by Calculated Risk on 3/10/2017 06:48:00 PM

Friday, March 10, 2017

Merrill on the March FOMC Meeting

A few excerpts from a research note from Merrill Lynch:

The markets listened to the chorus of Fed officials and are now pricing in near certainty of a hike. With the rate decision on 15 March likely to be a non-event, attention turns to the Summary of Economic Projections and the press conference. We believe the combination of a shift higher in the dots and language changes in the statement will send a hawkish signal. However, we suspect that Chair Yellen will sound more balanced in her press conference.

We expect a number of tweaks to the statement which will deliver a more hawkish message. In the first paragraph, we think the Fed will present a more positive assessment of the economy. We also think that the Fed will change the economic outlook paragraph to argue that the balance of risks has improved. ...

We think Chair Yellen's press conference will be less hawkish than the statement or SEP. ... Chair Yellen is likely to sound more positive about the outlook, noting the improvement in sentiment measures and reduction in labor market slack. However, we expect her to argue that inflation should only increase slowly to the target. Also, she is likely to argue that the Fed is not behind the curve and isn't “playing catch up” with policy. We also look for Yellen to note that the committee is discussing the plan for addressing the balance sheet and that more formal communication will be forthcoming. In the meantime, she is likely to note that the Fed will continue with the reinvestment program until an increase in fed funds rates is “well underway”.

emphasis added

Public and Private Sector Payroll Jobs: Carter, Reagan, Bush, Clinton, Bush, Obama, Trump

by Calculated Risk on 3/10/2017 01:53:00 PM

Here is another update of tracking employment during Presidential terms. We frequently use Presidential terms as time markers - we could use Speaker of the House, or any other marker.

NOTE: Several readers have asked if I could add a lag to these graphs (obviously a new President has zero impact on employment for the month they are elected). But that would open a debate on the proper length of the lag, so I'll just stick to the beginning of each term.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). Presidents Carter and George H.W. Bush only served one term, and President Obama is in the final months of his second term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (yellow) took office.

There was a recession towards the end of President G.H.W. Bush (purple) term, and Mr Clinton (light blue) served for eight years without a recession.

The first graph is for private employment only.

Mr. Trump is in Orange (just one month).

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 811,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 396,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased slightly under President G.H.W. Bush (purple), with 1,510,000 private sector jobs added.

Private sector employment increased by 20,966,000 under President Clinton (light blue), by 14,717,000 under President Reagan (yellow), and 9,041,000 under President Carter (dashed green).

There were only 1,937,000 more private sector jobs at the end of Mr. Obama's first term. At the end of his second term, there were 11,773,000 more private sector jobs than when Mr. Obama initially took office.

The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs).

However the public sector declined significantly while Mr. Obama was in office (down 263,000 jobs). This has been a significant drag on overall employment.

And a table for public sector jobs. Public sector jobs declined the most during Obama's first term, and increased the most during Reagan's 2nd term.

Below is a table of the top five presidential terms for total non-farm job creation.

Obama's 2nd term was the 3rd best ever for private job creation. However, with very few public sector jobs added, Obama's 2nd term was only the fifth best for total job creation.

| Top Employment Gains per Presidential Terms (000s) | ||||

|---|---|---|---|---|

| Rank | Term | Private | Public | Total Non-Farm |

| 1 | Clinton 1 | 10,883 | 692 | 11,575 |

| 2 | Clinton 2 | 10,085 | 1,242 | 11,317 |

| 3 | Reagan 2 | 9,357 | 1,438 | 10,795 |

| 4 | Carter | 9,041 | 1,304 | 10,345 |

| 5 | Obama 2 | 9,836 | 444 | 10,280 |

Comment: Another Solid Employment Report

by Calculated Risk on 3/10/2017 10:00:00 AM

The headline jobs number was above expectations, and there were combined slight upward revisions to the previous two months. In addition wage growth picked up. This was a solid report.

Note: The warm weather was a factor in the solid February employment report and there may be some payback in March.

Earlier: February Employment Report: 235,000 Jobs, 4.7% Unemployment Rate

In February, the year-over-year change was 2.35 million jobs. Solid job growth.

Average Hourly Earnings

This graph is based on “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report. Note: There are also two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation.

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth was at 2.8% YoY in February.

Wage growth is trending up.

Employment-Population Ratio, 25 to 54 years old

In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

The 25 to 54 participation rate increased in January to 81.7%, and the 25 to 54 employment population ratio increase to 78.3%.

The participation rate has been trending down for this group since the late '90s, however, with more younger workers (and fewer older workers), the participation rate might move up some more.

Part Time for Economic Reasons

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed at 5.7 million in February. These individuals, who would have preferred full-time employment, were working part time because their hours had been cut back or because they were unable to find full-time jobs.The number of persons working part time for economic reasons decreased in February. This level suggests a little slack still in the labor market.

These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 9.2% in February.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.80 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 1.85 million in January.

This was the lowest number since 2008.

This is generally trending down, but still somewhat elevated.

Overall this was another solid report.

February Employment Report: 235,000 Jobs, 4.7% Unemployment Rate

by Calculated Risk on 3/10/2017 08:42:00 AM

From the BLS:

Total nonfarm payroll employment increased by 235,000 in February, and the unemployment rate was little changed at 4.7 percent, the U.S. Bureau of Labor Statistics reported today. Employment gains occurred in construction, private educational services, manufacturing, health care, and mining.

...

The change in total nonfarm payroll employment for December was revised down from +157,000 to +155,000, and the change for January was revised up from +227,000 to +238,000. With these revisions, employment gains in December and January combined were 9,000 more than previously reported.

...

In February, average hourly earnings for all employees on private nonfarm payrolls increased by 6 cents to $26.09, following a 5-cent increase in January. Over the year, average hourly earnings have risen by 71 cents, or 2.8 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Total payrolls increased by 235 thousand in February (private payrolls increased 227 thousand).

Payrolls for December and January were revised up by a combined 9 thousand.

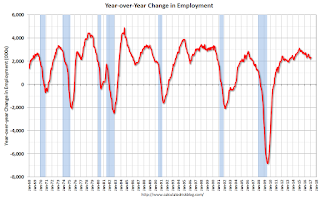

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In February, the year-over-year change was 2.35 million jobs. This is a solid year-over-year gain.

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate increased in February to 63.0%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics.

The Labor Force Participation Rate increased in February to 63.0%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics. The Employment-Population ratio was increased to 60.0% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate decreased in February to 4.7%.

This was above expectations of 195,000 jobs, and the previous two months were revised up slightly (combined). Another solid report.

I'll have much more later ...

Thursday, March 09, 2017

Friday: Jobs and Wages

by Calculated Risk on 3/09/2017 08:26:00 PM

Earlier:, my February Employment Preview and Goldman: February Employment Preview

Friday:

• At 8:30 AM ET, Employment Report for February. The consensus is for an increase of 195,000 non-farm payroll jobs added in February, down from the 227,000 non-farm payroll jobs added in January. The consensus is for the unemployment rate to decline to 4.7%.

Goldman: February Employment Preview

by Calculated Risk on 3/09/2017 05:17:00 PM

A few excerpts from a note by Goldman Sachs economist Spencer Hill: February Payrolls Preview

We estimate that February nonfarm payrolls increased 215k in February, following +227k in January ... Reasons to expect a strong report include favorable weather effects, the strong hiring trends indicated in the ADP employment report, and a further drop in jobless claims to their lowest levels since the 1970s.CR note: the consensus is for a 195k jobs added in February, and for the unemployment rate to decline to 4.7%.

We estimate that the unemployment rate fell one tenth to 4.7% ... We also forecast average hourly earnings increased 0.3% month over month and 2.7% year over year, reflecting tightening labor markets and the continued impact of state-level minimum wage hikes.

...

February exhibited unseasonably warm weather and relatively limited snowfall, both of which are likely to boost payrolls in weather-sensitive industries. ... such a pattern is associated with strong growth in weather-sensitive industries, including construction, retail trade, and leisure and hospitality.

Fed's Flow of Funds: Household Net Worth increased in Q4

by Calculated Risk on 3/09/2017 01:03:00 PM

The Federal Reserve released the Q4 2016 Flow of Funds report today: Flow of Funds.

According to the Fed, household net worth increased in Q4 compared to Q3:

The net worth of households and nonprofits rose to $92.8 trillion during the fourth quarter of 2016. The value of directly and indirectly held corporate equities increased $728 billion and the value of real estate increased $557 billion.Household net worth was at $92.8 trillion in Q4 2016, up from $90.8 trillion in Q3 2016.

The Fed estimated that the value of household real estate increased to $23.1 trillion in Q4. The value of household real estate is now above the bubble peak in early 2006 - but not adjusted for inflation, and also including new construction.

Click on graph for larger image.

Click on graph for larger image.The first graph shows Households and Nonprofit net worth as a percent of GDP. Household net worth, as a percent of GDP, is higher than the peak in 2006 (housing bubble), and above the stock bubble peak.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952. Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q4 2016, household percent equity (of household real estate) was at 57.8% - up from Q3, and the highest since Q2 2006. This was because of an increase in house prices in Q3 (the Fed uses CoreLogic).

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So the approximately 50+ million households with mortgages have far less than 57.8% equity - and about 3 million homeowners still have negative equity.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Mortgage debt increased by $63 billion in Q4.

Mortgage debt has declined by $1.21 trillion from the peak. Studies suggest most of the decline in debt has been because of foreclosures (or short sales), but some of the decline is from homeowners paying down debt (sometimes so they can refinance at better rates).

The value of real estate, as a percent of GDP, was up in Q4, and is above the average of the last 30 years (excluding bubble).

CoreLogic: "1 million borrowers moved out of negative equity during 2016"

by Calculated Risk on 3/09/2017 10:51:00 AM

From CoreLogic: CoreLogic Reports 1 Million US Borrowers Regained Equity in 2016

CoreLogic ... today released a new analysis showing that U.S. homeowners with mortgages (roughly 63 percent of all homeowners) saw their equity increase by a total of $783 billion in 2016, an increase of 11.7 percent. Additionally, just over 1 million borrowers moved out of negative equity during 2016, increasing the percentage of homeowners with positive equity to 93.8 percent of all mortgaged properties, or approximately 48 million homes.On states:

In Q4 2016, the total number of mortgaged residential properties with negative equity stood at 3.17 million, or 6.2 percent of all homes with a mortgage. This is a decrease of 2 percent quarter over quarter from 3.23 million homes, or 6.3 percent of all mortgaged properties, in Q3 2016* and a decrease of 25 percent year over year from 4.23 million homes, or 8.4 percent of all mortgaged properties, compared with Q4 2015 ...

...

Negative equity peaked at 26 percent of mortgaged residential properties in Q4 2009 based on CoreLogic equity data analysis, which began in Q3 2009.

...

“Average home equity rose by $13,700 for U.S. homeowners during 2016,” said Dr. Frank Nothaft, chief economist for CoreLogic. “The equity build-up has been supported by home-price growth and paydown of principal. The CoreLogic Home Price Index for the U.S. rose 6.3 percent over the year ending December 2016. Further, about one-fourth of all outstanding mortgages have a term of 20 years or less, which amortize more quickly than 30-year loans and contribute to faster equity accumulation.”

emphasis added

"Nevada had the highest percentage of homes with negative equity at 13.6 percent, followed by Florida (11.6 percent), Illinois (11.1 percent), Rhode Island (10 percent) and Arizona (9.8 percent). These top five states combined account for 29.7 percent of negative equity in the U.S., but only 16.3 percent of outstanding mortgages."Note: The share of negative equity is still high in Nevada and Florida, but down from a year ago.

Click on graph for larger image.

Click on graph for larger image.This graph shows the distribution of home equity in Q4 2016 compared to Q3 2016.

About 2% of properties have 25% or more negative equity. For reference, about four years ago, in Q3 2012, almost 10% of residential properties had 25% or more negative equity.

A year ago, in Q4 2015, there were 4.3 million properties with negative equity - now there are 3.2 million. A significant change.

Weekly Initial Unemployment Claims increase to 243,000

by Calculated Risk on 3/09/2017 08:39:00 AM

The DOL reported:

In the week ending March 4, the advance figure for seasonally adjusted initial claims was 243,000, an increase of 20,000 from the previous week's unrevised level of 223,000. The 4-week moving average was 236,500, an increase of 2,250 from the previous week's unrevised average of 234,250.The previous week was unrevised.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 236,500.

This was higher than the consensus forecast.

The low level of claims suggests relatively few layoffs.

Wednesday, March 08, 2017

Thursday: Unemployment Claims, Q4 Flow of Funds

by Calculated Risk on 3/08/2017 07:32:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Spike to 2017 Highs

Mortgage rates spiked, big-time, today. Underlying bond markets had already moved higher in rate overnight, but the trend was taken to a new level by an exceptionally strong employment report from ADP. Although this isn't the big jobs report (we'll get that on Friday), many market participants treat the ADP numbers as one of several advance indicators of Friday's jobs report. Sometimes it doesn't register a response, but when it beats the forecast by as much as it did today (298k vs 190k), markets can't help but adjust their trajectory ahead of Friday.Thursday:

The net effect was the sharpest move higher in rates in several months, slightly outpacing last Wednesday's rout. Moreover, with the exception of a modest improvement on Monday, rates have moved higher every single day since February 27th. In just over a week, the average conventional 30yr fixed quote is up approximately a quarter of a percent for most lenders. Stronger lenders are offering 4.25% on top tier scenarios while many moved up to 4.375% with today's weakness.

emphasis added

• At 8:30 AM ET, < The initial weekly unemployment claims report will be released. The consensus is for 238 thousand initial claims, up from 223 thousand the previous week.

• At 10:00 AM, The Q4 Quarterly Services Report from the Census Bureau.

• At 12:00 PM, Q4 Flow of Funds Accounts of the United States from the Federal Reserve.