by Calculated Risk on 11/23/2016 05:12:00 PM

Wednesday, November 23, 2016

Lawler: Table of Distressed Sales and All Cash Sales for Selected Cities in October

Economist Tom Lawler sent me the table below of short sales, foreclosures and all cash sales for selected cities in October.

On distressed: The total "distressed" share is down year-over-year in most of these markets.

Short sales and foreclosures are down in these areas.

The All Cash Share (last two columns) is mostly declining year-over-year. As investors continue to pull back, the share of all cash buyers continues to decline.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Oct- 2016 | Oct- 2015 | Oct- 2016 | Oct- 2015 | Oct- 2016 | Oct- 2015 | Oct- 2016 | Oct- 2015 | |

| Las Vegas | 5.1% | 6.3% | 5.6% | 7.3% | 10.7% | 13.6% | 27.4% | 30.9% |

| Reno** | 1.0% | 4.0% | 2.0% | 3.0% | 3.0% | 7.0% | ||

| Phoenix | 1.8% | 2.7% | 2.0% | 3.6% | 3.8% | 6.3% | 21.0% | 24.6% |

| Sacramento | 2.3% | 4.0% | 2.0% | 3.5% | 4.3% | 7.5% | 14.4% | 17.8% |

| Minneapolis | 1.2% | 2.3% | 3.9% | 7.8% | 5.1% | 10.1% | 12.7% | 15.5% |

| Mid-Atlantic | 2.8% | 3.7% | 8.9% | 11.9% | 11.8% | 15.6% | 16.6% | 19.3% |

| Florida SF | 2.3% | 3.6% | 8.0% | 15.6% | 10.4% | 19.3% | 28.6% | 34.2% |

| Florida C/TH | 1.5% | 2.1% | 6.7% | 13.5% | 8.2% | 15.7% | 55.5% | 61.6% |

| Miami MSA SF | 3.5% | 5.7% | 8.3% | 17.1% | 11.8% | 22.8% | 29.6% | 33.8% |

| Miami MSA CTH | 1.6% | 2.5% | 9.1% | 16.5% | 10.6% | 19.0% | 58.8% | 63.9% |

| Chicago (city) | 13.0% | 18.3% | ||||||

| Spokane | 7.2% | 12.3% | ||||||

| Northeast Florida | 13.9% | 25.6% | ||||||

| Orlando | 29.0% | 36.5% | ||||||

| Toledo | 25.6% | 30.4% | ||||||

| Tucson | 23.4% | 28.1% | ||||||

| Knoxville | 22.6% | 25.4% | ||||||

| Peoria | 23.3% | 20.8% | ||||||

| Georgia*** | 20.1% | 23.1% | ||||||

| Omaha | 16.1% | 15.5% | ||||||

| Pensacola | ||||||||

| Rhode Island | 9.9% | 9.6% | ||||||

| Richmond VA | 8.0% | 9.3% | 16.3% | 17.1% | ||||

| Memphis | 9.3% | 15.5% | ||||||

| Springfield IL** | 7.6% | 7.8% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

FOMC Minutes: "Appropriate to raise the target range for the federal funds rate relatively soon"

by Calculated Risk on 11/23/2016 02:30:00 PM

There are still different views, but most participants think it will be appropriate to raise the Fed Funds rate "relatively soon". (probably means December)

From the Fed: Minutes of the Federal Open Market Committee, November 1-2, 2016 . Excerpts:

Most participants expressed a view that it could well become appropriate to raise the target range for the federal funds rate relatively soon, so long as incoming data provided some further evidence of continued progress toward the Committee's objectives. Some participants noted that recent Committee communications were consistent with an increase in the target range for the federal funds rate in the near term or argued that to preserve credibility, such an increase should occur at the next meeting. A few participants advocated an increase at this meeting; they viewed recent economic developments as indicating that labor market conditions were at or close to those consistent with maximum employment and expected that recent progress toward the Committee's inflation objective would continue, even with further gradual steps to remove monetary policy accommodation. In addition, many judged that risks to economic and financial stability could increase over time if the labor market overheated appreciably, or expressed concern that an extended period of low interest rates risked intensifying incentives for investors to reach for yield, potentially leading to a mispricing of risk and misallocation of capital. In contrast, some others judged that allowing the unemployment rate to fall below its longer-run normal level for a time could result in favorable supply-side effects or help hasten the return of inflation to the Committee's 2 percent objective; noted that proximity of the federal funds rate to the effective lower bound places potential constraints on monetary policy; or stressed that global developments could pose risks to U.S. economic activity. More generally, it was emphasized that decisions regarding near-term adjustments of the stance of monetary policy would appropriately remain dependent on the outlook as informed by incoming data, and participants expected that economic conditions would evolve in a manner that would warrant only gradual increases in the federal funds rate.

emphasis added

A few Comments on October New Home Sales

by Calculated Risk on 11/23/2016 12:31:00 PM

New home sales for October were reported below the consensus forecast at 563,000 on a seasonally adjusted annual rate basis (SAAR). And the previous months were revised down.

However, sales were up 17.8% year-over-year in October, and this is the best month for October (NSA) since 2007. And sales are up 12.7% year-to-date compared to the same period in 2015.

The glass is more than half full. This is very solid year-over-year growth and just suggests that expectations were ahead of reality. This is why we look at the trend and not just one month.

Note that these sales (for October) were before the recent increase in mortgage rates.

Earlier: New Home Sales at 563,000 Annual Rate in October.

This graph shows new home sales for 2015 and 2016 by month (Seasonally Adjusted Annual Rate). Sales to date are up 12.7% year-over-year, because of very strong year-over-year growth over the last seven months.

Overall I expected lower growth this year, in the 4% to 8% range. Slower growth seemed likely this year because Houston (and other oil producing areas) will have a problem this year. It looks like I was too pessimistic on new home sales this year.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

I expect existing home sales to move more sideways, and I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales at 563,000 Annual Rate in October

by Calculated Risk on 11/23/2016 10:11:00 AM

The Census Bureau reports New Home Sales in October were at a seasonally adjusted annual rate (SAAR) of 563 thousand.

The previous three months were revised down by a total of 34 thousand (SAAR).

"Sales of new single-family houses in October 2016 were at a seasonally adjusted annual rate of 563,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 1.9 percent below the revised September rate of 574,000, but is 17.8 percent above the October 2015 estimate of 478,000"

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales since the bottom, new home sales are still fairly low historically.

The second graph shows New Home Months of Supply.

The months of supply increased in October to 5.2 months.

The months of supply increased in October to 5.2 months. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

"The seasonally adjusted estimate of new houses for sale at the end of October was 246,000. This represents a supply of 5.2 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In October 2016 (red column), 45 thousand new homes were sold (NSA). Last year, 39 thousand homes were sold in October. This was the highest sales for October since 2007.

The all time high for October was 105 thousand in 2005, and the all time low for October was 23 thousand in 2010.

This was below expectations of 590,000 sales SAAR in October. I'll have more later today.

Weekly Initial Unemployment Claims increase to 251,000

by Calculated Risk on 11/23/2016 08:39:00 AM

The DOL reported:

In the week ending November 19, the advance figure for seasonally adjusted initial claims was 251,000, an increase of 18,000 from the previous week's revised level. The previous week's level was revised down by 2,000 from 235,000 to 233,000. The 4- week moving average was 251,000, a decrease of 2,000 from the previous week's revised average. The previous week's average was revised down by 500 from 253,500 to 253,000.The previous week was revised down.

There were no special factors impacting this week's initial claims. This marks 90 consecutive weeks of initial claims below 300,000, the longest streak since 1970.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 251,000.

This was at the consensus forecast. The low level of claims suggests relatively few layoffs.

MBA: Mortgage "Purchase Applications Drive Increase in Latest Weekly Survey "

by Calculated Risk on 11/23/2016 07:00:00 AM

From the MBA: Purchase Applications Drive Increase in Latest MBA Weekly Survey

Mortgage applications increased 5.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 18, 2016.

... The Refinance Index decreased 3 percent from the previous week to its lowest level since January 2016. The seasonally adjusted Purchase Index increased 19 percent from one week earlier. The unadjusted Purchase Index increased 13 percent compared with the previous week and was 11 percent higher than the same week one year ago.

“Mortgage rates have continued to move higher in the post-election period, as investors worldwide are looking for increases in growth and inflation, with the 30-year mortgage rate reaching its highest weekly average since the beginning of 2016,” said Michael Fratantoni, Chief Economist and Senior Vice President of Research & Technology at the Mortgage Bankers Association. “Refinance volume dropped further over the week, particularly for refinances of FHA and VA loans. Purchase volume increased sharply for the week compared to both last week, which included the Veteran’s Day holiday, and last year, with purchase volume up more than 11 percent on a year over year basis. The increase in purchase activity was driven by borrowers seeking larger loans and that drove up the average loan amount on home purchase applications to $310 thousand, the highest in the survey, which dates back to 1990.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to its highest level since January 2016, 4.16 percent, from 3.95 percent, with points unchanged at 0.39 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

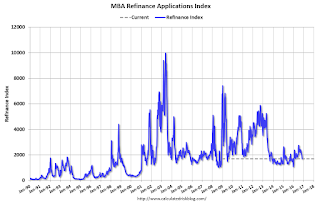

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With the current level of mortgage rates, refinance activity will probably decline further.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The purchase index was "11 percent higher than the same week one year ago".

Tuesday, November 22, 2016

Wednesday: New Home Sales, Unemployment Claims, FOMC Minutes, and More

by Calculated Risk on 11/22/2016 06:55:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 250 thousand initial claims, up from 235 thousand the previous week.

• Also at 8:30 AM, Durable Goods Orders for October from the Census Bureau. The consensus is for a 1.5% increase in durable goods orders.

• At 9:00 AM, FHFA House Price Index for September 2016. This was originally a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.7% month-to-month increase for this index.

• At 10:00 AM, New Home Sales for September from the Census Bureau. The consensus is for an decrease in sales to 590 thousand Seasonally Adjusted Annual Rate (SAAR) in October from 593 thousand in September.

• Also at 10:00 AM, University of Michigan's Consumer sentiment index (final for November). The consensus is for a reading of 91.6, unchanged from the preliminary reading 91.6.

• At 2:00 PM, FOMC Minutes for Meeting of November 1-2

Chemical Activity Barometer "Continues Strong Performance" in November

by Calculated Risk on 11/22/2016 03:34:00 PM

Note: This appears to be a leading indicator for industrial production.

From the American Chemistry Council: Chemical Activity Barometer Continues Strong Performance with Eighth Consecutive Gain

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), featured another solid gain of 0.3 percent in November, following a gain of 0.3 percent in October and a 0.4 percent gain in September and August. Accounting for adjustments, the CAB is up 4.2 percent over this time last year, a marked increase over earlier comparisons and the greatest year-over-year gain since August 2014. All data is measured on a three-month moving average (3MMA). On an unadjusted basis the CAB climbed 0.3 percent in November, following a 0.2 percent gain in October.

...

Applying the CAB back to 1912, it has been shown to provide a lead of two to fourteen months, with an average lead of eight months at cycle peaks as determined by the National Bureau of Economic Research. The median lead was also eight months. At business cycle troughs, the CAB leads by one to seven months, with an average lead of four months. The median lead was three months. The CAB is rebased to the average lead (in months) of an average 100 in the base year (the year 2012 was used) of a reference time series. The latter is the Federal Reserve’s Industrial Production Index.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

Currently CAB has increased solidly over the last several months, and this suggests an increase in Industrial Production over the next year.

A Few Comments on October Existing Home Sales

by Calculated Risk on 11/22/2016 12:45:00 PM

Earlier: Existing Home Sales increased in October to 5.60 million SAAR

First, these October existing home sales closed escrow before the recent increase in mortgage rates (rates started increasing after the election). Also, the recent increase in mortgage rates will probably have little impact on November closed sales, since most of those sales were already in process.

With the recent increase in rates, I'd expect some decline in sales volume as happened following the "taper tantrum" in 2013. So we might see sales fall to 5 million SAAR or below over the next 6 months. That would still be solid existing home sales. We might also see a little more inventory in the coming months, and therefore less price appreciation.

Usually a change in interest rates impacts new home sales first, because new home sales are reported when the contract is signed, whereas existing home sales are reported when the contract closes. So we might see some impact on new home sales for November (not October since that was before the recent increase).

On inventory, here is a repeat of some comments I wrote earlier: I expected some increase in inventory last year, but that didn't happened. Inventory is still very low and falling year-over-year (down 4.3% year-over-year in October). More inventory would probably mean smaller price increases and slightly higher sales, and less inventory means lower sales and somewhat larger price increases.

Two of the key reasons inventory is low: 1) A large number of single family home and condos were converted to rental units. Last year, housing economist Tom Lawler estimated there were 17.5 million renter occupied single family homes in the U.S., up from 10.7 million in 2000. Many of these houses were purchased by investors, and rents have increased substantially, and the investors are not selling (even though prices have increased too). Most of these rental conversions were at the lower end, and that is limiting the supply for first time buyers. 2) Baby boomers are aging in place (people tend to downsize when they are 75 or 80, in another 10 to 20 years for the boomers). Instead we are seeing a surge in home improvement spending, and this is also limiting supply.

Of course low inventory keeps potential move-up buyers from selling too. If someone looks around for another home, and inventory is lean, they may decide to just stay and upgrade.

A key point: Some areas are already seeing more inventory. For example, there is more inventory in some coastal areas of California, in New York city and for high rise condos in Miami.

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Sales NSA in October (red column) were the highest for October since 2006 (NSA).

Note that sales NSA are in the slower Fall period, and will really slow seasonally in January and February.

Existing Home Sales increased in October to 5.60 million SAAR

by Calculated Risk on 11/22/2016 10:09:00 AM

From the NAR: Existing-Home Sales Jump Again in October

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, grew 2.0 percent to a seasonally adjusted annual rate of 5.60 million in October from an upwardly revised 5.49 million in September. October's sales pace is 5.9 percent above a year ago (5.29 million) and surpasses June's pace (5.57 million) as the highest since February 2007 (5.79 million). ...

Total housing inventory 3 at the end of October declined 0.5 percent to 2.02 million existing homes available for sale, and is now 4.3 percent lower than a year ago (2.11 million) and has fallen year-over-year for 17 straight months. Unsold inventory is at a 4.3-month supply at the current sales pace, which is down from 4.4 months in September.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in October (5.60 million SAAR) were 2.0% higher than last month, and were 5.9% above the October 2015 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 2.02 million in October from 2.03 million in September. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory decreased to 2.02 million in October from 2.03 million in September. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The third graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 4.3% year-over-year in October compared to October 2015.

Inventory decreased 4.3% year-over-year in October compared to October 2015. Months of supply was at 4.3 months in October.

This was above consensus expectations. For existing home sales, a key number is inventory - and inventory is still low. I'll have more later ...