by Calculated Risk on 1/14/2017 08:09:00 AM

Saturday, January 14, 2017

Schedule for Week of Jan 15th

The key economic reports this week are Housing Starts, and the Consumer Price Index (CPI).

For manufacturing, December industrial production, and the January New York, and Philly Fed manufacturing surveys, will be released this week.

Speeches by Fed Chair Janet Yellen are scheduled on Wednesday and Thursday.

All US markets will be closed in observance of Martin Luther King Jr. Day

8:30 AM ET: The New York Fed Empire State manufacturing survey for January. The consensus is for a reading of 8.0, down from 9.0.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The Consumer Price Index for December from the BLS. The consensus is for 0.3% increase in CPI, and a 0.2% increase in core CPI.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for December.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for December.This graph shows industrial production since 1967.

The consensus is for a 0.6% increase in Industrial Production, and for Capacity Utilization to increase to 75.4%.

10:00 AM: The January NAHB homebuilder survey. The consensus is for a reading of 69, down from 70 in December. Any number above 50 indicates that more builders view sales conditions as good than poor.

During the day: The AIA's Architecture Billings Index for December (a leading indicator for commercial real estate).

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

3:00 PM: Speech, Fed Chair Janet Yellen, The Goals of Monetary Policy and How We Pursue Them, At the Commonwealth Club, San Francisco, California

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 255 thousand initial claims, up from 247 thousand the previous week.

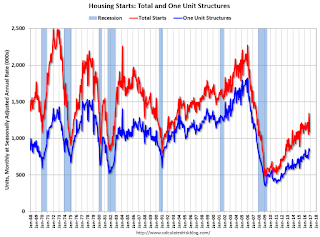

8:30 AM: Housing Starts for December.

8:30 AM: Housing Starts for December. Total housing starts decreased to 1.090 Million (SAAR) in November. Single family starts decreased to 828 thousand SAAR in November.

The consensus is for 1.200 million, up from the November rate.

8:30 AM: the Philly Fed manufacturing survey for January. The consensus is for a reading of 16.0, down from 19.7.

8:00 PM: Speech, Fed Chair Janet Yellen, The Economic Outlook and the Conduct of Monetary Policy, At the Stanford Institute for Economic Policy Research, San Francisco, California

No economic releases scheduled.

Friday, January 13, 2017

Sacramento Housing in December: Sales down 2%, Active Inventory down 17% YoY

by Calculated Risk on 1/13/2017 07:39:00 PM

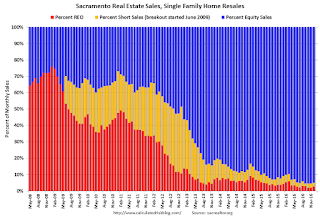

During the recession, I started following the Sacramento market to look for changes in the mix of houses sold (equity, REOs, and short sales). For several years, not much changed. But in 2012 and 2013, we saw some significant changes with a dramatic shift from distressed sales to more normal equity sales.

This data suggests healing in the Sacramento market and other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In December, total sales were down 2.6% from December 2015, and conventional equity sales were down 0.6% compared to the same month last year.

In December, 4.4% of all resales were distressed sales. This was up from 4.4% last month, and down from 8.3% in November 2015.

The percentage of REOs was at 2.5%, and the percentage of short sales was 2.3%.

Here are the statistics.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional (equity) sales that started in 2012 (blue) as the percentage of distressed sales declined sharply.

Active Listing Inventory for single family homes decreased 16.6% year-over-year (YoY) in December. This was the 20th consecutive monthly YoY decrease in inventory in Sacramento.

Cash buyers accounted for 13.1% of all sales - this has been steadily declining (frequently investors).

Summary: This data suggests a normal market with few distressed sales, and less investor buying - but with limited inventory.

Question #1 for 2017: What about fiscal and regulatory policy in 2017?

by Calculated Risk on 1/13/2017 02:30:00 PM

Late last year I posted some questions for 2017: Ten Economic Questions for 2017. I'll try to add some thoughts, and maybe some predictions for each question.

1) US Policy: There is significant uncertainty as to fiscal and regulatory policy in 2017. This is probably the biggest risk for the US economy this coming year. I assume some sort of tax cuts will be passed, possibly some additional infrastructure spending, and possibly some deregulation.

These is the potential for significant policy mistakes - like defaulting on the debt (seems unlikely) - or the start of a trade war. Usually at this point in the transition process, there is a pretty clear understanding of the new administration's policy proposals, but not this time.

Goldman Sachs economists David Mericle and Ben Snider recently looked at equity prices and concluded that investors expect the following policy changes:

We draw three conclusions. First, on the spending side, the equity market appears to expect large health care cutbacks, but has moderated its initial post-election expectations for increased infrastructure spending. Second, on the tax side, the equity market seems to expect meaningful corporate tax cuts, though the evidence that the market has even partially priced a switch to destination-based taxation with border adjustment is only mixed. Third, we see little evidence that the equity market expects major financial or energy-sector deregulation that meaningfully affects profits.Back in November I wrote: Some early Thoughts on the Impact of the Trump Economic Policies. Here are some excerpts:

"First, in broad brushes, the Trump economic plan seems to be:We are still waiting for the details. As far as the impact on 2017, my expectation is there will be both individual and corporate tax cuts - and some sort of infrastructure program. I expect that something will happen with the ACA (those that have insurance for 2017 will keep their insurance, but they might not have insurance in 2018 - and that impact would be in 2018). I think the negative proposals (immigration, trade) will impact the economy in 2018 or later - overall there will be a small boost to GDP in 2017.

1) Renegotiate trade deals and / or impose tariffs.

2) Stricter enforcement and control on immigration, and the deportation of illegal immigrants.

3) Significant Infrastructure spending.

4) Tax cuts mostly for high income earners and corporations.

5) No changes to Social Security and Medicare.

6) Deregulation.

...

Most analysts think there will be fiscal stimulus in 2017 and 2018, with a combination of tax cuts and some increase in infrastructure spending. In general, analysts believe that any changes to trade agreements will take time, and that deportations will not increase significantly. The bottom line for analysts is that the portions of the program that will boost the economy in the short term will be enacted, and the portions that won't (trade deals, deportations) and changes to the ACA (Obamacare) will be delayed.

This is why analysts have been somewhat positive on the impact of the Trump economic proposals for 2017. However no one knows what will actually be proposed. What matters is the details.

...

Members of Mr. Trump's team have been talking about a $1 trillion infrastructure plan. However the infrastructure proposal is really a proposal for about $100+ billion in tax credits to spur private investment in infrastructure. The $1 trillion in infrastructure investment is the projected size of the private investment, not the proposed government spending. This proposal is actually very modest in terms of a fiscal boost. If this is a privatization scheme, then there might be a modest short term boost, but the long term impact will be negative."

A final comment: The words of a President matter. Mr Trump has been impulsive, reckless and irresponsible with his comments, and that has continued since the election. One absurd comment could send the markets into a tailspin and negatively impact the economy (and that could happen at any time).

Here are the Ten Economic Questions for 2017 and a few predictions:

• Question #1 for 2017: What about fiscal and regulatory policy in 2017?

• Question #2 for 2017: How much will the economy grow in 2017?

• Question #3 for 2017: Will job creation slow further in 2017?

• Question #4 for 2017: What will the unemployment rate be in December 2017?

• Question #5 for 2017: Will the core inflation rate rise in 2017? Will too much inflation be a concern in 2017?

• Question #6 for 2017: Will the Fed raise rates in 2017, and if so, by how much?

• Question #7 for 2017: How much will wages increase in 2017?

• Question #8 for 2017: How much will Residential Investment increase?

• Question #9 for 2017: What will happen with house prices in 2017?

• Question #10 for 2017: Will housing inventory increase or decrease in 2017?

Preliminary January Consumer Sentiment at 98.1

by Calculated Risk on 1/13/2017 10:13:00 AM

The preliminary University of Michigan consumer sentiment index for January was at 98.1, down slightly from 98.2 in December.

Consumer confidence remained unchanged at the cyclical peak levels recorded in December. The Current Conditions Index rose 0.6 points to reach its highest level since 2004, and the Expectations Index fell 0.6 points which was lower than only the 2015 peak during the past dozen years. The post-election surge in optimism was accompanied by an unprecedented degree of both positive and negative concerns about the incoming administration spontaneously mentioned when asked about economic news. The importance of government policies and partisanship has sharply risen over the past half century. From 1960 to 2000, the combined average of positive and negative references to government policies was just 6%; during the past six years, this proportion averaged 20%, and rose to new peaks in early January, with positive and negative references totaling 44%. This extraordinary level of partisanship has had a dramatic impact on economic expectations. In early January, the partisan divide on the Expectations Index was a stunning 42.7 points (108.9 among those who favorably mentioned government policies, and 66.2 among those who made unfavorable references). Needless to say, these extreme differences would imply either strong growth or a recession. Since neither is likely, one would anticipate that both extreme views will be tempered in the months ahead.

emphasis added

Click on graph for larger image.

Consumer sentiment is a concurrent indicator (not a leading indicator). The survey shows some people are now much more positive than prior to the U.S. election - and others are much more negative.

Retail Sales increased 0.6% in December

by Calculated Risk on 1/13/2017 09:12:00 AM

On a monthly basis, retail sales increased 0.6 percent from November to December (seasonally adjusted), and sales were up 4.1 percent from December 2015.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for December 2016, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $469.1 billion, an increase of 0.6 percent from the previous month, and 4.1 percent above December 2015. Total sales for the 12 months of 2016 were up 3.3 percent from 2015. ... The October 2016 to November 2016 percent change was revised from up 0.1 percent to up 0.2 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.5% in December.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales ex-gasoline increased by 4.0% on a YoY basis.

Retail and Food service sales ex-gasoline increased by 4.0% on a YoY basis.The increase in December was below expectations, however sales for October and November were revised up. A solid report.

Thursday, January 12, 2017

Friday: Retail Sales, PPI, Consumer Sentiment

by Calculated Risk on 1/12/2017 07:39:00 PM

From Matthew Graham at Mortgage News Daily: Mixed Bag For Mortgage Rates Amid Market Volatility

Mortgage rates were mixed today, depending on the lender.Friday:

...

4.125% is still the most prevalent conventional 30yr fixed rate on top tier scenarios, with today's losses seen in the form of higher upfront costs.

emphasis added

• At 8:30 AM ET, Retail sales for December will be released. The consensus is for 0.7% increase in retail sales in December.

• At 8:30 AM, The Producer Price Index for December from the BLS. The consensus is for a 0.3% increase in prices, and a 0.1% increase in core PPI.

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for November. The consensus is for a 0.6% increase in inventories.

• At 10:00 AM, University of Michigan's Consumer sentiment index (preliminary for January). The consensus is for a reading of 98.6, up from 98.2 in November.

Question #2 for 2017: How much will the economy grow in 2017?

by Calculated Risk on 1/12/2017 02:01:00 PM

Late last year I posted some questions for 2017: Ten Economic Questions for 2017. I'll try to add some thoughts, and maybe some predictions for each question.

2) Economic growth: Heading into 2017, most analysts are pretty sanguine and expecting some pickup in growth due to tax cuts and infrastructure spending. How much will the economy grow in 2017?

Here is a table of the annual change in real GDP since 2007. Economic activity has mostly been in the 2% range since 2010. Given current demographics, that is about what we'd expect: See: 2% is the new 4%.

| Annual Real GDP Growth | ||

|---|---|---|

| Year | GDP | |

| 2005 | 3.3% | |

| 2006 | 2.7% | |

| 2007 | 1.8% | |

| 2008 | -0.3% | |

| 2009 | -2.8% | |

| 2010 | 2.5% | |

| 2011 | 1.6% | |

| 2012 | 2.2% | |

| 2013 | 1.7% | |

| 2014 | 2.4% | |

| 2015 | 2.6% | |

| 20161 | 1.7% | |

| 1 2016 estimate. | ||

It is possible that there will be a pickup in growth in 2017 due to a combination of factors.

The new administration's policy proposals are unclear, but it appears there will be tax cuts, possibly more government spending on infrastructure, and possibly less regulation (easier borrowing).

There will probably be some economic boost from oil sector investment in 2017 since oil prices have increased (this was a drag last year).

The housing recovery is ongoing, however auto sales might have peaked.

And demographics are improving (the prime working age population is growing about 0.5% per year, compared to declining a few years ago).

All these factors combined will probably push GDP growth into the mid-to-high 2% range in 2017, but this will depend somewhat on which policies are enacted.

Here are the Ten Economic Questions for 2017 and a few predictions:

• Question #1 for 2017: What about fiscal and regulatory policy in 2017?

• Question #2 for 2017: How much will the economy grow in 2017?

• Question #3 for 2017: Will job creation slow further in 2017?

• Question #4 for 2017: What will the unemployment rate be in December 2017?

• Question #5 for 2017: Will the core inflation rate rise in 2017? Will too much inflation be a concern in 2017?

• Question #6 for 2017: Will the Fed raise rates in 2017, and if so, by how much?

• Question #7 for 2017: How much will wages increase in 2017?

• Question #8 for 2017: How much will Residential Investment increase?

• Question #9 for 2017: What will happen with house prices in 2017?

• Question #10 for 2017: Will housing inventory increase or decrease in 2017?

Lawler: New “Household” Numbers, Same Old Conundrum

by Calculated Risk on 1/12/2017 11:08:00 AM

From housing economist Tom Lawler: New “Household” Numbers, Same Old Conundrum

Housing Survey (AHS) for 2015, and the “Families and Living Arrangements” data from the Annual Social and Economic Supplement to the Current Population Survey (or CPS/ASEC) for 2016. Both surveys produce estimates (wildly different, of course) of – among other things – the number of US households and the homeownership rate.

Starting with the American Housing Survey, 2015 marked the first time since 1985 that the AHS was based on new national and metropolitan area “longitudinal” samples based on the latest available Master Address File. From 1985 through 2013 the AHS sample was mainly based on housing units selected from the 1980 Census as well as samples of housing units subsequently constructed in areas requiring building permits. Not surprisingly, the previous methodology was subject to sizable “sampling” issues. The 2015 “national’ estimates are based on (1) a “national case” sample of 34,769 representative of the US and nine divisions; (2) a 45,270 “over-sample” of top 15 metropolitan areas; (3) a 30,111 over-sample of 10 additional metropolitan areas; and (4) a 5,248 oversample of subsidized renter units.

The AHS household estimates are “controlled” to independent estimates of the US housing stock in much the same was as are the household estimates from the Housing Vacancy Survey, a supplement to the Current Population Survey. And while the AHS-based US household estimates for 2015 in aggregate aren’t massively different from that of the HVS, the characteristics of the AHS-based households for 2015 are vastly different, and are more in synch with those of the 2015 American Community Survey, as shown in the table below.

| 2015 US Household Estimates by Age Group, Various Census Surveys | |||

|---|---|---|---|

| AHS | HVS | ACS | |

| Total | 118,290 | 117,397 | 118,209 |

| 15-24 | 4,347 | 6,125 | 4,441 |

| 25-34 | 18,096 | 19,106 | 17,885 |

| 35-44 | 20,441 | 19,917 | 20,576 |

| 45-54 | 23,534 | 22,021 | 23,238 |

| 55-64 | 23,638 | 22,068 | 23,069 |

| 65-74 | 16,292 | 15,996 | 16,524 |

| 75+ | 11,942 | 12,164 | 12,476 |

What is especially striking are the rather sizable differences in the shares of US households by age group between the the HVS estimates and the ACS or AHS estimates, with the HVS estimates suggesting a much larger “young-adult’ share of total households.

Even more striking are the differences in the homeowner estimates by age group.

| 2015 US Homeowner Estimates by Age Group, Various Census Surveys | |||

|---|---|---|---|

| AHS | HVS | ACS | |

| Total | 74,360 | 74,741 | 74,506 |

| 15-24 | 501 | 1,336 | 577 |

| 25-34 | 6,485 | 7,493 | 6,582 |

| 35-44 | 11,743 | 11,645 | 11,599 |

| 45-54 | 15,968 | 15,413 | 15,853 |

| 55-64 | 17,674 | 16,645 | 17,285 |

| 65-74 | 12,917 | 12,819 | 13,160 |

| 75+ | 9,072 | 9,390 | 9,450 |

As this table indicates, the HVS estimates for young-adult homeowners are vastly higher than the AHS and ACS estimates.

Census also produces household estimates based on the CPS Annual Social and Economic Supplement (CPS./ASEC) which are not controlled to independent housing stock estimates, but instead to independent estimates of the civilian non-institutionalized population. Since (1) CPS-based surveys overstate housing vacancy rates; and (2) housing stock estimates appear to be understated, CPS/ASEC household estimates are higher than CPS/HVS estimates.

While AHS, HVS, and ACS estimates are more or less annual averages, CPS/ASEC estimates are for March, and the last two estimates for the latter are shown below.

| US Household Estimates by Age Group, Various Census Surveys | |||||

|---|---|---|---|---|---|

| AHS (2015) | HVS (2015) | ACS (2015) | CPS/ASEC (Mar 2015) | CPS/ASEC (Mar 2016) | |

| Total | 118,290 | 117,397 | 118,209 | 124,587 | 125,819 |

| 15-24 | 4,347 | 6,125 | 4,441 | 6,370 | 6,361 |

| 25-34 | 18,096 | 19,106 | 17,885 | 20,075 | 20,047 |

| 35-44 | 20,441 | 19,917 | 20,576 | 21,121 | 21,222 |

| 45-54 | 23,534 | 22,021 | 23,238 | 23,566 | 23,295 |

| 55-64 | 23,638 | 22,068 | 23,069 | 23,509 | 23,896 |

| 65-74 | 16,292 | 15,996 | 16,524 | 16,886 | 17,551 |

| 75+ | 11,942 | 12,164 | 12,476 | 13,061 | 13,448 |

Again, what is “most striking” about the numbers in this table is the substantially higher estimates of young adult householders from the CPS-based surveys relative to the other surveys.

(I’ll have much more on this topic later, including an assessment of the reliability of the household estimates from these surveys).

Weekly Initial Unemployment Claims increase to 247,000

by Calculated Risk on 1/12/2017 08:54:00 AM

The DOL reported:

In the week ending January 7, the advance figure for seasonally adjusted initial claims was 247,000, an increase of 10,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 235,000 to 237,000. The 4-week moving average was 256,500, a decrease of 1,750 from the previous week's revised average. The previous week's average was revised up by 1,500 from 256,750 to 258,250.The previous week was revised up.

There were no special factors impacting this week's initial claims. This marks 97 consecutive weeks of initial claims below 300,000, the longest streak since 1970.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 256,500.

This was below the consensus forecast (it is difficult to seasonally adjusted during the holidays). The low level of claims suggests relatively few layoffs.

Wednesday, January 11, 2017

CNBC's Liesman: Trump's colossal error on jobs during his press conference

by Calculated Risk on 1/11/2017 07:44:00 PM

From CNBC's Steve Liesman: Donald Trump's colossal error on jobs during his press conference

Trump said that there "are 96 million wanting a job and they can't get (one). You know that story. The real number. That's the real number."This is a serious problem. Trump is at war with the data. There is a concern that Trump (and Congress) will defund the BLS and other data gathering agencies if he doesn't like what they report.

It is unfortunately very far from the real number. There are in fact 96 million Americans age 16 and older who are not in the labor force. Of this, just 5.4 million, or 91 million fewer than the number cited by Trump, say they want a job. The rest are retired, sick, disabled, running their households or going to school.