so oil prices are UP about 10% to 15% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.21 per gallon (close to unchanged from a year ago). Gasoline prices will be up year-over-year soon.

Vehicle Sales Forecasts: Sales Over 17 Million SAAR Again in October

by Calculated Risk on 10/23/2016 12:41:00 PM

The automakers will report October vehicle sales on Tuesday, November 1st.

Note: There were 26 selling days in October 2016, down from 28 in October 2015.

From WardsAuto: Forecast: October Daily Sales to Reach 15-Year High

A WardsAuto forecast calls for October U.S. light-vehicle sales to reach a 17.8 million-unit seasonally adjusted annual rate, making it the seventh month this year to surpass 17 million.From J.D. Power: New-Vehicle Retail Sales in October Slip; Sixth Monthly Decline of 2016

A 17.8 million SAAR is greatly higher than the 17.3 million recorded year-to-date through September, but does not beat the 18.1 million result recorded in the same month last year.

emphasis added

The SAAR for total sales is projected at 17.7 million units in October 2016, down from 18.1 million units a year ago.This graph shows light vehicle sales since the BEA started keeping data in 1967.

The dashed line is the September sales rate.

The dashed line is the September sales rate.Sales for 2016 - through the first nine months - were up slightly from the comparable period last year.

After increasing significantly for several years following the financial crisis, auto sales are now mostly moving sideways.

Saturday, October 22, 2016

Schedule for Week of Oct 23, 2016

by Calculated Risk on 10/22/2016 08:01:00 AM

The key economic reports this week are the advance estimate of Q3 GDP and September New Home Sales.

Also the Case-Shiller House Price Index for August will be released.

For manufacturing, the October Richmond and Kansas City Fed manufacturing surveys will be released this week.

8:30 AM ET: Chicago Fed National Activity Index for September. This is a composite index of other data.

9:00 AM: FHFA House Price Index for August 2016. This was originally a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.5% month-to-month increase for this index.

9:00 AM ET: S&P/Case-Shiller House Price Index for August. Although this is the August report, it is really a 3 month average of June, July and August prices.

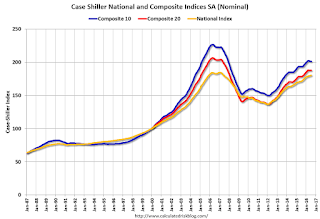

9:00 AM ET: S&P/Case-Shiller House Price Index for August. Although this is the August report, it is really a 3 month average of June, July and August prices.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the July 2016 report (the Composite 20 was started in January 2000).

The consensus is for a 5.1% year-over-year increase in the Comp 20 index for August. The Zillow forecast is for the National Index to increase 5.2% year-over-year in August.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for October.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM ET: New Home Sales for September from the Census Bureau.

10:00 AM ET: New Home Sales for September from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the August sales rate.

The consensus is for an decrease in sales to 600 thousand Seasonally Adjusted Annual Rate (SAAR) in September from 609 thousand in August.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 255 thousand initial claims, down from 260 thousand the previous week. Note: I expect some further impact on claims due to Hurricane Matthew.

8:30 AM: Durable Goods Orders for September from the Census Bureau. The consensus is for a 0.2% increase in durable goods orders.

10:00 AM: Pending Home Sales Index for September. The consensus is for a 1.0% increase in the index.

10:00 AM: the Q3 Housing Vacancies and Homeownership from the Census Bureau.

11:00 AM: Kansas City Fed Survey of Manufacturing Activity for October.

8:30 AM ET: Gross Domestic Product, 3rd quarter 2016 (Advance estimate). The consensus is that real GDP increased 2.5% annualized in Q3.

10:00 AM: University of Michigan's Consumer sentiment index (final for October). The consensus is for a reading of 88.5, up from the preliminary reading 87.9.

Friday, October 21, 2016

"The Structural Factors Behind the Steady Fall in Labor Force Participation Rates of Prime Age Workers"

by Calculated Risk on 10/21/2016 05:38:00 PM

Here is some additional analysis on the labor force participation rate. Dr. Frank Lysy discusses the various reasons for the decline in the labor force participation rate for prime age workers - especially the multi-decade decline for prime working age men: The Structural Factors Behind the Steady Fall in Labor Force Participation Rates of Prime Age Workers. Here is the introduction:

Increasing attention has recently been directed to the decline in labor force participation rates observed for men over the last several decades, and for women since the late 1990s. The chart above tracks this. It has indeed been dubbed (for men) a “quiet catastrophe” in a new book by Nicholas Eberstadt titled “Men Without Work”.Dr. Lysy discusses the various reasons for the decline (disability, "Mr. Mom", more prime workers in school, etc.).

The issue has been taken up by those both on the right and on the left. Even President Obama, in one of the rare “By invitation” pieces that The Economist occasionally publishes, has highlighted the concern in an article under his name in last week’s issue (the issue of October 8). President Obama treats it as one of “four crucial areas of unfinished business” his successor will need to address. A chart similar to that above is shown. President Obama notes that in 1953, just 3% of men between the ages of 25 and 54 were not working, while the figure today is 12% (that is, the labor force participation rate fell from 97% to 88%). The share of women of the same age group not participating in the formal labor market has similarly been falling since 1999.

While Obama is careful in his wording not to say directly that all of this increase in those not working was due to “involuntary joblessness”, he does note that involuntary joblessness takes a devastating toll on those unable to find jobs. This is certainly correct. The fundamental question, however, is to what degree do we know whether the rise has been involuntary, and to what degree has it risen due to possibly more benign factors with rational choices being made.

Q3 GDP Forecasts

by Calculated Risk on 10/21/2016 02:03:00 PM

The advance GDP report for Q3 GDP will be released next Friday. The consensus is real GDP increased at a 2.5% Seasonally Adjusted Annual Rate in Q3.

From the Altanta Fed: GDPNow

The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2016 is 2.0 percent on October 19, up from 1.9 percent on October 14.From the NY Fed Nowcasting Report

emphasis added

The FRBNY Staff Nowcast stands at 2.2% for 2016:Q3 and 1.4% for 2016:Q4.From Merrill Lynch:

We expect the first estimate of 3Q GDP to show growth of 2.5% qoq saar, an improvement from the 1.4% pace in 2Q and 0.8% gain in 1Q. Although consumer spending is expected to slow from the strong 4.3% increase in 2Q, we still expect a solid 2.6% increase in 3Q, owing to strong auto sales.CR Note: Looks like real GDP growth was around 2.0% to 2.5% in Q3.

BLS: Unemployment Rates stable in 42 states in September

by Calculated Risk on 10/21/2016 10:26:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were significantly lower in September in 7 states, higher in 1 state, and stable in 42 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today.

...

New Hampshire and South Dakota had the lowest jobless rates in September, 2.9 percent each. Alaska had the highest unemployment rate, 6.9 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement. The yellow squares are the lowest unemployment rate per state since 1976.

The states are ranked by the highest current unemployment rate. Alaska, at 6.9%, had the highest state unemployment rate. Note that the lowest unemployment rate in Alaska was 6.3%, so this is pretty close to the all time low.

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).Currently no state has an unemployment rate at or above 7% (light blue); Only four states and D.C are at or above 6% (dark blue). The states are Alaska (6.9%), New Mexico (6.7%), Louisiana (6.4%), D.C. (6.1%), and Mississippi (6.0%).