by Calculated Risk on 7/03/2017 10:03:00 AM

Monday, July 03, 2017

ISM Manufacturing index increased to 57.8 in June

The ISM manufacturing index indicated expansion in June. The PMI was at 57.8% in June, up from 54.9% in May. The employment index was at 57.2%, up from 53.5% last month, and the new orders index was at 63.5%, up from 59.5%.

From the Institute for Supply Management: June 2017 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in June, and the overall economy grew for the 97th consecutive month, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: "The June PMI® registered 57.8 percent, an increase of 2.9 percentage points from the May reading of 54.9 percent. The New Orders Index registered 63.5 percent, an increase of 4 percentage points from the May reading of 59.5 percent. The Production Index registered 62.4 percent, a 5.3 percentage point increase compared to the May reading of 57.1 percent. The Employment Index registered 57.2 percent, an increase of 3.7 percentage points from the May reading of 53.5 percent. The Supplier Deliveries index registered 57 percent, a 3.9 percentage point increase from the May reading of 53.1 percent. The Inventories Index registered 49 percent, a decrease of 2.5 percentage points from the May reading of 51.5 percent. The Prices Index registered 55 percent in June, a decrease of 5.5 percentage points from the May reading of 60.5 percent, indicating higher raw materials’ prices for the 16th consecutive month, but at a slower rate of increase in June compared with May. Comments from the panel generally reflect expanding business conditions; with new orders, production, employment, backlog and exports all growing in June compared to May and with supplier deliveries and inventories struggling to keep up with the production pace."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was above expectations of 55.1%, and suggests manufacturing expanded at a faster pace in June than in May.

A strong report.

Sunday, July 02, 2017

Monday: Auto Sales, ISM Mfg, Construction Spending

by Calculated Risk on 7/02/2017 08:11:00 PM

Weekend:

• Schedule for Week of July 2, 2017

Monday:

• At 10:00 AM ET, ISM Manufacturing Index for June. The consensus is for the ISM to be at 55.1, up from 54.9 in May.

• Also at 10:00 AM, Construction Spending for May. The consensus is for a 0.5% increase in construction spending.

• All day: Light vehicle sales for June. The consensus is for light vehicle sales to be 16.6 million SAAR in June, mostly unchanged from 16.6 million in May (Seasonally Adjusted Annual Rate).

From CNBC: Pre-Market Data and Bloomberg futures: S&P futures are up 4 and DOW futures are up 45 (fair value).

Oil prices were up over the last week with WTI futures at $46.30 per barrel and Brent at $48.77 per barrel. A year ago, WTI was at $49, and Brent was at $48 - so oil prices are down slightly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.22 per gallon - a year ago prices were at $2.28 per gallon - so gasoline prices are down 6 cents year-over-year.

June 2016: Unofficial Problem Bank list declines to 137 Institutions, Q2 2017 Transition Matrix

by Calculated Risk on 7/02/2017 11:18:00 AM

Note: Surferdude808 compiles an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for June 2017.

Here are the monthly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List for June 2017. During the month, the list declined slightly from 140 institutions to 137 after four removals and one addition. Assets increased by $946 million to an aggregate $35.2 billion. A year ago, the list held 203 institutions with assets of $60.6 billion.

This month, actions have been terminated against Bank of the Orient, San Francisco, CA ($611 million); Cornerstone Bank, Moorestown, NJ ($245 million Ticker: CFIC); and Central Bank, Savannah, TN ($98 million). Fayette County Bank, Saint Elmo, IL ($34 million) left the list through failure. The addition this month was the $1.9 billion MidSouth Bank, National Association, Lafayette, LA (Ticker: MSL).

With it being the end of the second quarter, we bring an updated transition matrix to detail how banks are moving off the Unofficial Problem Bank List. Since the Unofficial Problem Bank List was first published on August 7, 2009 with 389 institutions, a total of 1,720 institutions have appeared on a weekly or monthly list at some point. Only 8.0 percent of the banks that have appeared on the list remain today. In all, there have been 1,583 institutions that have transitioned through the list. Departure methods include 910 action terminations, 405 failures, 251 mergers, and 17 voluntary liquidations. Of the 389 institutions on the first published list, only 13 or 3.3 percent still remain nearly eight years later. The 405 failures represent 23.5 percent of the 1,720 institutions that have made an appearance on the list. This failure rate is well above the 10-12 percent rate frequently cited in media reports on the failure rate of banks on the FDIC's official list.

| Unofficial Problem Bank List | |||

|---|---|---|---|

| Change Summary | |||

| Number of Institutions | Assets ($Thousands) | ||

| Start (8/7/2009) | 389 | 276,313,429 | |

| Subtractions | |||

| Action Terminated | 174 | (64,391,534) | |

| Unassisted Merger | 40 | (9,818,439) | |

| Voluntary Liquidation | 4 | (10,584,114) | |

| Failures | 158 | (186,397,337) | |

| Asset Change | (443,904) | ||

| Still on List at 6/30/2017 | 13 | 4,678,101 | |

| Additions after 8/7/2009 | 124 | 30,505,792 | |

| End (6/30//2017) | 137 | 35,183,893 | |

| Intraperiod Removals1 | |||

| Action Terminated | 736 | 305,160,192 | |

| Unassisted Merger | 211 | 81,081,586 | |

| Voluntary Liquidation | 13 | 2,515,855 | |

| Failures | 247 | 125,118,011 | |

| Total | 1,207 | 513,875,644 | |

| 1Institution not on 8/7/2009 or 6/30/2017 list but appeared on a weekly list. | |||

Saturday, July 01, 2017

Schedule for Week of July 2, 2017

by Calculated Risk on 7/01/2017 08:12:00 AM

The key report this week is the June employment report on Friday.

Other key indicators include the June ISM manufacturing and non-manufacturing indexes, June auto sales, and the May Trade Deficit.

10:00 AM: ISM Manufacturing Index for June. The consensus is for the ISM to be at 55.1, up from 54.9 in May.

10:00 AM: ISM Manufacturing Index for June. The consensus is for the ISM to be at 55.1, up from 54.9 in May.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion at 54.9% in May. The employment index was at 53.5%, and the new orders index was at 59.5%.

10:00 AM: Construction Spending for May. The consensus is for a 0.5% increase in construction spending.

All day: Light vehicle sales for June. The consensus is for light vehicle sales to be 16.6 million SAAR in June, mostly unchanged from 16.6 million in May (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for June. The consensus is for light vehicle sales to be 16.6 million SAAR in June, mostly unchanged from 16.6 million in May (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the May sales rate.

All US markets will be closed in observance of Independence Day.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

2:00 PM: FOMC Minutes for the Meeting of June 13 - 14, 2017

8:15 AM: The ADP Employment Report for June. This report is for private payrolls only (no government). The consensus is for 178,000 payroll jobs added in June, down from 253,000 added in May.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 244 thousand initial claims, unchanged from 244 thousand the previous week.

8:30 AM: Trade Balance report for May from the Census Bureau.

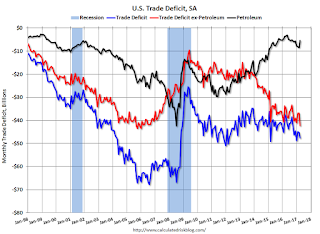

8:30 AM: Trade Balance report for May from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through March. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $46.2 billion in May from $47.6 billion in April.

10:00 AM: the ISM non-Manufacturing Index for June. The consensus is for index to decrease to 56.5 from 56.9 in May.

8:30 AM: Employment Report for June. The consensus is for an increase of 170,000 non-farm payroll jobs added in June, up from the 138,000 non-farm payroll jobs added in May.

The consensus is for the unemployment rate to be unchanged at 4.3%.

The consensus is for the unemployment rate to be unchanged at 4.3%.This graph shows the year-over-year change in total non-farm employment since 1968.

In May, the year-over-year change was 2.23 million jobs.

A key will be the change in wages.

Friday, June 30, 2017

Vehicle Sales Forecast: "Sixth Consecutive Decline in June"

by Calculated Risk on 6/30/2017 04:59:00 PM

The automakers will report June vehicle sales on Monday, July 3rd.

Note: There were 26 selling days in June 2017, the same as in June 2016.

From WardsAuto: U.S. Forecast: Sixth Consecutive Decline in June

A WardsAuto forecast calls for U.S. automakers to deliver 1.50 million light vehicles in June. A daily sales rate of 57,762 units over 26 days represents a 0.7% decline from like-2016 (also 26 days).From Reuters: U.S. auto sales seen down 2 percent in June: JD Power and LMC

...

The report puts the seasonally adjusted annual rate of sales for the month at 16.82 million units, above year-ago’s 16.77 million and May’s 16.58 million mark. ...

WardsAuto is forecasting U.S. sales of 17.1 million units in calendar-year 2017. The outlook assumes a sales surge in the summer caused by deep price discounting or other means to trim the excess stock. If inventory is not cut by 400,000 to 500,000 units by September, another sell-off is possible in Q4, probably December. Without such a surge, sales are heading to 16.8 million units for the year.

emphasis added

The seasonally adjusted annualized rate for the month will be 16.5 million vehicles, down nearly 2 percent from 16.8 million units in the same month in 2016.Overall sales are down from the record in 2016.

U.S. Births decreased in 2016, Women 30-34 Now have Highest Birth Rate

by Calculated Risk on 6/30/2017 12:57:00 PM

From the National Center for Health Statistics: Births: Provisional Data for 2016. The NCHS reports:

The provisional number of births for the United States in 2016 was 3,941,109, down 1% from 2015. The general fertility rate was 62.0 births per 1,000 women aged 15–44, down 1% from 2015 to a record low for the United States. ...Here is a long term graph of annual U.S. births through 2016 ...

The provisional birth rates for teenagers aged 15–17 and 18–19 were 8.8 and 37.5 births per 1,000 women, respectively, down by 11% and 8% from 2015 and record lows for both groups.

...

The provisional birth rate for women aged 20–24 was 73.7 births per 1,000 women in 2016, a decline of 4% from 2015 (76.8), reaching again another record low for this age group.

...

The rate for women aged 25–29 was 101.9 births per 1,000 women, down 2% from 2015 (104.3) and another record low for this age group.

...

The provisional birth rate for women aged 30–34 in 2016 was 102.6 births per 1,000 women, up 1% from 2015 (101.5) to the highest rate for this age group since 1964.

...

The provisional birth rate for women aged 40–44 in 2016 was 11.4 births per 1,000 women, up 4% from 2015 (11.0) to the highest rate for this age group since 1966.

Click on graph for larger image.

Click on graph for larger image.Births have declined for two consecutive years following increases in 2013 and 2014.

A key trend is that women are waiting longer to have babies. Waiting longer to have children makes sense (see: Demographics and Behavior and U.S. Demographics: The Millennials Take Over) and we should expect a baby boom in a few years as the largest cohorts move into the 25 to 34 years old age groups.

I expect that as families have babies, they will tend to buy homes (as opposed to rent). The demographics are favorable for renting now, but the demographics will become more positive for homeownership.

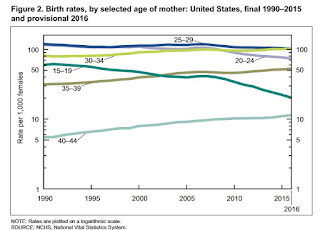

The second graph is from the NCHS report and shows birth rates by age group.

The second graph is from the NCHS report and shows birth rates by age group. From the NCHS:

The rate for women aged 25–29 was 101.9 births per 1,000 women, down 2% from 2015 (104.3) and another record low for this age group.Note that the highest birth rate is now for women in the 30 to 34 age group!

...

The provisional birth rate for women aged 30–34 in 2016 was 102.6 births per 1,000 women, up 1% from 2015 (101.5) to the highest rate for this age group since 1964.

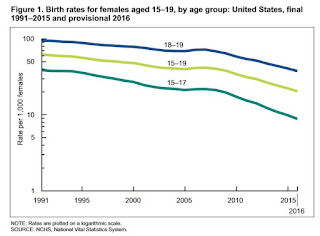

The third graph is from the NCHS report and shows births per 1,000 women by teen age group. From the NCHS:

The third graph is from the NCHS report and shows births per 1,000 women by teen age group. From the NCHS: The provisional birth rates for teenagers aged 15–17 and 18–19 were 8.8 and 37.5 births per 1,000 women, respectively, down by 11% and 8% from 2015 and record lows for both groups.Far fewer teens births is great news (and is probably related to the much higher enrollment rates).

Chicago PMI Increases in June, Highest in Three Years

by Calculated Risk on 6/30/2017 10:05:00 AM

From the Chicago PMI: June Chicago Business Barometer at 65.7 vs 59.4 in May

The MNI Chicago Business Barometer rose to 65.7 in June from 59.4 in May, the highest level in over three years.This was well above the consensus forecast.

...

“June’s MNI Chicago Business Barometer Survey is a testament to firms’ expectations of a busy summer. With Production and New Orders touching levels not seen in three years, rising pressure on backlogs and delivery times has led to higher optimism among firms both in general business conditions and the local economy,” said Shaily Mittal, Senior Economist at MNI Indicators.

emphasis added

Personal Income increased 0.4% in May, Spending increased 0.1%

by Calculated Risk on 6/30/2017 08:40:00 AM

The BEA released the Personal Income and Outlays report for May:

Personal income increased $67.1 billion (0.4 percent) in May according to estimates released today by the Bureau of Economic Analysis. ... personal consumption expenditures (PCE) increased $7.3 billion (0.1 percent).The May PCE price index increased 1.4 percent year-over-year and the May PCE price index, excluding food and energy, increased 1.4 percent year-over-year.

...

Real PCE increased 0.1 percent. The PCE price index decreased 0.1 percent. Excluding food and energy, the PCE price index increased 0.1 percent.

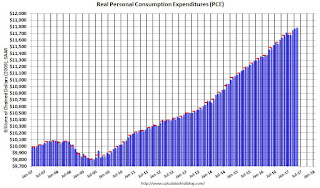

The following graph shows real Personal Consumption Expenditures (PCE) through May 2017 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was above expectations, and the increase in PCE was at expectations.

Using the two-month method to estimate Q2 PCE growth, PCE was increasing at a 3.5% annual rate in Q2 2017. (using the mid-month method, PCE was increasing 3.7%). This suggests decent PCE growth in Q2.

Thursday, June 29, 2017

Friday: Personal Income and Outlays, Chicago PMI

by Calculated Risk on 6/29/2017 08:51:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Highest in More Than a Month

Mortgage rates are higher again today, with the average lender now back to levels not seen since May 16th, 2017. Unless you've been following every little day-to-day change in rates, the apparent drama over the past few days is laughable. In the worst cases, some borrowers are now seeing rate quotes that are an eighth of percentage point higher than those seen on Monday morning. [30 year fixed 4% for top scenarios]Friday:

emphasis added

• At 8:30 AM ET, Personal Income and Outlays for May. The consensus is for a 0.3% increase in personal income, and for a 0.1% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• At 9:15 AM, Chicago Purchasing Managers Index for June. The consensus is for a reading of 58.2, down from 59.4 in May.

• At 10:00 AM, University of Michigan's Consumer sentiment index (final for June). The consensus is for a reading of 94.5, from the preliminary reading 94.5.

Fannie Mae: Mortgage Serious Delinquency rate declined in May, Lowest since December 2007

by Calculated Risk on 6/29/2017 04:17:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate declined to 1.04% in May, from 1.07% in April. The serious delinquency rate is down from 1.38% in May 2016.

This is the lowest serious delinquency rate since December 2007.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Although the rate is declining, the "normal" serious delinquency rate is under 1%.

The Fannie Mae serious delinquency rate has fallen 0.34 percentage points over the last year, and at that rate of improvement, the serious delinquency rate will below 1% this Summer.

Note: Freddie Mac reported earlier.