by Calculated Risk on 1/05/2017 03:33:00 PM

Thursday, January 05, 2017

December Employment Preview

On Friday at 8:30 AM ET, the BLS will release the employment report for December. The consensus, according to Bloomberg, is for an increase of 175,000 non-farm payroll jobs in December (with a range of estimates between 151,000 to 200,000), and for the unemployment rate to increase to 4.7%.

The BLS reported 178,000 jobs added in November.

Here is a summary of recent data:

• The ADP employment report showed an increase of 153,000 private sector payroll jobs in December. This was below expectations of 172,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth somewhat below expectations.

• The ISM manufacturing employment index increased in December to 53.1%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll was unchanged in December. The ADP report indicated 9,000 manufacturing jobs lost in December.

The ISM non-manufacturing employment index decreased in December to 53.8%. A historical correlation between the ISM non-manufacturing employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS non-manufacturing payroll jobs increased about 175,000 in December.

Combined, the ISM indexes suggests employment gains of about 175,000. This suggests employment growth close to expectations.

• Initial weekly unemployment claims averaged 257,000 in December, up from 252,000 in November. For the BLS reference week (includes the 12th of the month), initial claims were at 275,000, up from 233,000 during the reference week in November.

The increase during the reference suggests more layoffs during that week in December as compared to November. This suggests a below consensus employment report.

• The final December University of Michigan consumer sentiment index increased to 98.2 from the November reading of 93.8. Sentiment is frequently coincident with changes in the labor market, but there are other factors too like gasoline prices and politics.

• Conclusion: Unfortunately none of the indicators alone is very good at predicting the initial BLS employment report. The ADP report and weekly unemployment claims suggest weaker job growth. The ISM reports suggests growth close to consensus.

My guess is the December report will be below the consensus forecast.

Reis: Apartment Vacancy Rate declined in Q4 to 4.1%

by Calculated Risk on 1/05/2017 01:11:00 PM

Reis reported that the apartment vacancy rate was at 4.1% in Q4 2016, down from 4.2% in Q3, and down from 4.3% in Q4 2015. The vacancy rate peaked at 8.0% at the end of 2009, and this is a new low for this cycle.

A few comments from Reis Economist Barbara Denham:

Showing continued resiliency, the national apartment vacancy rate declined to 4.1% from 4.2% in the third quarter and 4.3% at year-end 2015. Although net absorption (occupancy growth) was the lowest level in more than two years, new construction was also weaker. The fourth quarter statistics ... confirm that the pace of new completions has slowed after soaring over the last few years. Rent growth decelerated as well to a rate of 0.3% in the fourth quarter. Although the fourth quarter usually sees the lowest growth rates of the year, this quarter's results were the lowest since 2009.

...

Looking ahead, while new construction is expected to exceed demand (occupancy growth), we do not foresee a spike in vacancy rates. As mentioned above, recently surveyed data shows that the pace of completions has slowed while net absorption has stayed healthy. This means that prospective home buyers have not abandoned the apartment market as rapidly as many had thought would do so by this stage of the expansion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the apartment vacancy rate starting in 1980. (Annual rate before 1999, quarterly starting in 1999). Note: Reis is just for large cities.

The vacancy rate had been mostly moving sideways for the last few years. It appeared that the vacancy rate had bottomed, but this is a new low for this cycle.

Apartment vacancy data courtesy of Reis.

ISM Non-Manufacturing Index at 57.2% in December

by Calculated Risk on 1/05/2017 10:04:00 AM

The December ISM Non-manufacturing index was at 57.2%, unchanged from 57.2% in November. The employment index decreased in December to 53.8%, from 58.1%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management:December 2016 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in December for the 83rd consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 57.2 percent in December, matching the November figure. This represents continued growth in the non-manufacturing sector at the same rate. The Non-Manufacturing Business Activity Index decreased to 61.4 percent, 0.3 percentage point lower than the November reading of 61.7 percent, reflecting growth for the 89th consecutive month, at a slightly slower rate in December. The New Orders Index registered 61.6 percent, 4.6 percentage points higher than the reading of 57 percent in November. The Employment Index decreased 4.4 percentage points in December to 53.8 percent from the November reading of 58.2 percent. The Prices Index increased 0.7 percentage point from the November reading of 56.3 percent to 57 percent, indicating prices increased in December for the ninth consecutive month at a slightly faster rate. According to the NMI®, 12 non-manufacturing industries reported growth in December. The non-manufacturing sector closed out the year strong maintaining its rate of growth month-over-month. Respondents' comments are mostly positive about business conditions and the overall economy."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was above the consensus forecast of 56.8, and suggests about the same rate of expansion in December as in November. A solid report.

Weekly Initial Unemployment Claims decrease to 235,000

by Calculated Risk on 1/05/2017 08:33:00 AM

The DOL reported:

In the week ending December 31, the advance figure for seasonally adjusted initial claims was 235,000, a decrease of 28,000 from the previous week's revised level. The previous week's level was revised down by 2,000 from 265,000 to 263,000. The 4-week moving average was 256,750, a decrease of 5,750 from the previous week's revised average. The previous week's average was revised down by 500 from 263,000 to 262,500.The previous week was revised down.

There were no special factors impacting this week's initial claims. This marks 96 consecutive weeks of initial claims below 300,000, the longest streak since 1970.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 256,750.

This was well below the consensus forecast (it is difficult to seasonally adjusted during the holidays). The low level of claims suggests relatively few layoffs.

ADP: Private Employment increased 153,000 in December

by Calculated Risk on 1/05/2017 08:21:00 AM

Private sector employment increased by 153,000 jobs from November to December according to the December ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was below the consensus forecast for 172,000 private sector jobs added in the ADP report.

...

“As we exit 2016, it’s interesting to note that the private sector generated an average of 174,000 jobs per month, down from 209,000 in 2015,” said Ahu Yildirmaz, vice president and head of the ADP Research Institute. “And while job gains in December were slightly below our monthly average, the U.S. labor market has experienced unprecedented seven years of growth that has brought us to near full employment. As we enter 2017, the tightening labor market will likely slow the growth.”

Mark Zandi, chief economist of Moody’s Analytics, said, “Job growth remains strong but is slowing. The gap between employment growth in the service economy and losses on the goods side persists. Smaller companies are struggling to maintain payrolls while large companies are expanding at a healthy pace.”

The BLS report for December will be released Friday, and the consensus is for 175,000 non-farm payroll jobs added in December.

Wednesday, January 04, 2017

Thursday: ADP Employment, Unemployment Claims, ISM Non-Mfg, Apartment Survey

by Calculated Risk on 1/04/2017 07:24:00 PM

Thursday:

• At 8:15 AM ET, the ADP Employment Report for December. This report is for private payrolls only (no government). The consensus is for 172,000 payroll jobs added in December, down from 216,000 added in November.

• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for 260 thousand initial claims, down from 265 thousand the previous week.

• Early, Reis Q4 2016 Apartment Survey of rents and vacancy rates.

• At 10:00 AM, the ISM non-Manufacturing Index for December. The consensus is for index to decrease to 56.8 from 57.2 in November.

U.S. Light Vehicle Sales increase to 18.3 million annual rate in December, Record Year

by Calculated Risk on 1/04/2017 03:00:00 PM

Based on a preliminary estimate from WardsAuto, light vehicle sales were at a 18.29 million SAAR in December.

That is up about 5% from December 2015, and up 3% from the 17.75 million annual sales rate last month.

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for December (red, light vehicle sales of 18.29 million SAAR from WardsAuto).

This was above the consensus forecast.

From John Sousanis at WardsAuto December 2016 U.S. LV Sales Thread: U.S. Automakers Set Light-Vehicle Sales Record in 2016

U.S. automakers outpaced analyst expectations in December, ensuring that 2016 was the best year for light-vehicle sales ever. A total of 1.68 million LVs were sold in the final month of the year, edging the full-year tally 0.4% over the prior record, set in 2015.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.Note: dashed line is current estimated sales rate.

Sales for 2016 hit a new annual record.

Sales in 2016 were at 17.465 million, up from the previous record of 17.396 million set last year.

Reis: Office Vacancy Rate declined in Q4 to 15.7%

by Calculated Risk on 1/04/2017 09:28:00 AM

Reis released their Q4 2016 Office Vacancy survey this morning. Reis reported that the office vacancy rate declined to 15.7% in Q4, down from 15.9% in Q3. This is down from 16.2% in Q4 2015, and down from the cycle peak of 17.6%.

From Reis Economist Barbara Denham:

The office market saw stronger demand in the fourth quarter than in the previous three as net absorption (increase in occupancy) exceeded new supply by the widest margin since before the recession. Still, office rent growth decelerated in the quarter to 0.3%. Office rents have decelerated all year.

The national vacancy rate declined to 15.7% in the fourth quarter of 2016 from 15.9% in the third quarter and 16.2% at year-end 2015. ...

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis reported the vacancy rate was at 15.7% in Q4. The office vacancy rate is at the lowest level since early 2009, but remains elevated.

Office vacancy data courtesy of Reis.

MBA: Mortgage Applications Decreased Over Two Week Period

by Calculated Risk on 1/04/2017 07:00:00 AM

From the MBA: Mortgage Applications Decreased Over Two Week Period in Latest MBA Weekly Survey

Mortgage applications decreased 12 percent from two weeks earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending December 30, 2016. The results included adjustments to account for the Christmas holiday.

... The Refinance Index decreased 22 percent from two weeks ago. The seasonally adjusted Purchase Index decreased 2 percent from two weeks earlier. The unadjusted Purchase Index decreased 41 percent compared with two weeks ago and was 1 percent lower than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.39 percent from 4.45 percent, with points increasing to 0.43 from 0.39 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

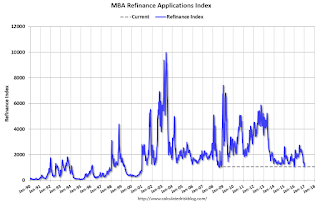

Click on graph for larger image.The first graph shows the refinance index since 1990.

With the current level of mortgage rates, refinance activity will probably decline further.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The purchase index was "1 percent lower than the same week one year ago".

Even with the increase in mortgage rates, purchase activity is still holding up. However refinance activity has declined significantly.

Tuesday, January 03, 2017

Wednesday: Auto Sales, Office Vacancy Survey, FOMC Minutes

by Calculated Risk on 1/03/2017 06:25:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Lowest in Weeks

Mortgage rates improved slightly to begin 2017, bringing them to the lowest levels in nearly a month, on average. December 8th was the last time rates were lower. During December, conventional 30yr fixed quotes were straying into the 4.375%-4.5% territory for many lenders. Now, nearly every lender is back down to 4.25% at least, with several already down to 4.125%. These rates assume a top tier scenario with no negative adjustments.Wednesday:

emphasis added

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• Early, Reis Q4 2016 Office Survey of rents and vacancy rates.

• All day: Light vehicle sales for December. The consensus is for light vehicle sales to decrease to 17.7 million SAAR in December, from 17.9 million in November (Seasonally Adjusted Annual Rate).

• At 2:00 PM, The Fed will release the FOMC minutes for the December meeting.