by Calculated Risk on 4/12/2017 12:09:00 PM

Wednesday, April 12, 2017

Q1 Review: Ten Economic Questions for 2017

At the end of last year, I posted Ten Economic Questions for 2017. I followed up with a brief post on each question. The goal was to provide an overview of what I expected in 2017 (I don't have a crystal ball, but I think it helps to outline what I think will happen - and understand - and change my mind, when the outlook is wrong).

By request, here is a quick Q1 review (it is very early in the year). I've linked to my posts from the beginning of the year, with a brief excerpt and a few comments:

10) Question #10 for 2017: Will housing inventory increase or decrease in 2017?

I was wrong on inventory last year, but right now my guess is active inventory will increase in 2017 (inventory will decline seasonally in December and January, but I expect to see inventory up again year-over-year in December 2017). My reasons for expecting more inventory are 1) inventory is historically low (lowest for November since 2000), 2) and the recent increase in interest rates.According to the February NAR report on existing home sales, inventory was down 6.4% year-over-year in February, and the months-of-supply was at 3.8 months. This was a smaller year-over-year decline than in January, and I still expect inventory to be up slightly by year end.

9) Question #9 for 2017: What will happen with house prices in 2017?

Inventories will probably remain low in 2017, although I expect inventories to increase on a year-over-year basis by December of 2017. Low inventories, and a decent economy suggests further price increases in 2017.If is very early, but the CoreLogic data released last week showed prices up 7.0% year-over-year in February. The CoreLogic year-over-year increase is higher than last year so far.

Perhaps higher mortgage rates will slow price appreciation. If we look back at the "taper tantrum" in 2013, price appreciation slowed somewhat over the next year - but that was from a high level. In June 2013, the Case-Shiller National index was up 9.3% year-over-year. By June 2014, the index was up 6.3% year-over-year.

If inventory increases year-over-year as I expect by December 2017, it seems likely that price appreciation will slow to the low-to-mid single digits.

8) Question #8 for 2017: How much will Residential Investment increase?

Most analysts are looking for starts to increase to around 1.25 million in 2017, and for new home sales of around 600 to 650 thousand. This would be an increase of around 7% for starts and maybe 10% for new home sales.Through February, starts were up 7.5% year-over-year compared to the same period in 2016. New home sales were up 7.1% year-over-year (more difficult comparison).

I think there will be further growth in 2017, but I think a combination of higher mortgage rates, less multi-family starts, and not enough lots for low-to-mid range new homes will mean sluggish growth in 2017.

My guess is starts will increase to just over 1.2 million in 2017 and new home sales will be in the low 600 thousand range.

7) Question #7 for 2017: How much will wages increase in 2017?

As the labor market continues to tighten, we should see more wage pressure as companies have to compete for employees. I expect to see some further increases in both the Average hourly earning from the CES, and in the Altanta Fed Wage Tracker. Perhaps nominal wages will increase more than 3% in 2017 according to the CES.Through March 2017, nominal hourly wages were up 2.7% year-over-year. This is a pickup from last year, and so far it appears wages will increase at a faster rate in 2017.

6) Question #6 for 2017: Will the Fed raise rates in 2017, and if so, by how much?

Analysts are being cautious on forecasting rate hikes, probably because they forecasted too many hikes over the last few years. However, as the economy approaches full employment, and with the possibility of fiscal stimulus in 2017, it is possible that inflation will pick up a little - and, if so, the Fed could hike more than expected.The Fed has already hiked once in 2017, and they are still forecasting three hikes this year (and to slow reinvesting by the end of the year).

My current guess is the Fed will hike twice in 2017.

5) Question #5 for 2017: Will the core inflation rate rise in 2017? Will too much inflation be a concern in 2017?

The Fed is projecting core PCE inflation will increase to 1.8% to 1.9% by Q4 2017. However there are risks for higher inflation. The labor market is approaching full employment, and the new administration is proposing some fiscal stimulus (tax cuts, possible infrastructure spending), so it is possible - as a result - that inflation will increase more than expected in 2017 and 2018.It is early, but inflation has moved up close to the Fed target through February.

Currently I think PCE core inflation (year-over-year) will increase further and be close to 2% in 2017, but too much inflation will still not be a serious concern in 2017.

4) Question #4 for 2017: What will the unemployment rate be in December 2017?

Depending on the estimate for the participation rate and job growth (next question), it appears the unemployment rate will declining slightly by December 2017 from the current 4.7%.The unemployment rate decline to 4.5% in March - about the level I expected for the end of 2017.

3) Question #3 for 2017: Will job creation slow further in 2017?

So my forecast is for gains of 125,000 to 150,000 payroll jobs per month in 2017. Lower than in 2016, but another solid year for employment gains given current demographics.Through March 2017, the economy has added 533,000 thousand jobs, or 178,000 per month, down from 187,000 per month in 2016. I still expect employment gains to slow this year.

2) Question #2 for 2017: How much will the economy grow in 2017?

There will probably be some economic boost from oil sector investment in 2017 since oil prices have increased (this was a drag last year).Once again, GDP will be sluggish in Q1 - and it is way too early to tell if there will be any pickup in GDP growth this year.

The housing recovery is ongoing, however auto sales might have peaked.

And demographics are improving (the prime working age population is growing about 0.5% per year, compared to declining a few years ago).

All these factors combined will probably push GDP growth into the mid-to-high 2% range in 2017, but this will depend somewhat on which policies are enacted.

1) Question #1 for 2017: What about fiscal and regulatory policy in 2017?

We are still waiting for the details. As far as the impact on 2017, my expectation is there will be both individual and corporate tax cuts - and some sort of infrastructure program. I expect that something will happen with the ACA (those that have insurance for 2017 will keep their insurance, but they might not have insurance in 2018 - and that impact would be in 2018). I think the negative proposals (immigration, trade) will impact the economy in 2018 or later - overall there will be a small boost to GDP in 2017.So far nothing has happened with the ACA, taxes, infrastructure, or trade. Policy remains a wild card.

A final comment: The words of a President matter. Mr Trump has been impulsive, reckless and irresponsible with his comments, and that has continued since the election. One absurd comment could send the markets into a tailspin and negatively impact the economy (and that could happen at any time).

It is very early in the year. Currently it looks like 2017 is unfolding somewhat as expected - although I'd revise up my forecast for FOMC rate hikes from 2 to 3.

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 4/12/2017 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 1.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 7, 2017.

... The Refinance Index remained unchanged from the previous week. The seasonally adjusted Purchase Index increased 3 percent from one week earlier. The unadjusted Purchase Index increased 5 percent compared with the previous week and was 3 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) decreased to 4.28 percent from 4.34 percent, with points increasing to 0.38 from 0.31 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

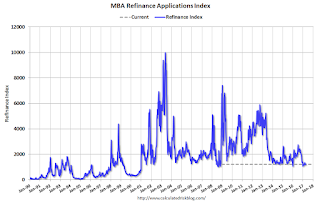

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity remains low - and will not increase significantly unless rates fall sharply.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. Even with the increase in mortgage rates late last year, purchase activity is still up.

However refinance activity has declined significantly since rates increased.

Tuesday, April 11, 2017

"Mortgage Rates Hit New 2017 Lows"

by Calculated Risk on 4/11/2017 10:19:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Hit New 2017 Lows

Mortgage rates moved lower today--significantly in some cases--with the average lender making it back to 2017's lows for the first time since January. Rates came close to 2017's lows in late February and again last week before officially crossing the line today.Here is a table from Mortgage News Daily:

...

Lenders are now fairly evenly split between 4.0% and 4.125% in terms of the most prevalent conventional 30yr fixed quote on top tier scenarios. A few of the most aggressive lenders are now quoting rates in the high 3's (emphasis on "few"), and there are still more than a few lenders up at 4.25%.

emphasis added

Update: Predicting the Next Recession

by Calculated Risk on 4/11/2017 03:45:00 PM

CR April 2017 Update: In 2013, I wrote a post "Predicting the Next Recession". I repeated the post in January 2015 (and in the summer of 2015, early last year and in August 2016) because of all the recession calls. In late 2015, the recession callers were out in force - arguing the problems in China, combined with the impact on oil producers of lower oil prices (and defaults by energy companies) - would lead to a global recession and drag the US into recession. I didn't think so - and I was correct.

I've added a few updates in italics by year. Most of the text is from January 2013.

A few thoughts on the "next recession" ... Forecasters generally have a terrible record at predicting recessions. There are many reasons for this poor performance. In 1987, economist Victor Zarnowitz wrote in "The Record and Improvability of Economic Forecasting" that there was too much reliance on trends, and he also noted that predictive failure was also due to forecasters' incentives. Zarnowitz wrote: "predicting a general downturn is always unpopular and predicting it prematurely—ahead of others—may prove quite costly to the forecaster and his customers".

Incentives motivate Wall Street economic forecasters to always be optimistic about the future (just like stock analysts). Of course, for the media and bloggers, there is an incentive to always be bearish, because bad news drives traffic (hence the prevalence of yellow journalism).

In addition to paying attention to incentives, we also have to be careful not to rely "heavily on the persistence of trends". One of the reasons I focus on residential investment (especially housing starts and new home sales) is residential investment is very cyclical and is frequently the best leading indicator for the economy. UCLA's Ed Leamer went so far as to argue that: "Housing IS the Business Cycle". Usually residential investment leads the economy both into and out of recessions. The most recent recovery was an exception, but it was fairly easy to predict a sluggish recovery without a contribution from housing.

Since I started this blog in January 2005, I've been pretty lucky on calling the business cycle. I argued no recession in 2005 and 2006, then at the beginning of 2007 I predicted a recession would start that year (made it by one month with the Great Recession starting in December 2007). And in 2009, I argued the economy had bottomed and we'd see sluggish growth.

Finally, over the last 18 months, a number of forecasters (mostly online) have argued a recession was imminent. I responded that I wasn't even on "recession watch", primarily because I thought residential investment was bottoming.

[CR 2015 Update: this was written two years ago - I'm not sure if those calling for a recession then have acknowledged their incorrect forecasts and / or changed theirs views (like ECRI and various bloggers). Clearly they were wrong.]

[CR April 2017 Update: Now it has been over four years! And yes, ECRI has admitted their recession calls were incorrect. Not sure about the rest of the recession callers.]

Now one of my blogging goals is to see if I can get lucky again and call the next recession correctly. Right now I'm pretty optimistic (see: The Future's so Bright ...) and I expect a pickup in growth over the next few years (2013 will be sluggish with all the austerity).

The next recession will probably be caused by one of the following (from least likely to most likely):

3) An exogenous event such as a pandemic, significant military conflict, disruption of energy supplies for any reason, a major natural disaster (meteor strike, super volcano, etc), and a number of other low probability reasons. All of these events are possible, but they are unpredictable, and the probabilities are low that they will happen in the next few years or even decades.

[CR 2016 Update: The recent recession calls are mostly based on exogenous events: the problems in China and in commodity based economies (especially oil based). There will be some spillover to the US such as fewer exports (and an impact on oil producing regions in the US), but unless there is a related financial crisis, I think the spillover will be insufficient to cause a recession in the US.]

2) Significant policy error. This might involve premature or too rapid fiscal or monetary tightening (like the US in 1937 or eurozone in 2012). Two examples: not reaching a fiscal agreement and going off the "fiscal cliff" probably would have led to a recession, and Congress refusing to "pay the bills" would have been a policy error that would have taken the economy into recession. Both are off the table now, but there remains some risk of future policy errors.

Note: Usually the optimal path for reducing the deficit means avoiding a recession since a recession pushes up the deficit as revenues decline and automatic spending (unemployment insurance, etc) increases. So usually one of the goals for fiscal policymakers is to avoid taking the economy into recession. Too much austerity too quickly is self defeating.

[CR 2017 Update: Austerity was a mistake (obvious at the time). And it is possible that we will see serious policy mistakes from the new administration (a complete wildcard). And it is possible the Fed could tighten too quickly. ]

1) Most of the post-WWII recessions were caused by the Fed tightening monetary policy to slow inflation. I think this is the most likely cause of the next recession. Usually, when inflation starts to become a concern, the Fed tries to engineer a "soft landing", and frequently the result is a recession. Since inflation is not an immediate concern, the Fed will probably stay accommodative for a few more years.

So right now I expect further growth for the next few years (all the austerity in 2013 concerns me, especially over the next couple of quarters as people adjust to higher payroll taxes, but I think we will avoid contraction). [CR 2015 Update: We avoided contraction in 2013!] I think the most likely cause of the next recession will be Fed tightening to combat inflation sometime in the future - and residential investment (housing starts, new home sales) will probably turn down well in advance of the recession. In other words, I expect the next recession to be a more normal economic downturn - and I don't expect a recession for a few years.

[CR April 2017 Update: This was written in 2013 - and my prediction for no "recession for a few years" was correct. This still seems correct today, so no recession in the immediate future (not in 2017). ]

EIA: Expect Record U.S. Oil Production in 2018, Exceeding 1970 Peak

by Calculated Risk on 4/11/2017 01:13:00 PM

“U.S. crude oil production is expected to be higher during the next two years than previously forecast, with annual output in 2018 now forecast to reach 9.9 million barrels per day, exceeding the previous record level of 9.6 million barrels per day reached in 1970.”

U.S. Energy Information Administration Acting Administrator Howard Gruenspecht, April 11, 2017

The EIA released the Short-Term Energy Outlook today. From the STEO:

• U.S. crude oil production averaged an estimated 8.9 million barrels per day (b/d) in 2016. U.S crude oil production is forecast to average 9.2 million b/d in 2017 and 9.9 million b/d in 2018.

• For the 2017 April-through-September summer driving season, U.S. regular gasoline retail prices are forecast to average $2.46/gallon (gal), compared with $2.23/gal last summer. The higher forecast gasoline price is primarily the result of higher forecast crude oil prices. For all of 2017, the forecast average price for regular gasoline is $2.39/gal, which, if realized, would result in the average U.S. household spending about $200 more on motor fuel in 2017 compared with 2016.

• North Sea Brent crude oil spot prices averaged $52 per barrel (b) in March, $3/b lower than the February average. EIA forecasts Brent prices to average $54/b in 2017 and $57/b in 2018. West Texas Intermediate (WTI) crude oil prices are forecast to average $2/b less than Brent prices in both 2017 and 2018.

emphasis added

BLS: Job Openings "little changed" in February

by Calculated Risk on 4/11/2017 10:06:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings was little changed at 5.7 million on the last business day of February, the U.S. Bureau of Labor Statistics reported today. Over the month, hires and separations were also little changed at 5.3 million and 5.1 million, respectively. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

The number of quits was essentially unchanged at 3.1 million in February. The quits rate was 2.1 percent. The number of quits was little changed for total private and for government.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for February, the most recent employment report was for March.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in February to 5.743 million from 5.625 million in January. Job openings are mostly moving sideways at a high level.

The number of job openings (yellow) are up 3% year-over-year.

Quits are up 3% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

This is another solid report.

NFIB: Small Business Optimism Index decreased in March

by Calculated Risk on 4/11/2017 09:49:00 AM

From the National Federation of Independent Business (NFIB): Small Business Optimism Sustained in March

The Index of Small Business Optimism fell 0.6 points to 104.7, sustaining the remarkable surge in optimism that started November 9, 2016, the day after the election.

...

Small business owners reported a seasonally adjusted average employment change per firm of 0.16 workers per firm, a solid showing. ... Sixteen percent of owners cited the difficulty of finding qualified workers as their Single Most Important Business Problem (down 1 point), far more than were concerned with weak sales. Thirty percent of all owners reported job openings they could not fill in the current period, down 2 points but historically high.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index decreased to 104.7 in March.

Monday, April 10, 2017

Tuesday: Job Openings

by Calculated Risk on 4/10/2017 08:09:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Slightly Higher, But Steady Overall

Mortgage rates rose slightly again today, despite moderate improvement in underlying bond markets. ... All that having been said, mortgage rate movement continues to take place inside an exceptionally narrow range. For the past 3 weeks, most borrowers would be quoted the exact same NOTE rate from most lenders, with the only variation coming in the form of upfront cost. The most prevalent top tier conventional 30yr fixed quote remains 4.125%, though several lenders are on either side of that by 0.125%.Thursday:

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for March.

• At 10:00 AM, Job Openings and Labor Turnover Survey for February from the BLS. Jobs openings were mostly unchanged in January at 5.626 million compared to 5.539 million in December. The number of job openings were down slightly year-over-year, and Quits were up 11% year-over-year in January.

Leading Index for Commercial Real Estate Increases in March

by Calculated Risk on 4/10/2017 03:25:00 PM

Note: This index is a leading indicator for new non-residential Commercial Real Estate (CRE) investment, except manufacturing.

From Dodge Data Analytics: Dodge Momentum Index Springs Forward in March

The Dodge Momentum Index increased by 0.9% in March to 144.4 (2000=100) from its revised February reading of 143.2. The Momentum Index is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. The Momentum Index has now risen for six consecutive months, with much of the gain being driven by institutional projects entering planning while commercial projects so far in 2017 have receded slightly. The institutional portion of the Momentum Index rose 3.7% in March, and is 23.0% higher than the end of 2016. Commercial planning meanwhile fell 1.2% in March and is down 2.9% from December 2016. However, the overall Momentum Index, as well as the commercial and institutional components, are well above their year-ago levels. This continues to signal the potential for increased construction activity in 2017 despite the short-term setbacks that are inherent in the volatile month-to-month planning data.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 144.4 in March, up from 143.2 in February.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This suggests further increases in CRE spending over the next year.

Philly Fed: State Coincident Indexes increased in 38 states in January

by Calculated Risk on 4/10/2017 11:30:00 AM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for January 2017. Over the past three months, the indexes increased in 46 states, decreased in three, and remained stable in one, for a three-month diffusion index of 86. In the past month, the indexes increased in 38 states, decreased in five, and remained stable in seven, for a one-month diffusion index of 66.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In January 39 states had increasing activity (including minor increases).

The downturn in 2015 and 2016, in the number of states increasing, was mostly related to the decline in oil prices. I'm not sure why this index was weak in January.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and almost all green now.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and almost all green now.Source: Philly Fed. Note: For complaints about red / green issues, please contact the Philly Fed.