by Calculated Risk on 12/17/2016 08:09:00 AM

Saturday, December 17, 2016

Schedule for Week of Dec 18, 2016

The key economic reports this week are November New and Existing Home sales.

Happy Holidays and Merry Christmas!

1:30 PM ET, Speech by Fed Chair Janet Yellen, The State of the Job Market, At the University of Baltimore 2016 Midyear Commencement, Baltimore, Maryland

No economic releases are scheduled.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Existing Home Sales for November from the National Association of Realtors (NAR). The consensus is for 5.53 million SAAR, down from 5.60 million in October.

10:00 AM: Existing Home Sales for November from the National Association of Realtors (NAR). The consensus is for 5.53 million SAAR, down from 5.60 million in October.Housing economist Tom Lawler expects the NAR to report sales of 5.60 million SAAR in November, unchanged from October's preliminary pace.

During the day: The AIA's Architecture Billings Index for November (a leading indicator for commercial real estate).

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 256 thousand initial claims, up from 254 thousand the previous week.

8:30 AM: Gross Domestic Product, 3rd quarter 2016 (third estimate). The consensus is that real GDP increased 3.3% annualized in Q3, revised from 3.2% in the second estimate.

8:30 AM: Durable Goods Orders for November from the Census Bureau. The consensus is for a 4.0% decrease in durable goods orders.

8:30 AM: Chicago Fed National Activity Index for November. This is a composite index of other data.

9:00 AM: FHFA House Price Index for October 2016. This was originally a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.5% month-to-month increase for this index.

10:00 AM: Personal Income and Outlays for November. The consensus is for a 0.3% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.1%.

11:00 AM: the Kansas City Fed manufacturing survey for December.

10:00 AM ET: New Home Sales for November from the Census Bureau.

10:00 AM ET: New Home Sales for November from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the October sales rate.

The consensus is for an increase in sales to 580 thousand Seasonally Adjusted Annual Rate (SAAR) in November from 563 thousand in October.

10:00 AM: University of Michigan's Consumer sentiment index (final for December). The consensus is for a reading of 98.0, unchanged from the preliminary reading 98.0.

Friday, December 16, 2016

Lawler: Early Look at Existing Home Sales in November

by Calculated Risk on 12/16/2016 03:13:00 PM

From housing economist Tom Lawler: Early Look at Existing Home Sales in November

Based on publicly-available local realtor/MLS reports from across the country released through today, I project that US existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.60 million in November, unchanged from October’s preliminary pace and up 15.2% from last November’s surprisingly low seasonally adjusted pace. Unadjusted sales should show a higher YOY gain, reflecting the higher business-day count this November compared to last November.

If my projection is correct, this November would break a string of “unusually” large monthly changes in November home sales, as shown in the table below.

| Monthly % Change in Existing Home Sales (SAAR) | |||||

|---|---|---|---|---|---|

| Nov. 2012 | Nov. 2013 | Nov. 2014 | Nov. 2015** | Nov. 2016** | |

| Preliminary | 5.9% | -4.3% | -6.1% | -10.5% | 0.0% |

| First Revision | 4.8% | -5.9% | -6.3% | -10.5% | |

| Latest* | 3.5% | -2.4% | -4.1% | -8.1% | |

| *Changes from "First Revision" to "Latest" reflect seasonal factor revisions **LEHC estimate | |||||

(Some analysts blamed the steep drop in seasonally-adjusted sales last November to the October implementation of the new “TRID” rules in October, which may have delayed some November closings. For November 2013, some analysts attributed the weak sales to the 16-day government shutdown in October of that year. I never saw an explanation for the November 2014 dip in home sales in November, though it was fully captured in my regional tracking.)

On the inventory front, both local realtor/MLS data and data from other listings trackers suggest that existing home listings fell by slightly more than the seasonal norm last month, and that the YOY decline in listings was greater in November than in October. How that will translate into NAR estimates, however, is not clear, as NAR inventory swings over the last few months have not synched up with publicly-available realtor data. For example, the NAR’s inventory estimates showed an unusually large monthly decline in August, followed by a contra-seasonal gain in September and a much smaller than normal decline in October. NAR’s October inventory estimate was above the August estimate -- implying a considerable two-month increase in “seasonally-adjusted” inventories. Realtor/listings data, in contrast, suggested that listings from July to October showed a more “normal” seasonal drop, with YOY declines accelerating from mid-year through October.

My “best guess” is that the NAR’s inventory estimate for November will be about 5.4% below October’s preliminary estimate and 6.4% lower than last November’s estimate.

Finally, local realtor data suggest that median existing SF home sales price in November will be up by about 6.5% from last November.

CR Note: Existing home sales for November will be released on Wednesday, December 21st. The consensus estimate is the NAR will report sales of 5.54 million SAAR.

Comments on November Housing Starts

by Calculated Risk on 12/16/2016 11:59:00 AM

Earlier: Housing Starts decreased to 1.090 Million Annual Rate in November

The housing starts report this morning was well below consensus because of the sharp decline in multi-family starts. However multi-family permits were decent in November, so multi-family starts will probably rebound in December.

Meanwhile single family starts were decent, and there were upward revisions to the prior two months combined. Just remember that multi-family can be very volatile ... no worries.

This first graph shows the month to month comparison between 2015 (blue) and 2016 (red).

Year-to-date starts are up 4.8% compared to the same period in 2015. My guess was starts would increase 4% to 8% in 2016, and that looks right.

Multi-family starts are down 4.1% year-to-date, and single-family starts are up 9.6% year-to-date.

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily over the last few years - but has started to decline. Completions (red line) have lagged behind - but completions have been generally catching up (more deliveries, although this has dipped lately). Completions lag starts by about 12 months.

I think most of the growth in multi-family starts is probably behind us - in fact multi-family starts probably peaked in June 2015 (at 510 thousand SAAR) - although I expect solid multi-family starts for a few more years (based on demographics).

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

BLS: Unemployment Rates Lower in 18 states, Stable in 32 states in November

by Calculated Risk on 12/16/2016 10:16:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were significantly lower in November in 18 states and stable in 32 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today. Nine states had notable jobless rate decreases from a year earlier, 2 states had increases, and 39 states and the District had no significant change. The national unemployment rate was 4.6 percent in November, down from 4.9 percent in October, and 0.4 percentage point lower than in November 2015.

...

New Hampshire and South Dakota had the lowest unemployment rates in November, 2.7 percent each. Alaska and New Mexico had the highest jobless rates, 6.8 percent and 6.7 percent, respectively.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement. The yellow squares are the lowest unemployment rate per state since 1976.

The states are ranked by the highest current unemployment rate. Alaska, at 6.8%, had the highest state unemployment rate. Note that the lowest recorded unemployment rate in Alaska was 6.3%, so this is pretty close to the all time low.

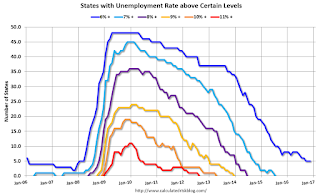

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).Currently no state has an unemployment rate at or above 7% (light blue); Only four states and D.C are at or above 6% (dark blue). The states are Alaska (6.8%), New Mexico (6.7%), Louisiana (6.2%), D.C. (6.0%), and West Virginia (6.0%).

Housing Starts decreased to 1.090 Million Annual Rate in November

by Calculated Risk on 12/16/2016 08:38:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in November were at a seasonally adjusted annual rate of 1,090,000. This is 18.7 percent below the revised October estimate of 1,340,000 and is 6.9 percent below the November 2015 rate of 1,171,000.

Single-family housing starts in November were at a rate of 828,000; this is 4.1 percent below the revised October figure of 863,000. The November rate for units in buildings with five units or more was 259,000.

Building Permits:

Privately-owned housing units authorized by building permits in November were at a seasonally adjusted annual rate of 1,201,000. This is 4.7 percent below the revised October rate of 1,260,000 and is 6.6 percent below the November 2015 estimate of 1,286,000.

Single-family authorizations in November were at a rate of 778,000; this is 0.5 percent above the revised October figure of 774,000. Authorizations of units in buildings with five units or more were at a rate of 384,000 in November

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased in November compared to October. Multi-family starts are down sharply year-over-year.

Multi-family is volatile, and the swings have been huge over the last three months.

Single-family starts (blue) decreased in November, and are up 5% year-over-year.

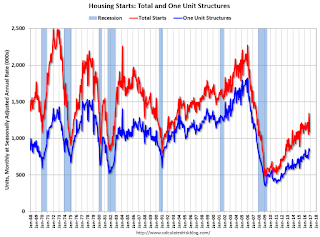

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low),

Total housing starts in November were well below expectations due to the sharp decrease in multi-family starts. However September and October were revised up, combined. I'll have more later ...

Thursday, December 15, 2016

Friday: Housing Starts

by Calculated Risk on 12/15/2016 08:31:00 PM

Total housing starts this year are up 5.9% compared to the same period in 2015. Through October, there have been 999.6 thousand total starts compared to 943.7 thousand for the same period in 2015.

Single family starts are up 10.1% through October. and multi-family starts are down 1.8%.

In June 2015, I asked: Are Multi-Family Housing Starts near a peak? That guess was based on demographics, and it looks like multi-family starts might have peaked that month (but are still solid).

Friday:

• At 8:30 AM, Housing Starts for November. Total housing starts increased to 1.323 million (SAAR) in October. Single family starts increased to 869 thousand SAAR in October. The consensus is for 1.230 million, down from the October rate.

• At 10:00 AM, Regional and State Employment and Unemployment (Monthly) for November 2016

Larry Kudlow is usually wrong

by Calculated Risk on 12/15/2016 05:19:00 PM

Larry Kudlow is usually wrong and frequently absurd, as an example, in June 2005 Kudlow wrote "The Housing Bears are Wrong Again" and called me (or people like me) "bubbleheads".

Homebuilders led the stock parade this week with a fantastic 11 percent gain. This is a group that hedge funds and bubbleheads love to hate. All the bond bears have been dead wrong in predicting sky-high mortgage rates. So have all the bubbleheads who expect housing-price crashes in Las Vegas or Naples, Florida, to bring down the consumer, the rest of the economy, and the entire stock market.I guess I was one of those "bubbleheads"!

In December 2007, he wrote: Bush Boom Continues

There’s no recession coming. The pessimistas were wrong. It’s not going to happen. At a bare minimum, we are looking at Goldilocks 2.0. (And that’s a minimum). Goldilocks is alive and well. The Bush boom is alive and well. It’s finishing up its sixth consecutive year with more to come. Yes, it’s still the greatest story never told.Note the date of the article. The recession started in December 2007!

Note: At the beginning of 2007 I predicted a recession would start that year - made it by one month. It seems I'm always on the opposite side from Kudlow of each forecast - and one of us has been consistently wrong.

In 2014, Kudlow claimed: "I've always believed the 1990s were Ronald Reagan's third term."

In that piece, Kudlow was rewriting his own history. Near the beginning of Clinton's first term, Kudlow was arguing Clinton's policies would take the economy into a deep recession or even depression. Kudlow was wrong then (I remember because I was on the other side of that debate), so he can't claim he "always believed" now. Nonsense.

Also in 2007, Kudlow wrote: A Stock Market Vote of Confidence for Bush:

"I have long believed that stock markets are the best barometer of the health, wealth and security of a nation. And today's stock market message is an unmistakable vote of confidence for the president."Well, maybe Kudlow had a point ... but not for the President he was writing about.

Now Larry Kudlow will be the new administration's chief economist. Oh my.

Key Measures Show Inflation close to 2% in November

by Calculated Risk on 12/15/2016 11:49:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.2% annualized rate) in November. The 16% trimmed-mean Consumer Price Index also rose 0.2% (1.9% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed released the median CPI details for November here. Motor fuel was up 36% annualized in November.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.2% (2.4% annualized rate) in November. The CPI less food and energy rose 0.2% (1.8% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.5%, the trimmed-mean CPI rose 2.1%, and the CPI less food and energy rose 2.1%. Core PCE is for October and increased 1.7% year-over-year.

On a monthly basis, median CPI was at 2.2% annualized, trimmed-mean CPI was at 1.9% annualized, and core CPI was at 1.8% annualized.

Using these measures, inflation has generally been moving up, and most of these measures are close to the Fed's 2% target (Core PCE is still below).

NAHB: Builder Confidence increased to 70 in December

by Calculated Risk on 12/15/2016 10:08:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 70 in December, up from 63 in November. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Closes Year on a High Note

Builder confidence in the market for newly-built single-family homes jumped seven points to a level of 70 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI). This is the highest reading since July 2005.

...

“Though this significant increase in builder confidence could be considered an outlier, the fact remains that the economic fundamentals continue to look good for housing,” said NAHB Chief Economist Robert Dietz. “The rise in the HMI is consistent with recent gains for the stock market and consumer confidence. At the same time, builders remain sensitive to rising mortgage rates and continue to deal with shortages of lots and labor.”

...

All three HMI components posted healthy gains in December. The component gauging current sales conditions increased seven points to 76 while the index charting sales expectations in the next six months jumped nine points to 78. Meanwhile, the component measuring buyer traffic rose six points to 53, marking the first time this gauge has topped 50 since October 2005.

Looking at the three-month moving averages for regional HMI scores, the Northeast rose six points to 51, the Midwest posted a three-point gain to 61, the South rose one point to 67 and the West registered a two-point gain to 79.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was well above the consensus forecast of 63, and is another solid reading.

NY and Philly Fed Manufacturing Expand in December

by Calculated Risk on 12/15/2016 09:01:00 AM

From the NY Fed: Empire State Manufacturing Survey

Business activity grew modestly in New York State, according to firms responding to the December 2016 Empire State Manufacturing Survey. The headline general business conditions index climbed eight points to 9.0. The new orders index rose to 11.4, and the shipments index was unchanged at 8.5.And from the Philly Fed: December 2016 Manufacturing Business Outlook Survey

...

As in November, both employment indexes remained negative in December. The index for number of employees was little changed at -12.2, a sign that employment levels continued to wane, and the average workweek index, at -7.0, pointed to a decline in hours worked. ...

Indexes for the six-month outlook strengthened, and suggested that respondents were very optimistic about future conditions. The index for future business conditions shot up twenty points to 50.2, its highest level in nearly five years, with 61 percent of respondents expecting conditions to improve in the months ahead.

emphasis added

The index for current manufacturing activity in the region increased from a reading of 7.6 in November to 21.5 this month. Nearly 34 percent of the firms reported increases in activity this month, compared with 24 percent last month. The general activity index has remained positive for five consecutive months, and the activity index reading was the highest since November 2014 [at 12.2].Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

...

The current employment index improved 9 points [to 6.4], its first positive reading in 12 months. Firms also reported an increase in work hours this month: The average workweek index, which increased 2 points, has now been positive for two consecutive months. ...

The diffusion index for future general activity increased from a reading of 29.3 in November to 52.6 this month. The index is now at its highest reading since January 2015.

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through December), and five Fed surveys are averaged (blue, through November) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through November (right axis).

It seems likely the ISM manufacturing index will show faster expansion again in December.