by Calculated Risk on 3/15/2017 08:44:00 PM

Wednesday, March 15, 2017

Thursday: Housing Starts, Unemployment Claims, Philly Fed Mfg, Job Openings

The FOMC's statement and projections were perceived at "dovish" (probably one less hike this year than expected). So mortgage rates declined ...

From Matthew Graham at Mortgage News Daily: Biggest Intraday Drop of the Year For Mortgage Rates

Mortgage rates fell at their fastest pace of the year following today's rate hike announcement from the Fed. If you're wondering why mortgage rates fell while the Fed's rate moved up, you're not alone. Fortunately, the explanation is simple.Thursday:

Financial markets had already fully accounted for the chance that the Fed would hike rates today. They'd even gone a step further an begun to account for a faster pace of future rate hikes. And it was that future outlook that allowed for our pleasant surprise.

As it turns out, the median forecast among Fed members didn't see the Fed Funds rate ending the year any higher than the previous batch of forecasts (both for 2017 AND 2018). ... The average lender offered mid-day improvements that brought rates 0.125% lower, on average. In terms of conventional 30yr fixed rates, most lenders are back down to 4.25% now on top tier scenarios.

emphasis added

• At 8:30 AM ET, Housing Starts for February. The consensus is for 1.266 million, up from the January rate of 1.246 million.

• Also at 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 242 thousand initial claims, down from 243 thousand the previous week.

• Also at 8:30 AM, the Philly Fed manufacturing survey for March. The consensus is for a reading of 32.5, down from 43.3.

• At 10:00 AM, Job Openings and Labor Turnover Survey for January from the BLS. Jobs openings were mostly unchanged in December at 5.501 million compared to 5.505 million in November.

FOMC Projections and Press Conference Link

by Calculated Risk on 3/15/2017 02:10:00 PM

Statement here. 25 bps rate hike.

Yellen press conference video here.

On the projections, projections for GDP in 2017 were narrowed slightly.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2017 | 2018 | 2019 |

| Mar 2017 | 2.0 to 2.2 | 1.8 to 2.3 | 1.8 to 2.0 |

| Dec 2016 | 1.9 to 2.3 | 1.8 to 2.2 | 1.8 to 2.0 |

The unemployment rate was at 4.7% in February, and the unemployment rate projections were mostly unchanged.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2017 | 2018 | 2019 |

| Mar 2017 | 4.5 to 4.6 | 4.3 to 4.6 | 4.3 to 4.7 |

| Dec 2016 | 4.5 to 4.6 | 4.3 to 4.7 | 4.3 to 4.8 |

As of January, PCE inflation was up 1.9% from January 2016. Inflation was revised up slightly for 2017.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2017 | 2018 | 2019 |

| Mar 2017 | 1.8 to 2.0 | 1.9 to 2.0 | 2.0 to 2.1 |

| Dec 2016 | 1.7 to 2.0 | 1.9 to 2.0 | 2.0 to 2.1 |

PCE core inflation was up 1.7% in January year-over-year. Core PCE inflation was unrevised for 2017.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2017 | 2018 | 2019 |

| Mar 2017 | 1.8 to 1.9 | 1.9 to 2.0 | 2.0 to 2.1 |

| Dec 2016 | 1.8 to 1.9 | 1.9 to 2.0 | 2.0 |

FOMC Statement: 25bps Rate Hike

by Calculated Risk on 3/15/2017 02:02:00 PM

Information received since the Federal Open Market Committee met in February indicates that the labor market has continued to strengthen and that economic activity has continued to expand at a moderate pace. Job gains remained solid and the unemployment rate was little changed in recent months. Household spending has continued to rise moderately while business fixed investment appears to have firmed somewhat. Inflation has increased in recent quarters, moving close to the Committee's 2 percent longer-run objective; excluding energy and food prices, inflation was little changed and continued to run somewhat below 2 percent. Market-based measures of inflation compensation remain low; survey-based measures of longer-term inflation expectations are little changed, on balance.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that, with gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace, labor market conditions will strengthen somewhat further, and inflation will stabilize around 2 percent over the medium term. Near-term risks to the economic outlook appear roughly balanced. The Committee continues to closely monitor inflation indicators and global economic and financial developments.

In view of realized and expected labor market conditions and inflation, the Committee decided to raise the target range for the federal funds rate to 3/4 to 1 percent. The stance of monetary policy remains accommodative, thereby supporting some further strengthening in labor market conditions and a sustained return to 2 percent inflation.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. The Committee will carefully monitor actual and expected inflation developments relative to its symmetric inflation goal. The Committee expects that economic conditions will evolve in a manner that will warrant gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run. However, the actual path of the federal funds rate will depend on the economic outlook as informed by incoming data.

The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction, and it anticipates doing so until normalization of the level of the federal funds rate is well under way. This policy, by keeping the Committee's holdings of longer-term securities at sizable levels, should help maintain accommodative financial conditions.

Voting for the FOMC monetary policy action were: Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Lael Brainard; Charles L. Evans; Stanley Fischer; Patrick Harker; Robert S. Kaplan; Jerome H. Powell; and Daniel K. Tarullo. Voting against the action was Neel Kashkari, who preferred at this meeting to maintain the existing target range for the federal funds rate.

emphasis added

Key Measures Show Inflation close to 2% in February

by Calculated Risk on 3/15/2017 11:41:00 AM

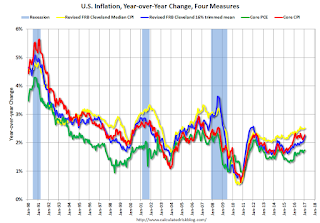

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.5% annualized rate) in February. The 16% trimmed-mean Consumer Price Index also rose 0.2% (2.2% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed released the median CPI details for February here. Motor fuel was down 30% annualized in February.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.1% (1.5% annualized rate) in February. The CPI less food and energy rose 0.2% (2.5% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.5%, the trimmed-mean CPI rose 2.2%, and the CPI less food and energy rose 2.2%. Core PCE is for January and increased 1.7% year-over-year.

On a monthly basis, median CPI was at 2.5% annualized, trimmed-mean CPI was at 2.2% annualized, and core CPI was at 2.5% annualized.

Using these measures, inflation has generally been moving up, and most of these measures are above the Fed's 2% target (Core PCE is still below).

NAHB: Builder Confidence increased to 71 in March, Highest in 12 Years

by Calculated Risk on 3/15/2017 10:17:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 71 in March, up from 65 in February. Any number above 50 indicates that more builders view sales conditions as good than poor.

From NAHB: Builder Confidence Hits 12-Year High

Builder confidence in the market for newly-built single-family homes jumped six points to a level of 71 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI). This is the highest reading since June 2005.

...

“While builders are clearly confident, we expect some moderation in the index moving forward,” said NAHB Chief Economist Robert Dietz. “Builders continue to face a number of challenges, including rising material prices, higher mortgage rates, and shortages of lots and labor.”

All three HMI components posted robust gains in March. The component gauging current sales conditions increased seven points to 78 while the index charting sales expectations in the next six months rose five points to 78. Meanwhile, the component measuring buyer traffic jumped eight points to 54.

Looking at the three-month moving averages for regional HMI scores, the Midwest increased three points to 68 and the South rose one point to 68. The West dipped three points to 76 and the Northeast edged one point lower to 48.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was above the consensus forecast and another solid reading.

Retail Sales increased 0.1% in February

by Calculated Risk on 3/15/2017 08:45:00 AM

On a monthly basis, retail sales increased 0.1 percent from January to February (seasonally adjusted), and sales were up 5.7 percent from February 2016.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for February 2017, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $474.0 billion, an increase of 0.1 percent from the previous month, and 5.7 percent above February 2016. ... The December 2016 to January 2017 percent change was revised from up 0.4 percent to up 0.6 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.1% in February.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 4.5% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 4.5% on a YoY basis.The increase in February was close to expectations, and sales for January were revised up. A solid report.

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 3/15/2017 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 3.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 10, 2017.

... The Refinance Index increased 4 percent from the previous week. The seasonally adjusted Purchase Index increased 2 percent from one week earlier. The unadjusted Purchase Index increased 3 percent compared with the previous week and was 6 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) increased to its highest level since April 2014, 4.46 percent, from 4.36 percent, with points decreasing to 0.37 from 0.44 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance is up over the last three weeks, but it seems like activity will decline again as interest rates increase.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. Even with the increase in mortgage rates over the last few months, purchase activity is still holding up.

However refinance activity has declined significantly since rates increased.

Tuesday, March 14, 2017

Wednesday: FOMC Meeting, Retail Sales, CPI, Homebuilder Survey and More

by Calculated Risk on 3/14/2017 07:01:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Retail sales for February will be released. The consensus is for 0.2% increase in retail sales in February.

• Also at 8:30 AM, The Consumer Price Index for February from the BLS. The consensus is for 0.1% increase in CPI, and a 0.2% increase in core CPI.

• Also at 8:30 AM, The New York Fed Empire State manufacturing survey for March. The consensus is for a reading of 15.7, down from 18.7.

• At 10:00 AM, The March NAHB homebuilder survey. The consensus is for a reading of 66, up from 65 in February. Any number above 50 indicates that more builders view sales conditions as good than poor.

• Also at 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for January. The consensus is for a 0.3% increase in inventories.

• At 2:00 PM, FOMC Meeting Announcement. The FOMC is expected to increase the Fed Funds rate 25 bps at this meeting.

• Also at 2:00 PM, FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

• At 2:30 PM, Fed Chair Janet Yellen holds a press briefing following the FOMC announcement

Duy on FOMC Meeting: Shifting Dots

by Calculated Risk on 3/14/2017 03:18:00 PM

From Tim Duy at Fed Watch: Shifting Dots

The Federal Reserve begins its two-day meeting today. The outcome of the meeting is no longer in debate. A 25bp rate hike is widely expected after a round of Fedspeak in the week prior to the blackout period and the February employment report. More important now is what signal the Fed sends with the statement, the press conference, and the dots. I anticipate the overall message to signal general confidence in the economic outlook while reinforcing the idea that the Fed is neither behind the curve nor intends to fall behind the curve. The combination will give the Fed room to tighten policy at a gradual pace. I think that four hikes this year would still be considered gradual from the Fed's perspective. After all, the expectation of four hikes a year was considered gradual at the beginning of 2016. Not sure why it shouldn't be considered gradual now.

...

Bottom Line: I see more reasons tha[n] not that the Fed will push up its 2017 rate hike projections. Lots of different factors - external, data flow, fiscal stimulus, and financial conditions - to say that with the economy hovering near potential output, the time is right to make a slightly faster move toward the neutral rate. Indeed, I have a hard time seeing why they would pull forward a rate hike if they weren't trying to create room for an additional hike this year. Note that this would really be just moving the ball down the field a bit quicker, not changing the goal posts - the estimate of the neutral rate. A higher estimate of the neutral rate would be much more hawkish than just quickening the pace slightly to that rate.

emphasis added

Mortgage Equity Withdrawal Positive in Q4

by Calculated Risk on 3/14/2017 11:29:00 AM

Note: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008.

The following data is calculated from the Fed's Flow of Funds data (released today) and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity - hence the name "MEW" - and normal principal payments and debt cancellation (modifications, short sales, and foreclosures).

For Q4 2016, the Net Equity Extraction was a positive $14 billion, or a positive 0.4% of Disposable Personal Income (DPI) . This is only the third positive MEW since Q1 2008.

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

Note: This data is impacted by debt cancellation and foreclosures, but much less than a few years ago.

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding increased by $63 billion in Q4.

The Flow of Funds report also showed that Mortgage debt has declined by $1.21 trillion since the peak. This decline is mostly because of debt cancellation per foreclosures and short sales, and some from modifications. There has also been some reduction in mortgage debt as homeowners paid down their mortgages so they could refinance.

With a slower rate of debt cancellation, MEW will likely stay positive.

For reference:

Dr. James Kennedy also has a simple method for calculating equity extraction: "A Simple Method for Estimating Gross Equity Extracted from Housing Wealth". Here is a companion spread sheet (the above uses my simple method).

For those interested in the last Kennedy data included in the graph, the spreadsheet from the Fed is available here.