by Calculated Risk on 10/13/2017 02:30:00 PM

Friday, October 13, 2017

Sacramento Housing in September: Sales down 5% YoY, Active Inventory down 5% YoY

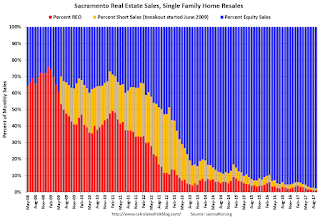

During the recession, I started following the Sacramento market to look for changes in the mix of houses sold (equity, REOs, and short sales). For several years, not much changed. But in 2012 and 2013, we saw some significant changes with a dramatic shift from distressed sales to more normal equity sales.

Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In September, total sales were down 5.3% from September 2016, and conventional equity sales were down 1.0% compared to the same month last year.

In September, 2.2% of all resales were distressed sales. This was down from 2.5% last month, and down from 4.5% in September 2016.

The percentage of REOs was at 1.0%, and the percentage of short sales was 1.2%.

Sacramento Realtor Press Release: Sales volume drops for September, sales price stalls

Septemberendedwitha10%decrease in sales,downfrom1,734to 1,5260.Compared withSeptember2016, current number is a 5.3 %decrease from the 1,647sales for that month. Equity sales for the month reached a high point, accounting for 97.8% (1,526)of the sales this month. REO/bank-owned and Short Sales made up the difference with 16 sales(1%) and 18 sales (1.2%) for the month, respectively.Here are the statistics.

...

Active Listing Inventory increased slightly, rising 1.2% from 2,593 to 2,625. The Months of Inventory increased from 1.5 to1.7 Months. A year ago the Months of inventory was also 1.7 and Active Listing Inventory stood at 2,774 listings.

emphasis added

Click on graph for larger image.

Click on graph for larger image. This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional (equity) sales that started in 2012 (blue) as the percentage of distressed sales declined sharply.

Active Listing Inventory for single family homes decreased 5.4% year-over-year (YoY) in September. This was the 29th consecutive monthly YoY decrease in inventory in Sacramento.

Cash buyers accounted for 12.9% of all sales - this has been generally declining (frequently investors).

Summary: This data suggests a normal market with few distressed sales, and less investor buying - but with limited inventory.

Key Measures Show Inflation mostly below 2% in September

by Calculated Risk on 10/13/2017 11:11:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.5% annualized rate) in September. The 16% trimmed-mean Consumer Price Index rose 0.1% (1.8% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed released the median CPI details for September here. Motor fuel increased 335% in September, annualized.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.5% (6.8% annualized rate) in September. The CPI less food and energy rose 0.1% (1.5% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.2%, the trimmed-mean CPI rose 1.8%, and the CPI less food and energy rose 1.7%. Core PCE is for August and increased 1.3% year-over-year.

On a monthly basis, median CPI was at 2.5% annualized, trimmed-mean CPI was at 1.8% annualized, and core CPI was at 1.5% annualized.

Using these measures, inflation was soft year-over-year again in September (although inflation picked up month-to-month, with gasoline prices up sharply due to Hurricane Harvey). Overall these measures are mostly below the Fed's 2% target (Median CPI is slightly above).

Cost of Living Adjustment increases 2.0% in 2018, Contribution Base increased to $128,700

by Calculated Risk on 10/13/2017 09:18:00 AM

With the release of the CPI report this morning, we now know the Cost of Living Adjustment (COLA), and the contribution base for 2018.

From Social Security: Social Security Announces 2.0 Percent Benefit Increase for 2018

Monthly Social Security and Supplemental Security Income (SSI) benefits for more than 66 million Americans will increase 2.0 percent in 2018, the Social Security Administration announced today.Currently CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). Here is a discussion from Social Security on the current calculation (2.0% increase) and a list of previous Cost-of-Living Adjustments.

The 2.0 percent cost-of-living adjustment (COLA) will begin with benefits payable to more than 61 million Social Security beneficiaries in January 2018. Increased payments to more than 8 million SSI beneficiaries will begin on December 29, 2017. (Note: some people receive both Social Security and SSI benefits) The Social Security Act ties the annual COLA to the increase in the Consumer Price Index as determined by the Department of Labor’s Bureau of Labor Statistics.

Some other adjustments that take effect in January of each year are based on the increase in average wages. Based on that increase, the maximum amount of earnings subject to the Social Security tax (taxable maximum) will increase to $128,700 from $127,200. Of the estimated 175 million workers who will pay Social Security taxes in 2018, about 12 million will pay more because of the increase in the taxable maximum.

The contribution and benefit base will be $128,700 in 2018.

The National Average Wage Index increased to $48,664.73 in 2016, up 1.2% from $48,098.63 in 2015 (used to calculate contribution base).

Retail Sales increased 1.6% in September

by Calculated Risk on 10/13/2017 08:38:00 AM

On a monthly basis, retail sales increased 1.6 percent from August to September(seasonally adjusted), and sales were up 4.4 percent from September 2016.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for September 2017, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $483.9 billion, an increase of 1.6 percent from the previous month, and 4.4 percent above September 2016. ... The July 2017 to August 2017 percent change was revised from down 0.2 percent to down 0.1 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 1.2% in September.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 3.8% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 3.8% on a YoY basis.The increase in September was slightly below expectations, however sales in July and August were revised up.

Thursday, October 12, 2017

Friday: Retail Sales, CPI and 2018 COLA

by Calculated Risk on 10/12/2017 08:18:00 PM

Friday:

• At 8:30 AM ET, The Consumer Price Index for September from the BLS. The consensus is for a 0.6% increase in CPI, and a 0.2% increase in core CPI. Note: The 2018 Cost-Of-Living Adjustments and Maximum Contribution Base will be announced tomorrow. COLA will probably be around 2%.

• Also at 8:30 AM, Retail sales for September will be released. The consensus is for a 1.9% increase in retail sales.

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for August. The consensus is for a 0.6% increase in inventories.

• Also at 10:00 AM, University of Michigan's Consumer sentiment index (preliminary for October). The consensus is for a reading of 95.5, up from 95.1 in September.

LA area Port Traffic: Imports increased, Exports decreased in September

by Calculated Risk on 10/12/2017 03:40:00 PM

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was up 1.0% compared to the rolling 12 months ending in August. Outbound traffic was down 0.3% compared to the rolling 12 months ending in August.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

This was the highest level of imports ever for the month of September - following record imports in July and August - suggesting the retailers are optimistic about the Christmas Holiday shopping season.

In general imports have been increasing, and exports are mostly moving sideways to down recently.

Hotel Occupancy Rate increases YoY, Just behind Record Year

by Calculated Risk on 10/12/2017 02:50:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 7 October

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 1-7 October 2017, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 2-8 October 2016, the industry recorded the following:

• Occupancy: +0.9% to 71.4%

• Average daily rate (ADR): +2.0% to US$130.92

• Revenue per available room (RevPAR): +3.0% to US$93.51

Among the Top 25 Markets, Houston, Texas, once again reported the largest year-over-year increases in occupancy (+45.0% to 85.9%) and RevPAR (+66.0% to US$99.25). With a spike in post-Hurricane Harvey demand, Houston also posted the second-largest ADR increase (+14.5% to US$115.51).

emphasis added

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).Currently the occupancy rate, to date, is ahead of last year, and just behind the record year in 2015. The hurricanes might push the annual occupancy rate to a new record.

Seasonally, the occupancy rate will remain close to this level during the Fall business travel season.

Data Source: STR, Courtesy of HotelNewsNow.com

Update: Real Estate Agent Boom and Bust

by Calculated Risk on 10/12/2017 12:15:00 PM

Way back in 2005, I posted a graph of the Real Estate Agent Boom. Here is another update to the graph.

The graph shows the number of real estate licensees in California.

The number of agents peaked at the end of 2007 (housing activity peaked in 2005, and prices in 2006).

The number of salesperson's licenses is off 29% from the peak, and is increasing again (up 6.6% from low). The number of salesperson's licenses has increased to July 2004 levels.

Brokers' licenses are off 12.9% from the peak and have only fallen to February 2006 levels, but are still slowly declining (down almost 1% year-over-year).

We are seeing a pickup in Real Estate licensees in California, although the number of Brokers is still declining.

Weekly Initial Unemployment Claims decrease to 243,000

by Calculated Risk on 10/12/2017 08:34:00 AM

The DOL reported:

In the week ending October 7, the advance figure for seasonally adjusted initial claims was 243,000, a decrease of 15,000 from the previous week's revised level. The previous week's level was revised down by 2,000 from 260,000 to 258,000. The 4-week moving average was 257,500, a decrease of 9,500 from the previous week's revised average. The previous week's average was revised down by 1,250 from 268,250 to 267,000.The previous week was revised down.

Hurricanes Harvey, Irma, and Maria impacted this week's claims.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 257,500.

This was below the consensus forecast. The recent increase in claims is due to the hurricanes.

Wednesday, October 11, 2017

Port of Long Beach: Record Month, "Looks like retailers are optimistic about the holiday season"

by Calculated Risk on 10/11/2017 06:45:00 PM

From the Port of Long Beach: Port of Long Beach Sets Record for September

Cargo volume continues to break records at the Port of Long Beach, which moved more containers last month than any September in its history.CR Note: I'll have more on port traffic soon.

The 701,619 twenty-foot equivalent units (TEUs) processed in Long Beach for September — up 28.3 percent — also resulted in the Port’s best quarter ever. In the third quarter (July, August and September), the Port of Long Beach handled 2,114,306 TEUs, as volumes swelled 15.9 percent over the same period last year.

“Simply put, we are having the best trade months in Port history,” said Harbor Commission President Lou Anne Bynum. “Back-to-school merchandise was strong for us, and it looks like retailers are optimistic about the holiday season.”

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 252 thousand initial claims, down from 260 thousand the previous week.

• Also at 8:30 AM, The Producer Price Index for September from the BLS. The consensus is a 0.4% increase in PPI, and a 0.2% increase in core PPI.