by Calculated Risk on 3/27/2017 07:01:00 AM

Monday, March 27, 2017

Black Knight: House Price Index up 0.1% in January, Up 5.4% year-over-year

Note: I follow several house price indexes (Case-Shiller, CoreLogic, Black Knight, Zillow, FHFA, FNC and more). Note: Black Knight uses the current month closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From Black Knight: Black Knight Home Price Index Report - January 2017 Transactions: U.S. Home Prices Up 0.1 Percent for the Month; Up 5.4 Percent Year-Over-Year

• U.S. home prices at the start of 2017 continued the trend of incremental monthly gains, rising 0.1 percent from DecemberThe year-over-year increase in this index has been about the same for the last year.

• January marks 57 consecutive months of annual national home price appreciation

• Home prices in three of the nation’s 20 largest states and nine of the 40 largest metros hit new peaks

Note that house prices are close to the bubble peak in nominal terms (just 0.3% below), but not in real terms (adjusted for inflation). Case-Shiller for January will be released tomorrow.

Sunday, March 26, 2017

Sunday Night Futures

by Calculated Risk on 3/26/2017 09:30:00 PM

Weekend:

• Schedule for Week of Mar 26, 2017

Monday:

• 10:30 AM: Dallas Fed Survey of Manufacturing Activity for March.

From CNBC: Pre-Market Data and Bloomberg futures: S&P futures are down 13 and DOW futures are down 90 (fair value).

Oil prices were down over the last week with WTI futures at $47.93 per barrel and Brent at $50.80 per barrel. A year ago, WTI was at $40, and Brent was at $40 - so oil prices are up about 25% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.28 per gallon - a year ago prices were at $2.05 per gallon - so gasoline prices are up about 23 cents a gallon year-over-year.

Fed: Q4 Household Debt Service Ratio Very Low

by Calculated Risk on 3/26/2017 12:59:00 PM

The Fed's Household Debt Service ratio through Q4 2016 was released on Friday: Household Debt Service and Financial Obligations Ratios. I used to track this quarterly back in 2005 and 2006 to point out that households were taking on excessive financial obligations.

These ratios show the percent of disposable personal income (DPI) dedicated to debt service (DSR) and financial obligations (FOR) for households. Note: The Fed changed the release in Q3 2013.

The household Debt Service Ratio (DSR) is the ratio of total required household debt payments to total disposable income.This data has limited value in terms of absolute numbers, but is useful in looking at trends. Here is a discussion from the Fed:

The DSR is divided into two parts. The Mortgage DSR is total quarterly required mortgage payments divided by total quarterly disposable personal income. The Consumer DSR is total quarterly scheduled consumer debt payments divided by total quarterly disposable personal income. The Mortgage DSR and the Consumer DSR sum to the DSR.

The limitations of current sources of data make the calculation of the ratio especially difficult. The ideal data set for such a calculation would have the required payments on every loan held by every household in the United States. Such a data set is not available, and thus the calculated series is only an approximation of the debt service ratio faced by households. Nonetheless, this approximation is useful to the extent that, by using the same method and data series over time, it generates a time series that captures the important changes in the household debt service burden.

Click on graph for larger image.

Click on graph for larger image.The graph shows the Total Debt Service Ratio (DSR), and the DSR for mortgages (blue) and consumer debt (yellow).

The overall Debt Service Ratio decreased slightly in Q4, and has been moving sideways and is near a record low. Note: The financial obligation ratio (FOR) was decreased slightly in Q4 and is also near a record low (not shown)

The DSR for mortgages (blue) are near the low for the last 35 years. This ratio increased rapidly during the housing bubble, and continued to increase until 2007. With falling interest rates, and less mortgage debt (mostly due to foreclosures), the mortgage ratio has declined significantly.

The consumer debt DSR (yellow) has been increasing for the last four years.

This data suggests aggregate household cash flow has improved.

Saturday, March 25, 2017

Schedule for Week of Mar 26, 2017

by Calculated Risk on 3/25/2017 08:11:00 AM

The key economic reports this week are the third estimate of Q4 GDP, Personal Income and Outlays for February, and the Case-Shiller house price index.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for March.

9:00 AM ET: S&P/Case-Shiller House Price Index for January. Although this is the January report, it is really a 3 month average of November, December and January prices.

9:00 AM ET: S&P/Case-Shiller House Price Index for January. Although this is the January report, it is really a 3 month average of November, December and January prices.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the December 2016 report (the Composite 20 was started in January 2000).

The consensus is for a 5.7% year-over-year increase in the Comp 20 index for January.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for March. This is the last of the regional Fed surveys for March.

12:50 PM: Speech by Fed Chair Janet Yellen, Addressing Workforce Development Challenges in Low-Income Communities, At the National Community Reinvestment Coalition Annual Conference, Washington, D.C.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Pending Home Sales Index for February. The consensus is for a 1.8% increase in the index.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 247 thousand initial claims, down from 258 thousand the previous week.

8:30 AM: Gross Domestic Product, 4th quarter 2016 (third estimate). The consensus is that real GDP increased 2.0% annualized in Q4, up from the second estimate of 1.9%.

8:30 AM: Personal Income and Outlays for February. The consensus is for a 0.4% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.2%.

9:45 AM: Chicago Purchasing Managers Index for March. The consensus is for a reading of 57.1, down from 57.4 in February.

10:00 AM: University of Michigan's Consumer sentiment index (final for March). The consensus is for a reading of 97.6, unchanged from the preliminary reading 95.7.

Friday, March 24, 2017

Oil: "Incredible strength in rig additions"

by Calculated Risk on 3/24/2017 07:08:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on Mar 24, 2017:

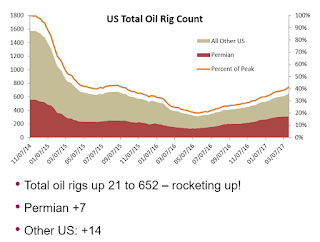

• US oil rig count was up an eye-popping 21 this week to 652

• US horizontal oil rigs were up by 13 to 543

...

• Despite a major correction in oil prices, rig additions continue at a rapid pace.

Click on graph for larger image.

Click on graph for larger image.Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

CoreLogic: "Between 2007–2016, Nearly 7.8 Million Homes Lost to Foreclosure"

by Calculated Risk on 3/24/2017 04:22:00 PM

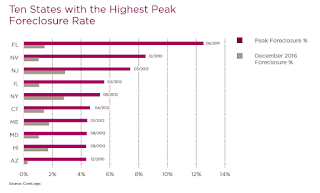

Here is a report from CoreLogic: US Residential Foreclosure Crisis: 10 Years Later. There are several interesting graphs in the report, including foreclosures completed by year.

This graph for CoreLogic the Ten States with the highest peak foreclosure rate during the crisis, and the current foreclosure rate.

Here is a table based on data from the CoreLogic report showing completed foreclosure per year.

| Completed foreclosure by Year Source: CoreLogic | |

|---|---|

| Year | Completed Foreclosures |

| 2000 | 191,295 |

| 2001 | 183,437 |

| 2002 | 232,330 |

| 2003 | 255,010 |

| 2004 | 275,900 |

| 2005 | 293,541 |

| 2006 | 383,037 |

| 2007 | 592,622 |

| 2008 | 983,881 |

| 2009 | 1,035,033 |

| 2010 | 1,178,234 |

| 2011 | 958,957 |

| 2012 | 853,358 |

| 2013 | 679,923 |

| 2014 | 608,321 |

| 2015 | 506,609 |

| 2016 | 385,748 |

Vehicle Sales Forecast: Sales Over 17 Million SAAR in March

by Calculated Risk on 3/24/2017 02:20:00 PM

The automakers will report March vehicle sales on Tuesday, April 4th.

Note: There were 27 selling days in March 2017, unchanged from 27 in March 2016.

From WardsAuto: Forecast: U.S. March Sales to Reach 17-Year High

A WardsAuto forecast calls for U.S. automakers to deliver 1.61 million light vehicles in March, a 17-year high for the month. The forecasted daily sales rate of 59,776 over 27 days is a best-ever March result. This DSR represents a 2.6% improvement from like-2016 (also 27 days). March is anticipated to be the first month in 2017 to outpace prior-year.From J.D. Power: March U.S. auto sales seen up nearly 1.9 pct -JD Power and LMC

The report puts the seasonally adjusted annual rate of sales for the month at 17.2 million units, below the 17.4 million SAAR from the first two months of 2017 combined, but well above the 16.6 million from same-month year-ago. ...

emphasis added

U.S. auto sales in March will increase almost 1.9 percent from a year earlier, even as consumer discounts continue to remain at record levels, industry consultants J.D. Power and LMC Automotive said on Friday.Looks like another strong month for vehicle sales, but incentives are at record levels and inventories are high.

March U.S. new vehicle sales will be about 1.62 million units, up about 1.9 percent from 1.59 million units a year earlier, the consultancies said. The forecast was based on the first 16 selling days of the month.

The seasonally adjusted annualized rate for the month will be 17.3 million vehicles, up from 16.8 million a year earlier.

U.S. Heavy Truck Sales increasing following Oil Price Related Slump

by Calculated Risk on 3/24/2017 11:52:00 AM

The following graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the February 2017 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the great recession, falling to a low of 181 thousand in April and May 2009, on a seasonally adjusted annual rate basis (SAAR). Then sales increased more than 2 1/2 times, and hit 479 thousand SAAR in June 2015.

Heavy truck sales declined again - probably mostly due to the weakness in the oil sector - and bottomed at 352 thousand SAAR in October of last year.

Click on graph for larger image.

With the increase in oil prices over the last year, heavy truck sales have been increasing too.

Heavy truck sales were at 400 thousand SAAR in February 2017.

BLS: Unemployment Rates "significantly lower in February in 10 states", Arkansas and Oregon at New Lows

by Calculated Risk on 3/24/2017 10:11:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were significantly lower in February in 10 states, higher in 1 state, and stable in 39 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today. Nine states had notable jobless rate decreases from a year earlier, and 41 states and the District had no significant change. The national unemployment rate, at 4.7 percent, was little changed from January but 0.2 percentage point lower than in February 2016.

...

New Hampshire had the lowest unemployment rate in February, 2.7 percent, closely followed by Hawaii and South Dakota, 2.8 percent each, and Colorado and North Dakota, 2.9 percent each. The rates in both Arkansas (3.7 percent) and Oregon (4.0 percent) set new series lows. ... New Mexico had the highest jobless rate, 6.8 percent, followed by Alaska and Alabama, 6.4 percent and 6.2 percent, respectively.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement. The yellow squares are the lowest unemployment rate per state since 1976.

The states are ranked by the highest current unemployment rate. New Mexico, at 6.8%, had the highest state unemployment rate.

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).Currently no state has an unemployment rate at or above 7% (light blue); Only three states are at or above 6% (dark blue). The states are New Mexico (6.8%), Alaska (6.4%), and Alabama (6.2%).

Thursday, March 23, 2017

A few Comments on February New Home Sales

by Calculated Risk on 3/23/2017 12:51:00 PM

New home sales for February were reported at 592,000 on a seasonally adjusted annual rate basis (SAAR). This was well above the consensus forecast, however the three previous months combined were revised down slightly. Overall this was a solid report.

Note: February 2017 was warmer than normal in most of the country, and since new home sales are counted when the contract is signed, the nice weather might have had a positive impact on sales in February.

Sales were up 12.8% year-over-year in February. However, January and February were the weakest months last year on a seasonally adjusted annual rate basis - so this was an easy comparison.

It will take several months of data to see the impact of higher mortgage rates - and this is the seasonally weak period - so we might have to wait for the March and April data to see if there was any impact.

Earlier: New Home Sales increase to 592,000 Annual Rate in February.

This graph shows new home sales for 2016 and 2017 by month (Seasonally Adjusted Annual Rate). Sales were up 12.8% year-over-year in January.

For the first two months of 2017, new home sales are up 7.1% compared to the same period in 2016.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The gap has persisted even though distressed sales are down significantly, since new home builders focused on more expensive homes.

I expect existing home sales to move more sideways, and I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.