by Calculated Risk on 4/01/2017 08:11:00 AM

Saturday, April 01, 2017

Schedule for Week of Apr 2, 2017

The key report this week is the March employment report on Friday.

Other key indicators include the March ISM manufacturing and non-manufacturing indexes, March auto sales, and the February Trade Deficit.

Also the Q1 quarterly Reis surveys for office and malls will be released this week.

10:00 AM: ISM Manufacturing Index for March. The consensus is for the ISM to be at 57.1, down from 57.7 in February.

10:00 AM: ISM Manufacturing Index for March. The consensus is for the ISM to be at 57.1, down from 57.7 in February.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion at 57.7% in February. The employment index was at 54.2%, and the new orders index was at 65.1%.

10:00 AM: Construction Spending for February. The consensus is for a 1.0% increase in construction spending.

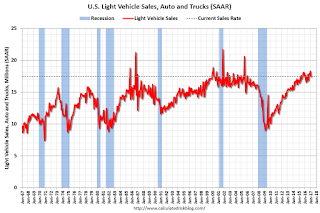

All day: Light vehicle sales for March. The consensus is for light vehicle sales to decrease to 17.4 million SAAR in March, from 17.5 million in February (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for March. The consensus is for light vehicle sales to decrease to 17.4 million SAAR in March, from 17.5 million in February (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the February sales rate.

8:30 AM: Trade Balance report for February from the Census Bureau.

8:30 AM: Trade Balance report for February from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through January. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $44.5 billion in February from $48.5 billion in January.

Early: Reis Q1 2017 Mall Survey of rents and vacancy rates.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for February. The consensus is a 1.0% increase in orders.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for March. This report is for private payrolls only (no government). The consensus is for 170,000 payroll jobs added in March, down from 298,000 added in February.

Early: Reis Q1 2017 Office Survey of rents and vacancy rates.

10:00 AM: the ISM non-Manufacturing Index for March. The consensus is for index to decrease to 57.0 from 57.6 in February.

2:00 PM: FOMC Minutes for the Meeting of March 14 - 15, 2017

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 250 thousand initial claims, down from 258 thousand the previous week.

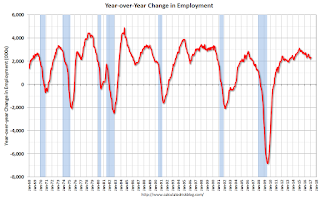

8:30 AM: Employment Report for March. The consensus is for an increase of 178,000 non-farm payroll jobs added in March, down from the 235,000 non-farm payroll jobs added in February.

The consensus is for the unemployment rate to be unchanged at 4.7%.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In February, the year-over-year change was 2.35 million jobs.

A key will be the change in wages.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for February.

3:00 PM: Consumer credit from the Federal Reserve. The consensus is for a $15.0 billion increase in credit.

Friday, March 31, 2017

Q1 GDP Forecasts Downgraded

by Calculated Risk on 3/31/2017 05:11:00 PM

The advance GDP report for Q1 GDP will be released in April. Based on the February Personal Income and Outlays report released this morning, it appears PCE growth is tracking less than 0.5% in Q1. Here are a few updated forecasts for Q1:

From the Altanta Fed: GDPNow

The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2017 is 0.9 percent on March 31, down from 1.0 percent on March 24.From the NY Fed Nowcasting Report

emphasis added

The FRBNY Staff Nowcast stands at 2.9% for 2017:Q1 and 2.6% for 2017:Q2.From Merrill Lynch:

Negative news from consumption data reduced the nowcast by about one-tenth of a percentage point for both quarters.

Real personal spending fell 0.1% mom in February, missing expectations of 0.1% growth ... On balance, these data sliced 0.7pp from 1Q GDP tracking, bringing us down to 1.2% qoq saar.

Fannie Mae: Mortgage Serious Delinquency rate declined in February, Lowest since March 2008

by Calculated Risk on 3/31/2017 02:02:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate declined to 1.19% in February, from 1.20% in January. The serious delinquency rate is down from 1.52% in February 2016.

This is the lowest serious delinquency rate since March 2008.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Although the rate is declining, the "normal" serious delinquency rate is under 1%.

The Fannie Mae serious delinquency rate has fallen 0.33 percentage points over the last year, and at that rate of improvement, the serious delinquency rate will not be below 1% until later this year.

Note: Freddie Mac reported earlier.

Reis: Apartment Vacancy Rate increased in Q1 to 4.3%

by Calculated Risk on 3/31/2017 11:59:00 AM

Reis reported that the apartment vacancy rate was at 4.3% in Q1 2017, up from 4.2% in Q4, and unchanged from 4.3% in Q1 2016. The vacancy rate peaked at 8.0% at the end of 2009.

From Reis: Effective Apartment Rents Decline in 23 of 79 Metros Across the U.S. The National Effective Rent Grew 0.3% in the Quarter, 3.1% over the Year

Apartment markets are slowing in 23 metros across the U.S. as indicated by a decline in effective rents in these metros. Effective rents net out landlord concessions which suggests that rents are flat in most of these markets but landlords have boosted free rent and other concessions to maintain occupancy.

At 4.3%, the national vacancy rate increased 10 basis points in the first quarter of 2017 from 4.2% in the previous quarter. One year ago, the vacancy rate was also 4.3%. New apartment construction has been robust across the U.S., yet occupancy growth has moved in step with supply growth for most metros.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the apartment vacancy rate starting in 1980. (Annual rate before 1999, quarterly starting in 1999). Note: Reis is just for large cities.

The vacancy rate had been mostly moving sideways for the last few years. It is possible that the vacancy rate has bottomed.

Apartment vacancy data courtesy of Reis.

Chicago PMI increases in March

by Calculated Risk on 3/31/2017 09:58:00 AM

Chicago PMI: March Chicago Business Barometer at 57.7 vs 57.4 in February

The MNI Chicago Business Barometer was broadly stable at 57.7 in March, following a hefty rise of 7.1 points in February to 57.4.This was above the consensus forecast of 57.1.

Following a strong February, firms remained upbeat this month, with the increase led by four of the five components of the Barometer, as only Employment receded. March’s positive outturn left the Q1 calendar quarter average at 55.1, the highest level since Q4 2014.

Demand continued to grow, rising for the second month in a row. New orders rose by 1.2 points, to touch a fourmonth high. To keep pace with rising demand, Production also increased, up 1.4 points to a 14-month high of 61.7 in March. Order Backlogs rose for the third consecutive month, but remained just below the breakeven level, where it has sat for the previous three months. Suppliers took longer to deliver key inputs, with the respective indicator 1.6 points higher at 54.4 in March. Employment slipped back into contraction after rising above 50 briefly last month.

...

“The March Chicago report echoed last month’s upbeat tone of general business conditions. Though the Barometer was little changed, the underlying trend for many key indicators shows improvement, with a shift away from firms reporting worsening to that of remaining at the same level as last month,” said Shaily Mittal, senior economist at MNI Indicators.

emphasis added

Personal Income increased 0.4% in February, Spending increased 0.1%

by Calculated Risk on 3/31/2017 08:49:00 AM

The BEA released the Personal Income and Outlays report for February:

Personal income increased $57.7 billion (0.4 percent) in February according to estimates released today by the Bureau of Economic Analysis. ... personal consumption expenditures (PCE) increased $7.4 billion (0.1 percent).The February PCE price index increased 2.1 percent year-over-year and the February PCE price index, excluding food and energy, increased 1.8 percent year-over-year.

...

Real PCE decreased 0.1 percent. The PCE price index increased 0.1 percent. Excluding food and energy, the PCE price index increased 0.2 percent.

The following graph shows real Personal Consumption Expenditures (PCE) through February 2017 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was at expectations, however the increase in PCE was below expectations.

Using the two-month method to estimate Q1 PCE growth, PCE was increasing at a 0.4% annual rate in Q1 2017. (using the mid-month method, PCE was increasing 1.0%). This suggests weak PCE growth in Q1.

Thursday, March 30, 2017

Friday: Personal Income and Outlays, Chicago PMI

by Calculated Risk on 3/30/2017 08:03:00 PM

Friday:

• At 8:30 Personal Income and Outlays for February. The consensus is for a 0.4% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• Also at 9:45 AM, Chicago Purchasing Managers Index for March. The consensus is for a reading of 57.1, down from 57.4 in February.

• At 10:00 AM, University of Michigan's Consumer sentiment index (final for March). The consensus is for a reading of 97.6, unchanged from the preliminary reading 95.7.

Census: "One-third of the adult population in the United States has a bachelor’s degree or higher"

by Calculated Risk on 3/30/2017 04:46:00 PM

From the Census Bureau: More than one-third of the adult population in the United States has a bachelor’s degree or higher

More than one-third of the adult population in the United States has a bachelor’s degree or higher marking the first time in decades of data.

“The percentage rose to 33.4 percent in 2016, a significant milestone since the Current Population Survey began collecting educational attainment in 1940,” said Kurt Bauman, Chief of the Education and Social Stratification Branch. “In 1940, only 4.6 percent had reached that level of education.”

In 2010, less than 30 percent of those 25 and older had completed a bachelor’s degree or higher, and in 2006, 28 percent had reached that level of education.

emphasis added

This graph shows the percent of adults, 25 years and older, with a bachelor's degree or higher.

This graph shows the percent of adults, 25 years and older, with a bachelor's degree or higher. More education is one of the reasons I've argued the Future is Bright!

Hotels: Hotel Occupancy Rate Solid in March

by Calculated Risk on 3/30/2017 11:23:00 AM

After some weakness early in the year, hotel occupancy has picked up in recent weeks and is now close to the record year (2015 was the record).

From HotelNewsNow.com: STR: US hotel results for week ending 25 March

U.S. hotels saw year-over-year performance increases for the week of 19-25 March. Occupancy rose 5% to 68.7%, ADR increased 2.9% to $127.68 and RevPAR jumped 7.9% to $87.75.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

STR analysts note that performance growth was boosted by an Easter calendar shift (27 March 2016). In comparison with the week of 20-26 March 2016, the industry reported the following in year-over-year comparisons:

Occupancy: +5.0% to 68.7%

Average daily rate (ADR): +2.9% to US$127.68

Revenue per available room (RevPAR): +7.9% to US$87.75

emphasis added

The red line is for 2017, dashed is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.

The red line is for 2017, dashed is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.2015 was the best year on record for hotels.

For hotels, occupancy will now move mostly sideways until the summer travel season.

Data Source: STR, Courtesy of HotelNewsNow.com

Weekly Initial Unemployment Claims decrease to 258,000

by Calculated Risk on 3/30/2017 08:40:00 AM

The DOL reported:

In the week ending March 25, the advance figure for seasonally adjusted initial claims was 258,000, a decrease of 3,000 from the previous week's unrevised level of 261,000. The 4-week moving average was 254,250, an increase of 7,750 from the previous week's unrevised average of 246,500.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 254,250.

This was above the consensus forecast.

The low level of claims suggests relatively few layoffs.