by Calculated Risk on 12/15/2016 08:32:00 AM

Thursday, December 15, 2016

Weekly Initial Unemployment Claims decrease to 254,000

The DOL reported:

In the week ending December 10, the advance figure for seasonally adjusted initial claims was 254,000, a decrease of 4,000 from the previous week's unrevised level of 258,000. The 4-week moving average was 257,750, an increase of 5,250 from the previous week's unrevised average of 252,500.The previous week was unrevised.

There were no special factors impacting this week's initial claims. This marks 93 consecutive weeks of initial claims below 300,000, the longest streak since 1970.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 257,750.

This was close to the consensus forecast. The low level of claims suggests relatively few layoffs.

Wednesday, December 14, 2016

Thursday: CPI, Unemployment Claims, NY and Philly Mfg Surveys

by Calculated Risk on 12/14/2016 08:26:00 PM

Thursday:

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 255 thousand initial claims, down from 258 thousand the previous week.

• At 8:30 AM, The Consumer Price Index for November from the BLS. The consensus is for 0.2% increase in CPI, and a 0.2% increase in core CPI.

• At 8:30 AM, The New York Fed Empire State manufacturing survey for December. The consensus is for a reading of 3.0, up from 1.5.

• At 8:30 AM, the Philly Fed manufacturing survey for December. The consensus is for a reading of 10.0, up from 7.6.

• At 10:00 AM, The December NAHB homebuilder survey. The consensus is for a reading of 63, unchanged from 63 in November. Any number above 50 indicates that more builders view sales conditions as good than poor.

Quick FOMC Analysis

by Calculated Risk on 12/14/2016 04:42:00 PM

The Fed raised the Fed Funds rate 25bp to a range of "1/2 to 3/4 percent".

On the assessment of appropriate monetary policy, one FOMC member sees just one 25bp rate hike in 2017, four members see two hikes, six members see three hikes, and five see four or more. This is an increase of one additional rate hike from previous expectations.

Note: Merrill Lynch published a note after the announcement, and they are forecasting just one rate hike in 2017.

By the end of 2018, 5 members see a total of five rate hikes over the next two years, and three members see six. There are outliers - one member sees just one hike over the next two years, and one member sees 11 rate hikes!

Based on Fed Chair Yellen's comments, most FOMC members are waiting to see the fiscal proposals before incorporating those policies in their forecasts. Yellen said at the press conference: "all the FOMC participants recognize that there is considerable uncertainty about how economic policies may change and what effect they will have on the economy."

So right now I think the Fed is on hold. Many analysts are thinking the next rate hike might happen in March, but that probably won't give the Fed enough time to consider the impact of various fiscal proposals. So my guess - depending on the proposals and the incoming data - is the next rate hike might happen in June (or later in the year).

FOMC Projections and Press Conference Link

by Calculated Risk on 12/14/2016 02:11:00 PM

Statement here. 25 bps rate hike.

Yellen press conference video here.

On the projections, GDP was mostly unchanged.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Change in Real GDP1 | 2016 | 2017 | 2018 | 2019 |

| Dec 2016 | 1.8 to 1.9 | 1.9 to 2.3 | 1.8 to 2.2 | 1.8 to 2.0 |

| Sept 2016 | 1.7 to 1.9 | 1.9 to 2.2 | 1.9 to 2.2 | 1.7 to 2.0 |

The unemployment rate was at 4.6% in November and 4.9% in October, so the unemployment rate projections were revised down slightly.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Unemployment Rate2 | 2016 | 2017 | 2018 | 2019 |

| Dec 2016 | 4.7 to 4.8 | 4.5 to 4.6 | 4.3 to 4.7 | 4.3 to 4.8 |

| Sept 2016 | 4.7 to 4.9 | 4.5 to 4.7 | 4.4 to 4.7 | 4.4 to 4.8 |

As of October, PCE inflation was up 1.4% from October 2015. With oil prices up year-over-year, PCE inflation has been moving up. So inflation was revised up for 2016, but there was little change for 2017 and 2018.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| PCE Inflation1 | 2016 | 2017 | 2018 | 2019 |

| Dec 2016 | 1.5 | 1.7 to 2.0 | 1.9 to 2.0 | 2.0 to 2.1 |

| Sept 2016 | 1.2 to 1.4 | 1.7 to 1.9 | 1.8 to 2.0 | 1.9 to 2.0 |

PCE core inflation was up 1.7% in October year-over-year. Core PCE inflation was unrevised for 2016.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Core Inflation1 | 2016 | 2017 | 2018 | 2019 |

| Dec 2016 | 1.7 to 1.8 | 1.8 to 1.9 | 1.9 to 2.0 | 2.0 |

| Sept 2016 | 1.6 to 1.8 | 1.7 to 1.9 | 1.9 to 2.0 | 2.0 |

FOMC Statement: 25bps Rate Hike

by Calculated Risk on 12/14/2016 02:02:00 PM

Information received since the Federal Open Market Committee met in November indicates that the labor market has continued to strengthen and that economic activity has been expanding at a moderate pace since mid-year. Job gains have been solid in recent months and the unemployment rate has declined. Household spending has been rising moderately but business fixed investment has remained soft. Inflation has increased since earlier this year but is still below the Committee's 2 percent longer-run objective, partly reflecting earlier declines in energy prices and in prices of non-energy imports. Market-based measures of inflation compensation have moved up considerably but still are low; most survey-based measures of longer-term inflation expectations are little changed, on balance, in recent months.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that, with gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace and labor market conditions will strengthen somewhat further. Inflation is expected to rise to 2 percent over the medium term as the transitory effects of past declines in energy and import prices dissipate and the labor market strengthens further. Near-term risks to the economic outlook appear roughly balanced. The Committee continues to closely monitor inflation indicators and global economic and financial developments. In view of realized and expected labor market conditions and inflation, the Committee decided to raise the target range for the federal funds rate to 1/2 to 3/4 percent. The stance of monetary policy remains accommodative, thereby supporting some further strengthening in labor market conditions and a return to 2 percent inflation.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. In light of the current shortfall of inflation from 2 percent, the Committee will carefully monitor actual and expected progress toward its inflation goal. The Committee expects that economic conditions will evolve in a manner that will warrant only gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run. However, the actual path of the federal funds rate will depend on the economic outlook as informed by incoming data.

The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction, and it anticipates doing so until normalization of the level of the federal funds rate is well under way. This policy, by keeping the Committee's holdings of longer-term securities at sizable levels, should help maintain accommodative financial conditions. Voting for the FOMC monetary policy action were: Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Lael Brainard; James Bullard; Stanley Fischer; Esther L. George; Loretta J. Mester; Jerome H. Powell; Eric Rosengren; and Daniel K. Tarullo.

emphasis added

Sacramento Housing in November: Sales up 19%, Active Inventory down 4.8% YoY

by Calculated Risk on 12/14/2016 11:31:00 AM

Important note: In November 2015, sales were impacted by a regulation change, TILA-RESPA Integrated Disclosure (TRID), so the strong year-over-year increase in many markets last month is because of the weak sales last November.

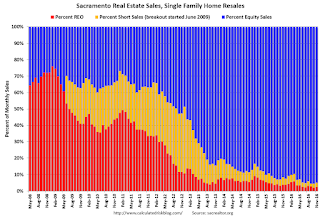

During the recession, I started following the Sacramento market to look for changes in the mix of houses sold (equity, REOs, and short sales). For a few years, not much changed. But in 2012 and 2013, we saw some significant changes with a dramatic shift from distressed sales to more normal equity sales.

This data suggests healing in the Sacramento market and other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In November, total sales were up 19.0% from November 2015, and conventional equity sales were up 22.9% compared to the same month last year.

In November, 4.4% of all resales were distressed sales. This was up from 4.4% last month, and down from 8.3% in November 2015.

The percentage of REOs was at 2.4%, and the percentage of short sales was 2.6%.

Here are the statistics.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional (equity) sales that started in 2012 (blue) as the percentage of distressed sales declined sharply.

Active Listing Inventory for single family homes decreased 4.8% year-over-year (YoY) in October. This was the nineteenth consecutive monthly YoY decrease in inventory in Sacramento.

Cash buyers accounted for 11.1% of all sales - this has been steadily declining (frequently investors).

Summary: This data suggests a normal market with few distressed sales, and less investor buying - but with limited inventory.

Industrial Production declined 0.4% in November

by Calculated Risk on 12/14/2016 09:25:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production declined 0.4 percent in November after edging up 0.1 percent in October. In November, manufacturing output moved down 0.1 percent, and mining posted a gain of 1.1 percent. The index for utilities dropped 4.4 percent, as warmer-than-normal temperatures reduced the demand for heating. At 103.9 percent of its 2012 average, total industrial production in November was 0.6 percent lower than its year-earlier level. Capacity utilization for the industrial sector decreased 0.4 percentage point in November to 75.0 percent, a rate that is 5.0 percentage points below its long-run (1972–2015) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 8.3 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 75.0% is 5.0% below the average from 1972 to 2015 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production declined in November to 104.2. This is 18.9% above the recession low, and is close to the pre-recession peak.

This was below expectations of a 0.2% decrease.

Retail Sales increased 0.1% in November

by Calculated Risk on 12/14/2016 08:36:00 AM

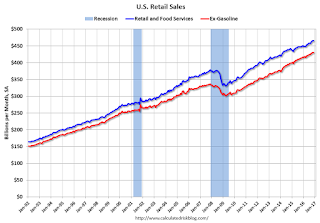

On a monthly basis, retail sales increased 0.1 percent from October to November (seasonally adjusted), and sales were up 3.8 percent from November 2015.

From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for November, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $465.5 billion, an increase of 0.1 percent from the previous month, and 3.8 percent above November 2015. ... The September 2016 to October 2016 percent change was revised from up 0.8 percent to up 0.6 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.1% in November.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales ex-gasoline increased by 3.8% on a YoY basis.

Retail and Food service sales ex-gasoline increased by 3.8% on a YoY basis.The increase in November was below expectations and October sales were revised down, however September sales were revised up.

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 12/14/2016 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 4.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending December 9, 2016.

The Market Composite Index, a measure of mortgage loan application volume, decreased 4.0 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 5 percent compared with the previous week. The Refinance Index decreased 4 percent from the previous week. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier. The unadjusted Purchase Index decreased 7 percent compared with the previous week and was 2 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to its highest level since October 2014, 4.28 percent, from 4.27 percent, with points decreasing to 0.36 from 0.37 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With the current level of mortgage rates, refinance activity will probably decline further.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The purchase index was "2 percent higher than the same week one year ago".

In general, the purchase index has held up over the last month (up and down week to week). However, refinance activity - as would be expected with higher rates - has declined sharply.

Tuesday, December 13, 2016

Wednesday: FOMC Announcement Retail Sales, PPI, Industrial Production

by Calculated Risk on 12/13/2016 06:24:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Steady-to-Lower Ahead of Fed Day

Mortgage rates started stronger out of the gate, but morning weakness in bond markets prompted many lenders to adjust rates higher by early afternoon. On balance, the average lender ended the day just a hair better than yesterday's latest levels. To be clear, we're talking about microscopic differences. Note rates are the same as yesterday. The most prevalent conventional 30yr fixed quote is 4.25%, followed closely by 4.125%. The microscopic improvement refers to changes in upfront costs/credits.Wednesday:

In the bigger picture, rates remain very close to the highest levels in more than 2 years.

emphasis added

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Retail sales for November will be released. The consensus is for 0.4% increase in retail sales in November.

• At 8:30 AM, The Producer Price Index for November from the BLS. The consensus is for a 0..2% increase in prices, and a 0.2% increase in core PPI.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for November. The consensus is for a 0.2% decrease in Industrial Production, and for Capacity Utilization to decrease to 75.0%.

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for October. The consensus is for no change in inventories.

• At 2:00 PM, FOMC Meeting Announcement. The FOMC is expected to increase the Fed Funds rate 25 bps at this meeting.

• At 2:00 PM, FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

• At 2:30 PM, Fed Chair Janet Yellen holds a press briefing following the FOMC announcement.