by Calculated Risk on 11/08/2016 10:05:00 AM

Tuesday, November 08, 2016

BLS: Job Openings increased slightly in September

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings was little changed at 5.5 million on the last business day of September, the U.S. Bureau of Labor Statistics reported today. Hires edged down to 5.1 million and total separations was little changed at 4.9 million. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

The number of quits was little changed in September at 3.1 million. The quits rate was 2.1 percent. Over the month, the number of quits was little changed for total private, and increased for government (+36,000).

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for September, the most recent employment report was for October.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings decreased in September to 5.486 million from 5.453 million in August.

The number of job openings (yellow) are up 2% year-over-year.

Quits are up 12% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

This is another solid report.

NFIB: Small Business Optimism Index increases in October

by Calculated Risk on 11/08/2016 08:44:00 AM

From the National Federation of Independent Business (NFIB): October 2016 Report: Small Business Economic Trends

The Index of Small Business Optimism rose 0.8 points to 94.9, still in the 94 range that has bound it for the past five months and well below the 42 year average of 98.

...

Fifty-five percent reported hiring or trying to hire (down 3 points), but 48 percent reported few or no qualified applicants for the positions they were trying to fill. Twenty-eight percent of all owners reported job openings they could not fill in the current period, up 4 points. This indicates that labor markets remain tight and the unemployment rate will remain steady at what many call “full employment”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 94.9 in October.

This is the highest level this year.

Monday, November 07, 2016

Tuesday: Election Day, Job Openings

by Calculated Risk on 11/07/2016 08:07:00 PM

A few truths: Trump lies repeatedly, he knows nothing about economics, and he is a disgusting person (his comments were not locker room comments). And his threat to jail his political opponent will be discussed and criticized for centuries.

Back in May, I wrote A Comment on Litmus Test Moments. I gave an example of some litmus test moments (issues that will come back and haunt people if they were on the wrong side - like the housing bubble). I argued that rejecting Trump will be a "litmus test" in the future.

Send a message to the future! It is important that Trump loses and loses badly. You will feel better about yourself in a few years when you can honestly say you didn't vote for Trump. It will be even better if you can point to a public post opposing Trump written before the election (twitter, Facebook, blog, etc). You will thank me later.

Tuesday:

• At 6:00 AM ET, NFIB Small Business Optimism Index for October.

• At 10:00 AM, Job Openings and Labor Turnover Survey for September from the BLS. Jobs openings decreased in August to 5.443 million from 5.831 million in July. The number of job openings were up 3% year-over-year, and Quits were up 4% year-over-year.

• All day, U.S. Presidential Election. The forecasts of all key analysts and economists assume Ms. Clinton will be the next President (my forecasts also assume a Clinton presidency). So if Trump is elected, expect some market volatility as forecasts are revised.

A beautiful story ...

Fed Letter: "Has the Fed Fallen behind the Curve This Year?"

by Calculated Risk on 11/07/2016 04:24:00 PM

From Fernanda Nechio and Glenn D. Rudebusch at the San Francisco Fed: Has the Fed Fallen behind the Curve This Year?

Last December, monetary policy analysts inside and outside the Fed expected several increases in short-term interest rates this year. Indeed, the median federal funds rate projection in December 2015 by Federal Open Market Committee (FOMC) participants was consistent with four ¼ percentage point hikes in 2016. So far, none of those increases has taken place.And the conclusion:

Of course, monetary policy decisions are often described as data-dependent, so as economic conditions change, FOMC projections for the appropriate path of monetary policy adjusts in response. However, as Rudebusch and Williams (2008) note, changes in forward policy guidance can confound observers and whipsaw investors. In fact, some have complained that the lower path for the funds rate this year represents an inexplicable deviation from past policy norms. A reporter described these complaints to Federal Reserve Chair Janet Yellen at the most recent FOMC press conference (Board of Governors 2016b): “Madam Chair, critics of the Federal Reserve have said that you look for any excuse not to hike, that the goalpost constantly moves.” Such critics have accused the Fed of reacting to transitory, episodic factors, such as financial market volatility, in a manner very different from past systematic Fed policy responses to underlying economic fundamentals.

This Economic Letter examines whether the recent revision to the FOMC’s projection of appropriate monetary policy in 2016 can be viewed as a reasonable course correction consistent with past FOMC behavior. We first show that the projected funds rate revision is not large relative to historical forecast errors. Next, we show that a simple interest rate rule that summarizes past Fed policy can account for this year’s revision to the funds rate projection based on recent changes to the FOMC’s assessment of economic conditions.

The downward shift to the FOMC’s 2016 funds rate projection was not large by historical standards and appears consistent with past Fed policy behavior in response to evolving economic fundamentals. Therefore, if monetary policy was correctly calibrated at the end of last year, it likely remains so, and the Fed has not fallen behind the curve this year.

Fed Survey: "Banks reported stronger demand for most categories of RRE home-purchase loans"

by Calculated Risk on 11/07/2016 02:08:00 PM

From the Federal Reserve: The October 2016 Senior Loan Officer Opinion Survey on Bank Lending Practices

Regarding loans to businesses, the October survey results indicated that, on balance, banks left their standards on commercial and industrial (C&I) loans basically unchanged while tightening standards on commercial real estate (CRE) loans over the third quarter of 2016. Regarding the demand for C&I loans, a modest net fraction of domestic banks reported weaker demand from large and middle-market firms, while demand from small firms was little changed, on balance. Regarding the demand for CRE loans, a moderate net fraction of banks reported stronger demand for construction and land development loans, while demand for loans secured by multifamily residential and nonfarm nonresidential properties remained basically unchanged on net.

...

Regarding loans to households, moderate net fractions of banks reported easing standards on loans eligible for purchase by government-sponsored enterprises (known as GSE-eligible mortgage loans), and modest net fractions of banks reported easing standards on loans categorized as QM jumbo and QM non-jumbo, non-GSE-eligible residential mortgages. The remaining categories of home-purchase loans were little changed on net. Banks also reported that demand for most types of home-purchase loans strengthened over the third quarter on net. Regarding consumer loans, on balance, banks indicated that changes in standards on consumer loans remained basically unchanged, while demand for auto and credit card loans rose.

...

On net, domestic survey respondents generally indicated that their lending standards for CRE loans of all types tightened during the third quarter.6 In particular, a moderate net fraction of banks reported tightening standards for loans secured by nonfarm nonresidential properties, whereas significant net fractions of banks reported tightening standards for construction and land development loans and loans secured by multifamily residential properties.

Regarding the demand for CRE loans, a moderate net fraction of banks reported stronger demand for construction and land development loans, while demand for loans secured by multifamily residential and nonfarm nonresidential properties remained basically unchanged on net.

...

During the third quarter, a moderate net fraction of banks reported having eased standards on GSE-eligible loans, while modest net fractions reported easing standards on mortgage loans categorized as QM non-jumbo, non-GSE-eligible residential and QM jumbo residential mortgages. Meanwhile, banks left their lending standards basically unchanged for all other categories of residential real estate (RRE) home-purchase loans on net.

Over the third quarter, banks reported stronger demand for most categories of RRE home-purchase loans except for government and subprime residential mortgages. In particular, significant net fractions of banks reported stronger demand for GSE-eligible residential mortgages. Moderate net fractions of banks reported stronger demand for QM non-jumbo, non-GSE-eligible, QM jumbo, non-QM jumbo, and non-QM non-jumbo residential mortgages. emphasis added

Update: Framing Lumber Prices Up Year-over-year

by Calculated Risk on 11/07/2016 11:18:00 AM

Here is another update on framing lumber prices. Early in 2013 lumber prices came close to the housing bubble highs.

The price increases in early 2013 were due to a surge in demand (more housing starts) and supply constraints (framing lumber suppliers were working to bring more capacity online).

Prices didn't increase as much early in 2014 (more supply, smaller "surge" in demand).

In 2015, even with the pickup in U.S. housing starts, prices were down year-over-year. Note: Multifamily starts do not use as much lumber as single family starts, and there was a surge in multi-family starts. This decline in 2015 was also probably related to weakness in China.

Prices in 2016 are now up year-over-year.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through early October 2016 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are up 6% from a year ago, and CME futures are up about 20% year-over-year.

Black Knight September Mortgage Monitor

by Calculated Risk on 11/07/2016 08:29:00 AM

Black Knight Financial Services (BKFS) released their Mortgage Monitor report for September today. According to BKFS, 4.27% of mortgages were delinquent in September, down from 4.87% in September 2015. BKFS also reported that 1.00% of mortgages were in the foreclosure process, down from 1.46% a year ago.

This gives a total of 5.27% delinquent or in foreclosure.

Press Release: Black Knight’s Mortgage Monitor: ‘Balancing Act’ of Low Rates, Rising Home Prices is Keeping Affordability Stable for Now; Raising Conforming Loan Limits Could Increase Origination Volumes

Today, the Data & Analytics division of Black Knight Financial Services, Inc. released its latest Mortgage Monitor Report, based on data as of the end of September 2016. This month, in light of 52 consecutive months of annual home price appreciation (HPA) and discussion in many quarters around the possibility of raising conforming loan limits, Black Knight took a closer look at HPA trends, home affordability and the impact that raising those limits might have on mortgage originations. ...

...

“The Housing and Economic Recovery Act (HERA) of 2008 restricted any additional increases in the conforming loan limit until national home values returned to pre-crisis levels. Now that we’ve reached that point by multiple measures, the GSEs can consider raising the national conforming limit above the static $417,000 where it has stayed for the last 10 years – aside from the 234 designated ‘high-cost’ counties, of course. Our analysis shows that there are approximately 17 times as many originations – roughly 100,000 in total over the past 12 months – right at the conforming limit compared to preceding dollar amount buckets, and that originations drop off by about 70 percent immediately above the limit. In addition, the data shows that a GSE loan originated right at the conforming limit is nine times more likely to carry a second lien than one that is not. One example scenario shows that, with all else being equal, raising the conforming loan limit by $10,000 could result in a one percent increase in originations – approximately 40,000 new loans and $20 billion in new loan balances.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from Black Knight shows the Black Knight HPI.

From Black Knight:

• As of August, we’ve seen 52 consecutive months of year-over-year home price appreciation (HPA)Even though nominal prices are close to the previous high in the Black Knight index, real prices (adjusted for inflation) are still around 20% below the price peak in June 2006.

• The national level HPI is now $266K, the highest median home value seen since 2006 and just 0.7 percent off of the June 2006 peak of $268K

• Annual HPA was 5.3 percent in August, and has remained relatively stable in that range over the last 12 months

• The current rate of annual HPA is above the 19921996 average growth of 2.8 percent, but well below what was seen from 19982005

• Housing supply remains low by historical standards; as of August, there was a 4.6-month supply of homes for sale, down from 5.5, 5.5 and 5.2 months the last three years

There is much more in the mortgage monitor.

Sunday, November 06, 2016

Sunday Night Futures

by Calculated Risk on 11/06/2016 06:48:00 PM

Weekend:

• Schedule for Week of Nov 6, 2016

Monday:

• At 10:00 AM ET, The Fed will release the monthly Labor Market Conditions Index (LMCI).

• At 2:00 PM, the October 2016 Senior Loan Officer Opinion Survey on Bank Lending Practices from the Federal Reserve.

• At 3:00 PM, Consumer credit from the Federal Reserve. The consensus is for a $18.7 billion increase in credit.

From CNBC: Pre-Market Data and Bloomberg futures: S&P futures are up 30 and DOW futures are up 235 (fair value).

Oil prices were down over the last week with WTI futures at $44.59 per barrel and Brent at $45.58 per barrel. A year ago, WTI was at $44, and Brent was at $46 - so oil prices are basically unchanged year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.21 per gallon - a year ago prices were also at $2.21 per gallon - so gasoline prices are unchanged year-over-year.

NAHB: Builder Confidence increases for the 55+ Housing Market in Q3

by Calculated Risk on 11/06/2016 10:45:00 AM

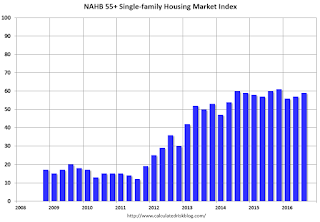

This is a quarterly index that was released last week by the the National Association of Home Builders (NAHB). This index is similar to the overall housing market index (HMI). The NAHB started this index in Q4 2008 (during the housing bust), so the readings were initially very low

From the NAHB: 55+ Housing Market Has Strong Third Quarter Showing

Builders report that the single-family 55+ housing market is holding strong in the third quarter, according to the National Association of Home Builders' (NAHB) 55+ Housing Market Index (HMI) released today. The index had a reading of 59, up two points from the previous quarter and the 10th consecutive quarter with a reading above 50.

“Builders and developers for the 55+ housing sector tell us that business is solid right now and they expect that trend to continue through the rest of the year,” said Jim Chapman, chairman of NAHB's 55+ Housing Industry Council and president of Jim Chapman Homes LLC in Atlanta.

...

“The 55+ housing market continues on a steady path toward recovery, much like the overall housing market,” said NAHB Chief Economist Robert Dietz. “Older home owners are able to take advantage of low mortgage rates and rising home prices, enabling them to sell their current homes and buy or rent a home in a 55+ community.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB 55+ Single Family HMI through Q3 2016. And reading above 50 indicates that more builders view conditions as good than as poor. The index increased to 59 in Q3 up from 57 in Q2.

There are two key drivers in addition to the improved economy: 1) there is a large cohort moving into the 55+ group, and 2) the homeownership rate typically increases for people in the 55 to 70 year old age group. So demographics should be favorable for the 55+ market.

Saturday, November 05, 2016

Schedule for Week of Nov 6, 2016

by Calculated Risk on 11/05/2016 10:05:00 AM

This will be a light week for economic data.

The key event will be the US election on Tuesday.

10:00 AM ET: The Fed will release the monthly Labor Market Conditions Index (LMCI).

2:00 PM ET: the October 2016 Senior Loan Officer Opinion Survey on Bank Lending Practices from the Federal Reserve.

3:00 PM: Consumer credit from the Federal Reserve. The consensus is for a $18.7 billion increase in credit.

6:00 AM ET: NFIB Small Business Optimism Index for October.

10:00 AM: Job Openings and Labor Turnover Survey for September from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for September from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in August to 5.443 million from 5.831 million in July.

The number of job openings (yellow) were up 3% year-over-year, and Quits were up 4% year-over-year.

All day, U.S. Presidential Election. The forecasts of all key analysts and economists assume Ms. Clinton will be the next President (my forecasts also assume a Clinton presidency). So if Trump is elected, expect some market volatility as forecasts are revised.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for July. The consensus is for a 0.2% increase in inventories.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 263 thousand initial claims, down from 265 thousand the previous week.

10:00 AM: University of Michigan's Consumer sentiment index (preliminary for November). The consensus is for a reading of 87.1, up from 87.2 in October.