by Calculated Risk on 5/11/2017 11:41:00 AM

Thursday, May 11, 2017

Hotels: Occupancy Rate Increases Year-over-Year

From HotelNewsNow.com: STR: US hotel results for week ending 6 May

The U.S. hotel industry reported positive results in the three key performance metrics during the week of 30 April to 6 May 2017, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 1-7 May 2016, the industry reported the following:

• Occupancy: +3.3% to 67.9%

• Average daily rate (ADR): +2.4% to US$126.67

• Revenue per available room (RevPAR): +5.8% to US$85.96

STR analysts note that performance growth was particularly strong on Friday and Saturday due to a comparison with Mother’s Day weekend a year ago.

emphasis added

The red line is for 2017, dashed is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.

The red line is for 2017, dashed is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.2015 was the best year on record for hotels.

For hotels, the occupancy rate will now move mostly sideways until the summer travel season.

Data Source: STR, Courtesy of HotelNewsNow.com

Weekly Initial Unemployment Claims decrease to 236,000

by Calculated Risk on 5/11/2017 08:43:00 AM

The DOL reported:

In the week ending May 6, the advance figure for seasonally adjusted initial claims was 236,000, a decrease of 2,000 from the previous week's unrevised level of 238,000. The 4-week moving average was 243,500, an increase of 500 from the previous week's unrevised average of 243,000.The previous week was unrevised.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 243,500.

This was lower than the consensus forecast.

The low level of claims suggests relatively few layoffs.

Wednesday, May 10, 2017

Thursday: Unemployment Claims, PPI

by Calculated Risk on 5/10/2017 07:44:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Moved Higher This Afternoon

Mortgage rates were steady to slightly higher again today, making it the 13th out of the past 16 business days without an improvement. The situation was more palatable earlier this morning and quite a few lenders were actually in better territory vs yesterday. As the day progressed, bond markets (which dictate mortgage rates) deteriorated, resulting in most lenders issuing negative reprices.Thursday:

...

Most borrowers won't see a meaningful difference between today's quotes and yesterday's. Lenders continue operating near a conventional 30yr fixed rate of 4.125% on top tier scenarios, although it's worth noting that the general trend is toward higher rates at the moment.

emphasis added

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 244 thousand initial claims, up from 238 thousand the previous week.

• Also at 8:30 AM, The Producer Price Index for April from the BLS. The consensus is for 0.2% increase in PPI, and a 0.2% increase in core PPI.

Three Years Ago: Housing Doom and Gloom

by Calculated Risk on 5/10/2017 11:39:00 AM

Three years ago, there were numerous "doom and gloom" stories about housing. I responded with What's Right with Housing? written on May 6, 2014. I wrote:

The first mistake these writers make is they are asking the wrong question. Of course housing is lagging the recovery because of the residual effects of the housing bust and financial crisis (this lag was predicted on this blog and elsewhere for years - it should not be a surprise).What has happened since?

The correct question is: What's right with housing? And there is plenty.

...

Housing is a slow moving market - and the recovery will not be smooth or fast with all the residual problems. But overall housing is clearly improving and the outlook remains positive for the next few years.

Housing starts are up 25% from March 2014 to March 2017.

New home sales are up 50% from March 2014 to March 2017.

Existing home sales are up 21%.

House prices are up 15% (Case-Shiller National Index February 2014 to February 2017).

Some day I'll be bearish again on housing, but not yet. Clearly those bearish on housing in 2014 were wrong.

MBA: Mortgage "Mortgage Applications Increase in Latest Weekly Survey"

by Calculated Risk on 5/10/2017 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 2.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 5, 2017.

... The Refinance Index increased 3 percent from the previous week. The seasonally adjusted Purchase Index increased 2 percent from one week earlier to its highest level since October 2015. The unadjusted Purchase Index increased 2 percent compared with the previous week and was 6 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) remained unchanged at 4.23 percent, with points decreasing to 0.31 from 0.32 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity remains low - and will not increase significantly unless rates fall sharply.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. Even with the increase in mortgage rates late last year, purchase activity is still up year-over-year.

Tuesday, May 09, 2017

Lawler: Selected Operating Statistics, Large Publicly-Traded Home Builders

by Calculated Risk on 5/09/2017 02:44:00 PM

First a note from housing economist Tom Lawler: Next “Official” Census Long-Term Population Projection Not Due Out Until End of This Year

In several earlier reports I highlighted how the last “official” long-term population projections from the Census Bureau (released in December 2014) were way out of date, and that analysts should not use them for any analysis. Someone asked me when the next Census population forecast report would be released, and someone from the Population Projection Staff of the Census Bureau told me that the next official population projections would probably come out at the end of this year.

And from Tom Lawler.

Below is a table showing selected operating statistics for nine large, publicly-traded home builders for the quarter ended March 31, 2017.

Preliminary statistics from the Commerce Department estimated that US new single-family home sales (unadjusted) last quarter were up 12.0% from the comparable quarter of 2016.

| Net Orders | Settlements | Average Closing Price (000s) | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Qtr. Ended: | 3/17 | 3/16 | % Chg | 3/17 | 3/16 | % Chg | 3/17 | 3/16 | % Chg |

| D.R. Horton | 13,991 | 12,292 | 13.8% | 10,685 | 9,262 | 15.4% | 296 | 295 | 0.2% |

| Pulte Group | 6,126 | 5,652 | 8.4% | 4,225 | 3,945 | 7.1% | 375 | 353 | 6.2% |

| NVR | 4,424 | 4,137 | 6.9% | 3,256 | 3,006 | 8.3% | 383 | 369 | 3.7% |

| Cal Atlantic | 4,304 | 4,134 | 4.1% | 3,012 | 2,727 | 10.5% | 444 | 432 | 2.8% |

| Beazer Homes | 1,549 | 1,538 | 0.7% | 1,239 | 1,150 | 7.7% | 341 | 328 | 3.8% |

| Meritage Homes | 2,135 | 1,987 | 7.4% | 1,581 | 1,488 | 6.3% | 418 | 405 | 3.2% |

| MDC Holdings | 1,696 | 1,646 | 3.0% | 1,256 | 907 | 38.5% | 448 | 435 | 3.2% |

| M/I Homes | 1,454 | 1,314 | 10.7% | 1,038 | 876 | 18.5% | 373 | 353 | 5.7% |

| Total | 35,679 | 32,700 | 9.1% | 26,292 | 23,361 | 12.5% | 356 | 346 | 2.7% |

Update: Framing Lumber Prices Up Year-over-year

by Calculated Risk on 5/09/2017 12:40:00 PM

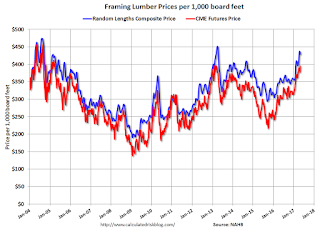

Here is another update on framing lumber prices. Early in 2013 lumber prices came close to the housing bubble highs - and prices are once again near the bubble highs.

The price increases in early 2013 were due to a surge in demand (more housing starts) and supply constraints (framing lumber suppliers were working to bring more capacity online).

Prices didn't increase as much early in 2014 (more supply, smaller "surge" in demand).

In 2015, even with the pickup in U.S. housing starts, prices were down year-over-year. Note: Multifamily starts do not use as much lumber as single family starts, and there was a surge in multi-family starts. This decline in 2015 was also probably related to weakness in China.

Prices in 2017 are up year-over-year.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through early May 2017 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are up 19% from a year ago, and CME futures are up about 27% year-over-year.

BLS: Job Openings "little changed" in March

by Calculated Risk on 5/09/2017 10:06:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings was little changed at 5.7 million on the last business day of March, the U.S. Bureau of Labor Statistics reported today. Over the month, hires and separations were also little changed at 5.3 million and 5.1 million, respectively. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

The number of quits was little changed at 3.1 million in March. The quits rate was 2.1 percent. The number of quits was little changed for total private and for government.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for March, the most recent employment report was for April.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in March to 5.743 million from 5.682 million in February. Job openings are mostly moving sideways at a high level.

The number of job openings (yellow) are down 2% year-over-year.

Quits are up 6% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

This is another solid report.

NFIB: Small Business Optimism Index decreased in April

by Calculated Risk on 5/09/2017 09:20:00 AM

From the National Federation of Independent Business (NFIB): April 2017 Report: Small Business Optimism Index

The NFIB Index of Small Business Optimism posted another historically high reading in April, but expectations for future business conditions plunged by eight points ...

...

The Index dipped 0.2 points April, settling at 104.5. ... Small business owners reported a seasonally adjusted average employment change per firm of 0.19 workers per firm ...

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index decreased to 104.5 in April.

Monday, May 08, 2017

Tuesday: Job Openings, Small Business Optimism

by Calculated Risk on 5/08/2017 06:56:00 PM

Tuesday:

• At 9:00 AM ET, NFIB Small Business Optimism Index for April.

• At 10:00 AM: Job Openings and Labor Turnover Survey for March from the BLS. Jobs openings increased in February to 5.743 million from 5.625 million in January. The number of job openings were up 3% year-over-year, and Quits were up 3% year-over-year.