by Calculated Risk on 12/21/2016 07:00:00 AM

Wednesday, December 21, 2016

MBA: Mortgage Applications Increase in Latest Weekly Survey

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications increased 2.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending December 16, 2016.

... The Refinance Index increased 3 percent from the previous week. The seasonally adjusted Purchase Index increased 3 percent from one week earlier. The unadjusted Purchase Index decreased 0.1 percent compared with the previous week and was 1 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to its highest level since May 2014, 4.41 percent, from 4.28 percent, with points increasing to 0.38 from 0.36 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With the current level of mortgage rates, refinance activity will probably decline further.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The purchase index was "1 percent higher than the same week one year ago".

Even with the increase in mortgage rates, purchase activity is still holding up. However refinance activity has declined significantly - and will probably decline further.

Tuesday, December 20, 2016

Wednesday: Existing Home Sales

by Calculated Risk on 12/20/2016 06:26:00 PM

A little data tomorrow ...

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, Existing Home Sales for November from the National Association of Realtors (NAR). The consensus is for 5.53 million SAAR, down from 5.60 million in October. Housing economist Tom Lawler expects the NAR to report sales of 5.60 million SAAR in November, unchanged from October's preliminary pace.

• During the day: The AIA's Architecture Billings Index for November (a leading indicator for commercial real estate).

CoreLogic: "Mortgage loans originated in Q3 continued to exhibit low credit risk"

by Calculated Risk on 12/20/2016 02:05:00 PM

Some credit statistics from CoreLogic: Housing Credit Index: Third Quarter 2016

Loans originated in Q3 2016 are among the highest-quality home loans originated since the year 2001, according to the latest CoreLogic Housing Credit Index (HCI) Report. Figure 1 shows the overall Housing Credit Index from Q1 2001 through the end of Q3 2016. Higher index values indicate a higher level of credit risk for new originations and lower index values indicate less credit risk present. Compared with other loans made since mid-2009, the starting point of the current economic expansion, Q3 2016 loans are among the loans originated with the lowest credit risk based on six important credit-risk attributes.

Click on graph for larger image.

Click on graph for larger image.The average credit score for homebuyers increased 5 points between the third quarter of 2015 and the third quarter of 2016, rising from 734 to 739.CR note: Recent mortgage loans - in general - have low credit risk.

The average DTI for homebuyers fell slightly comparing the third quarters of 2015 and 2016, falling from 35.7 percent to 35.4 percent.

The LTV for homebuyers decreased nearly 1 percentage point between the third quarter of 2015 and the third quarter of 2016, declining from 86.8 percent to 85.8 percent.

Chemical Activity Barometer "Ends Year on Strong Note"

by Calculated Risk on 12/20/2016 11:07:00 AM

Note: This appears to be a leading indicator for industrial production.

From the American Chemistry Council: Chemical Activity Barometer Ends Year on Strong Note; Suggests Expanded Business Growth in Early 2017

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), ended the year on a strong note, posting a monthly gain of 0.3 percent and a year-over-year gain of 4.4 percent, a significant improvement over the first half of the year, and a pace not seen since September 2010. All data is measured on a three-month moving average (3MMA). On an unadjusted basis the CAB climbed 0.6 percent in December, and 4.8 percent for the year.

...

In December all of the four core categories for the CAB improved. Production-related indicators were positive, despite last week’s announcement that housing starts tumbled. “Housing starts were at a nine-year high,” noted ACC Chief Economist Kevin Swift. “The foundation remains strong. Overall trends in construction-related resins, pigments, and related performance chemistry were positive and suggest further gains in housing next year,” he added. Other indicators, including equity prices, product prices, and inventory were also positive.

...

Applying the CAB back to 1912, it has been shown to provide a lead of two to fourteen months, with an average lead of eight months at cycle peaks as determined by the National Bureau of Economic Research. The median lead was also eight months. At business cycle troughs, the CAB leads by one to seven months, with an average lead of four months. The median lead was three months. The CAB is rebased to the average lead (in months) of an average 100 in the base year (the year 2012 was used) of a reference time series. The latter is the Federal Reserve’s Industrial Production Index.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

Currently CAB has increased solidly over the last several months, and this suggests an increase in Industrial Production over the next year.

Hamilton on the Fed: "Back to normal?"

by Calculated Risk on 12/20/2016 09:47:00 AM

A few excerpts from a piece by Professor Hamilton at Econbrowser: Back to normal?

A year ago, the Federal Reserve decided to raise its target for the fed funds rate by 25 basis points above the floor of 0-0.25% at which we’d been stuck for 7 years. FOMC members indicated at the time that they were expecting to end 2016 at 1.4%, or four rate hikes during the last year. We started this December at 0.41%, and the first hike of 2016 didn’t come until last week. Now FOMC members say they are expecting to end 2017 at 1.4%, or three more hikes from here during the next year. The January 2018 fed funds futures contract is currently priced at 1.23%, suggesting that the market is buying into two, not three hikes during 2017.

...

I like the visual device that Federal Reserve Bank of Chicago President Charles Evans proposed, which summarizes the Fed’s inflation and unemployment objectives in terms of a target with a bull’s-eye. I’ve centered the bull’s-eye below assuming a long-run inflation target of 2% and a natural unemployment rate of 4.8%. We’d like to be as close to the center of the target as possible. The U.S. has been moving steadily toward that objective since 2009, though up until the November employment report both the inflation and the unemployment data were arguing for more stimulus. This month for the first time the inflation number calls for more stimulus while the unemployment number suggests we may need less.

Horizontal axis: civilian unemployment rate. Vertical axis: inflation rate as measured by year-over-year percent change in implicit price deflator for personal consumption expenditures. 2017 entry represents FOMC projections. Crosses denote values for October unemployment and October year-over-year inflation for indicated year, with exception that 2016 unemployment number is for Nov 2016 and 2017 projection is for end of year. Adapted from Evans (2014).

If you took the bulls-eye literally, on net you’d still want to see some additional stimulus today, bringing unemployment even lower until inflation is closer to target. And in fact the Fed sees enough underlying strength in the economy that it thinks that, even with the rate hike last week and additional hikes planned for next year, on balance they’re still providing a modest stimulus and expect that by the end of 2017 we’ll end up very close to target ...

But the elephant in the room is of course the possibility that fiscal stimulus may soon be a factor pushing us in a northwest direction on that target. And that may soon come to play a bigger role in U.S. monetary policy determination.

Monday, December 19, 2016

"Rates Stay Near Highs Despite Market Improvement"

by Calculated Risk on 12/19/2016 05:48:00 PM

From Matthew Graham at Mortgage News Daily: Rates Stay Near Highs Despite Market Improvement

Mortgage rates stayed close to the highest levels in more than 2 years today, even though underlying bond markets left plenty of room for improvement. Typically, when bond markets improve as much as they did today, rates would be noticeably lower. The inconsistency has to do with more conservative lender pricing strategies surrounding the holiday season.CR Note: We should see a further drop in refinance activity, and I expect some slowdown in housing (still thinking about this).

...

All this having been said, a few lenders did update rates this afternoon, offering slight improvements. The average effective rate (which adjusts for closing costs) fell just slightly, but the average contract rate for a conventional 30yr fixed loan remained at 4.375% for a top tier scenario, with several lenders still up at 4.5%

emphasis added

Here is a table from Mortgage News Daily:

Yellen: "Strongest job market in nearly a decade"

by Calculated Risk on 12/19/2016 02:02:00 PM

From Fed Chair Janet Yellen: Commencement Remarks

The short version of what I have to say is that while I expect workers will continue to face some challenges in the coming years, I believe, for two reasons, that the job prospects and career opportunities for new graduates at this time are very good. First, after years of a slow economic recovery, you are entering the strongest job market in nearly a decade. The unemployment rate, at 4.6 percent, is near what it was before the recession. This is a level that has been associated with good job opportunities. Job creation is continuing at a steady pace; the layoff rate is low; and job openings are up over the past couple years, which is another sign of a healthy job market. There are also indications that wage growth is picking up, and weekly earnings for younger workers have made strong gains over the past couple of years. That is probably one reason why younger workers reported feeling significantly more optimistic about the job market compared with 2013, according to a survey published just today by the Federal Reserve.

Challenges do remain. The economy is growing more slowly than in past recoveries, and productivity growth, which is a major influence on wages, has been disappointing.

But it also looks like the economic gains of the past few years are finally raising living standards for most people.

emphasis added

LA area Port Traffic increases Year-over-year in November

by Calculated Risk on 12/19/2016 10:02:00 AM

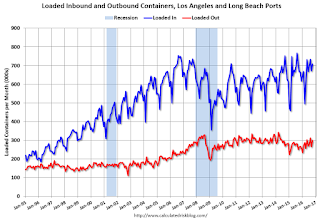

Special note: Now that the expansion to the Panama Canal has been completed, some of the traffic that used the ports of Los Angeles and Long Beach will eventually go through the canal. This could impact TEUs on the West Coast in the future.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was up 0.5% compared to the rolling 12 months ending in October. Outbound traffic was up 1.1% compared to 12 months ending in October.

The downturn in exports last year was probably due to the slowdown in China and the stronger dollar. Now exports are picking up a little.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

In general exports have started increasing, and imports have been gradually increasing.

Sunday, December 18, 2016

Sunday Night Futures

by Calculated Risk on 12/18/2016 06:40:00 PM

Weekend:

• Schedule for Week of Dec 18, 2016

Monday:

• 1:30 PM ET, Speech by Fed Chair Janet Yellen, The State of the Job Market, At the University of Baltimore 2016 Midyear Commencement, Baltimore, Maryland

From CNBC: Pre-Market Data and Bloomberg futures: S&P futures are up 6, and DOW futures are up 40 (fair value).

Oil prices were down over the last week with WTI futures at $51.90 per barrel and Brent at $55.21 per barrel. A year ago, WTI was at $35, and Brent was at $37 - so oil prices are up about 50% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.25 per gallon - a year ago prices were at $2.00 per gallon - so gasoline prices are up about 25 cents per gallon year-over-year.

Hotels: Strong Finish to 2016, Could be Best Year Ever

by Calculated Risk on 12/18/2016 08:11:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 10 December

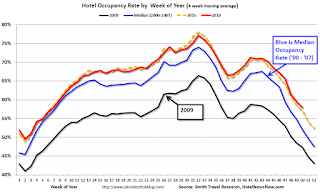

The U.S. hotel industry reported positive results in the three key performance metrics during the week of 4-10 December 2016, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In year-over-year comparisons, the industry’s occupancy increased 1.7% to 59.2%, and average daily rate (ADR) was up 3.9% to US$120.12. As a result, revenue per available room (RevPAR) grew 5.7% to US$71.08.

STR analysts note that the week’s performance was helped by a comparison to a 2015 week that included the first day of Hanukkah.

emphasis added

The red line is for 2016, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.

The red line is for 2016, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.2015 was the best year on record for hotels.

So far 2016 is tracking 2015, and well ahead of the median rate. With a solid finish over the remaining weeks, 2016 could be the best year on record.

Year-to-date, the three best years are:

1) 2016: 66.69% average occupancy.

2) 2015: 66.68% average.

3) 2000: 65.5% average.

For hotels, the Fall business travel season is over and the occupancy rate will decline during the holiday season.

Data Source: STR, Courtesy of HotelNewsNow.com