by Calculated Risk on 6/29/2017 12:17:00 PM

Thursday, June 29, 2017

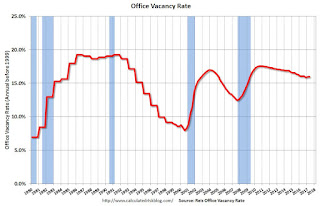

Reis: Office Vacancy Rate "flat" in Q2 at 16.0%

Reis released their Q2 2017 Office Vacancy survey this morning. Reis reported that the office vacancy rate was unchanged at 16.0% in Q2, from 16.0% in Q1. This is down from 16.1% in Q1 2016, and down from the cycle peak of 17.6%.

From Reis Economist Barbara Denham: Office Vacancy Holds Steady at 15.8%; Rents Increase 0.5% in the Quarter. Vacancy Increases in 42 U.S. Metros, but only 10 See Effective Rent Decline.

The Office Vacancy Rate remained flat in the second quarter at 16.0%. Asking rents increased 0.4% in the quarter and only 1.6% since the second quarter of 2016 – the lowest annual rate since 2011.

Continuing its lackluster pace, the Office market recorded the lowest quarterly net absorption in three years as the vacancy rate remained flat at 16.0%. One year ago, the vacancy rate was 16.1%. In the last expansion, the U.S. vacancy rate had fallen from a high of 17.0% in 2003 to a low of 12.5% in 2007. In the current expansion that is now seven quarters longer than the previous expansion, the vacancy rate has fallen from a high of 17.6% to only 16.0% as tenants have leased far fewer square feet per added employee than in past cycles.

New construction of 7.5 million square feet was also low by historic standards, but developers have been cautious throughout these last few years and have expanded the office supply at a less aggressive rate than in previous cycles. Net absorption, or occupancy growth, of 3.3 million square feet was the lowest since the second quarter of 2014. ...

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis reported the vacancy rate was at 16.0% in Q2. The office vacancy rate is moving sideways at an elevated level.

Office vacancy data courtesy of Reis.

Q1 GDP Revised up to 1.4% Annual Rate

by Calculated Risk on 6/29/2017 08:39:00 AM

From the BEA: Gross Domestic Product: First Quarter 2017 (Third Estimate)

Real gross domestic product (GDP) increased at an annual rate of 1.4 percent in the first quarter of 2017, according to the "third" estimate released by the Bureau of Economic Analysis. In the fourth quarter of 2016, real GDP increased 2.1 percent.Here is a Comparison of Third and Second Estimates. PCE growth was revised up from 0.6% to 1.1%. (still soft PCE, but better than the 0.3% reported in the Advance estimate of GDP). Residential investment was revised down slightly from 13.8% to +13.0%. This was above the consensus forecast.

The GDP estimate released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was 1.2 percent. With the third estimate for the first quarter, personal consumption expenditures (PCE) and exports increased more than previously estimated, but the general picture of economic growth remains the same ...

emphasis added

Weekly Initial Unemployment Claims increase to 244,000

by Calculated Risk on 6/29/2017 08:34:00 AM

The DOL reported:

In the week ending June 24, the advance figure for seasonally adjusted initial claims was 244,000, an increase of 2,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 241,000 to 242,000. The 4-week moving average was 242,250, a decrease of 2,750 from the previous week's revised average. The previous week's average was revised up by 250 from 244,750 to 245,000.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 242,250.

This was higher than the consensus forecast.

The low level of claims suggests relatively few layoffs.

Wednesday, June 28, 2017

Thursday: Unemployment Claims, GDP

by Calculated Risk on 6/28/2017 08:49:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Highest in More Than 2 Weeks

Mortgage rates moved moderately higher again today, as investors continued digesting the possibility of a "taper tantrum" in Europe.Thursday:

...

The average lender is once again quoting 4.0% on top tier conventional 30yr fixed scenarios. Before today (and especially before yesterday), 3.875% was fairly prevalent.

emphasis added

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 239 thousand initial claims, down from 241 thousand the previous week.

• Also at 8:30 AM, Gross Domestic Product, 1st quarter 2017 (Third estimate). The consensus is that real GDP increased 1.2% annualized in Q1, unchanged from the second estimate of 1.2%.

• Early, Reis Q2 2017 Office Survey of rents and vacancy rates.

Zillow Forecast: "May Case-Shiller Forecast: Expect the Cooldown to Continue"

by Calculated Risk on 6/28/2017 03:21:00 PM

The Case-Shiller house price indexes for April were released yesterday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Svenja Gudell at Zillow: May Case-Shiller Forecast: Expect the Cooldown to Continue

On the heels of a larger-than-expected slowdown in April, Zillow anticipates Case-Shiller data to show a continued cooling in home price growth in May almost across the board, with prices even falling slightly from April in one key index.The year-over-year change for the Case-Shiller National index will probably be smaller in May than in April.

Annual growth in all three main indices – the 10-city Composite, 20-city Composite and U.S. National Index – is expected to slow to 4.8 percent, 5.5 percent and 5.3 percent year-over-year growth in May, respectively, down from 4.9 percent, 5.7 percent and 5.5 percent in April. The U.S. National Index is expected to grow by a seasonally adjusted 0.2 percent in May from April, while prices will be unchanged from April on the 20-city Composite Index. Home prices are expected to fall by 0.1 percent from April to May on the smaller 10-city Composite Index (seasonally adjusted).

April’s slower-than-expected growth caught some analysts off-guard, especially the monthly figures. One potential reason cited for the surprise to the downside could be related to the difficulty in seasonally adjusting a repeat-sales index like Case-Shiller’s. Over the long term, Zillow’s monthly forecast of Case-Shiller data has proven remarkably accurate, thanks in large part to differences in methodology between Case-Shiller’s indices and Zillow’s, and the timeliness and granularity of data collected.

Zillow’s full forecast for May Case-Shiller data is shown below. These forecasts are based on today’s April Case-Shiller data release and the May 2017 Zillow Home Value Index. The May S&P CoreLogic Case-Shiller Indices will not be officially released until Tuesday, July 25.

Reis: Mall Vacancy Rate increased in Q2 2017

by Calculated Risk on 6/28/2017 12:11:00 PM

Reis reported that the vacancy rate for regional malls was 8.1% in Q2 2017, up from 7.9% in Q1, and up from 7.9% in Q2 2016. This is down from a cycle peak of 9.4% in Q3 2011.

For Neighborhood and Community malls (strip malls), the vacancy rate was 10.0% in Q2, up from 9.9% in Q1, and up from 9.8% in Q2 2016. For strip malls, the vacancy rate peaked at 11.1% in Q3 2011.

Comments from Reis Economist Barbara Byrne Denham:

The Retail Vacancy Rate increased 0.1% in the second quarter to 10.0%. Asking rents increased 0.4% in the quarter that saw new stores opening on par with the number that closed. The Mall Vacancy Rate increased 0.2% to 8.1%. Mall Rents also increased 0.4%.

Defying the doom and gloom aired in media reports, the retail real estate market posted positive net absorption in the second quarter. The vacancy rate increased a bit due to new construction that was only partially absorbed by new leasing. Still, the vacancy rate increase from 9.9% to 10.0% was smaller than most expected.

The increase in the Mall vacancy rate was due to confirmed closings of Macy’s stores.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis.

In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

Recently both the strip mall and regional mall vacancy rates have increased slightly from an already elevated level.

Mall vacancy data courtesy of Reis.

NAR: Pending Home Sales Index decreased 0.8% in May, down 1.7% year-over-year

by Calculated Risk on 6/28/2017 10:04:00 AM

From the NAR: Pending Home Sales Tumble in May for Third Straight Month

The Pending Home Sales Index, a forward-looking indicator based on contract signings, decreased 0.8 percent to 108.5 in May from a downwardly revised 109.4 in April. The index is now 1.7 percent below a year ago, which marks the second straight annual decline and the most recent since November and December of last year.This was below expectations of a 0.5% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in June and July.

...

The PHSI in the Northeast decreased 0.8 percent to 96.4 in May, but remains 3.1 percent above a year ago. In the Midwest the index was 104.5 in May (unchanged from April), and is 2.8 percent lower than May 2016.

Pending home sales in the South declined 1.2 percent to an index of 123.4 in May and are now 1.4 percent below last May. The index in the West subsided 1.3 percent in May to 98.6, and is now 4.5 percent below a year ago.

emphasis added

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 6/28/2017 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 6.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending June 23, 2017.

... The Refinance Index decreased 9 percent from the previous week. The seasonally adjusted Purchase Index decreased 4 percent from one week earlier. The unadjusted Purchase Index decreased 5 percent compared with the previous week and was 8 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) remained unchanged at 4.13 percent, with points decreasing to 0.32 from 0.34 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity is mostly moving sideways at a low level this year, and will not increase significantly unless rates fall well below 4%.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, purchase activity is up 8% year-over-year.

Tuesday, June 27, 2017

Wednesday: Pending Home Sales

by Calculated Risk on 6/27/2017 08:27:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• Early: Reis Q2 2017 Mall Survey of rents and vacancy rates.

• At 10:00 AM, Pending Home Sales Index for May. The consensus is for a 0.5% increase in the index.

Richmond Fed: "Manufacturers in the Fifth District Improved in June"

by Calculated Risk on 6/27/2017 05:04:00 PM

From the Richmond Fed: Reports from Manufacturers in the Fifth District Improved in June

Reports from Fifth District manufacturers improved in June, according to the latest survey by the Federal Reserve Bank of Richmond. The composite manufacturing index rose from 1 in May to 7 in June, as the indexes for shipments and new orders increased. The employment index was relatively flat. Most firms continued to report steady or higher wages; although the index for wages did fall in June, it remained above 0. Meanwhile, more firms reported a decline in the average workweek than reported an increase.This was the last of the regional Fed surveys for June.

Looking six months ahead, manufacturing executives were more optimistic in June than in May, although even the May readings were very positive.

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through June), and five Fed surveys are averaged (blue, through June) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through April (right axis).

Based on these regional surveys, it seems likely the ISM manufacturing index will increase slightly in June compared to May (to be released this coming Monday, July 3rd). The early consensus is for the ISM index to be unchanged in June.