by Calculated Risk on 7/11/2017 01:14:00 PM

Tuesday, July 11, 2017

NFIB: Small Business Optimism Index declined in June

Earlier from the National Federation of Independent Business (NFIB): June 2017 Report: Small Business Optimism Index

The Index of Small Business Optimism fell 0.9 points to 103.6, but sustained the surge in optimism that started the day after the election. The Index peaked at 105.9 in January and has dropped 2.3 points to date, no doubt in part due to the mess in Washington, D.C. ... There isn’t much euphoria in the outlook for the second half of the year.

...

Small business owners reported an adjusted average employment change per firm of negative 0.04 workers per firm over the past few months, basically zero. This followed one of the best readings since 2008 posted in May. Ten percent (down 5 points) reported increasing employment an average of 3.4 workers per firm and 11 percent (up 2 points) reported reducing employment an average of 2.1 workers per firm (seasonally adjusted). Fifty-four percent reported hiring or trying to hire (down 5 points), but 46 percent reported few or no qualified applicants for the positions they were trying to fill. ...

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index declined to 103.6 in June.

BLS: Job Openings Decreased in May

by Calculated Risk on 7/11/2017 10:08:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings decreased to 5.7 million on the last business day of May, the U.S. Bureau of Labor Statistics reported today. Over the month, hires increased to 5.5 million and separations increased to 5.3 million. Within separations, the quits rate was little changed at 2.2 percent and the layoffs and discharges rate was unchanged at 1.1 percent. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

The number of quits increased to 3.2 million (+177,000) in May. The quits rate was 2.2 percent. The number of quits rose for total private (+159,000) and for government (+19,000).

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for May, the most recent employment report was for June.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings decreased in May to 5.666 million from 5.967 in April.

The number of job openings (yellow) are up 2% year-over-year.

Quits are up 7% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Job openings are mostly moving sideways at a high level, and quits are increasing. This is another solid report.

Monday, July 10, 2017

Tuesday: Job Openings

by Calculated Risk on 7/10/2017 09:19:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Little-Changed Near Recent Highs

Mortgage rates improved somewhat today, on average, but the gains were modest. Some lenders were unchanged from Friday afternoon's latest levels. That leaves us essentially in line with the highest rates since early April, after having been at 8-month lows just 2 weeks ago. From 8-month lows to 3-month highs is an abrupt move taken at face value, but it's made possible due to a narrow range persisting during that time (relative to other stretches of 8 months of time). [30YR FIXED - 4.125%]Tuesday:

• At 6:00 AM ET: NFIB Small Business Optimism Index for June.

• At 10:00 AM, Job Openings and Labor Turnover Survey for May from the BLS. Jobs openings increased in April to 6.044 million from 5.785 million in March.

House Prices to National Average Wage Index

by Calculated Risk on 7/10/2017 04:04:00 PM

One of the metrics we'd like to follow is a ratio of house prices to incomes. Unfortunately most income data is released with a significantly lag, and there are always questions about which income data to use (the average total income is skewed by the income of a few people).

And for key measures of house prices - like Case-Shiller - we have indexes, not actually prices.

But we can construct a ratio of the house price indexes to some measure of income.

For this graph I decided to look at house prices and the National Average Wage Index from Social Security.

This graph shows the ratio of house price indexes divided by the National Average Wage Index (the Wage index is first divided by 1000).

This uses the annual average National Case-Shiller index since 1976.

As of 2016, house prices were somewhat above the median historical ratio - but far below the bubble peak.

Prices have increased further in 2017, but house prices relative to incomes are still below the 1989 peak (and way below 2006).

Going forward, I think it would be a positive if wages outpaced, or at least kept pace with house prices increases for a few years.

Notes: The national wage index for 2016 is estimated using the same increase as in 2015.

Q2 Review: Ten Economic Questions for 2017

by Calculated Risk on 7/10/2017 11:59:00 AM

At the end of last year, I posted Ten Economic Questions for 2017. I followed up with a brief post on each question. The goal was to provide an overview of what I expected in 2017 (I don't have a crystal ball, but I think it helps to outline what I think will happen - and understand - and change my mind, when the outlook is wrong).

By request, here is a quick Q2 review. I've linked to my posts from the beginning of the year, with a brief excerpt and a few comments:

10) Question #10 for 2017: Will housing inventory increase or decrease in 2017?

I was wrong on inventory last year, but right now my guess is active inventory will increase in 2017 (inventory will decline seasonally in December and January, but I expect to see inventory up again year-over-year in December 2017). My reasons for expecting more inventory are 1) inventory is historically low (lowest for November since 2000), 2) and the recent increase in interest rates.According to the May NAR report on existing home sales, inventory was down 8.4% year-over-year in May, and the months-of-supply was at 4.2 months. This was a smaller year-over-year decline than in April, but it appears inventory unlikely inventory will be up by year end. This is a key metric to watch!

9) Question #9 for 2017: What will happen with house prices in 2017?

Inventories will probably remain low in 2017, although I expect inventories to increase on a year-over-year basis by December of 2017. Low inventories, and a decent economy suggests further price increases in 2017.If is early, but the Case-Shiller data released last month showed prices up 5.5% year-over-year in April. The Case-Shiller year-over-year increase is about the same as the annual increase in 2016.

Perhaps higher mortgage rates will slow price appreciation. If we look back at the "taper tantrum" in 2013, price appreciation slowed somewhat over the next year - but that was from a high level. In June 2013, the Case-Shiller National index was up 9.3% year-over-year. By June 2014, the index was up 6.3% year-over-year.

If inventory increases year-over-year as I expect by December 2017, it seems likely that price appreciation will slow to the low-to-mid single digits.

8) Question #8 for 2017: How much will Residential Investment increase?

Most analysts are looking for starts to increase to around 1.25 million in 2017, and for new home sales of around 600 to 650 thousand. This would be an increase of around 7% for starts and maybe 10% for new home sales.Through May, starts were up 3.2% year-over-year compared to the same period in 2016. New home sales were up 12.2% year-over-year.

I think there will be further growth in 2017, but I think a combination of higher mortgage rates, less multi-family starts, and not enough lots for low-to-mid range new homes will mean sluggish growth in 2017.

My guess is starts will increase to just over 1.2 million in 2017 and new home sales will be in the low 600 thousand range.

7) Question #7 for 2017: How much will wages increase in 2017?

As the labor market continues to tighten, we should see more wage pressure as companies have to compete for employees. I expect to see some further increases in both the Average hourly earning from the CES, and in the Altanta Fed Wage Tracker. Perhaps nominal wages will increase more than 3% in 2017 according to the CES.Through June 2017, nominal hourly wages were up 2.5% year-over-year. This is a pickup from last year, and so far it appears wages will increase at a faster rate in 2017.

6) Question #6 for 2017: Will the Fed raise rates in 2017, and if so, by how much?

Analysts are being cautious on forecasting rate hikes, probably because they forecasted too many hikes over the last few years. However, as the economy approaches full employment, and with the possibility of fiscal stimulus in 2017, it is possible that inflation will pick up a little - and, if so, the Fed could hike more than expected.The Fed has already hiked twice in 2017, and they are still forecasting three hikes this year (and to slow reinvesting by the end of the year). The third hike is currently expected in December.

My current guess is the Fed will hike twice in 2017.

5) Question #5 for 2017: Will the core inflation rate rise in 2017? Will too much inflation be a concern in 2017?

The Fed is projecting core PCE inflation will increase to 1.8% to 1.9% by Q4 2017. However there are risks for higher inflation. The labor market is approaching full employment, and the new administration is proposing some fiscal stimulus (tax cuts, possible infrastructure spending), so it is possible - as a result - that inflation will increase more than expected in 2017 and 2018.Inflation has eased recently, and is below the Fed's target by most measures.

Currently I think PCE core inflation (year-over-year) will increase further and be close to 2% in 2017, but too much inflation will still not be a serious concern in 2017.

4) Question #4 for 2017: What will the unemployment rate be in December 2017?

Depending on the estimate for the participation rate and job growth (next question), it appears the unemployment rate will declining slightly by December 2017 from the current 4.7%.The unemployment rate was at 4.4% in June - about the level I expected for the end of 2017.

3) Question #3 for 2017: Will job creation slow further in 2017?

So my forecast is for gains of 125,000 to 150,000 payroll jobs per month in 2017. Lower than in 2016, but another solid year for employment gains given current demographics.Through June 2017, the economy has added 1,079,000 thousand jobs, or 180,000 per month, down from 187,000 per month in 2016. I still expect employment gains to slow further this year.

2) Question #2 for 2017: How much will the economy grow in 2017?

There will probably be some economic boost from oil sector investment in 2017 since oil prices have increased (this was a drag last year).Once again, GDP was sluggish in Q1 - and it is way too early to tell if there will be any pickup in GDP growth this year.

The housing recovery is ongoing, however auto sales might have peaked.

And demographics are improving (the prime working age population is growing about 0.5% per year, compared to declining a few years ago).

All these factors combined will probably push GDP growth into the mid-to-high 2% range in 2017, but this will depend somewhat on which policies are enacted.

1) Question #1 for 2017: What about fiscal and regulatory policy in 2017?

We are still waiting for the details. As far as the impact on 2017, my expectation is there will be both individual and corporate tax cuts - and some sort of infrastructure program. I expect that something will happen with the ACA (those that have insurance for 2017 will keep their insurance, but they might not have insurance in 2018 - and that impact would be in 2018). I think the negative proposals (immigration, trade) will impact the economy in 2018 or later - overall there will be a small boost to GDP in 2017.So far nothing has happened with the ACA, taxes, infrastructure, or trade. Policy remains a wild card.

A final comment: The words of a President matter. Mr Trump has been impulsive, reckless and irresponsible with his comments, and that has continued since the election. One absurd comment could send the markets into a tailspin and negatively impact the economy (and that could happen at any time).

It is early in the year. Currently it looks like 2017 is unfolding somewhat as expected.

Black Knight Mortgage Monitor: "Underwater Borrower Population Below Two Million for First Time Since 2006"

by Calculated Risk on 7/10/2017 09:36:00 AM

Black Knight Financial Services (BKFS) released their Mortgage Monitor report for May today. According to BKFS, 3.79% of mortgages were delinquent in May, down from 4.25% in May 2016. BKFS also reported that 0.83% of mortgages were in the foreclosure process, down from 1.13% a year ago.

This gives a total of 4.62% delinquent or in foreclosure.

Press Release: Black Knight’s May Mortgage Monitor: Underwater Borrower Population Below Two Million for First Time Since 2006

Today, the Data and Analytics division of Black Knight Financial Services, Inc. released its latest Mortgage Monitor Report, based on data as of the end of May 2017. This month, Black Knight finds that rising home prices have both decreased the number of borrowers underwater on their mortgages while increasing the amount of tappable – or lendable – equity available to homeowners. As Black Knight Data & Analytics Executive Vice President Ben Graboske explained, continued growth in the equity landscape has also improved the net worth of many – but not all – homeowners with mortgages.

“The steady upward trajectory of home prices continues to improve the equity positions of many homeowners,” said Graboske. “This is plainly visible in the number of borrowers who are underwater on their mortgages, owing more than their homes are worth. Over the past year, we’ve seen a 35 percent decline in the total underwater population, with a 16 percent decline in that population over the first three months of 2017 alone. Home prices rose 2.3 percent in the first quarter, as compared to 1.8 percent over the same period last year, helping an additional 350,000 borrowers regain equity in their homes. As of today, there are 1.8 million underwater borrowers remaining, the first time this population has fallen below two million since 2006.

“What stands out is the disparity we see in this improvement. As has been the case for some time now, negative equity has become more and more a localized phenomenon. But it’s also becoming concentrated among a particular class of homeowner. Nearly half of all borrowers who remain underwater own homes in the lowest 20 percent of prices in their respective markets. While the nation as a whole now has a negative equity rate of just 3.6 percent, among owners in that lowest price tier, it’s over eight percent. In fact, these lowest-price-tier properties are more than twice as likely to be underwater as those in the next price tier up, and 6.5 times more likely to be underwater than those living in the top 20 percent of the market. This is the highest differential we’ve seen between high and low price tiers since we began keeping track in 2005. In some areas, the disparity between the lowest price tier and the highest is staggering. In Detroit, for example, borrowers whose homes are in the lowest 20 percent of prices are 50 times more likely to be underwater than those in the top 20 percent.”

Rising home prices are also increasing the amount of equity available for homeowners to borrow against. Looking solely at borrowers with at least 20 percent equity in their homes, Black Knight found that total tappable (or lendable) equity increased by $695 billion dollars over the last year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from Black Knight shows the number of mortgage holders with negative equity over time.

From Black Knight:

• The steady upward trajectory of home prices – as well as ongoing foreclosure activity – has helped to consistently reduce the nation’s total number of underwater borrowersThere is much more in the mortgage monitor.

• Over the past year, we’ve seen a 35 percent decline in the underwater population, with a 16 percent decline over the first three months of 2017 alone

• Home prices rose 2.3 percent in the first quarter, as compared to 1.8 percent over the same period last year, helping an additional 350K borrowers regain equity in their homes

• As of today, there are 1.8 million underwater borrowers remaining, the first time this population has fallen below 2M since 2006

• Negative equity is still well above 2005 levels, at the end of which only 750K borrowers owed more than their homes were worth

Sunday, July 09, 2017

Sunday Night Futures

by Calculated Risk on 7/09/2017 07:19:00 PM

Weekend:

• Schedule for Week of July 9, 2017

Monday:

• At 10:00 AM ET, The Fed will release the monthly Labor Market Conditions Index (LMCI).

• At 3:00 PM, Consumer credit from the Federal Reserve. The consensus is for a $14.6 billion increase in credit.

From CNBC: Pre-Market Data and Bloomberg futures: S&P futures and DOW futures are mostly unchanged (fair value).

Oil prices were down over the last week with WTI futures at $44.44 per barrel and Brent at $46.71 per barrel. A year ago, WTI was at $45, and Brent was at $45 - so oil prices are mostly unchanged year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.26 per gallon - a year ago prices were at $2.24 per gallon - so gasoline prices are mostly unchanged year-over-year.

AAR: Rail Traffic increased in June

by Calculated Risk on 7/09/2017 09:11:00 AM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

U.S. rail traffic in June 2017 was a mix of the good and the not so good. The good included intermodal, which was up 4.6% in June and 2.7% (179,515 containers and trailers) for the year to date. Year to-date intermodal volume through June was the highest ever. On the carload side, coal was up 13.2% in June and up 18.0% (326,783 carloads) for the first half. The first half of 2016 was a ridiculously bad period for coal, so the comparisons this year were pretty easy. As we go forward in 2017, the comps for coal will get much tougher. Carloads of crushed stone, gravel and sand were 18.5% higher in June and 12.8% higher in the first half. Thanks to surging sand shipments, this category set a year-to-date record this year. Year-to-date carloads of chemicals thorugh June were the highest ever too. The not so good included petroleum and petroleum products (down 15.2% in June, their 25th straight year-over-year decline) and motor vehicles and parts (down 7.9% in June for combined U.S. and Canadian carloads, their sixth straight monthly decline to match the six straight months in which new light vehicle sales have fallen). Total carloads in June 2017 were up 4.4% over last year; total carloads in the first half of 2017 were up 6.4% (404,078 carloads) over last year.

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows U.S. average weekly rail carloads (NSA). Dark blue is 2017.

Rail carloads have been weak over the last decade due to the decline in coal shipments.

t’s all relative, but from a short term perspective, for now U.S. rail carloads are doing pretty well. In June 2017 totaled 1,065,976, up 4.4%, or 45,174, over June 2016. That’s the eighth straight year-over-year monthly increase following 21 straight year-over-year monthly declines. Average weekly carloads in June 2017 were 266,494, the most for any month since October 2016. While June 2017 compares favorably with June 2016, it doesn’t fare well against June in most other years — since our records begin in 1988, only 2009 and 2016 had lower weekly average total carloads in June.

The second graph is for intermodal traffic (using intermodal or shipping containers):

The second graph is for intermodal traffic (using intermodal or shipping containers):U.S. railroads originated 1,113,575 containers and trailers in June 2017, up 4.6% (49,425 units) over June 2016 and the second-best June in history in terms of weekly average volume (slightly behind 2015). In June, the number of intermodal units originated by U.S. railroads exceeded the number of carloads for the ninth straight month. The first time that ever happened was May 2015, but it’s common now.

Saturday, July 08, 2017

Schedule for Week of July 9, 2017

by Calculated Risk on 7/08/2017 08:11:00 AM

The key economic reports this week are June Retail Sales and the Consumer Price Index (CPI).

For manufacturing, June industrial production will be released this week.

Also Fed Chair Janet Yellen will present the Semiannual Monetary Policy Report to the Congress.

10:00 AM ET: The Fed will release the monthly Labor Market Conditions Index (LMCI).

3:00 PM: Consumer credit from the Federal Reserve. The consensus is for a $14.6 billion increase in credit.

6:00 AM ET: NFIB Small Business Optimism Index for June.

10:00 AM: Job Openings and Labor Turnover Survey for May from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for May from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in April to 6.044 million from 5.785 million in March.

The number of job openings (yellow) were up 7% year-over-year, and Quits were up 4% year-over-year.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Testimony from Fed Chair Janet L. Yellen, Semiannual Monetary Policy Report to the Congress, Before the Committee on Financial Services, U.S. House of Representatives, Washington, D.C.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 245 thousand initial claims, down from 248 thousand the previous week.

8:30 AM: The Producer Price Index for June from the BLS. The consensus is for no change in PPI, and a 0.2% increase in core PPI.

10:00 AM: Testimony from Fed Chair Janet L. Yellen, Semiannual Monetary Policy Report to the Congress, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate, Washington, D.C.

8:30 AM ET: Retail sales for June will be released. The consensus is for a 0.1% increase in retail sales.

8:30 AM ET: Retail sales for June will be released. The consensus is for a 0.1% increase in retail sales.This graph shows retail sales since 1992 through May 2017.

8:30 AM: The Consumer Price Index for June from the BLS. The consensus is for a 0.1% increase in CPI, and a 0.2% increase in core CPI.

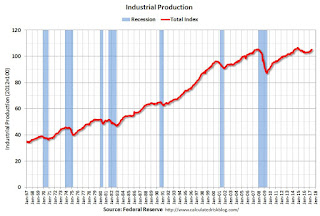

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for June.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for June.This graph shows industrial production since 1967.

The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 76.8%.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for May. The consensus is for a 0.3% increase in inventories.

10:00 AM: University of Michigan's Consumer sentiment index (preliminary for July). The consensus is for a reading of 95.1, unchanged from 95.1 in June.

Friday, July 07, 2017

Oil Rigs: "The party's not over yet"

by Calculated Risk on 7/07/2017 05:18:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on July 7, 2017:

• Total US oil rigs were up 7 to 763

• Horizontal oil rigs were up an impressive 9 to 657

• Since the beginning of June, much of the growth has come from less favored basins – the Bakken and Cana Woodford – and from ‘Other US’

• Similarly, Canada has gained relative to expectations

• These developments suggest operators outside the Permian and Eagle Ford are learning how to prosper with lower oil prices.

• Decidedly bearish – and the market couldn’t care less

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.