by Calculated Risk on 3/21/2017 05:41:00 PM

Tuesday, March 21, 2017

Wednesday: Existing Home Sales

First, I expect existing home sales to be below consensus tomorrow. See: Existing Home Sales: Take the Under

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 9:00 AM, FHFA House Price Index for January 2017. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, Existing Home Sales for February from the National Association of Realtors (NAR). The consensus is for 5.55 million SAAR, down from 5.69 million in January. Housing economist Tom Lawler expects the NAR to report sales of 5.41 million SAAR in February.

• During the day: The AIA's Architecture Billings Index for February (a leading indicator for commercial real estate).

Here is a graph (click on graph for larger image) from Doug Short and shows the S&P 500 since the 2007 high. Today is that little blip at the end.

More graphs here: S&P 500 Snapshot: Biggest Loss in Five Months

Chemical Activity Barometer increases in March

by Calculated Risk on 3/21/2017 11:52:00 AM

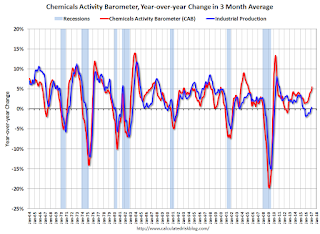

Note: This appears to be a leading indicator for industrial production.

From the American Chemistry Council: Consumer, Business Confidence Reach Levels Not Seen in Decades; Optimism Reflected in Increased Chemical Industry Activity

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), posted its strongest year-over-year gain in nearly seven years. The 5.5 percent increase over this time last year reflects elevated consumer and business confidence and an overall rising optimism in the U.S. economy. Speaking last week, Federal Reserve Chairwoman Janet Yellen also referenced a “confidence in the robustness of the economy” as a reason to move forward with an interest rate hike.

The barometer posted a 0.5 percent gain in March, following a 0.5 percent gain in February and 0.4 percent gain in January. All data is measured on a three-month moving average (3MMA). Coupled with consecutive monthly gains in the fourth quarter of 2016, the pattern shows consistent, accelerating activity. On an unadjusted basis the CAB climbed 0.4 percent in March, following a 0.4 percent gain in February and a 0.6 percent increase in January.

...

Applying the CAB back to 1912, it has been shown to provide a lead of two to fourteen months, with an average lead of eight months at cycle peaks as determined by the National Bureau of Economic Research. The median lead was also eight months. At business cycle troughs, the CAB leads by one to seven months, with an average lead of four months. The median lead was three months. The CAB is rebased to the average lead (in months) of an average 100 in the base year (the year 2012 was used) of a reference time series. The latter is the Federal Reserve’s Industrial Production Index.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

CAB has increased solidly over the last several months, and this suggests an increase in Industrial Production in 2017.

"Mortgage Rates at 2 Week Lows"

by Calculated Risk on 3/21/2017 10:03:00 AM

From Matthew Graham at Mortgage News Daily: Mortgage Rates at 2 Week Lows Amid Political Uncertainty

Mortgage rates were steady-to-slightly lower today, keeping them in line with the lowest levels in 2 weeks and very close to the lowest levels of the month. For most lenders, that means conventional 30yr fixed rate quotes of 4.25% on top tier scenarios. Some lenders are still up at 4.375% and an aggressive few are back down to 4.125%.Here is a table from Mortgage News Daily:

Last week, we discussed the motivations for the rate improvements in detail. To recap: longer-term rates like mortgages had already risen in anticipation of the Fed rate hike. It wasn't a surprise. Instead, markets were focused on the Fed's forward-looking rate hike forecasts, which came out slightly slower than markets expected. Thus, rates were overly-prepared for a fast rate hike timeline and had some room to return to early March levels.

From there, attention has turned to fiscal uncertainty as several policy objectives of the Trump administration have run into roadblocks. Specifically, investors are concerned that tax cuts will be significantly delayed as the health care debate seems to be front and center. The expectation of tax cuts (and other fiscal measures) was a major contributor to the move higher in rates and stocks after the election. To whatever extent those measures are delayed, investors can easily question if rates and stocks are higher than they should be.

emphasis added

Monday, March 20, 2017

Hotels: Hotel Occupancy Solid in early March

by Calculated Risk on 3/20/2017 03:11:00 PM

Hotel occupancy has picked up in recent weeks and is now close to the record year (2015 was the record).

From HotelNewsNow.com: STR: US hotel results for week ending 11 March

The U.S. hotel industry reported positive results in the three key performance metrics during the week of 5-11 March 2017, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In a year-over-year comparison with the week of 6-12 March 2016:

• Occupancy: +0.8% to 67.4%

• Average daily rate (ADR): +3.9% to US$128.61

• Revenue per available room (RevPAR): +4.8% to US$86.72

emphasis added

The red line is for 2017, dashed is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.

The red line is for 2017, dashed is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.2015 was the best year on record for hotels.

For hotels, occupancy will now move mostly sideways until the summer travel season.

Data Source: STR, Courtesy of HotelNewsNow.com

Housing: Upside and Downside Risks

by Calculated Risk on 3/20/2017 10:33:00 AM

In a note today, Merrill Lynch economist Michelle Meyer notes a few upside and downside risks for housing. A few excerpts:

The housing market is being hit by several cross currents. On the upside, the warmer than-normal weather in the winter likely boosted housing activity over the past few months. The risk, however, is that this could be pulling activity forward from the spring. In addition, the general improvement in the economy and gain in consumer confidence could be underpinning housing activity. The NAHB homebuilder confidence index has climbed higher, reaching a new cyclical high of 71 in March. Clearly builders are optimistic. However, on the downside, interest rates have increased which weighs on affordability.CR note: If, later this year, the Fed starts to reduce their balance sheet, that might push up longer rates (and pushing up mortgage rates a little more). Another downside risk for housing is reduced foreign buying due to the strong dollar, U.S. political concerns, and capital controls in China.

There are also a variety of potential policy changes which can impact the outlook for the housing market. High on the list is financial market deregulation and its impact on the flow of credit. In addition, there seems to be renewed focus on reforming the mortgage finance system and bringing Fannie Mae and Freddie Mac out of conservatorship. In addition, immigration reform could have significant impacts on the housing market over the medium term.

emphasis added

Chicago Fed "Economic Growth Increased in February"

by Calculated Risk on 3/20/2017 08:44:00 AM

From the Chicago Fed: Economic Growth Increased in February

Led by improvements in employment-related indicators, the Chicago Fed National Activity Index (CFNAI) increased to +0.34 in February from –0.02 in January. All four broad categories of indicators that make up the index increased from January, and only one of the four categories made a negative contribution to the index in February.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, improved to +0.25 in February from +0.07 in January, reaching its highest level since December 2014. February’s CFNAI-MA3 suggests that growth in national economic activity was somewhat above its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests limited inflationary pressure from economic activity over the coming year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was somewhat above the historical trend in February (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Sunday, March 19, 2017

Sunday Night Futures

by Calculated Risk on 3/19/2017 07:35:00 PM

Weekend:

• Schedule for Week of Mar 19, 2017

• Existing Home Sales: Take the Under

• Goldman on Fed Balance Sheet Runoff

From CNBC: Pre-Market Data and Bloomberg futures: S&P futures and DOW futures are down slightly (fair value).

Oil prices were up over the last week with WTI futures at $48.68 per barrel and Brent at $51.74 per barrel. A year ago, WTI was at $40, and Brent was at $40 - so oil prices are up about 25% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.29 per gallon - a year ago prices were at $2.00 per gallon - so gasoline prices are up about 30 cents a gallon year-over-year.

Existing Home Sales: Take the Under

by Calculated Risk on 3/19/2017 02:05:00 PM

The NAR will report February Existing Home Sales on Wednesday, March 22nd at 10:00 AM ET.

The consensus, according to Bloomberg, is that the NAR will report sales of 5.55 million. Housing economist Tom Lawler estimates the NAR will report sales of 5.41 million on a seasonally adjusted annual rate (SAAR) basis, down from 5.69 million SAAR in January.

Housing economist Tom Lawler has been sending me his predictions of what the NAR will report for almost 7 years. The table below shows the consensus for each month, Lawler's predictions, and the NAR's initial reported level of sales.

Lawler hasn't always been closer than the consensus, but usually when there has been a fairly large spread between Lawler's estimate and the "consensus", Lawler has been closer.

NOTE: There have been times when Lawler "missed", but then he pointed out an apparent error in the NAR data - and the subsequent revision corrected that error. As an example, see: The “Curious Case” of Existing Home Sales in the South in April

Over the last seven years, the consensus average miss was 150 thousand, and Lawler's average miss was 70 thousand.

Many analysts now change their "forecast" after Lawler's estimate is posted, so the consensus has improved a little recently!

| Existing Home Sales, Forecasts and NAR Report millions, seasonally adjusted annual rate basis (SAAR) | |||

|---|---|---|---|

| Month | Consensus | Lawler | NAR reported1 |

| May-10 | 6.20 | 5.83 | 5.66 |

| Jun-10 | 5.30 | 5.30 | 5.37 |

| Jul-10 | 4.66 | 3.95 | 3.83 |

| Aug-10 | 4.10 | 4.10 | 4.13 |

| Sep-10 | 4.30 | 4.50 | 4.53 |

| Oct-10 | 4.50 | 4.46 | 4.43 |

| Nov-10 | 4.85 | 4.61 | 4.68 |

| Dec-10 | 4.90 | 5.13 | 5.28 |

| Jan-11 | 5.20 | 5.17 | 5.36 |

| Feb-11 | 5.15 | 5.00 | 4.88 |

| Mar-11 | 5.00 | 5.08 | 5.10 |

| Apr-11 | 5.20 | 5.15 | 5.05 |

| May-11 | 4.75 | 4.80 | 4.81 |

| Jun-11 | 4.90 | 4.71 | 4.77 |

| Jul-11 | 4.92 | 4.69 | 4.67 |

| Aug-11 | 4.75 | 4.92 | 5.03 |

| Sep-11 | 4.93 | 4.83 | 4.91 |

| Oct-11 | 4.80 | 4.86 | 4.97 |

| Nov-11 | 5.08 | 4.40 | 4.42 |

| Dec-11 | 4.60 | 4.64 | 4.61 |

| Jan-12 | 4.69 | 4.66 | 4.57 |

| Feb-12 | 4.61 | 4.63 | 4.59 |

| Mar-12 | 4.62 | 4.59 | 4.48 |

| Apr-12 | 4.66 | 4.53 | 4.62 |

| May-12 | 4.57 | 4.66 | 4.55 |

| Jun-12 | 4.65 | 4.56 | 4.37 |

| Jul-12 | 4.50 | 4.47 | 4.47 |

| Aug-12 | 4.55 | 4.87 | 4.82 |

| Sep-12 | 4.75 | 4.70 | 4.75 |

| Oct-12 | 4.74 | 4.84 | 4.79 |

| Nov-12 | 4.90 | 5.10 | 5.04 |

| Dec-12 | 5.10 | 4.97 | 4.94 |

| Jan-13 | 4.90 | 4.94 | 4.92 |

| Feb-13 | 5.01 | 4.87 | 4.98 |

| Mar-13 | 5.03 | 4.89 | 4.92 |

| Apr-13 | 4.92 | 5.03 | 4.97 |

| May-13 | 5.00 | 5.20 | 5.18 |

| Jun-13 | 5.27 | 4.99 | 5.08 |

| Jul-13 | 5.13 | 5.33 | 5.39 |

| Aug-13 | 5.25 | 5.35 | 5.48 |

| Sep-13 | 5.30 | 5.26 | 5.29 |

| Oct-13 | 5.13 | 5.08 | 5.12 |

| Nov-13 | 5.02 | 4.98 | 4.90 |

| Dec-13 | 4.90 | 4.96 | 4.87 |

| Jan-14 | 4.70 | 4.67 | 4.62 |

| Feb-14 | 4.64 | 4.60 | 4.60 |

| Mar-14 | 4.56 | 4.64 | 4.59 |

| Apr-14 | 4.67 | 4.70 | 4.65 |

| May-14 | 4.75 | 4.81 | 4.89 |

| Jun-14 | 4.99 | 4.96 | 5.04 |

| Jul-14 | 5.00 | 5.09 | 5.15 |

| Aug-14 | 5.18 | 5.12 | 5.05 |

| Sep-14 | 5.09 | 5.14 | 5.17 |

| Oct-14 | 5.15 | 5.28 | 5.26 |

| Nov-14 | 5.20 | 4.90 | 4.93 |

| Dec-14 | 5.05 | 5.15 | 5.04 |

| Jan-15 | 5.00 | 4.90 | 4.82 |

| Feb-15 | 4.94 | 4.87 | 4.88 |

| Mar-15 | 5.04 | 5.18 | 5.19 |

| Apr-15 | 5.22 | 5.20 | 5.04 |

| May-15 | 5.25 | 5.29 | 5.35 |

| Jun-15 | 5.40 | 5.45 | 5.49 |

| Jul-15 | 5.41 | 5.64 | 5.59 |

| Aug-15 | 5.50 | 5.54 | 5.31 |

| Sep-15 | 5.35 | 5.56 | 5.55 |

| Oct-15 | 5.41 | 5.33 | 5.36 |

| Nov-15 | 5.32 | 4.97 | 4.76 |

| Dec-15 | 5.19 | 5.36 | 5.46 |

| Jan-16 | 5.32 | 5.36 | 5.47 |

| Feb-16 | 5.30 | 5.20 | 5.08 |

| Mar-16 | 5.27 | 5.27 | 5.33 |

| Apr-16 | 5.40 | 5.44 | 5.45 |

| May-16 | 5.64 | 5.55 | 5.53 |

| Jun-16 | 5.48 | 5.62 | 5.57 |

| Jul-16 | 5.52 | 5.41 | 5.39 |

| Aug-16 | 5.44 | 5.49 | 5.33 |

| Sep-16 | 5.35 | 5.55 | 5.47 |

| Oct-16 | 5.44 | 5.47 | 5.60 |

| Nov-16 | 5.54 | 5.60 | 5.61 |

| Dec-16 | 5.54 | 5.55 | 5.49 |

| Jan-17 | 5.55 | 5.60 | 5.69 |

| Feb-17 | 5.55 | 5.41 | --- |

| 1NAR initially reported before revisions. | |||

Saturday, March 18, 2017

Goldman on Fed Balance Sheet Runoff

by Calculated Risk on 3/18/2017 07:04:00 PM

A few brief excerpts from a note today by Goldman Sachs economist Daan Struyven: Balance Sheet Runoff: Sooner, Slower, Safer

The debate within the FOMC about balance sheet normalization is now underway. Fed officials have two basic choices. They can rely exclusively on the funds rate for now and leave balance sheet decisions to the new leadership team in 2018, or they can combine ongoing funds rate hikes with a turn to balance sheet runoff later this year.CR Note: This might depend on who is the next Fed Chair. Fed Chair Janet Yellen's term expires in Feb 2018 and the smart choice would be to reappoint her to another term (Like Reagan reappointing Democrat Volcker in 1983, Clinton reappointing Republican Greenspan, and Obama reappointing Republican Bernanke).

...

A ... practical case for early balance sheet normalization is based on the upcoming Fed leadership transition. If the new appointments—especially the new Chair—are thought to favor aggressive balance sheet normalization, perhaps even including asset sales ... financial markets might experience heightened uncertainty during the transition. ...

The current FOMC could reduce that uncertainty by establishing an early “baseline” path for very gradual balance sheet rundown. Committee decisions are subject to change, of course, but markets would probably take comfort from the fact that most FOMC members will remain in their positions and that it is harder for the new leadership to radically change a policy that is already in place than to devise a new one. We therefore expect the committee to announce gradual tapering of reinvestments in December 2017, while holding the funds rate unchanged at that meeting.

Schedule for Week of Mar 19, 2017

by Calculated Risk on 3/18/2017 08:11:00 AM

The key economic report this week are February New and Existing Home sales.

8:30 AM: Chicago Fed National Activity Index for February. This is a composite index of other data.

No economic releases scheduled.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

9:00 AM: FHFA House Price Index for January 2017. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: Existing Home Sales for February from the National Association of Realtors (NAR). The consensus is for 5.55 million SAAR, down from 5.69 million in January.

10:00 AM: Existing Home Sales for February from the National Association of Realtors (NAR). The consensus is for 5.55 million SAAR, down from 5.69 million in January.Housing economist Tom Lawler expects the NAR to report sales of 5.41 million SAAR in February.

During the day: The AIA's Architecture Billings Index for February (a leading indicator for commercial real estate).

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 240 thousand initial claims, down from 241 thousand the previous week.

8:45 AM, Speech by Fed Chair Janet L. Yellen, Opening Remarks, At the 2017 Federal Reserve System Community Development Research Conference, Washington, D.C.

10:00 AM ET: New Home Sales for February from the Census Bureau.

10:00 AM ET: New Home Sales for February from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the January sales rate.

The consensus is for a increase in sales to 565 thousand Seasonally Adjusted Annual Rate (SAAR) in February from 555 thousand in January.

11:00 AM: the Kansas City Fed manufacturing survey for March.

8:30 AM: Durable Goods Orders for January from the Census Bureau. The consensus is for a 1.5% increase in durable goods orders.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for February 2017