by Calculated Risk on 12/26/2016 07:27:00 PM

Monday, December 26, 2016

Question #10 for 2017: Will housing inventory increase or decrease in 2017?

Earlier I posted some questions for next year: Ten Economic Questions for 2017. I'll try to add some thoughts, and maybe some predictions for each question.

10) Housing Inventory: Housing inventory declined in 2015 and 2016. Will inventory increase or decrease in 2017?

Tracking housing inventory is very helpful in understanding the housing market. The plunge in inventory in 2011 helped me call the bottom for house prices in early 2012 (The Housing Bottom is Here). And the increase in inventory in late 2005 (see first graph below) helped me call the top for house prices in 2006.

This graph shows nationwide inventory for existing homes through November 2016.

According to the NAR, inventory decreased to 1.85 million in November 2016 from 2.04 million in November 2015.

This was the lowest level for the month of November since 2000.

Inventory is not seasonally adjusted, and usually inventory decreases from the seasonal high in mid-summer to the seasonal lows in December and January as sellers take their homes off the market for the holidays.

Inventory decreased 9.3% year-over-year in November compared to November 2015. (blue line). Note that the blue line (year-over-year change) turned slightly positive in 2013, but has been negative since mid-2015.

Two of the key reasons inventory is low: 1) A large number of single family home and condos were converted to rental units. Last year, housing economist Tom Lawler estimated there were 17.5 million renter occupied single family homes in the U.S., up from 10.7 million in 2000. Many of these houses were purchased by investors, and rents have increased substantially, and the investors are not selling (even though prices have increased too). Most of these rental conversions were at the lower end, and that is limiting the supply for first time buyers. 2) Baby boomers are aging in place (people tend to downsize when they are 75 or 80, in another 10 to 20 years for the boomers). Instead we are seeing a surge in home improvement spending, and this is also limiting supply.

Of course low inventory keeps potential move-up buyers from selling too. If someone looks around for another home, and inventory is lean, they may decide to just stay and upgrade.

I've heard reports of more inventory in some coastal areas of California, in New York city and for high rise condos in Miami. But we haven't seen a change in trend for inventory yet.

The recent increase in interest rates might impact inventory. Looking back at the "taper tantrum" in May and June 2013 suggests we might see more inventory in the coming months. In May 2013, inventory was down 13% year-over-year, but by September 2013, inventory was unchanged year-over-year. However that change in year-over-year inventory was part of an ongoing trend (look at 2013 in the second graph above), and the "taper tantrum" might not have been the cause.

I was wrong on inventory last year, but right now my guess is active inventory will increase in 2017 (inventory will decline seasonally in December and January, but I expect to see inventory up again year-over-year in December 2017). My reasons for expecting more inventory are 1) inventory is historically low (lowest for November since 2000), 2) and the recent increase in interest rates.

If correct, this will keep house price increases down in 2017 (probably lower than the 5% or so gains in 2014, 2015 and 2016).

Here are the Ten Economic Questions for 2017 and a few predictions:

• Question #1 for 2017: What about fiscal and regulatory policy in 2017?

• Question #2 for 2017: How much will the economy grow in 2017?

• Question #3 for 2017: Will job creation slow further in 2017?

• Question #4 for 2017: What will the unemployment rate be in December 2017?

• Question #5 for 2017: Will the core inflation rate rise in 2017? Will too much inflation be a concern in 2017?

• Question #6 for 2017: Will the Fed raise rates in 2017, and if so, by how much?

• Question #7 for 2017: How much will wages increase in 2017?

• Question #8 for 2017: How much will Residential Investment increase?

• Question #9 for 2017: What will happen with house prices in 2017?

• Question #10 for 2017: Will housing inventory increase or decrease in 2017?

Ten Economic Questions for 2017

by Calculated Risk on 12/26/2016 11:56:00 AM

Here is a review of the Ten Economic Questions for 2016.

Here are my ten questions for 2017. I'll follow up with some thoughts on each of these questions.

The purpose of these questions is to provide a framework to think about how the U.S. economy will perform in 2017, and - when there are surprises - to adjust my thinking.

1) US Policy: There is significant uncertainty as to fiscal and regulatory policy in 2017. This is probably the biggest risk for the US economy this coming year. I assume some sort of tax cuts will be passed, possibly some additional infrastructure spending, and possibly some deregulation.

These is the potential for significant policy mistakes - like defaulting on the debt (seems unlikely) - or the start of a trade war. Usually at this point in the transition process, there is a pretty clear understanding of the new administration's policy proposals, but not this time. I'll write much more about this issue.

2) Economic growth: Heading into 2017, most analysts are pretty sanguine and expecting some pickup in growth due to tax cuts and infrastructure spending. How much will the economy grow in 2017?

3) Employment: Through November, the economy has added almost 2,000,000 jobs this year, or 180,000 per month. As expected, this was down from the 230 thousand per month in 2015. Will job creation in 2017 be as strong as in 2016? Or will job creation be even stronger, like in 2014 or 2015? Or will job creation slow further in 2017?

4) Unemployment Rate: The unemployment rate was at 4.6% in November, down 0.4 percentage points year-over-year. Currently the FOMC is forecasting the unemployment rate will be in the 4.5% to 4.6% range in Q4 2017. What will the unemployment rate be in December 2017?

5) Inflation: The inflation rate has increased a little recently, and some key measures are now close to the the Fed's 2% target. Will core inflation rate rise in 2017? Will too much inflation be a concern in 2017?

6) Monetary Policy: The Fed raised rates this month, and now the question is how much will the Fed raise rates in 2017? The market is pricing in three 25 bps rate hikes in 2017, and most analysts expect two to three hikes in 2017. Will the Fed raise rates in 2017, and if so, by how much?

7) Real Wage Growth: Wage growth picked up in 2016. How much will wages increase in 2017?

8) Residential Investment: Residential investment (RI) was sluggish in 2016, although new home sales were up solidly. Note: RI is mostly investment in new single family structures, multifamily structures, home improvement and commissions on existing home sales. How much will RI increase in 2017? How about housing starts and new home sales in 2017?

9) House Prices: It appears house prices - as measured by the national repeat sales index (Case-Shiller, CoreLogic) - will be up about 5% to 6% or so in 2016. What will happen with house prices in 2017?

10) Housing Inventory: Housing inventory declined in 2015 and 2016. Will inventory increase or decrease in 2017?

There are other important questions, but these are the ones I'm focused on right now. I'll write on each of these questions over the next couple of weeks.

Vehicle Sales Forecast: Sales Over 17 Million SAAR Again in December, On Track for Record Year in 2016

by Calculated Risk on 12/26/2016 09:53:00 AM

The automakers will report December vehicle sales on Wednesday, January 4th.

Note: There were 27 selling days in December 2016, down from 28 in December 2015.

From WardsAuto: December Light-Vehicle Sales to Push U.S. Market to New Record

December U.S. light-vehicle sales are forecast to finish strong enough for 2016 to top 2015’s record 17.396 million units. However, actual volume largely will be determined by results in the final third of the month, because a major portion of December’s deliveries typically occur after Christmas.Here is a table (source: BEA) showing the 5 top years for light vehicle sales through November, and the top 5 full years. 2016 will probably finish in the top 3, and could be the best year ever - just beating last year.

The forecast 17.7 million-unit seasonally adjusted annual rate is below November’s 17.8 million, but above December 2015’s 17.4 million.

...

Despite the drop in December’s volume, total 2016 sales will end at 17.41 million units, barely edging out the all-time high set last year.

emphasis added

| Light Vehicle Sales, Top 5 Years and Through November | ||||

|---|---|---|---|---|

| Through November | Full Year | |||

| Year | Sales (000s) | Year | Sales (000s) | |

| 1 | 2000 | 16,109 | 2015 | 17,396 |

| 2 | 2001 | 15,812 | 2000 | 17,350 |

| 3 | 2016 | 15,783 | 2001 | 17,122 |

| 4 | 2015 | 15,766 | 2005 | 16,948 |

| 5 | 1999 | 15,498 | 1999 | 16,894 |

Sunday, December 25, 2016

Happy Holidays!

by Calculated Risk on 12/25/2016 08:19:00 AM

Happy Holidays and Merry Christmas to All!

Whose woods these are I think I know."Stopping by Woods on a Snowy Evening" by Robert Frost

His house is in the village though;

He will not see me stopping here

To watch his woods fill up with snow.

My little horse must think it queer

To stop without a farmhouse near

Between the woods and frozen lake

The darkest evening of the year.

He gives his harness bells a shake

To ask if there is some mistake.

The only other sound’s the sweep

Of easy wind and downy flake.

The woods are lovely, dark and deep,

But I have promises to keep,

And miles to go before I sleep,

And miles to go before I sleep.

Enjoy the season!

Saturday, December 24, 2016

Schedule for Week of Dec 25, 2016

by Calculated Risk on 12/24/2016 08:09:00 AM

This will be a light week for economic data.

Happy Holidays and Merry Christmas!

All US markets will be closed in observance of the Christmas Holiday.

9:00 AM ET: S&P/Case-Shiller House Price Index for October. Although this is the October report, it is really a 3 month average of August, September and October prices.

9:00 AM ET: S&P/Case-Shiller House Price Index for October. Although this is the October report, it is really a 3 month average of August, September and October prices.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the September 2016 report (the Composite 20 was started in January 2000).

The consensus is for a 5.1% year-over-year increase in the Comp 20 index for October. The Zillow forecast is for the National Index to increase 5.7% year-over-year in October.

10:00 AM: Pending Home Sales Index for November. The consensus is for a 0.5% increase in the index.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 262 thousand initial claims, down from 275 thousand the previous week.

9:45 AM: Chicago Purchasing Managers Index for December. The consensus is for a reading of 57.0, down from 57.6 in November.

Friday, December 23, 2016

Lawler: Table of Distressed Sales and All Cash Sales for Selected Cities in November

by Calculated Risk on 12/23/2016 05:26:00 PM

Economist Tom Lawler sent me the table below of short sales, foreclosures and all cash sales for selected cities in November.

On distressed: The total "distressed" share is down year-over-year in all of these markets.

Short sales and foreclosures are mostly down in these areas.

The All Cash Share (last two columns) is mostly declining year-over-year. As investors continue to pull back, the share of all cash buyers continues to decline.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Nov- 2016 | Nov- 2015 | Nov- 2016 | Nov- 2015 | Nov- 2016 | Nov- 2015 | Nov- 2016 | Nov- 2015 | |

| Las Vegas | 4.0% | 7.1% | 6.5% | 6.2% | 10.5% | 13.3% | 26.9% | 33.2% |

| Reno** | 2.0% | 4.0% | 3.0% | 4.0% | 5.0% | 8.0% | ||

| Phoenix | 1.5% | 2.9% | 2.2% | 3.8% | 3.7% | 6.7% | 23.4% | 29.1% |

| Sacramento | 2.6% | 4.4% | 2.4% | 3.6% | 5.0% | 8.0% | 12.9% | 22.9% |

| Minneapolis | 1.8% | 2.6% | 4.8% | 9.6% | 6.6% | 12.2% | 12.7% | 16.6% |

| Mid-Atlantic | 3.1% | 3.9% | 9.4% | 11.9% | 12.6% | 15.8% | 17.5% | 20.9% |

| Florida SF | 2.2% | 3.7% | 8.1% | 15.3% | 10.3% | 19.0% | 29.5% | 37.7% |

| Florida C/TH | 1.3% | 2.4% | 6.1% | 13.4% | 7.4% | 15.7% | 57.2% | 65.4% |

| Chicago (city) | 15.5% | 18.6% | ||||||

| Spokane | 6.7% | 9.8% | ||||||

| Northeast Florida | 13.7% | 26.2% | ||||||

| Rhode Island | 9.2% | 11.2% | ||||||

| Tucson | 23.1% | 32.2% | ||||||

| Knoxville | 21.3% | 26.0% | ||||||

| Peoria | 23.2% | 27.2% | ||||||

| Georgia*** | 19.7% | 25.2% | ||||||

| Omaha | 18.1% | 20.6% | ||||||

| Richmond VA | 8.8% | 10.2% | 17.2% | 21.0% | ||||

| Memphis | 10.9% | 15.3% | ||||||

| Springfield IL** | 5.6% | 8.6% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

Review: Ten Economic Questions for 2016

by Calculated Risk on 12/23/2016 02:31:00 PM

At the end of each year, I post Ten Economic Questions for the coming year. I followed up with a brief post on each question. The goal was to provide an overview of what I expected in 2016 (I don't have a crystal ball, but I think it helps to outline what I think will happen - and understand - and change my mind, when the outlook is wrong).

Here is a review. I've linked to my posts from the beginning of the year, with a brief excerpt and a few comments:

10) Question #10 for 2016: How much will housing inventory increase in 2016?

Right now my guess is active inventory will increase in 2016 (inventory will decline seasonally in December and January, but I expect to see inventory up again year-over-year in 2016). I don't expect a double digit surge in inventory, but maybe a mid-single digit increase year-over-year. If correct, this will keep house price increases down in 2015 (probably lower than the 5% or so gains in 2014 and 2015).According to the November NAR report on existing home sales, inventory was down 9.3% year-over-year in August, and the months-of-supply was at 4.0 months. It is clear inventory will decrease in 2016. Note: I changed my view on inventory early this year (one of the key reasons for writing down expectations - so we can change our views when the data is different than expected).

Two of the key reasons inventory is low: 1) A large number of single family home and condos were converted to rental units. Last year, housing economist Tom Lawler estimated there were 17.5 million renter occupied single family homes in the U.S., up from 10.7 million in 2000. Many of these houses were purchased by investors, and rents have increased substantially, and the investors are not selling (even though prices have increased too). Most of these rental conversions were at the lower end, and that is limiting the supply for first time buyers. 2) Baby boomers are aging in place (people tend to downsize when they are 75 or 80, in another 10 to 20 years for the boomers). Instead we are seeing a surge in home improvement spending, and this is also limiting supply.

9) Question #9 for 2016: What will happen with house prices in 2016?

Low inventories, and a decent economy suggests further price increases in 2016. However I expect we will see prices up less in 2016, than in 2015, as measured by these house price indexes - mostly because I expect more inventory.It is early, but the recently released Case-Shiller data showed prices up 5.5% year-over-year in September. The price increase is slightly higher than in 2015 (prices were up 5.25% nationally in 2015), probably due to less inventory.

8) Question #8 for 2016: How much will Residential Investment increase?

My guess is growth of around 4% to 8% in 2016 for new home sales, and about the same percentage growth for housing starts. Also I think the mix between multi-family and single family starts will shift a little more towards single family in 2016.Through November, starts were up 4.8% year-over-year compared to the same period in 2015. New home sales were up 12.7% year-over-year. Starts will increase as expected; new home sales will be higher than I expected.

7) Question #7 for 2016: What about oil prices in 2016?

It is impossible to predict an international supply disruption, however if a significant disruption happens, then prices will move higher. Continued weakness in Europe and China seems likely, however sluggish demand will be somewhat offset by less tight oil production. It seems like the key oil producers (Saudi, etc) will continue production at current levels. This suggests in the short run (2016) that prices will stay low, but probably move up a little in 2016. I'll guess WTI will be up from the current price [WTI at $38 per barrel] by December 2016 (but still under $50 per barrel).As of this morning, WTI futures are at $52.85 per barrel. Prices moved up as expected, but are a little above $50.

6) Question #6 for 2016: Will real wages increase in 2016?

For this post the key point is that nominal wages have been only increasing about 2% per year with some pickup in 2015. As the labor market continues to tighten, we should start see more wage pressure as companies have to compete more for employees. I expect to see some further increase in nominal wage increases in 2016 (perhaps over 3% later in the year). The year-over-year change in real wages will depend on inflation, and I expect headline CPI to pickup some this year as the impact on headline inflation of declining oil prices fades.Through November, nominal hourly wages were up 2.5% year-over-year. This is a pickup from last year - and wage growth appears to be trending up. Wages will increase at a faster rate in 2016 than in 2015.

5) Question #5 for 2016: Will the Fed raise rates in 2016, and if so, by how much?

I've seen several people arguing the Fed will be cutting rates by the end of 2016 - I think that is unlikely. Instead I think the Fed will be cautious - and they will not want to reverse course. Right now I think something around three rate hikes in 2016 is likely.Events have pushed the Fed to delay rate increases, and the Fed only hiked once in 2016.

4) Question #4 for 2016: Will the core inflation rate rise in 2016? Will too much inflation be a concern in 2016?

Due to some remaining slack in the labor market (example: elevated level of part time workers for economic reasons), I expect these measures of inflation will be close to the Fed's target in 2016.It is early, but inflation has moved up close to the Fed target through November.

So currently I think core inflation (year-over-year) will increase further in 2016, but too much inflation will not be a serious concern in 2016.

3) Question #3 for 2016: What will the unemployment rate be in December 2016?

Depending on the estimate for the participation rate and job growth (next question), it appears the unemployment rate will decline to around 4.5% by December 2016. My guess is based on the participation rate declining slightly in 2016 and for decent job growth in 2016 (however less in 2016 than in 2015).The unemployment rate was 4.6% in November, down from 5.0% in December 2015.

2) Question #2 for 2016: How many payroll jobs will be added in 2016?

Energy related construction hiring will decline in 2016, but I expect other areas of construction to be solid. For manufacturing, growth in the auto sector will probably slow this year, but the drag on manufacturing employment from the strong dollar should be less in 2016.Through November 2016, the economy has added almost 2 million jobs; or 180,000 per month. It now appears employment gains will be lower than in 2015 (as expected).200,000 per month in 2016.

As I mentioned above, in addition to layoffs in the energy sector, exporters will have a difficult year - but probably not the severe contraction as in 2015, and more companies will have difficulty finding qualified candidates. Even with some boost from lower oil prices - and some additional public hiring, I expect total jobs added to be lower in 2016 than in 2015.

So my forecast is for gains of around 200,000 payroll jobs per month in 2015. Lower than in 2015, but another solid year for employment gains given current demographics.

1) Question #1 for 2016: How much will the economy grow in 2016?

In addition, the sharp decline in oil prices should be a net positive for the US economy in 2016. And, hopefully, the negative impact from the strong dollar will fade in 2016.GDP growth was sluggish again in the first half (just up 1.1% annualized), and solid in Q3. GDP is now tracking 2.5% in Q4. This would be GDP growth just over 2% from Q4 2015 to Q4 2016.

The most likely growth rate is in the mid-2% range again ...

In general, 2016 unfolded as expected with some key exceptions (one of the reasons I write down what I think will happen). I changed my view on Fed rate hikes earlier this year to just one hike. And existing home inventory is declined again this year.

Residential investment, oil prices, inflation, wage growth and employment were about as I expected.

A few Comments on November New Home Sales

by Calculated Risk on 12/23/2016 11:41:00 AM

New home sales for November were reported at 592,000 on a seasonally adjusted annual rate basis (SAAR). This was above the consensus forecast, however the previous months combined were revised down slightly.

Sales were up 16.5% year-over-year in November, and this is the best month for November (NSA) since 2007. And sales are up 12.7% year-to-date compared to the same period in 2015.

This is very solid year-over-year growth.

Note that these sales (for November) mostly happened while mortgage rates were increasing (but still below the current level). So far the increase in rates hasn't impacted sales, but we need to wait a few months to see the impact.

Earlier: New Home Sales increase to 592,000 Annual Rate in November.

This graph shows new home sales for 2015 and 2016 by month (Seasonally Adjusted Annual Rate). Sales to date are up 12.7% year-over-year, because of very strong year-over-year growth over the last seven months.

Overall I expected lower growth this year, in the 4% to 8% range. Slower growth seemed likely this year because Houston (and other oil producing areas) will have a problem this year. I was too pessimistic on new home sales this year.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

I expect existing home sales to move more sideways, and I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales increase to 592,000 Annual Rate in November

by Calculated Risk on 12/23/2016 10:09:00 AM

The Census Bureau reports New Home Sales in November were at a seasonally adjusted annual rate (SAAR) of 592 thousand.

The previous three months were revised down slightly.

"Sales of new single-family houses in November 2016 were at a seasonally adjusted annual rate of 592,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 5.2 percent above the revised October rate of 563,000 and is 16.5 percent above the November 2015 estimate of 508,000."

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are still fairly low historically.

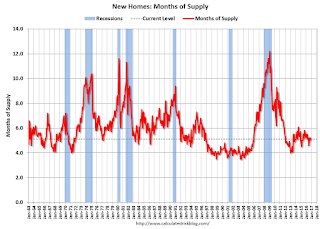

The second graph shows New Home Months of Supply.

The months of supply decreased in November to 5.1 months.

The months of supply decreased in November to 5.1 months. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

"The seasonally adjusted estimate of new houses for sale at the end of November was 250,000. This represents a supply of 5.1 months at the current sales rate"

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In November 2016 (red column), 41 thousand new homes were sold (NSA). Last year, 36 thousand homes were sold in November. This was the highest sales for November since 2007.

The all time high for November was 86 thousand in 2005, and the all time low for November was 20 thousand in 2010.

This was above expectations of 580,000 sales SAAR in November. I'll have more later today.

Thursday, December 22, 2016

Friday: New Home Sales

by Calculated Risk on 12/22/2016 07:17:00 PM

A couple of Q4 GDP tracking estimates ...

From Merrill Lynch updated today: "our 4Q GDP tracking estimate [is] 1.8% qoq saar"

And from the Atlanta Fed GDPNow:

The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2016 is 2.5 percent on December 22, down from 2.6 percent on December 16. The forecasts of fourth-quarter real personal consumption expenditures and real intellectual property products investment growth increased modestly after this morning's GDP and personal income outlays reports from the U.S. Bureau of Economic Analysis (BEA). These were offset by modest declines in the forecasted contributions to growth from residential, nonresidential equipment and inventory investment after the aforementioned BEA releases, this morning's advance manufacturing report from the U.S. Census Bureau, and yesterday's existing-home sales release from the National Association of Realtors.Friday:

• At 10:00 AM ET, New Home Sales for November from the Census Bureau. The consensus is for an increase in sales to 580 thousand Seasonally Adjusted Annual Rate (SAAR) in November from 563 thousand in October.

• Also at 10:00 AM, University of Michigan's Consumer sentiment index (final for December). The consensus is for a reading of 98.0, unchanged from the preliminary reading 98.0.