by Calculated Risk on 4/27/2017 11:00:00 AM

Thursday, April 27, 2017

Kansas City Fed: Regional Manufacturing Activity "Expanded at Slow Pace" in April

From the Kansas City Fed: Tenth District Manufacturing Activity Expanded at a Slower Pace

The Federal Reserve Bank of Kansas City released the April Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity expanded at a slower pace with solid expectations for future activity.The Kansas City region was hit hard by the decline in oil prices, but activity is expanding again.

“We came down a bit from the rapid growth rate of the past two months,” said Wilkerson. “But firms still reported a good increase in activity and expected this to continue.”

...

The month-over-month composite index was 7 in April, down from the very strong readings of 20 in March and 14 in February. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. Activity in both durable and nondurable goods plants eased slightly, particularly for metals, machinery, food, and plastic products. Most month-over-month indexes expanded at a slower pace in April. The production, shipments, and new orders indexes fell but remained positive, and the employment index edged lower from 13 to 9. In contrast, the new orders for exports index increased from 2 to 4. Both inventory indexes fell moderately after rising the past two months.

emphasis added

This was the last of the regional Fed surveys for April.

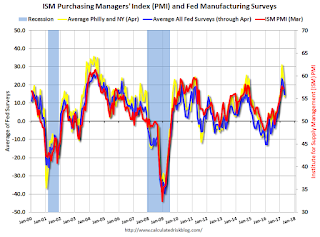

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through April), and five Fed surveys are averaged (blue, through April) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through March (right axis).

It seems likely the ISM manufacturing index will decline in April, but still show solid expansion (to be released next week).

NAR: Pending Home Sales Index decreased 0.8% in March, up 0.8% year-over-year

by Calculated Risk on 4/27/2017 10:00:00 AM

From the NAR: Pending Home Sale Dip 0.8% in March

The Pending Home Sales Index, a forward-looking indicator based on contract signings, declined 0.8 percent to 111.4 in March from 112.3 in February. Despite last month's decrease, the index is 0.8 percent above a year ago.This was below expectations of a 0.4% decrease for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in April and May.

...

The PHSI in the Northeast decreased 2.9 percent to 99.1 in March, but is still 1.8 percent above a year ago. In the Midwest the index declined 1.2 percent to 109.6 in March, and is now 2.4 percent lower than March 2016.

Pending home sales in the South rose 1.2 percent to an index of 129.4 in March and are now 3.9 percent above last March. The index in the West fell 2.9 percent in March to 94.5, and is now 2.7 percent below a year ago.

emphasis added

Weekly Initial Unemployment Claims increase to 257,000

by Calculated Risk on 4/27/2017 08:33:00 AM

The DOL reported:

In the week ending April 22, the advance figure for seasonally adjusted initial claims was 257,000, an increase of 14,000 from the previous week's revised level. The previous week's level was revised down by 1,000 from 244,000 to 243,000. The 4-week moving average was 242,250, a decrease of 500 from the previous week's revised average. The previous week's average was revised down by 250 from 243,000 to 242,750.The previous week was revised down.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 242,250.

This was above the consensus forecast.

The low level of claims suggests relatively few layoffs.

Wednesday, April 26, 2017

Thursday: Unemployment Claims, Durable Goods, Pending Home Sales

by Calculated Risk on 4/26/2017 08:59:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 243 thousand initial claims, down from 244 thousand the previous week.

• Also at 8:30 AM, Durable Goods Orders for February from the Census Bureau. The consensus is for a 1.1% increase in durable goods orders.

• At 10:00 AM, Pending Home Sales Index for March. The consensus is for a 0.4% decrease in the index.

• Also at 10:00 AM, the Q1 2017 Housing Vacancies and Homeownership from the Census Bureau.

• At 11:00 AM, the Kansas City Fed manufacturing survey for April. This is the last of the regional Fed surveys for April.

Freddie Mac: Mortgage Serious Delinquency rate declined in March, Lowest since May 2008

by Calculated Risk on 4/26/2017 05:14:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in March was at 0.92%, down from 0.98% in February. Freddie's rate is down from 1.20% in March 2016.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

This is the lowest serious delinquency rate since May 2008.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Although the rate is still declining, the rate of decline has slowed.

Maybe the rate will decline another 0.2 to 0.4 percentage points or so to a cycle bottom, but this is pretty close to normal.

Note: Fannie Mae will report soon.

Philly Fed: State Coincident Indexes increased in 45 states in March

by Calculated Risk on 4/26/2017 01:40:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for March 2017. Over the past three months, the indexes increased in 45 states, decreased in three, and remained stable in two, for a three-month diffusion index of 84. In the past month, the indexes increased in 45 states and decreased in five, for a one-month diffusion index of 80.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In March 45states had increasing activity (including minor increases).

The downturn in 2015 and 2016, in the number of states increasing, was mostly related to the decline in oil prices.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and almost all green now.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and almost all green now.Source: Philly Fed. Note: For complaints about red / green issues, please contact the Philly Fed.

New Home Prices

by Calculated Risk on 4/26/2017 11:02:00 AM

As part of the new home sales report, the Census Bureau reported the number of homes sold by price and the average and median prices.

From the Census Bureau: "The median sales price of new houses sold in March 2017 was $315,100. The average sales price was $388,200."

The following graph shows the median and average new home prices.

During the housing bust, the builders had to build smaller and less expensive homes to compete with all the distressed sales. When housing started to recovery - with limited finished lots in recovering areas - builders moved to higher price points to maximize profits.

The average price in March 2017 was $388,200, and the median price was $315,100. Both are above the bubble high (this is due to both a change in mix and rising prices).

The second graph shows the percent of new homes sold by price.

The $400K+ bracket has increased significantly. I'll break that bracket up in the future.

A majority of new home in the U.S. are in the $200K to $400K range.

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 4/26/2017 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Surve

Mortgage applications increased 2.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 21, 2017.

... The Refinance Index increased 7 percent from the previous week. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index increased 0.1 percent compared with the previous week and was 0.4 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) decreased to its lowest level since November 2016, 4.20 percent, from 4.22 percent, with points increasing to 0.37 from 0.35 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity increased last week as rates declined, but remains low - and will not increase significantly unless rates fall sharply.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. Even with the increase in mortgage rates late last year, purchase activity is still up slightly year-over-year.

Tuesday, April 25, 2017

Zillow Forecast: "The national Case-Shiller index is projected to climb 5.9 percent year-over-year in March"

by Calculated Risk on 4/25/2017 08:39:00 PM

The Case-Shiller house price indexes for February were released this morning. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Svenja Gudell at Zillow: March Case-Shiller Forecast: The Home Price Party Rages On

Home prices are expected to continue to climb in March, but the pace of month-over-month growth is expected to slow, according to Zillow’s March Case-Shiller forecast.The year-over-year change for the Case-Shiller national index will probably increase in March.

The national Case-Shiller index is projected to climb 5.9 percent year-over-year in March, following a 5.8 percent gain in February. Month-to-month, the national index is expected to be up a seasonally adjusted 0.3 percent in March, following a 0.4 percent monthly gain in February.

Annual growth in the smaller 10- and 20-city indices is also expected to slow slightly: The 10-city forecast is for a 5.1 percent gain in annual growth for March, following 5.2 percent annual growth in February. And the 20-city index is projected to gain 5.7 percent in March, below its 5.9 percent annual gain in February.

The 10-city index is forecast to climb a seasonally adjusted 0.7 percent in March from February, following 0.6 percent monthly growth between January and February. Growth in the 20-city index is expected to hold steady on a seasonally adjusted, month-over-month basis, rising 0.7 percent in March as it did in February.

Zillow’s March Case-Shiller forecast is shown below. These forecasts are based on today’s February Case-Shiller data release and the March 2017 Zillow Home Value Index. The March S&P CoreLogic Case-Shiller Indices will not be officially released until Tuesday, May 30.

Real House Prices and Price-to-Rent Ratio in February

by Calculated Risk on 4/25/2017 05:09:00 PM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 5.8% year-over-year in February

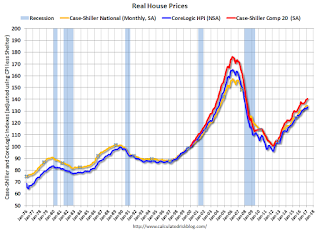

It has been more than ten years since the bubble peak. In the Case-Shiller release this morning, the seasonally adjusted National Index (SA), was reported as being 2.1% above the previous bubble peak. However, in real terms, the National index (SA) is still about 14.4% below the bubble peak.

The year-over-year increase in prices is mostly moving sideways now just over 5%. In February, the index was up 5.8% YoY.

In the earlier post, I graphed nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $280,000 today adjusted for inflation (40%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) is at a new peak, and the Case-Shiller Composite 20 Index (SA) is back to October 2005 levels, and the CoreLogic index (NSA) is back to September 2005.

Real House Prices

In real terms, the National index is back to April 2004 levels, the Composite 20 index is back to December 2003, and the CoreLogic index back to February 2004.

In real terms, house prices are back to late 2003 / early 2004 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to November 2003 levels, the Composite 20 index is back to August 2003 levels, and the CoreLogic index is back to July 2003.

In real terms, and as a price-to-rent ratio, prices are back to late 2003 / early 2004 - and the price-to-rent ratio maybe moving a little more sideways now.